- Gold sold off violently from highs in 2020 and 2022, but is holding its ground in 2023

- “An important bullish signal for gold could be a weekly close above US$2035, the highest close in history”: FxPro

- Weekly ASX small cap standouts: Chesser, Besra

Our Gold Digger column wraps all the news driving ASX stocks with exposure to precious metals.

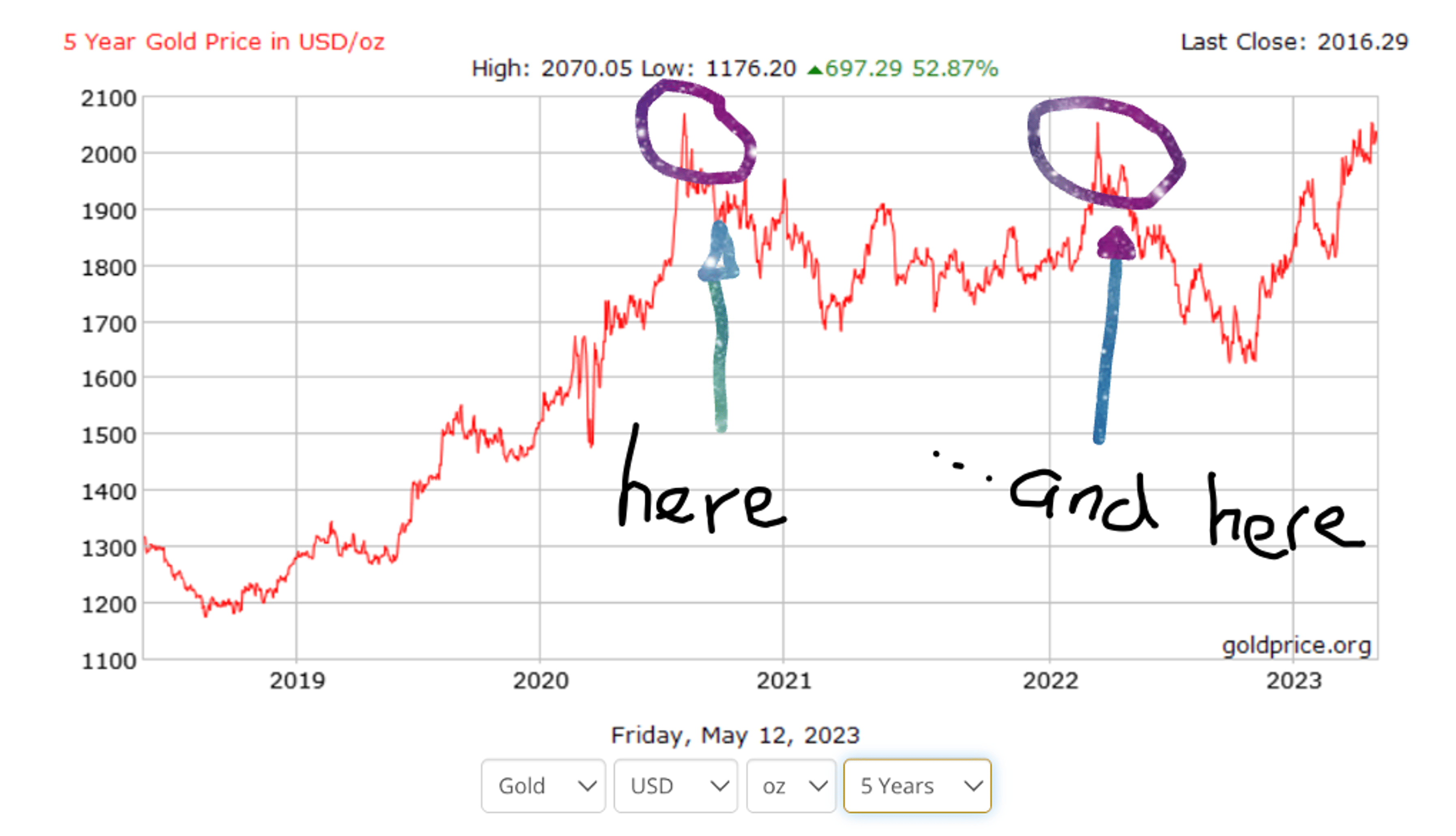

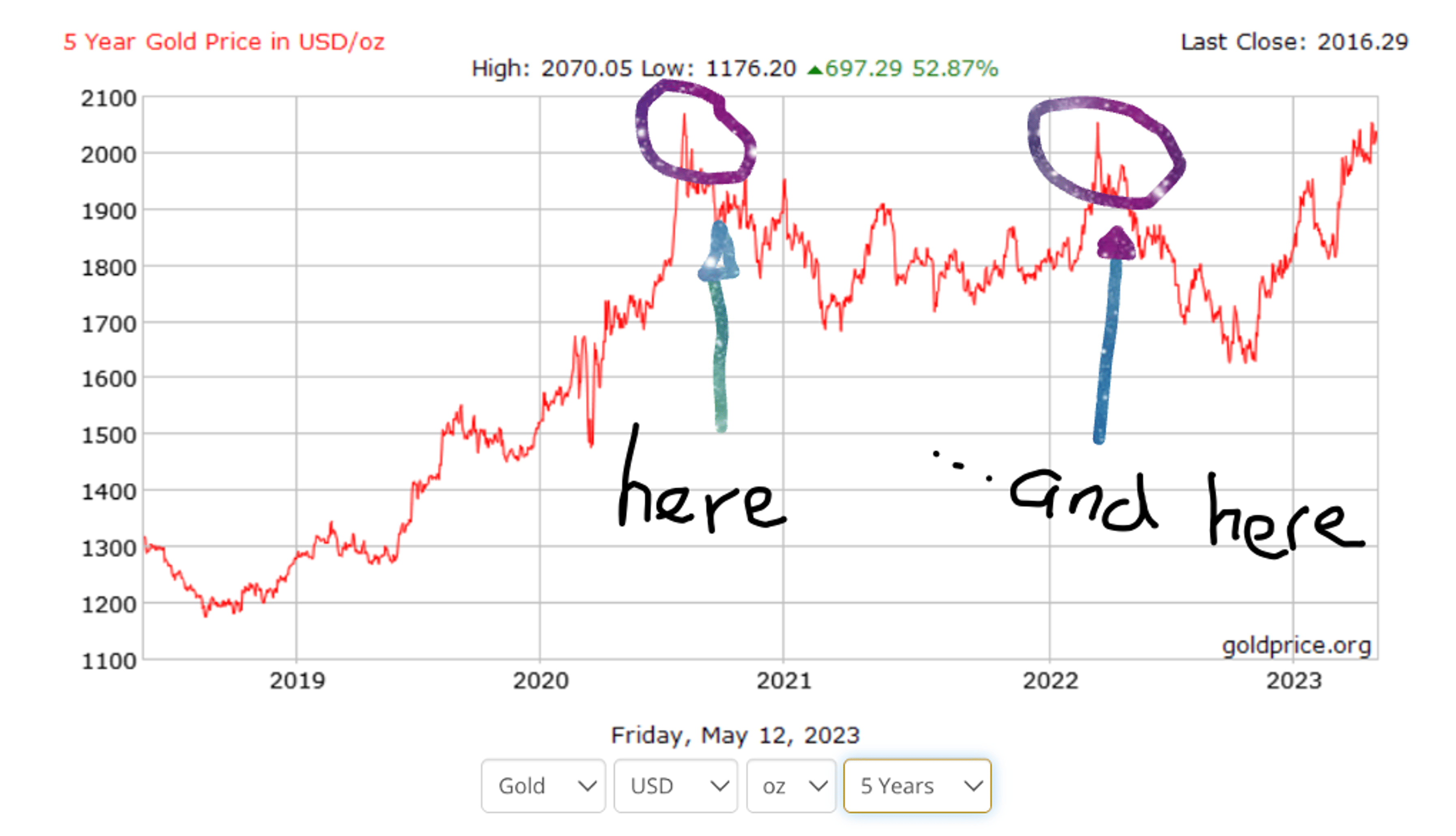

In 2020 and 2022, gold sold off violently from its highs of ~US$2050-80/oz.

Gold showed very high volatility on Thursday and Friday last week, rising to $2081 and falling below $2000 in less than 48 hours.

But, unlike 2020 and 2022, this time the precious metal is holding its ground, an important bullish signal as the next leg up into US$2100/oz territory beckons.

The price is remaining within the uptrend that has been in place since the second half of March, Alex Kuptsikevich, FxPro senior market analyst says.

“Gold … is approaching historical highs much more smoothly than in 2020 or 2022, leaving more strength for a breakout,” he says.

While gold has rallied on US banking drama, this is not the only driver of gold’s bullish run in 2023.

“Investors should also bear in mind the trend towards increasing purchases of gold as a reserve by emerging market central banks, which are also exposed to the risk of being hit by US or EU sanctions that block settlement in dollars and euros,” Kuptsikevich says.

Geopolitical risks and sanctions against Russia have highlighted importance of central banks maintaining gold holdings, WGC head of Asia-Pacific and director of central banks Shaokai Fan says.

“When sanctions were announced against the Bank of Russia last year, it was really the first time that a major large central bank was sanctioned in this way,” he said.

The World Gold Council declared the March quarter this year the best in a decade for central bank purchases.

National reserves added around 228t of bullion, equivalent to around two-thirds of Australia’s annual gold production and 34% higher than the previous record in 2013.

