Gold Digger: Scientific research, and Metals Focus analysis, tells us gold will shine in 2024

Mining

Mining

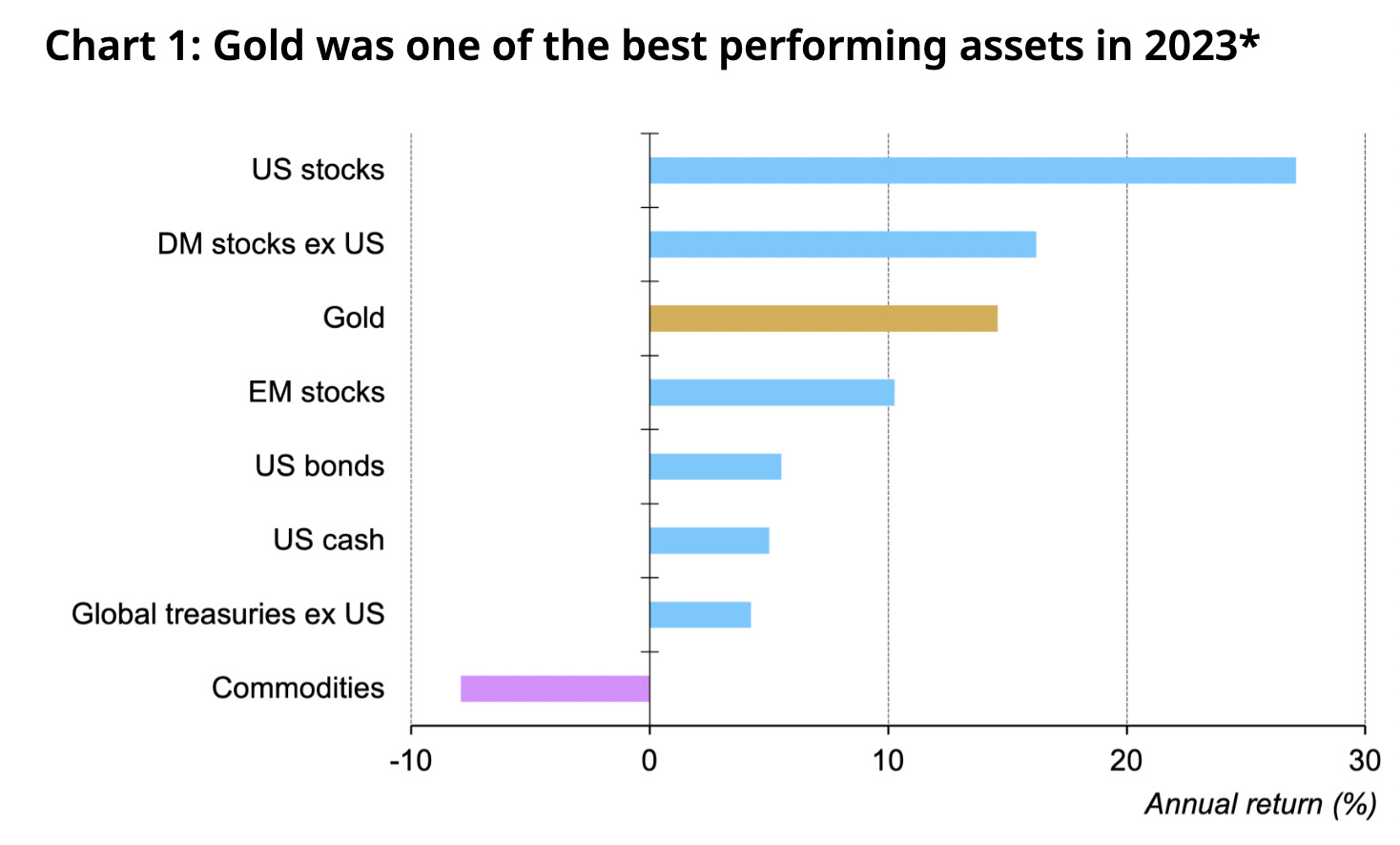

Gold’s good 2023 form (a 14.6% return) hasn’t so far continued in 2024, but, of course, that’s not saying much – the year is but an embryo.

