Budget Smuggling 2023: The bottom line is it’s awfully tight in there, Dr Chalmers

Via Getty

Our Man of Marrickville’s Treasurer Jim Chalmers has lobbed upon us his 1st full budget – and a straight up and down document it is.

Here’s what you might need to know now:

– A budget surplus of $4.2 billion (0.2% of GDP) is now forecast in 2022–23

That’s actually pretty good and ahead of most major advanced economies (Ed: who we should add, aren’t that good.)

Underlying cash deficit of $13.9bn forecast in 2023–24; an improvement of over $30 billion since the October Budget.

Over five years to 2026–27, there’s a cumulative improvement in the underlying cash balance of $125.9bn.

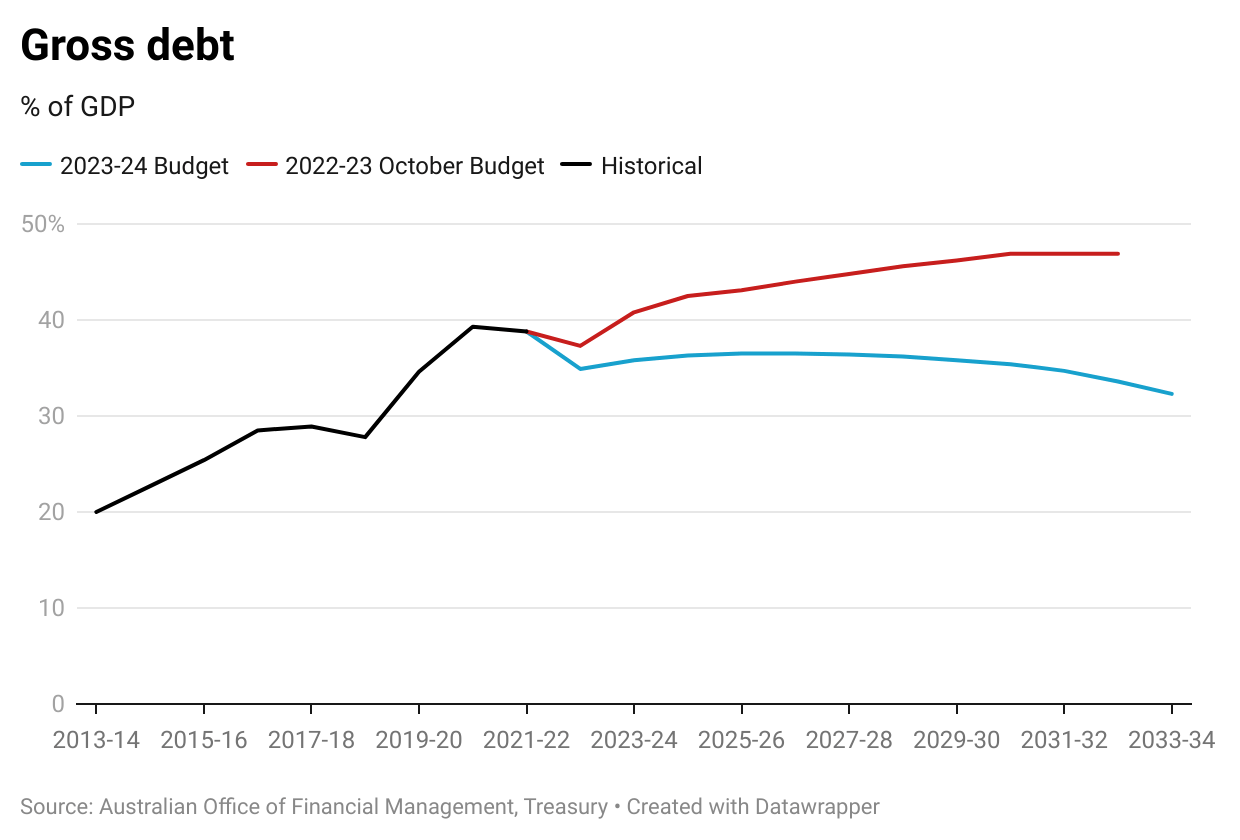

Debt and deficits are lower in each year of the forward estimates and medium term.

They estimate gross debt to peak at 36.5% of GDP in 2025–26, exacto 10.4 percentage points lower and five years earlier than at the October Budget. Ooh.

“This stronger fiscal position is a consequence of the Government’s decision to bank 82% of the revenue upgrades in this Budget, and 87% across two Budgets…” (Ed: possibly true, his words not mine).