It followed a record 2022, when central banks added 1078t to their reserves.

Can gold hit a record-high weekly close?

Gold is currently paying US$2011/oz, or $3004/oz Aussie with one day left in the US working week.

Silver is paying US$24/oz, or $36/oz Aussie.

“An important bullish signal for gold could be a weekly close above US$2035, the highest close in history,” FxPro’s Kuptsikevich says.

“However, a much smoother ride with a touch of the lower end of the uptrend range around US$2000 is seen as a more likely scenario before the uptrend resumes.”

How did precious metals miners perform this week?

An understandably flat week on the bourse for ASX listed gold miners with an average loss of between 3-7%.

In the news was Silver Lake Resources (ASX:SLR), which has not given up it audacious 11th hour bid for the Gwalia gold mine.

Silver Lake had an initial offer knocked back by the St Barbs (ASX:SBM) board, which plans to see the original Genesis (ASX:GMD) deal through.

But SLR returned with a second proposal –$707m including $326m cash and 327.1m shares, with St Barbara keeping 7.5% or 94.8m of SLR’s shares worth around $111m to provide liquidity and working capital in its new life as an overseas gold miner.

The rest of the SLR shares issued in the deal would go in-specie to SBM shareholders.

An expert’s report will also no longer be required for the transaction, reducing the time risk.

SLR reckons this one is a 27% premium to the Genesis bid on the disturbed VWAP since it revealed its offer to the market on May 4.

SBM and GMD are yet to give their takes on the revised bid from Silver Lake, which if successful would become a 400,000ozpa gold miner with three operations in WA and one in Canada.

SLR, GMD, SBM share price charts

Meanwhile, Ramelius Resources (ASX:RMS) has given itself a shot of making ambitious Q4 production guidance after securing approvals to haul ore from its high grade Penny gold mine.

The mid-tier gold miner considers Penny the key to reinvigorating its business, with its ultra-high-grade ore expected to slash production costs.