In US dollars, the yellow metal’s spot price has dipped about $30, from $2,077 an ounce on January 2, to about $2,047 at the time of writing.

In Aussie bucks, gold rode up nicely to $3,056 an ounce a couple of days ago, falling back again to roughly where it began the year, just a shade below $3,040. (Update: actually, it’s finished regular Aussie trading on Friday back around $3,056 again. Flat then.)

Here, by the way, is how gold shaped up in 2023 compared with several other key assets, according to the World Gold Council.

(Bitcoin, by the way, with roughly a 154% return in 2023, was clearly too big to fit on this graph.)

Meanwhile, Metals Focus, a prominent global independent precious metals research consultancy based in London has just released its latest outlook, and it provides a fairly positive take, which we’ll get to further below.

But before we do, this…

Here’s something for you, fresh from the Stockhead lab. (Which is basically the end of the desk where our chief social engineer and professional X-operator Banksy sits.)

It’s a highly scientifically put-together poll on gold’s price direction this year, resulting in a small but not totally insignificant data capture from a searingly intelligent section of the community – Stockhead followers on X.

$GOLD and #bitcoin will both shoot the lights out 💪🏼 win-win in my opinion!

— RiskItForTheBiscuit (@Anthony02274412) January 3, 2024

And the survey says…

• More than 71% of the 46 of you who took the time to click a button think gold will continue to trend very nicely up and to the right in 2024.

• 37% of those who took part on in the poll actually believe it’ll hit stratospheric heights, mooning above at least US$2,500 per ounce. Thanks for voting six times each, by the way, Robert Kiyosaki and Peter Schiff. (Possibly.)

• 19.6% think the spot gold price is one big yawn, and will remain as steady as an undertaker’s or ATO worker’s pay cheques.

• While just a handful of you (8.7%) reckon it might be about to be disgustingly outperformed by Bitcoin. (Again.) By our calculations, that’s four whole people, and a tiny fraction of another one – possibly an itchy trigger finger hovering over a buy button on Coinbase.

$GOLD and #bitcoin will both shoot the lights out 💪🏼 win-win in my opinion!

— RiskItForTheBiscuit (@Anthony02274412) January 3, 2024

— Dan Held (@danheld) January 1, 2024

Precious metals gurus Metals Focus notes in its latest report, released today, that it expects 2024 to begin with a small dip – “a modest retreat” – for gold prices, which is playing out.

Part of the analysts’ reasoning is central banks keeping rates steady for longer than current market consensus.

The next US Federal Reserve FOMC meeting to reveal its next rates-focused move, by the way, is happening later this month, and the CME FedWatch Tool indicates a 95% chance of the Fed keeping rates in the US exactly where they are for now.

Metals Focus continued, though with:

“That said, we believe the downside [for gold prices] will be limited and temporary.

“Once the interest rate cutting cycle starts, most likely in mid-2024, gold will receive a strong boost in the latter part of the year. Silver is expected to broadly shadow gold.”

A drop in real yields and pressure on the dollar, plus systemic risks, turbulent geopolitics and richly priced equities, should all favour fresh gold investment, believes Metal Focus, which is targeting a “notable price recovery” later this year to around US$2,100.

On the conservative side? Certainly compared with some, but it’s an ultimately positive take.

The precious metals analysts caveated, however that a “persistent structural deficit, sizeable above-ground stocks and concerns about the Chinese economy” will likely dampen investor interest for a little while first.

