Great Southern Mining is counting on its two leading projects to deliver value when gold equities rally

Mining

Mining

Gold prices have elevated for several months now and while gold equities on the ASX largely haven’t seen any real gains to date, companies such as Great Southern Mining are already taking steps to ensure that they are positioned to benefit once they do so.

Speaking to Stockhead, Great Southern Mining (ASX:GSN) managing director Matthew Keane said that while gold equities currently aren’t reflecting very strong gold prices, he expected appetite for gold equities to turn at some point this year.

“It is probably at some point where interest rates fall as the inflation cycle ends and people have more money to spend on equities, but more so because gold prices will have another leg,” he added.

“The other factors include one of the juniors making a ground-breaking discovery and investors looking for the next one, or it could be when mid caps and majors get fully valued and then people have to basically come down the curve if they want gold stocks because it is too expensive to buy the majors.”

Keane adds that GSN is currently on the highest ramping phase of the Lassonde Curve – essentially a graph that shows the usual life cycle of a junior miner with the development staged mapped to the X axis and company value/EV on the Y axis.

“Effectively when you make a discovery, you have the most rapid growth in value and then you start to go over a hump and start to down in value when you got through financing, metallurgy and study phases,” Keane said.

“We are on the highest ramping phase in terms of value creation for an explorer. We have made the discoveries and we just have to drill them out.”

“And because our projects are so close to mills, we don’t have to go down the ‘valley of death’ – the study, financing build stage. We will most likely feed ore into one of our neighbours’ mills unless we find a real +3Moz monster.”

Keane also pointed out that the company’s strong register – with the board and management owning 27% and friendly parties making up well above 50% – giving GSN some real clout in the event of corporate activity.

So just what are the projects that GSN is counting on to ride the expected gold value wave?

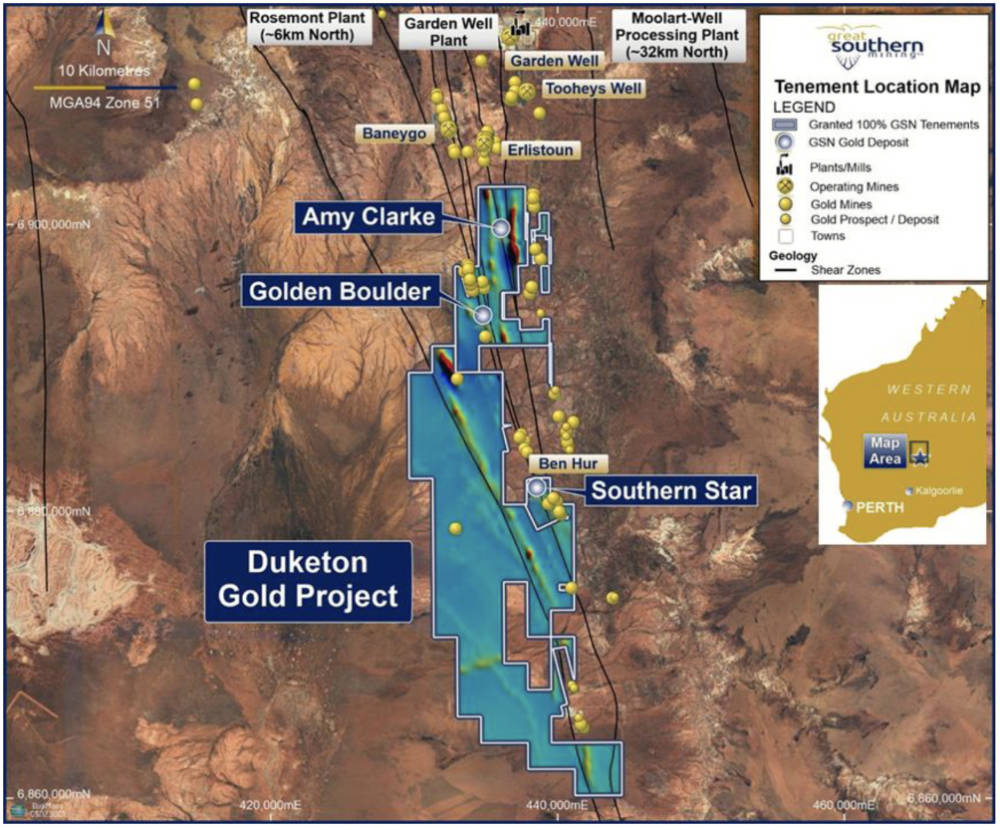

While the company has several projects in its portfolio, the Duketon project immediately south of Regis Resources’ (ASX:RRL) ground in WA’s Duketon Belt and its Edinburgh Park project in Queensland that has drawn a $15m farm-in from major producer Gold Fields share equal top billing.