RBC’s Alex Barkley says RMS is forecast to deliver 244,000oz in FY23, around the mid-point of its revised 240,000-250,000oz guidance range.

“While a minor update from RMS, we think the approval of large capacity ore haulage from Penny is a positive outcome and a Q4 de-risking event which should help Ramelius hit FY23 guidance considering that the lack of high-grade Penny ore was one of the key drivers to the Q3FY23 production miss,” he said.

“With the approvals in place RMS should be able to see significant QoQ production uplift. We expect a 22% QoQ gold increase in Q4. We stay sector perform, Price target A$1.20/sh, but expect RMS to trade higher today with some FY23 operational risks removed.”

And Newmont has been granted an additional week to do due diligence on gold target Newcrest (ASX:NCM).

The deadline was due to strike just before midnight yesterday, but the US gold behemoth now has until May 18 to decide whether it will lob a binding offer for the 2Mozpa plus Aussie gold miner.

At an implied price of $32.87 per share, the deal would come in at an equity value of $29.4b and enterprise value of $32b, implying a 46.4% premium to NCM’s price on February 3 before Newmont’s approaches were publicly revealed.

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| Code | Company | % Week | % Month | YTD% | % Year | Price | Market Cap |

|---|

| CHZ | Chesser Resources | 67% | 46% | 41% | 20% | 0.12 | $73,575,169 |

| XTC | Xantippe Res | 67% | 25% | 0% | -50% | 0.005 | $52,900,498 |

| BEZ | Besragoldinc | 45% | 73% | 515% | 712% | 0.32 | $118,543,732 |

| BMO | Bastion Minerals | 42% | 31% | 0% | -80% | 0.034 | $4,304,113 |

| ENR | Encounter Resources | 37% | 79% | 44% | 93% | 0.26 | $74,660,414 |

| HMG | Hamelingoldlimited | 35% | 37% | -10% | -10% | 0.13 | $16,500,000 |

| LYN | Lycaonresources | 32% | 9% | -33% | -53% | 0.185 | $4,444,031 |

| CDR | Codrus Minerals | 32% | 92% | 27% | 101% | 0.165 | $7,075,250 |

| MEI | Meteoric Resources | 30% | 59% | 244% | 1304% | 0.1825 | $305,520,056 |

| AZS | Azure Minerals | 29% | 9% | 118% | 96% | 0.49 | $195,118,036 |

| DLI | Delta Lithium | 27% | 40% | 18% | 26% | 0.56 | $254,229,020 |

| SIH | Sihayo Gold Limited | 25% | 25% | 25% | -29% | 0.0025 | $15,255,320 |

| ICG | Inca Minerals | 25% | 39% | 9% | -73% | 0.025 | $11,604,347 |

| ORN | Orion Minerals | 24% | 31% | 31% | -13% | 0.021 | $120,246,737 |

| IDA | Indiana Resources | 23% | 7% | -11% | -14% | 0.049 | $20,754,398 |

| CEL | Challenger Exp | 21% | 3% | -3% | -37% | 0.17 | $188,130,223 |

| MI6 | Minerals260Limited | 21% | 13% | 44% | 36% | 0.49 | $109,980,000 |

| FG1 | Flynngold | 21% | -19% | -22% | -46% | 0.078 | $7,818,389 |

| VRC | Volt Resources | 20% | 0% | -20% | -37% | 0.012 | $43,333,663 |

| XAM | Xanadu Mines | 17% | 14% | 66% | 66% | 0.048 | $75,339,913 |

| OAU | Ora Gold Limited | 17% | 40% | -30% | -57% | 0.0035 | $11,810,775 |

| HXG | Hexagon Energy | 17% | 17% | -18% | -50% | 0.014 | $7,180,823 |

| RDN | Raiden Resources | 17% | -8% | -26% | -63% | 0.0035 | $6,491,039 |

| CPM | Coopermetalslimited | 16% | 2% | 40% | -12% | 0.33 | $12,998,679 |

| MAT | Matsa Resources | 15% | 0% | 22% | -15% | 0.045 | $19,364,346 |

| AVM | Advance Metals | 14% | 0% | -20% | -38% | 0.008 | $4,656,353 |

| ICL | Iceni Gold | 14% | -2% | -14% | -47% | 0.0685 | $14,287,143 |

| EMC | Everest Metals Corp | 14% | 17% | 4% | -22% | 0.082 | $10,354,649 |

| TLM | Talisman Mining | 13% | 20% | 29% | 29% | 0.18 | $32,854,412 |

| ALY | Alchemy Resource | 13% | 29% | -22% | -14% | 0.018 | $18,849,220 |

| GTR | Gti Energy | 13% | 0% | -17% | -43% | 0.009 | $16,692,563 |

| RDS | Redstone Resources | 13% | 0% | 13% | 13% | 0.009 | $6,676,906 |

| SRN | Surefire Rescs NL | 12% | -24% | 58% | -34% | 0.019 | $30,045,906 |

| MOH | Moho Resources | 12% | 27% | -10% | -53% | 0.019 | $3,737,920 |

| NXM | Nexus Minerals | 11% | -42% | -52% | -65% | 0.097 | $31,568,971 |

| USL | Unico Silver Limited | 11% | -14% | -12% | -12% | 0.15 | $45,823,073 |