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.0165 | 3% | -3% | -48% | $17,900,314 |

| NPM | Newpeak Metals | 0.023 | 35% | 15% | -77% | $1,999,035 |

| ASO | Aston Minerals Ltd | 0.022 | -4% | -29% | -74% | $31,081,542 |

| MTC | Metalstech Ltd | 0.26 | 33% | 79% | -45% | $44,404,329 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.045 | 0% | -6% | -55% | $5,198,506 |

| G88 | Golden Mile Res Ltd | 0.02 | 0% | -5% | -2% | $6,587,790 |

| DCX | Discovex Res Ltd | 0.002 | 0% | 0% | -33% | $6,605,136 |

| NMR | Native Mineral Res | 0.019 | -5% | -30% | -83% | $3,985,260 |

| AQX | Alice Queen Ltd | 0.0055 | 10% | -8% | -84% | $3,800,413 |

| SLZ | Sultan Resources Ltd | 0.02 | -13% | 25% | -76% | $2,963,801 |

| MKG | Mako Gold | 0.011 | 10% | 10% | -73% | $6,624,094 |

| KSN | Kingston Resources | 0.078 | -3% | -15% | -6% | $38,841,023 |

| AMI | Aurelia Metals Ltd | 0.11 | 0% | -4% | -8% | $185,874,414 |

| PNX | PNX Metals Limited | 0.003 | -25% | -25% | -29% | $16,141,874 |

| GIB | Gibb River Diamonds | 0.03 | 7% | 0% | -53% | $6,345,283 |

| KCN | Kingsgate Consolid. | 1.26 | -11% | -13% | -30% | $324,767,132 |

| TMX | Terrain Minerals | 0.005 | 25% | 0% | -17% | $6,767,139 |

| BNR | Bulletin Res Ltd | 0.14 | 0% | 8% | 40% | $39,637,799 |

| NXM | Nexus Minerals Ltd | 0.042 | -11% | -29% | -79% | $17,507,706 |

| SKY | SKY Metals Ltd | 0.039 | 8% | 8% | -24% | $17,994,526 |

| LM8 | Lunnonmetalslimited | 0.58 | -3% | -11% | -33% | $130,233,745 |

| CST | Castile Resources | 0.08 | -4% | 21% | -17% | $19,352,194 |

| YRL | Yandal Resources | 0.091 | 15% | 1% | -8% | $20,655,902 |

| FAU | First Au Ltd | 0.004 | 0% | 100% | 0% | $6,647,973 |

| ARL | Ardea Resources Ltd | 0.47 | -4% | 8% | -36% | $94,568,119 |

| GWR | GWR Group Ltd | 0.094 | 1% | 12% | 66% | $30,194,366 |

| IVR | Investigator Res Ltd | 0.036 | -5% | -29% | -14% | $55,430,428 |

| GTR | Gti Energy Ltd | 0.0095 | 19% | 19% | -12% | $20,499,471 |

| IPT | Impact Minerals | 0.013 | 18% | 24% | 86% | $31,511,743 |

| BNZ | Benzmining | 0.23 | -4% | -22% | -43% | $25,693,639 |

| MOH | Moho Resources | 0.01 | 0% | 11% | -52% | $5,359,412 |

| BCM | Brazilian Critical | 0.026 | 0% | 8% | -74% | $17,758,964 |