The Budget “prioritises responsible and targeted cost-of-living relief.”

This includes:

- up to $3 billion in energy bill relief in partnership with the states and territories

- investing $1.3bn to deliver ongoing bill savings through home energy upgrades

- tripling of the bulk billing incentive to make it cheaper and easier for Australians to see a doctor

- $1.9bn for the extension of the single parenting payment

- with the cutoff age for the youngest child lifted from eight to 14

Earnings on superannuation balances over $3 million will be taxed at an increased rate of 30 per cent, up from 15 per cent from July 1, 2025.

Budget savings include:

- reform of the Petroleum Resource Rent Tax to raise $2.4bn over 4 yrs

- extension of GST compliance program (saving $3.8bn over 4 years)

- 5% rise in tobacco excise raising $3.3bn;

- measures to slow NDIS growth to 8% pa from 13.8% currently;

- 30% tax on super fund earnings where balances exceed $3m;

- increasing the payment frequency of super and lifting compliance

There looks like no changes to the stage three tax cuts, I can see.

An unflationary budget

In essence Dr Chalmers’ conservative budget delivers a $4 billion surplus in the current financial year and shaves a further $125.9 billion off the deficit – pretty decent for a few weeks work of number crunching and a nice political win for Marrickville Albo to wake up to.

He says the Government’s cost-of-living measures will directly reduce the CPI in 2023–24 and are not expected to add to broader inflationary pressures in the economy.

AMP Capital’s deputy chief economist Diana Mousina says there’ll be little blowback over at the RBA, which really has its hands full enough tearing up the economy in its day job to worry about policy outside of the monetary kind.

“With the Budget overall taking more out of the economy than it’s putting back in compared to what was projected last October, it’s hard to see significant implications for the RBA but it will be wary of the boost to households from the cost-of-living measures which could boost spending,” Mousine says.

Here’s how Diana and co-conspirator, AMP’s Dr Shane Oliver, head of Investment Strategy and chief economist, see the Budget’s implications for Aussie assets:

• Equity/stocks – the Budget is a small positive for household spending but not enough to offset the negatives impacting the sector and overall there is not really a lot in it for the share market.

• Property – the housing measures are unlikely to alter the property price outlook which is dominated by supply shortages and surging immigration

versus the impact of rate hikes. We see roughly flat home prices this year.

• Cash and term deposits – cash and bank deposit returns have improved substantially with RBA rate hikes but are still relatively low.

• Bonds – budget deficits add to upwards pressure on bond yields, but at least they have been lowered near term so there should be no new pressure.

• The $A – the Budget is unlikely to change the direction for the $A.

Thanks mining and commodities. Thanks war.

Not so much great money management as right time, right war.