| CLA | Celsius Resource | 11% | 33% | 25% | 5% | 0.02 | $37,514,367 |

| SKY | SKY Metals | 11% | 11% | 4% | -44% | 0.05 | $19,215,957 |

| PKO | Peako Limited | 11% | 11% | -31% | -47% | 0.01 | $4,236,583 |

| KNB | Koonenberrygold | 11% | -17% | -19% | -47% | 0.05 | $3,787,822 |

| BBX | BBX Minerals | 10% | -21% | -29% | -18% | 0.075 | $38,122,292 |

| MAU | Magnetic Resources | 10% | -19% | -36% | -61% | 0.55 | $128,526,933 |

| SPQ | Superior Resources | 9% | -33% | -38% | -5% | 0.035 | $59,542,715 |

| SFM | Santa Fe Minerals | 9% | -2% | -25% | -43% | 0.06 | $4,223,490 |

| GAL | Galileo Mining | 8% | 2% | -10% | 25% | 0.795 | $160,076,191 |

| GMR | Golden Rim Resources | 8% | 1% | 11% | -48% | 0.0345 | $19,522,416 |

| IPT | Impact Minerals | 8% | 27% | 100% | 40% | 0.014 | $36,981,151 |

| AAJ | Aruma Resources | 8% | -1% | 32% | -12% | 0.07 | $10,987,305 |

| SNG | Siren Gold | 8% | 8% | -41% | -69% | 0.1075 | $14,097,175 |

| KCC | Kincora Copper | 7% | 7% | 0% | -21% | 0.073 | $8,586,739 |

| BTR | Brightstar Resources | 7% | 0% | -12% | -35% | 0.015 | $12,489,432 |

| PNT | Panthermetals | 6% | -20% | -56% | -60% | 0.084 | $5,197,750 |

| LCL | Los Cerros Limited | 6% | 17% | -39% | -45% | 0.035 | $25,417,743 |

| PUR | Pursuit Minerals | 6% | 0% | 13% | -14% | 0.018 | $46,553,359 |

| MEU | Marmota Limited | 6% | 0% | -21% | -22% | 0.038 | $40,234,422 |

| MEG | Megado Minerals | 5% | -11% | -13% | -68% | 0.039 | $9,923,767 |

| IGO | IGO Limited | 5% | 17% | 9% | 30% | 14.67 | $11,124,264,173 |

| MXR | Maximus Resources | 5% | -5% | 0% | -45% | 0.04 | $12,124,119 |

| FEG | Far East Gold | 5% | 5% | -36% | -23% | 0.305 | $48,975,427 |

| POL | Polymetals Resources | 5% | 78% | 31% | 205% | 0.32 | $14,458,461 |

| MGV | Musgrave Minerals | 5% | 2% | 10% | -21% | 0.23 | $135,977,828 |

| SAU | Southern Gold | 5% | 0% | -8% | -49% | 0.023 | $7,206,847 |

| EM2 | Eagle Mountain | 4% | -20% | -29% | -59% | 0.12 | $38,120,858 |

| BGD | Bartongoldholdings | 4% | 14% | 30% | 27% | 0.26 | $23,309,936 |

| SSR | SSR Mining Inc. | 4% | 2% | 4% | -15% | 23.94 | $441,433,347 |

| KZR | Kalamazoo Resources | 4% | -15% | -33% | -58% | 0.14 | $22,098,921 |

| GBZ | GBM Rsources | 4% | 4% | -33% | -69% | 0.029 | $16,014,984 |

| A8G | Australasian Metals | 4% | -17% | -24% | -63% | 0.145 | $5,969,722 |

| BNZ | Benzmining | 3% | -12% | -12% | -42% | 0.36 | $28,244,214 |

| PNR | Pantoro Limited | 3% | 4% | -21% | -71% | 0.076 | $230,190,363 |

| STN | Saturn Metals | 3% | -5% | 6% | -46% | 0.19 | $31,067,447 |

| GSR | Greenstone Resources | 3% | -9% | -38% | -44% | 0.02 | $24,265,368 |

| TRM | Truscott Mining Corp | 2% | -6% | 7% | -10% | 0.044 | $7,354,911 |

| OKR | Okapi Resources | 2% | -9% | -18% | -50% | 0.1225 | $24,061,182 |

| SVY | Stavely Minerals | 2% | -27% | -48% | -66% | 0.1275 | $44,046,952 |

| OZM | Ozaurum Resources | 2% | 8% | -14% | -64% | 0.057 | $7,366,000 |

| TUL | Tulla Resources | 1% | 8% | 6% | -37% | 0.355 | $114,240,421 |

| ERM | Emmerson Resources | 1% | -4% | -4% | -22% | 0.072 | $38,674,395 |

| HCH | Hot Chili | 1% | 0% | 19% | -15% | 1.045 | $123,625,788 |

| SXG | Southern Cross Gold | 1% | -24% | -29% | 0% | 0.57 | $48,506,021 |

| LM8 | Lunnonmetalslimited | 0% | -7% | 15% | 10% | 1.025 | $114,845,817 |

| OBM | Ora Banda Mining | 0% | 7% | 73% | 339% | 0.145 | $241,671,034 |

| FFX | Firefinch | 0% | 0% | 0% | -36% | 0.2 | $236,569,315 |

| X64 | Ten Sixty Four | 0% | 0% | -11% | -20% | 0.57 | $130,184,182 |

| LCY | Legacy Iron Ore | 0% | -6% | -16% | -30% | 0.016 | $108,916,045 |

| DCN | Dacian Gold | 0% | 9% | -16% | -55% | 0.084 | $102,211,279 |

| TTM | Titan Minerals | 0% | 3% | -10% | -24% | 0.06 | $84,676,391 |

| WMC | Wiluna Mining Corp | 0% | 0% | 0% | -58% | 0.205 | $74,238,031 |

| TRY | Troy Resources | 0% | 0% | 0% | 0% | 0.0295 | $62,920,961 |

| WA8 | Warriedarresour | 0% | -10% | -24% | 8% | 0.13 | $58,192,940 |

| ZNC | Zenith Minerals | 0% | 3% | -43% | -58% | 0.15 | $50,997,376 |