| PUA | Peak Minerals Ltd | 0.0035 | 17% | 17% | -30% | $3,124,130 |

| MRZ | Mont Royal Resources | 0.145 | -3% | -9% | -17% | $12,329,320 |

| SMS | Starmineralslimited | 0.038 | 9% | 3% | -45% | $2,885,066 |

| MVL | Marvel Gold Limited | 0.012 | 0% | 14% | -54% | $10,365,488 |

| PRX | Prodigy Gold NL | 0.006 | 0% | -33% | -54% | $12,257,755 |

| AAU | Antilles Gold Ltd | 0.023 | 0% | 0% | -28% | $18,884,459 |

| CWX | Carawine Resources | 0.11 | 0% | 0% | 12% | $25,973,799 |

| RND | Rand Mining Ltd | 1.37 | 0% | 7% | 1% | $77,920,067 |

| CAZ | Cazaly Resources | 0.03 | 3% | -17% | -3% | $13,639,090 |

| BMR | Ballymore Resources | 0.13 | 8% | -13% | -16% | $22,041,323 |

| DRE | Dreadnought Resources Ltd | 0.029 | -3% | -12% | -70% | $100,893,116 |

| ZNC | Zenith Minerals Ltd | 0.14 | -13% | 0% | -45% | $49,333,324 |

| REZ | Resourc & En Grp Ltd | 0.012 | 0% | -25% | -25% | $5,997,669 |

| LEX | Lefroy Exploration | 0.175 | 3% | 3% | -34% | $35,952,714 |

| ERM | Emmerson Resources | 0.054 | -2% | -8% | -29% | $29,959,038 |

| AM7 | Arcadia Minerals | 0.069 | -5% | -19% | -64% | $7,524,457 |

| ADT | Adriatic Metals | 3.65 | -11% | 12% | 16% | $874,807,240 |

| AS1 | Asara Resources Ltd | 0.011 | 10% | -8% | -63% | $8,720,040 |

| CYL | Catalyst Metals | 0.7 | -10% | -33% | -42% | $159,614,219 |

| CHN | Chalice Mining Ltd | 1.4325 | -19% | -8% | -77% | $575,665,690 |

| KAL | Kalgoorliegoldmining | 0.029 | 16% | 16% | -65% | $4,596,521 |

| MLS | Metals Australia | 0.036 | 3% | 0% | -23% | $22,465,303 |

| ADN | Andromeda Metals Ltd | 0.023 | -4% | 5% | -48% | $71,530,194 |

| MEI | Meteoric Resources | 0.295 | 13% | 44% | 368% | $567,184,156 |

| SRN | Surefire Rescs NL | 0.0085 | 0% | -11% | -23% | $15,705,263 |

| SIH | Sihayo Gold Limited | 0.0015 | 0% | -25% | -25% | $18,306,384 |

| WA8 | Warriedarresourltd | 0.055 | 2% | -13% | -66% | $26,031,517 |

| HMX | Hammer Metals Ltd | 0.046 | -10% | -19% | -32% | $42,547,553 |

| WCN | White Cliff Min Ltd | 0.009 | 0% | -25% | -36% | $11,489,034 |

| AVMDC | Advance Metals Ltd | 0.036 | -10% | -40% | -78% | $1,300,224 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | -10% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.007 | 0% | 0% | -67% | $11,455,470 |

