Tier 1 discovery country: Great Southern Mining attracts lucrative earn-in from $16bn capped giant Gold Fields

Gold Fields will spend $15m for 75% of the project. Pic: via Getty Images.

- Gold Fields to earn 75% interest in the Edinburgh Park Project by spending $15m in exploration over six years with a minimum of $2.5m to be spent within two years

- Project underexplored despite proximity to Mt Carlton gold-silver-copper mine

- Deal allows Great Southern to focus on exploration at its 100% owned Duketon gold and East Laverton nickel-gold projects

Great Southern Mining has secured an earn-in agreement with major producer Gold Fields, which will spend up to $15m to earn 75% of the Edinburgh Park project in Queensland.

The 1,750 km2 project is in tier 1 discovery country surrounding the producing ~1.7-million-ounce equivalent Mt Carlton gold-silver-copper mine.

It is prospective for gold-copper porphyries, high and low sulphidation epithermal gold-silver-copper systems and intrusive related gold (IRG) but remains underexplored.

Great Southern Mining (ASX:GSN) has identified up to 29 targets to follow up, but the scale and potential vertical extent of these styles of mineralisation require large drilling programs which can be cost prohibitive for junior explorers.

That’s why the company sought a partner with both the experience and funding to expedite exploration of the project.

“Great Southern is extremely pleased to have the expertise and funding of Gold Fields to accelerate discoveries at Edinburgh Park,” MD Matthew Keane said.

“This earn-in validates our belief that the project has potential to host Tier One mineral deposits.

“We regard Gold Fields as an ideal partner having a track record of discovering and operating large-scale porphyry, epithermal and IRG deposits.”

$15m exploration expenditure over 6 years

Under the agreement, Gold Fields can sole fund up to A$15 million exploration expenditure over a six-year period to earn a 75% interest in the project.

The producer can elect to exit the agreement at any time within the six-year period, but must spend a minimum A$2.5 million within the first two years.

Gold Fields has already identified several targets within Edinburgh Park, and following minimal validation and ground truthing work, drill testing is expected to commence after the northern Queensland wet season in 2024.

Gold Fields will also subscribe for ~38.5 million ordinary shares in GSN at $0.026 per share – valued at A$1 million and representing a 5.4% stake in the company. The subscription comes at a 11.5% premium to GSN’s 10-day VWAP.

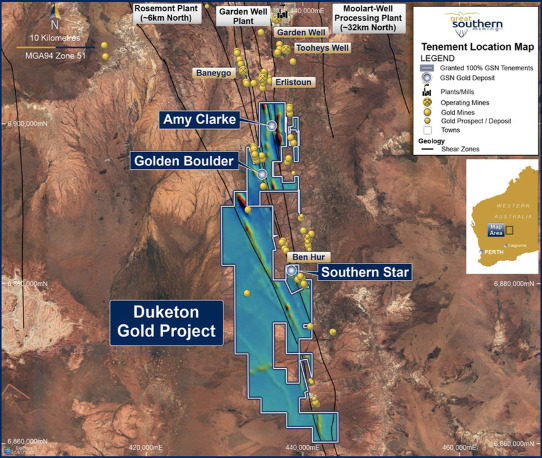

Keane said the earn-in agreement enables the company to focus its resources on the company’s WA projects including the Duketon Gold Project, just south of the operations of Regis Resources, accounting for about 10 per cent of the underexplored greenstone belt, and the large-scale East Laverton nickel-gold project.

GSN to focus on WA projects

The Duketon project sits on the Duketon Greenstone Belt, along trend from Regis Resources’ (ASX:RRL) Rosemont (~1.06Moz), Baneygo (380,000oz) and Ben Hur (~390,000oz Au) deposits near Laverton, WA.

GSN believes the three primary mineralised corridors in the belt continue into its tenure.

Earlier this year, aircore drilling at the Golden Boulder prospect extended the strike of the Golden Boulder Main mineralised trend by 1.3km (for a total of 1.6km) and returned 12m at 1.1g/t gold from 44m, including 4m at 2.4 g/t gold from 48m.

The next stage of drilling at Golden Boulder will incorporate RC drilling to test mineralisation at depth as well as step out aircore drilling along strike from known mineralised trends.

At the Southern Star prospect, located just 3 kilometres from Regis’ new Ben Hur mine, intercepts have included 17 metres at 7 g/t gold from 11 metres and 59 metres at 2.1 g/t gold from 59 metres. Follow up RC drilling is planned to test depth extensions to known mineralisation and a parallel zone to the west, which GSN interprets to be on the same trend as RRL’s Ben Hur deposit to the north.

At the East Laverton nickel-gold project, a moving loop electromagnetic survey over the 10km Rotorua ultramafic trend – which has had very little nickel exploration – is planned for later in the year.

This article was developed in collaboration with Great Southern Mining.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.