| AAR | Astral Resources NL | 0% | -13% | 0% | -14% | 0.072 | $50,308,436 |

| KAI | Kairos Minerals | 0% | 5% | -9% | -19% | 0.021 | $43,210,057 |

| RVR | Red River Resources | 0% | 0% | 0% | -59% | 0.073 | $37,847,908 |

| WWI | West Wits Mining | 0% | -12% | -6% | -40% | 0.015 | $33,645,259 |

| TBA | Tombola Gold | 0% | 0% | 0% | -54% | 0.026 | $33,129,243 |

| SVG | Savannah Goldfields | 0% | -6% | -18% | -23% | 0.155 | $28,327,266 |

| ANL | Amani Gold | 0% | 0% | 0% | 0% | 0.001 | $25,143,441 |

| ADV | Ardiden | 0% | -13% | 0% | -36% | 0.007 | $18,818,347 |

| CWX | Carawine Resources | 0% | 0% | -5% | -34% | 0.095 | $18,697,659 |

| PXX | Polarx Limited | 0% | 18% | -35% | -19% | 0.013 | $18,264,783 |

| CDT | Castle Minerals | 0% | -16% | -24% | -56% | 0.016 | $17,991,888 |

| CGN | Crater Gold Min | 0% | 0% | 0% | 0% | 0.014499 | $17,965,037 |

| WRM | White Rock Min | 0% | 0% | -5% | -48% | 0.063 | $17,508,200 |

| PNX | PNX Metals Limited | 0% | 0% | -29% | -36% | 0.003 | $16,141,874 |

| ASR | Asra Minerals | 0% | -17% | -50% | -74% | 0.01 | $14,671,187 |

| CTO | Citigold Corp | 0% | -17% | -17% | 0% | 0.005 | $14,368,295 |

| BMR | Ballymore Resources | 0% | -3% | 3% | -34% | 0.155 | $13,966,031 |

| BAT | Battery Minerals | 0% | -20% | 0% | -50% | 0.004 | $13,427,769 |

| A1G | African Gold . | 0% | -5% | -5% | -26% | 0.079 | $13,375,586 |

| NSM | Northstaw | 0% | -19% | -32% | -58% | 0.105 | $12,613,335 |

| YRL | Yandal Resources | 0% | -13% | -18% | -61% | 0.08 | $12,308,640 |

| GUL | Gullewa Limited | 0% | 0% | -8% | -24% | 0.055 | $10,767,521 |

| CAZ | Cazaly Resources | 0% | 4% | -21% | -29% | 0.027 | $10,039,188 |

| DCX | Discovex Res | 0% | -25% | 0% | -55% | 0.003 | $9,907,704 |

| MTH | Mithril Resources | 0% | 50% | -14% | -57% | 0.003 | $9,789,271 |

| GIB | Gibb River Diamonds | 0% | -6% | -27% | -27% | 0.044 | $9,729,434 |

| NPM | Newpeak Metals | 0% | 0% | 0% | 0% | 0.001 | $9,145,132 |

| WCN | White Cliff Min | 0% | 14% | -43% | -62% | 0.008 | $8,631,490 |

| MBK | Metal Bank | 0% | -9% | -12% | -50% | 0.03 | $8,294,566 |

| AM7 | Arcadia Minerals | 0% | -5% | -15% | -17% | 0.175 | $8,172,131 |

| GED | Golden Deeps | 0% | -13% | -22% | -50% | 0.007 | $8,086,587 |

| REZ | Resourc & En Grp | 0% | 23% | 0% | -66% | 0.016 | $7,996,893 |

| THR | Thor Energy PLC | 0% | 25% | -17% | -63% | 0.005 | $7,368,064 |

| NAE | New Age Exploration | 0% | -17% | -29% | -55% | 0.005 | $7,179,495 |

| MCT | Metalicity Limited | 0% | -20% | -33% | -67% | 0.002 | $7,009,079 |

| CXU | Cauldron Energy | 0% | -14% | -14% | -48% | 0.006 | $6,520,981 |

| TMX | Terrain Minerals | 0% | 9% | 0% | -33% | 0.006 | $6,499,196 |

| AVW | Avira Resources | 0% | 50% | 0% | -40% | 0.003 | $6,401,370 |

| GMN | Gold Mountain | 0% | -14% | -57% | -50% | 0.003 | $5,909,798 |

| CLZ | Classic Min | 0% | 0% | -89% | -99% | 0.001 | $5,761,929 |

| DEX | Duke Exploration | 0% | 0% | 0% | -56% | 0.053 | $5,587,240 |

| G88 | Golden Mile Res | 0% | -25% | 3% | -57% | 0.021 | $5,532,077 |

| AYM | Australia United Min | 0% | -25% | 0% | -63% | 0.003 | $5,527,732 |

| TMB | Tambourahmetals | 0% | 29% | 5% | -48% | 0.11 | $4,531,186 |

| TMZ | Thomson Res | 0% | 0% | -74% | -82% | 0.005 | $4,349,755 |

| AL8 | Alderan Resource | 0% | -13% | 0% | -65% | 0.007 | $4,316,863 |

| PUA | Peak Minerals | 0% | 0% | -33% | -67% | 0.004 | $4,165,506 |

| GNM | Great Northern | 0% | -33% | -50% | -60% | 0.002 | $4,052,627 |

| NMR | Native Mineral Res | 0% | -12% | -73% | -82% | 0.03 | $3,604,162 |

| M2R | Miramar | 0% | 2% | -44% | -65% | 0.045 | $3,515,478 |

| FAU | First Au | 0% | -42% | -13% | -73% | 0.0035 | $3,284,350 |

| NES | Nelson Resources. | 0% | -11% | -43% | -71% | 0.004 | $2,648,674 |

| RMS | Ramelius Resources | -1% | -7% | 44% | 4% | 1.3425 | $1,244,379,356 |

| ADT | Adriatic Metals | -1% | -3% | 10% | 55% | 3.48 | $840,520,390 |

| SPD | Southernpalladium | -1% | -5% | -39% | 0% | 0.495 | $21,323,772 |

| BRB | Breaker Res NL | -1% | -6% | 47% | 119% | 0.47 | $168,757,423 |