| MCT | Metalicity Limited | 0.002 | 0% | 0% | -33% | $8,970,108 |

| AME | Alto Metals Limited | 0.043 | 0% | -2% | -37% | $31,025,496 |

| CTO | Citigold Corp Ltd | 0.005 | -17% | 0% | 0% | $14,368,295 |

| TIE | Tietto Minerals | 0.5975 | -4% | -4% | -23% | $677,934,271 |

| SMI | Santana Minerals Ltd | 0.965 | -4% | 19% | 46% | $178,720,666 |

| M2R | Miramar | 0.023 | 10% | 21% | -70% | $3,126,260 |

| MHC | Manhattan Corp Ltd | 0.003 | -25% | -25% | -50% | $8,810,939 |

| GRL | Godolphin Resources | 0.04 | 5% | 5% | -46% | $7,615,891 |

| SVG | Savannah Goldfields | 0.044 | -12% | -20% | -73% | $8,834,037 |

| EMC | Everest Metals Corp | 0.079 | -2% | -9% | -12% | $13,552,498 |

| GUL | Gullewa Limited | 0.055 | 0% | 0% | -8% | $11,262,521 |

| CY5 | Cygnus Metals Ltd | 0.12 | -4% | -20% | -69% | $33,529,301 |

| G50 | Gold50Limited | 0.135 | 0% | 13% | -44% | $14,754,150 |

| ADV | Ardiden Ltd | 0.17 | -3% | -6% | -51% | $10,940,564 |

| AAR | Astral Resources NL | 0.074 | 1% | -8% | -1% | $59,482,315 |

| VMC | Venus Metals Cor Ltd | 0.1 | -5% | -5% | 27% | $18,972,868 |

| NAE | New Age Exploration | 0.005 | -17% | -29% | -29% | $9,866,444 |

| VKA | Viking Mines Ltd | 0.014 | 8% | 8% | 56% | $14,353,618 |

| LCL | LCL Resources Ltd | 0.0165 | 3% | -25% | -68% | $16,169,492 |

| MTH | Mithril Resources | 0.002 | 0% | 0% | -43% | $6,737,609 |

| ADG | Adelong Gold Limited | 0.0055 | 10% | -8% | -8% | $3,848,106 |

| RMX | Red Mount Min Ltd | 0.003 | 0% | 0% | -33% | $8,020,728 |

| PRS | Prospech Limited | 0.03 | -6% | -6% | 12% | $8,104,462 |

| XTC | XTC Lithium Limited | 0.2 | 19900% | 0% | -67% | $17,528,272 |

| TTM | Titan Minerals | 0.025 | -11% | -14% | -65% | $42,281,734 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -57% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.044 | -6% | -27% | -63% | $22,576,405 |

| KZR | Kalamazoo Resources | 0.135 | 23% | 4% | -45% | $18,850,642 |

| BCN | Beacon Minerals | 0.025 | -4% | -17% | -11% | $93,919,204 |

| MAU | Magnetic Resources | 1 | -2% | -7% | 18% | $244,667,260 |

| BC8 | Black Cat Syndicate | 0.23 | -8% | -22% | -41% | $71,384,856 |

| EM2 | Eagle Mountain | 0.076 | 3% | 36% | -54% | $23,177,482 |

| EMR | Emerald Res NL | 2.975 | -4% | 3% | 149% | $1,828,261,292 |

| BYH | Bryah Resources Ltd | 0.013 | 0% | -13% | -46% | $5,636,894 |

| HCH | Hot Chili Ltd | 1 | -1% | -7% | 12% | $119,445,206 |

| WAF | West African Res Ltd | 0.9275 | -6% | -5% | -23% | $933,762,900 |

| MEU | Marmota Limited | 0.042 | 2% | 0% | -9% | $43,410,824 |

| NVA | Nova Minerals Ltd | 0.36 | -1% | 29% | -45% | $78,029,286 |

| SVL | Silver Mines Limited | 0.165 | -3% | -15% | -20% | $224,693,143 |

| PGD | Peregrine Gold | 0.27 | 6% | 0% | -27% | $18,759,015 |

| ICL | Iceni Gold | 0.058 | 12% | -6% | -30% | $13,684,000 |

| FG1 | Flynngold | 0.05 | -4% | -34% | -49% | $7,286,213 |

| WWI | West Wits Mining Ltd | 0.012 | 9% | 0% | -20% | $29,164,700 |

| RML | Resolution Minerals | 0.0035 | 17% | 17% | -50% | $4,409,989 |

| AAJ | Aruma Resources Ltd | 0.027 | 0% | -16% | -47% | $5,316,071 |

| AL8 | Alderan Resource Ltd | 0.005 | 0% | -23% | -38% | $6,641,168 |

| GMN | Gold Mountain Ltd | 0.0055 | 10% | 10% | -21% | $11,345,393 |

| MEG | Megado Minerals Ltd | 0.03 | -17% | 20% | -27% | $7,633,667 |

| HMG | Hamelingoldlimited | 0.08 | 1% | -2% | -45% | $12,600,000 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | 0% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.225 | 22% | 7% | -55% | $17,827,378 |