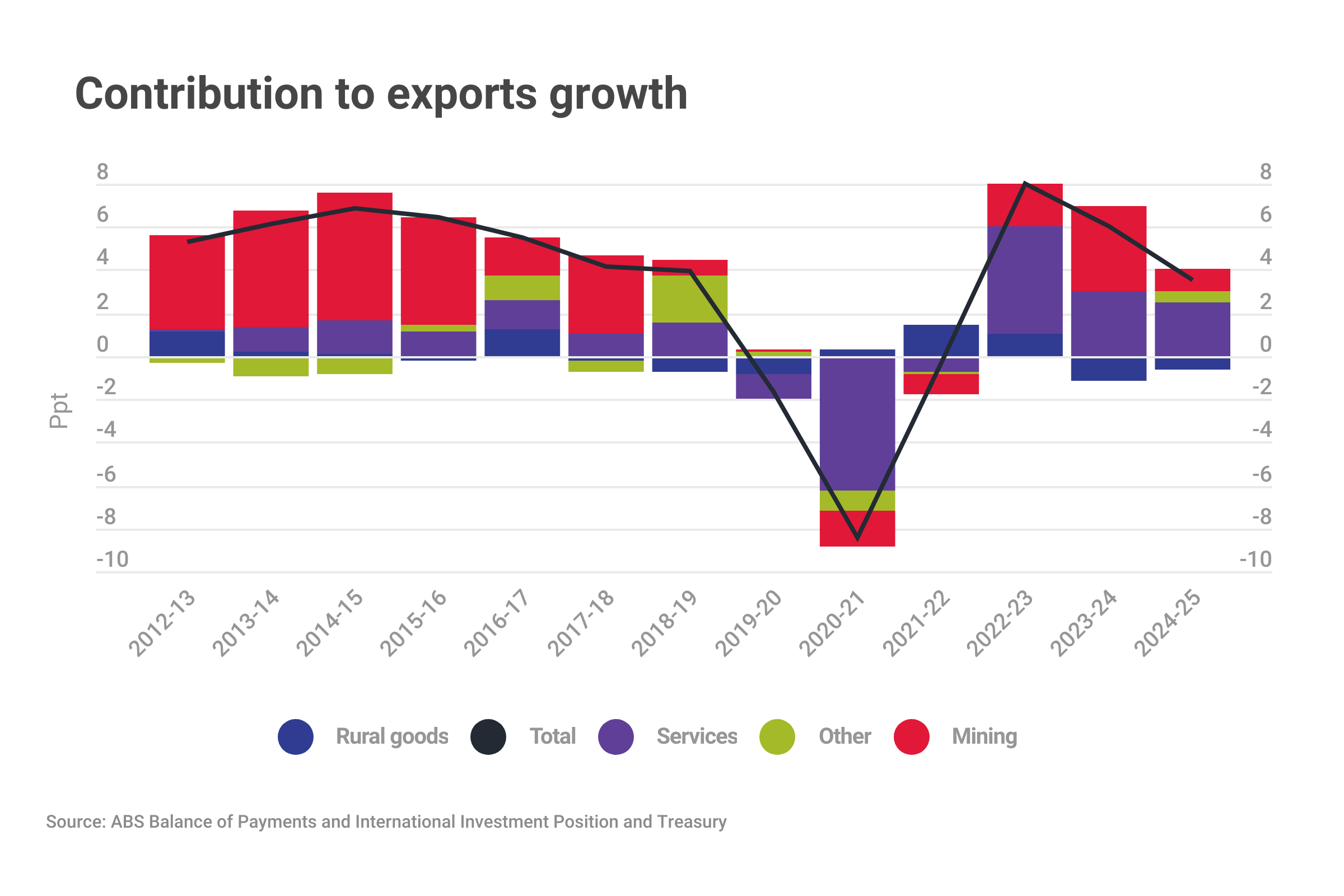

The next five years provides Chalmers – and the rest of us – $130 billion of tax windfall to lean on, thanks not to cunning Treasury accounting, but simply higher commodity prices.

In fact, according to CEDA’s Jarrod Ball, policy decisions in aggregate will clip just over $20 billion off the budget balance over the same period.

The boom in energy, metals and battery metals has driven strong jobs growth, healthy company profits and an enlarged Federal purse.

The commodities complex has all but underwritten Dr Chalmers’ surplus (a wee one, but a surplus) and trimmed a fair bit of ugly fat off the previous deficits as we look out across the forward estimates.

“Yet the government has still been relatively restrained,” Jarrod Ball says, “banking 82% of economic windfalls to the bottom line and achieving average real spending growth of just 0.6% a year.”

Chalmers reckons the national numbers should be reaching a semblance of parity in about a decade – 2033-34 – to be exact.

OFC, this is based on the higher-than-expected tax income, lower-than-expected interest payments as interest rates ease, debt peaks and NDIS costs start to moderate.

And like any good Treasurer, Dr Chalmers set about managing expectations from the beginning of the document…

“The global economic outlook has deteriorated and is highly uncertain. High inflation and rising interest rates will see the weakest two years for the global economy in over two decades, outside of the Global Financial Crisis and the pandemic. Tighter financial conditions associated with recent banking strains in the United States and Europe are a further drag on growth and add more uncertainty to the global outlook.”

– Chalmers Budget 2023/24

This debt is not as gross as we thought

According to the Budget papers stronger than expected growth and lower deficits will see gross debt peak five years earlier and 10.4% of GDP lower than at the last budget, at 36.5% of GDP.

“This retains Australia’s relatively low debt position compared to advanced economies and makes the fiscal task easier and opportunity cost of interest payments lower,”

Ball says.

“The bottom line is that the economy is doing most of the heavy lifting in this budget.”

“While that is the path of least pain for budget repair, it is also far from assured and carries significant risks in a difficult economic environment even if tax windfalls have surprised on the upside in the immediate term.”

Tax and productivity

For both of these the government could come and see how we do things at Stockhead.

Frankly we have a helluva lot of both.

Ball says structural tax reform is still badly needed to both “strengthen revenue and better support economic growth.”