| EMR | Emerald Res NL | -1% | 10% | 60% | 76% | 1.8975 | $1,149,074,533 |

| TG1 | Techgen Metals | -1% | 35% | 2% | -35% | 0.084 | $5,402,135 |

| PGD | Peregrine Gold | -1% | -8% | -8% | -17% | 0.355 | $20,757,966 |

| BM8 | Battery Age Minerals | -1% | -5% | -30% | -30% | 0.35 | $28,573,993 |

| AME | Alto Metals Limited | -2% | -7% | -3% | -23% | 0.065 | $39,833,006 |

| DTM | Dart Mining NL | -2% | -21% | 5% | -5% | 0.058 | $9,131,223 |

| HAV | Havilah Resources | -2% | -16% | -23% | 55% | 0.255 | $85,492,587 |

| CHN | Chalice Mining | -2% | -4% | 19% | 33% | 7.475 | $2,913,701,282 |

| MRZ | Mont Royal Resources | -2% | -16% | -50% | -73% | 0.088 | $6,163,440 |

| STK | Strickland Metals | -2% | 0% | 0% | -45% | 0.04 | $65,179,796 |

| CYL | Catalyst Metals | -3% | -4% | -19% | -41% | 0.96 | $167,697,430 |

| FML | Focus Minerals | -3% | 3% | -25% | -3% | 0.19 | $54,446,143 |

| KAL | Kalgoorliegoldmining | -3% | -26% | -55% | -70% | 0.037 | $2,790,757 |

| MTC | Metalstech | -3% | 1% | -32% | 0% | 0.355 | $63,040,754 |

| MLS | Metals Australia | -3% | -13% | -21% | -61% | 0.035 | $21,246,267 |

| AAU | Antilles Gold | -3% | 0% | 17% | -44% | 0.035 | $20,312,225 |

| TAM | Tanami Gold NL | -3% | -11% | -13% | -41% | 0.034 | $39,953,300 |

| MEK | Meeka Metals Limited | -3% | -32% | -50% | -17% | 0.034 | $38,433,922 |

| SMS | Starmineralslimited | -3% | -6% | -6% | -69% | 0.068 | $2,079,784 |

| NST | Northern Star | -3% | 0% | 24% | 54% | 13.485 | $15,964,840,736 |

| TBR | Tribune Res | -3% | -10% | -12% | -16% | 3.54 | $185,736,993 |

| BCN | Beacon Minerals | -3% | -3% | 14% | 0% | 0.032 | $120,216,581 |

| GOR | Gold Road Res | -3% | 7% | 11% | 41% | 1.875 | $2,059,784,857 |

| G50 | Gold50Limited | -3% | -26% | -38% | -23% | 0.155 | $8,826,165 |

| NCM | Newcrest Mining | -3% | -5% | 37% | 14% | 28.23 | $25,834,325,847 |

| KTA | Krakatoa Resources | -3% | 3% | -32% | -64% | 0.03 | $10,901,298 |

| KRM | Kingsrose Mining | -3% | -9% | -9% | -12% | 0.059 | $45,151,591 |

| S2R | S2 Resources | -4% | -7% | -21% | -13% | 0.135 | $57,412,813 |

| PNM | Pacific Nickel Mines | -4% | -5% | -2% | 3% | 0.081 | $34,800,360 |

| ARN | Aldoro Resources | -4% | -25% | -16% | -37% | 0.135 | $18,819,324 |

| AGG | AngloGold Ashanti | -4% | 0% | 35% | 58% | 7.93 | $719,014,586 |

| RXL | Rox Resources | -4% | -4% | 123% | 15% | 0.39 | $87,498,161 |

| SFR | Sandfire Resources | -4% | -8% | 14% | 23% | 6.185 | $2,969,797,532 |

| GCY | Gascoyne Res | -4% | 0% | -25% | -41% | 0.125 | $114,011,704 |

| ARV | Artemis Resources | -4% | -11% | -50% | -70% | 0.0125 | $20,298,439 |

| MVL | Marvel Gold Limited | -4% | -26% | -52% | -69% | 0.0125 | $7,756,038 |

| AWJ | Auric Mining | -4% | -17% | -22% | -41% | 0.05 | $6,542,980 |

| EVN | Evolution Mining | -4% | 6% | 25% | 4% | 3.715 | $7,119,863,318 |

| ANX | Anax Metals | -4% | -3% | 34% | -17% | 0.071 | $29,476,428 |

| KSN | Kingston Resources | -4% | -18% | 16% | -33% | 0.094 | $39,487,097 |

| BNR | Bulletin Res | -4% | -22% | -25% | -56% | 0.07 | $19,964,195 |

| CY5 | Cygnus Metals | -4% | -6% | -39% | 64% | 0.23 | $49,332,190 |

| GMD | Genesis Minerals | -4% | 12% | -1% | 0% | 1.235 | $580,246,500 |

| SBR | Sabre Resources | -4% | 0% | -42% | -56% | 0.022 | $6,412,696 |

| AQI | Alicanto Min | -5% | -7% | -9% | -55% | 0.039 | $21,073,135 |

| VMC | Venus Metals Cor | -5% | -5% | 41% | 6% | 0.19 | $34,433,450 |

| CST | Castile Resources | -5% | 2% | 0% | -50% | 0.095 | $23,222,633 |

| HRN | Horizon Gold | -5% | 10% | 21% | 7% | 0.375 | $46,943,115 |

| CAI | Calidus Resources | -5% | -24% | -31% | -79% | 0.185 | $101,633,046 |

| TSO | Tesoro Gold | -5% | 37% | 3% | -42% | 0.037 | $38,983,665 |

| MZZ | Matador Mining | -5% | -5% | -36% | -65% | 0.074 | $23,956,631 |

| GWR | GWR Group | -5% | 4% | 25% | -43% | 0.074 | $23,127,599 |

| SLZ | Sultan Resources | -5% | -10% | -56% | -75% | 0.037 | $3,821,522 |

| MDI | Middle Island Res | -5% | -3% | -8% | -76% | 0.035 | $4,529,474 |