| TBR | Tribune Res Ltd | 2.87 | 0% | 0% | -27% | $154,256,146 |

| FML | Focus Minerals Ltd | 0.18 | 3% | 3% | -16% | $50,147,763 |

| GSR | Greenstone Resources | 0.008 | 0% | -11% | -75% | $10,944,908 |

| VRC | Volt Resources Ltd | 0.006 | -8% | -14% | -57% | $26,845,694 |

| ARV | Artemis Resources | 0.019 | -5% | -17% | -21% | $32,132,727 |

| HRN | Horizon Gold Ltd | 0.25 | -17% | -12% | -19% | $43,451,977 |

| CLA | Celsius Resource Ltd | 0.012 | 0% | -8% | -33% | $29,198,672 |

| QML | Qmines Limited | 0.078 | -1% | -8% | -53% | $16,452,232 |

| RDN | Raiden Resources Ltd | 0.038 | -12% | -12% | 567% | $100,881,924 |

| TCG | Turaco Gold Limited | 0.13 | 4% | 4% | 124% | $76,336,000 |

| KCC | Kincora Copper | 0.044 | -2% | 52% | -37% | $9,143,192 |

| GBZ | GBM Rsources Ltd | 0.009 | 0% | -33% | -78% | $6,582,896 |

| DTM | Dart Mining NL | 0.016 | -6% | 0% | -71% | $3,641,274 |

| MKR | Manuka Resources. | 0.075 | -5% | 50% | -12% | $42,949,125 |

| AUC | Ausgold Limited | 0.028 | -13% | -18% | -42% | $68,884,236 |

| ANX | Anax Metals Ltd | 0.029 | -3% | 7% | -45% | $13,946,611 |

| EMU | EMU NL | 0.001 | 0% | 0% | -80% | $2,024,771 |

| SFM | Santa Fe Minerals | 0.043 | 0% | 0% | -46% | $3,131,208 |

| SSR | SSR Mining Inc. | 15.75 | -4% | -13% | -35% | $100,767,340 |

| PNR | Pantoro Limited | 0.052 | -9% | -5% | -42% | $265,405,556 |

| CMM | Capricorn Metals | 4.445 | -8% | -9% | -9% | $1,641,342,052 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | -12% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.005 | 0% | -17% | -17% | $7,975,438 |

| HAW | Hawthorn Resources | 0.095 | 2% | 19% | -17% | $33,166,546 |

| BGD | Bartongoldholdings | 0.265 | 0% | 8% | 8% | $52,795,056 |

| SVY | Stavely Minerals Ltd | 0.044 | -6% | -25% | -80% | $16,423,424 |

| AGC | AGC Ltd | 0.072 | -1% | 4% | 22% | $15,333,333 |

| RGL | Riversgold | 0.013 | 8% | -19% | -54% | $12,579,599 |

| TSO | Tesoro Gold Ltd | 0.027 | 0% | 0% | -29% | $33,378,720 |

| GUE | Global Uranium | 0.098 | -1% | 1% | -37% | $19,311,016 |

| CPM | Coopermetalslimited | 0.38 | 7% | -1% | 58% | $24,455,147 |

| MM8 | Medallion Metals. | 0.062 | -5% | -6% | -59% | $19,997,357 |

| FFM | Firefly Metals Ltd | 0.575 | -8% | 0% | -35% | $215,803,073 |

| CBY | Canterbury Resources | 0.025 | -7% | -11% | -39% | $4,293,522 |

| LYN | Lycaonresources | 0.19 | -5% | 23% | -31% | $7,049,000 |

| SFR | Sandfire Resources | 7.03 | -4% | 11% | 25% | $3,317,764,853 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | -72% | $4,881,018 |

| TAM | Tanami Gold NL | 0.035 | 0% | -8% | -10% | $41,128,397 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.032 | 19% | 7% | -33% | $9,202,224 |