“Productivity remains the missing piece of the puzzle, with limited initiatives in the budget to support the productive capacity necessary to underpin future growth.”

The Chalmers team says Australia is still expected to outperform in contrast to most other developed nations over the short to mid-term.

That’s despite the roiling global economic situation.

In 2023-24, growth in the economy will be just 1.5 per cent with unemployment increasing to 4.25 per cent.

The good news is that 2023-24 is expected to see a turning point, with moderating inflation and growing real wages. As CEDA has previously suggested, a surging recovery in migration is supporting growth. This includes the increasing contribution of services to exports growth.

Over the last few weeks, the Treasurer warned that services like Medicare were looking structurally bereft largely to years of inattention and a structural shortfall in the nation’s coffers after the problem went more than a decade without acknowledgement by governments of both stripes.

Last year, the Treasurer started a national conversation about how the government raises revenue to pay for services this year and it has so far delivered changes to superannuation tax breaks for the super rich and the mining industry untouched by other governments.

Chalmers told Parliament this cash consolidation isn’t just about rampant inflation but more a kind of numb leftie idealism – or the bigger pic issues of political reform and the nation’s future etc.

“These are the foundations on which our government is building a stronger economy and a fairer society,” he told Parliament just after the budget was released at 7.30pm Marrickville time.

So welcome to the Dr Chalmers budget rich in colloquial charm.

A budget about “seeing our people through the hard times – and setting our country up for a better future.”

Leaning heavily on the old ‘global economic growth looks crap for a while yet’ schtick, the Chalmers budget promises that the Australian economy will begin working for Aussie workers, slack-jawed, wide-eyed and innocent alike.

I like the last one.

Some would say that’s a given, but we remember you, Scott.

What else?

Wages will grow at 4% by next financial year, putting them ahead of rising prices (3.5 per cent) and on track for real pay rises of a scale not seen since 2009.

Increasing the rate of JobSeeker has been presented as a litmus test for the government’s values in a budget focused most of all on economic growth and sustainable services to improve Australians’ lives.

Labor will also spend more on poverty alleviation for jobless Aussies than any other in three decades.

JobSeeker peeps will get a $500 one-off energy bill cost relief thingy, as well as $30-a-fortnight rise in rent assistance and a $40 rise in JobSeeker itself.

Single-parent families (about 50K of them) will also get an extra $176 a fortnight, while often punitive requirements placed by Centrelink on unemployed people older than 55 will be relaxed.

Medicare

The hero of the dish for the politicians and the punters is a more than $5.5 billion plan to address the meagre rationing that’s made Medicare’s future look decidedly thin and gruel-like.

Last year reports and a parliamentary inquiry into GP waiting times that identified days-long wait times for bulk-billed consultations and the increasing unavailability of free medical services in others.

“Families are being forced into a lose-lose choice between getting the help they need or paying their bills,” Dr Chalmers said.

“It means more problems go undiagnosed or untreated. And it means our workforce is not as healthy or productive as it could be – and should be.

“The government will spend $3.5 billion to subsidise free doctors’ visits for a group of 11 million Australians it says face difficulties seeing a doctor, including children and pensioners.”

More changes will be needed to a revenue base increasingly reliant on income tax to hold together services in the face of ballooning costs and demand, especially after the fiscal challenge of tax cuts for high-income earners take more than $20 billion more from the budget from next year.

Summary of key measures

• $14.6bn over four years in cost-of-living support for mostly low to middle income households, including $3bn (shared with states) in one off energy bill relief for 5mn low-middle income households and 1mn small businesses

• an additional $3.5bn to Medicare over five years to allow better access to GPs through a lift in the bulk billing incentive, cheaper medicines, a boost to rent assistance, subsidies to move from gas to electric appliances

• increased support for single parents costing $1.9bn over five years and a modest increase in Jobseeker with more for over 55s;

• increased spending on aged care partly flowing from a 15% pay rise for aged care workers which will cost $14.1bn over four years;

• a $20,000 instant asset write-off for small businesses;

• a ramp up in defence spending on missiles and submarines, offset by a reallocation of defence spending;

• some measures to help boost housing affordability – with tax changes to boost build-to-rent housing and wider access to the Home Guarantee Schemes;

• a lift in renewables investment through $2bn for the hydrogen industry and incentives for developers to build “greener” houses;

• measures to support impact investing to tackle social problems;

• $498m to crack down on vaping and reduce smoking

Sources: Budget papers, AMP Capital, CEDA, CBA

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.