| FAL | Falconmetals | -6% | -3% | 21% | 13% | 0.34 | $61,950,000 |

| WAF | West African Res | -6% | -8% | -20% | -21% | 0.9425 | $997,988,303 |

| RED | Red 5 Limited | -6% | -9% | -22% | -54% | 0.16 | $570,814,758 |

| PRS | Prospech Limited | -6% | -40% | 19% | -32% | 0.032 | $7,421,443 |

| KCN | Kingsgate Consolid. | -6% | -13% | -20% | 2% | 1.3825 | $366,007,403 |

| GML | Gateway Mining | -6% | -22% | -22% | -53% | 0.047 | $13,050,344 |

| MRR | Minrex Resources | -6% | -6% | -53% | -72% | 0.015 | $17,357,880 |

| DTR | Dateline Resources | -6% | -17% | -59% | -85% | 0.015 | $10,944,933 |

| TAR | Taruga Minerals | -6% | -6% | -38% | -12% | 0.015 | $10,590,402 |

| ZAG | Zuleika Gold | -6% | 15% | -29% | -48% | 0.015 | $7,845,759 |

| LEX | Lefroy Exploration | -6% | -10% | -15% | -24% | 0.22 | $36,103,050 |

| RRL | Regis Resources | -6% | -7% | -1% | 10% | 2.04 | $1,623,305,739 |

| GSM | Golden State Mining | -6% | -12% | -33% | -55% | 0.029 | $3,393,412 |

| NAG | Nagambie Resources | -7% | -7% | -35% | -7% | 0.043 | $25,014,232 |

| PRU | Perseus Mining | -7% | -13% | -2% | 18% | 2.075 | $2,886,452,254 |

| AMI | Aurelia Metals | -7% | -10% | 8% | -63% | 0.135 | $167,054,024 |

| KWR | Kingwest Resources | -7% | -27% | -23% | -80% | 0.027 | $7,606,624 |

| CMM | Capricorn Metals | -7% | -12% | -9% | 19% | 4.17 | $1,586,543,499 |

| GRL | Godolphin Resources | -7% | 2% | -20% | -49% | 0.066 | $7,102,167 |

| BGL | Bellevue Gold | -7% | -10% | 13% | 55% | 1.2825 | $1,463,401,449 |

| AUC | Ausgold Limited | -7% | -2% | 6% | -11% | 0.05 | $117,665,561 |

| PGO | Pacgold | -8% | -12% | 3% | -38% | 0.37 | $20,335,872 |

| GBR | Greatbould Resources | -8% | -14% | -10% | -14% | 0.081 | $40,844,817 |

| ALK | Alkane Resources | -8% | -1% | 56% | -13% | 0.8325 | $526,937,481 |

| SBM | St Barbara Limited | -8% | -2% | -19% | -46% | 0.63 | $551,165,610 |

| PDI | Predictive Disc | -8% | -6% | -6% | -17% | 0.17 | $314,580,622 |

| ARL | Ardea Resources | -8% | -4% | -41% | -61% | 0.4175 | $69,458,623 |

| WGX | Westgold Resources. | -8% | 1% | 74% | 12% | 1.5225 | $767,268,823 |

| MKG | Mako Gold | -9% | -21% | -23% | -61% | 0.031 | $16,814,371 |

| BYH | Bryah Resources | -9% | -21% | -30% | -63% | 0.018 | $5,062,563 |

| TCG | Turaco Gold Limited | -9% | -26% | -12% | -41% | 0.051 | $22,668,983 |

| AGC | AGC | -9% | -7% | -15% | -44% | 0.051 | $5,600,000 |

| KAU | Kaiser Reef | -9% | 11% | 21% | 8% | 0.2 | $29,539,536 |

| TMS | Tennant Minerals | -9% | -12% | -3% | -19% | 0.03 | $22,783,002 |

| RSG | Resolute Mining | -9% | 2% | 134% | 74% | 0.4675 | $1,032,568,186 |

| DEG | De Grey Mining | -9% | -8% | 12% | 41% | 1.4425 | $2,326,138,703 |

| NVA | Nova Minerals | -10% | -2% | -53% | -51% | 0.32 | $70,120,851 |

| SMI | Santana Minerals | -10% | -20% | -3% | -22% | 0.635 | $92,985,999 |

| ASO | Aston Minerals | -10% | -18% | 18% | -27% | 0.0945 | $105,899,439 |

| KIN | KIN Min NL | -10% | -20% | -45% | -54% | 0.036 | $42,413,420 |

| PRX | Prodigy Gold NL | -10% | -25% | -25% | -49% | 0.009 | $17,506,078 |

| MHC | Manhattan Corp | -10% | -10% | -18% | -59% | 0.0045 | $13,213,254 |

| VKA | Viking Mines | -10% | -18% | -10% | -10% | 0.009 | $9,227,326 |

| SI6 | SI6 Metals Limited | -10% | -10% | -25% | -50% | 0.0045 | $7,476,973 |

| MOM | Moab Minerals | -10% | 29% | 0% | -67% | 0.009 | $6,819,635 |

| HMX | Hammer Metals | -10% | -30% | 3% | -18% | 0.07 | $59,141,329 |

| BC8 | Black Cat Syndicate | -10% | -7% | 23% | 0% | 0.435 | $119,954,004 |

| HRZ | Horizon | -10% | -12% | -15% | -53% | 0.052 | $36,243,151 |

| AZY | Antipa Minerals | -11% | -15% | -19% | -62% | 0.017 | $61,081,695 |

| TGM | Theta Gold Mines | -11% | 12% | 12% | -37% | 0.076 | $47,359,547 |

| NML | Navarre Minerals | -11% | -29% | -41% | -70% | 0.024 | $37,571,979 |

| RND | Rand Mining | -11% | -8% | -10% | -19% | 1.22 | $68,819,913 |

| CBY | Canterbury Resources | -11% | -11% | -24% | -50% | 0.031 | $4,480,229 |