Duketon covers about 10% of the Duketon Belt where more than 8Moz of gold has been discovered to date with Keane pointing out that while the company’s ground has seen the least drilling, it has all the geology and structures that host gold to the north.

“Effectively, it just needs metres to define the ounces. If you put metres into the ground on those structures that we know host gold, we are confident that we will define deposits,” he said.

GSN has three advanced prospects at Duketon of which Southern Star – just 3km from Regis’ new Ben Hur mine – is the most advanced.

Recent drilling at Southern Star has extended mineralisation up to 65m down dip and opened up the possibility of repeats over a 1.5km stretch, up to the border of RRL’s ground.

Recent targeted drilling to extend mineralisation returned a shallow intersection of 13m @ 2.16g/t gold from a down-hole depth of 57m in the northern-most hole while holes drilled to test for depth extensions to the main zone returned high grade zones such as 4m @ 6.91g/t gold within a broader 13m interval grading 2.52g/t gold from 144m.

And while Southern Star is the most advanced, the other two prospects – Golden Boulder and Amy Clarke – also feature very long strike extents of gold anomalism and high-grade gold intersections.

Keane adds that two of the prospects show very good continuity, meaning that infill drilling would be all that is needed to start sizing up resources.

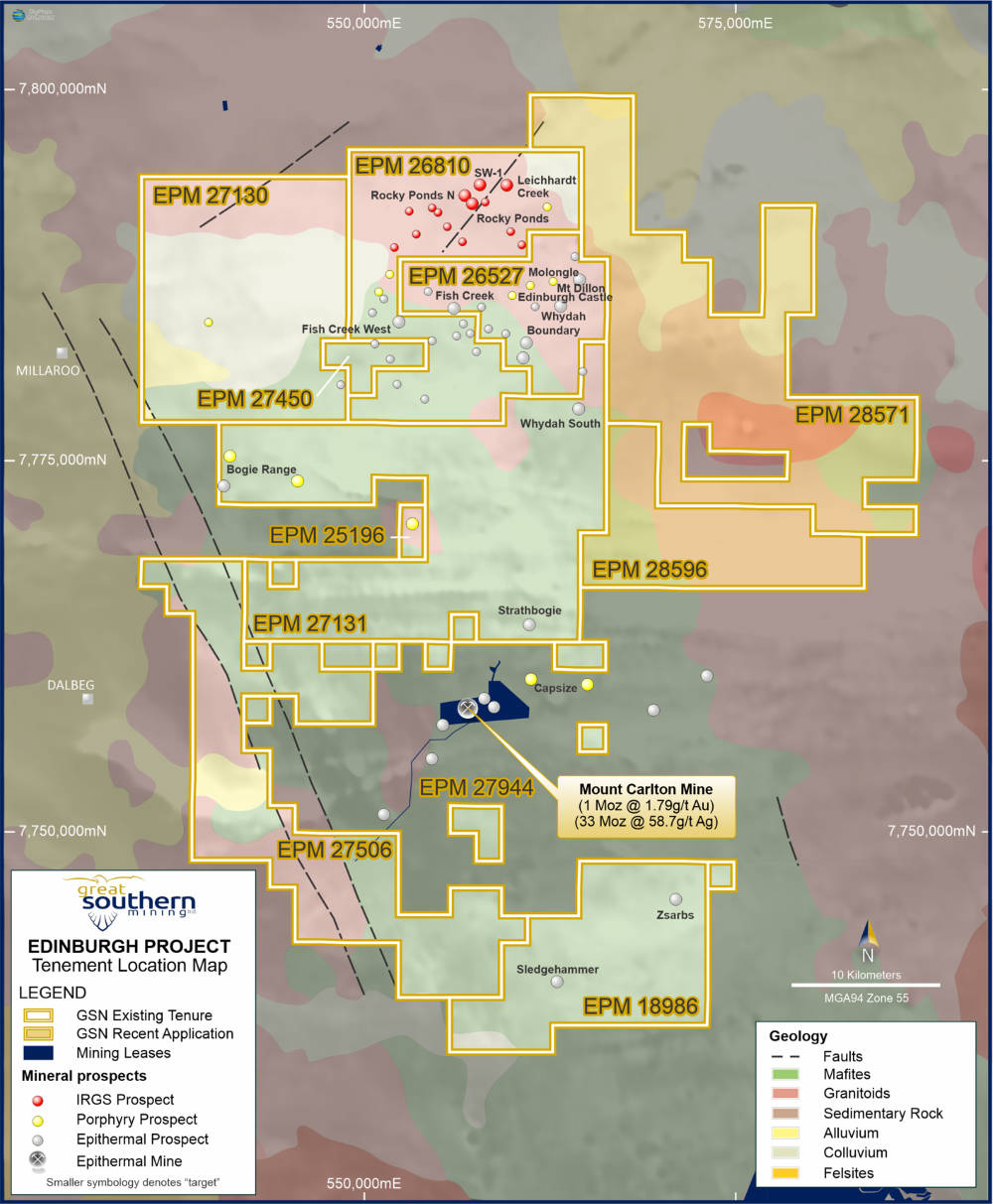

Over in Queensland, the company’s Edinburgh Park project is a province or belt-scale play that surrounds the Mt Carlton mine that is currently on care and maintenance.

“We have ground that is prospective for really big mineralisation styles such as epithermals, porphyries and intrusion-related gold-copper-silver systems,” Keane noted.

“We invited partners last year and we got Gold Fields, who right now are the fourth or fifth largest gold company globally and are earning 75% of the project by spending $15m on exploration over six years.

“There’s no interim ownership, so they have to stick to the whole $15m to earn the 75%. It is a nice, clean earn-in agreement.”

Gold Fields wasted little time after closing the deal in October 2023, starting work in November though drilling will have to wait until the wet season ends, which is expected to occur after April.