| DRE | Dreadnought Resources | -12% | -23% | -50% | 39% | 0.053 | $178,887,324 |

| AUT | Auteco Minerals | -12% | -23% | -27% | -38% | 0.037 | $90,200,616 |

| HAW | Hawthorn Resources | -13% | -9% | -39% | -39% | 0.07 | $23,451,093 |

| GSN | Great Southern | -13% | 5% | -28% | -57% | 0.021 | $14,560,497 |

| SVL | Silver Mines Limited | -13% | -15% | 3% | 3% | 0.205 | $294,909,750 |

| ADG | Adelong Gold Limited | -13% | -23% | 43% | -67% | 0.01 | $5,338,223 |

| MM8 | Medallion Metals. | -13% | -33% | -41% | -62% | 0.091 | $22,371,354 |

| M24 | Mamba Exploration | -13% | -30% | -37% | -30% | 0.091 | $5,793,417 |

| LRL | Labyrinth Resources | -14% | -20% | -29% | -60% | 0.012 | $12,473,335 |

| TIE | Tietto Minerals | -15% | -33% | -28% | 19% | 0.505 | $576,389,570 |

| QML | Qmines Limited | -16% | -10% | -18% | -47% | 0.135 | $23,244,339 |

| SLR | Silver Lake Resource | -17% | -19% | -15% | -34% | 1.0125 | $985,528,993 |

| EMU | EMU NL | -17% | 25% | -49% | -79% | 0.0025 | $3,625,053 |

| ADN | Andromeda Metals | -17% | -31% | -23% | -65% | 0.034 | $111,960,304 |

| IVR | Investigator Res | -17% | -7% | 26% | 6% | 0.053 | $80,481,521 |

| NWM | Norwest Minerals | -21% | -37% | -50% | -41% | 0.027 | $7,173,765 |

| MKR | Manuka Resources. | -22% | -34% | -33% | -74% | 0.057 | $33,533,944 |

| RGL | Riversgold | -24% | 12% | -37% | -60% | 0.019 | $17,963,887 |

| RMX | Red Mount Min | -25% | -14% | -40% | -63% | 0.003 | $6,815,553 |

| RML | Resolution Minerals | -25% | -25% | -44% | -65% | 0.0045 | $5,015,167 |

| AQX | Alice Queen | -33% | 0% | -50% | -80% | 0.001 | $2,530,288 |

Small Cap Standouts

The advanced African gold explorer is recommending an all-share takeover offer from TSX/NYSE listed Fortuna Silver Mines at a 95% premium to the last closing price.

Under the proposal CHZ shareholders will receive 0.0248 shares in Fortuna per CHZ share. That’s an implied value of $0.142 per CHZ share, or $89m all up.

The attraction for $1.5bn capped Fortuna — which has five operating mines in Peru, Argentina, Mexico, Côte d’Ivoire, and Burkina Faso – is CHZ’s 860,000oz and growing Diamba Sud project in Senegal.

Diamba Sud lies 12km from Barrick’s 12.5Moz Loulo mine and 7km from its 5.5Moz Gounkoto mine.

A recent scoping study envisaged a low cost mine producing ~100kozpa at AISC US$856/oz over an intial 7-8 year mine life.

“In a short time, Chesser has done a great job advancing Diamba Sud from early-stage exploration to a PEA-stage [scoping] project with multiple targets yet to be tested,” Fortuna boss Jorge A. Ganoza says.

“Within the larger and diversified Fortuna portfolio, the advancement of Diamba Sud will benefit from our technical and operational strength and lower cost of capital.”

The US$300m Binding Gold Purchase Agreement with Quantum Metal Recovery Inc is now legally binding.

The facility, paid over 30 months against future gold production ounces, enables BEZ to fully fund development of the ~3Moz Bau project in Malaysia’s Sarawak region.

The company is now updating an old feasibility study completed back in 2013, with initial results due in the second half of 2023.

BEZ pared a big chunk of those early week gains after clarifying that it was required to produce gold concentrate in a pilot plant on or before 31 December 2023.

If it doesn’t, the legally binding Gold Purchase Agreement (GPA) may be terminated by Quantum Metal Recovery.

“In essence, there is a requirement that Besra demonstrates proof of concept – being able, by the end of the year, to physically produce a concentrate from Bau that contains gold,” it says.

“The pilot plant is expected to have a capacity of up to 200 tpd, which is not a commercial scale operation and is not intended to produce gold per se, merely concentrate.

“Based on studies undertaken to date by ZJH Minerals Company Ltd of China (as reported in the Company’s Quarterly Activities Reports since 2 May 2022), the Board of Besra considers the requirement to produce the concentrate is highly achievable.”

You might be interested in