“The key there is that you have got a gold major who is not looking for 1-2Moz, they are looking for monster 5-30Moz type of discovery,” Keane noted.

“They are looking for huge systems and if we end up with 25% of one of those after the earn-in is completed, we would be more than happy. That’s a great outcome for us.”

While Duketon and Edinburg Park are the projects which take up the lion’s share of GSN’s attention, its other projects are also pretty prospective.

The early stage 400km2 East Laverton project has both gold and nickel potential and is considered to be one of the largest underexplored ultramafic and mafic geological packages in the region with nickel anomalies that have yet to be chased up or drilled.

There’s also historical gold potential that hasn’t been followed up, though Keane says the company will probably not go too heavily on nickel exploration at this point as the metal is currently experiencing a down cycle.

Meanwhile, the Mon Ami project – also in the Laverton region – has a comparatively modest resource of 55,000oz of gold but is shallow and open in several directions.

It is also essentially shovel ready with the mining licence in place, heritage survey completed and native title done.

Over the next couple of months, GSN will look at options to finance further exploration – primarily to quantify what it has at the Duketon project.

While equity markets are always an option, Keane says the company’s preference is for an asset divestment.

Keane said proceeds from such a sale or other capital raising will be used to either define resources at the three main prospects at Duketon or to at least give the market line of sight to what sort of ounces or resources they are likely to contain.

“We want to drill, drill, drill and show the market what we have got,” he noted, adding that newsflow will also come from the Queensland joint venture with Gold Fields to drill “exciting deep diamond holes which could give us anything”.

“They have got the balance sheet and the technical capability, there are not too many groups with the skillset to really understand porphyry systems and epithermals,” Keane added.

“Gold Fields has not only discovered those but are mining them, so they have got the in house technical capability which is beyond what we have as a junior.”