| ALK | Alkane Resources Ltd | 0.65 | -3% | -10% | 13% | $386,199,883 |

| BMO | Bastion Minerals | 0.016 | -16% | 7% | -47% | $4,983,105 |

| IDA | Indiana Resources | 0.083 | 12% | 38% | 43% | $51,679,913 |

| GSM | Golden State Mining | 0.015 | 0% | -21% | -70% | $4,050,874 |

| NSM | Northstaw | 0.049 | -2% | -26% | -71% | $6,853,913 |

| GSN | Great Southern | 0.02 | 0% | -5% | -33% | $15,092,704 |

| RED | Red 5 Limited | 0.2875 | -9% | -24% | 22% | $1,004,502,159 |

| DEG | De Grey Mining | 1.1975 | -5% | -15% | -15% | $2,193,749,647 |

| THR | Thor Energy PLC | 0.03 | 3% | 0% | -50% | $5,395,054 |

| CDR | Codrus Minerals Ltd | 0.062 | 9% | 11% | -50% | $5,436,625 |

| MDI | Middle Island Res | 0.016 | 0% | 7% | -58% | $3,482,464 |

| WTM | Waratah Minerals Ltd | 0.11 | -8% | 197% | -27% | $16,430,095 |

| POL | Polymetals Resources | 0.305 | -2% | 11% | 27% | $46,411,308 |

| RDS | Redstone Resources | 0.005 | 0% | -17% | -38% | $5,528,271 |

| NAG | Nagambie Resources | 0.028 | -3% | -7% | -56% | $23,027,094 |

| BGL | Bellevue Gold Ltd | 1.48 | -13% | -18% | 27% | $1,694,783,210 |

| GBR | Greatbould Resources | 0.064 | 0% | -11% | -32% | $38,315,981 |

| KAI | Kairos Minerals Ltd | 0.0145 | -6% | -3% | -28% | $38,003,227 |

| KAU | Kaiser Reef | 0.145 | -12% | -17% | -17% | $24,801,365 |

| HRZ | Horizon | 0.038 | -5% | -5% | -38% | $28,039,347 |

| CAI | Calidus Resources | 0.205 | -7% | 5% | -27% | $131,530,839 |

| CDT | Castle Minerals | 0.009 | 0% | -10% | -59% | $11,020,437 |

| RSG | Resolute Mining | 0.415 | -11% | -9% | 102% | $904,846,256 |

| MXR | Maximus Resources | 0.034 | -3% | -32% | -15% | $10,900,596 |

| EVN | Evolution Mining Ltd | 3.805 | -5% | -8% | 21% | $7,487,169,749 |

| CXU | Cauldron Energy Ltd | 0.031 | 29% | 107% | 424% | $30,586,655 |

| DLI | Delta Lithium | 0.415 | -12% | -11% | -5% | $320,147,052 |

| ALY | Alchemy Resource Ltd | 0.01 | 0% | 0% | -60% | $11,780,763 |

| HXG | Hexagon Energy | 0.012 | -8% | 33% | -29% | $6,154,991 |

| OBM | Ora Banda Mining Ltd | 0.245 | 7% | 0% | 172% | $409,624,769 |

| SLR | Silver Lake Resource | 1.13 | -8% | -2% | -10% | $1,042,239,931 |

| AVW | Avira Resources Ltd | 0.0015 | 0% | 0% | -40% | $3,200,685 |

| LCY | Legacy Iron Ore | 0.018 | 6% | 13% | -5% | $115,322,872 |

| PDI | Predictive Disc Ltd | 0.2075 | -1% | -14% | 5% | $415,248,818 |

| MAT | Matsa Resources | 0.028 | 8% | 8% | -20% | $13,402,873 |

| ZAG | Zuleika Gold Ltd | 0.018 | 0% | 6% | -14% | $13,249,539 |

| GML | Gateway Mining | 0.02 | -20% | -9% | -68% | $7,829,565 |

| SBM | St Barbara Limited | 0.205 | 0% | -5% | -41% | $163,594,076 |

| SBR | Sabre Resources | 0.03 | -6% | -14% | -29% | $11,224,752 |

| STK | Strickland Metals | 0.125 | 39% | -31% | 213% | $195,886,577 |

| ION | Iondrive Limited | 0.012 | 0% | 0% | -54% | $5,835,423 |

| CEL | Challenger Gold Ltd | 0.072 | 6% | 0% | -59% | $89,542,955 |

| LRL | Labyrinth Resources | 0.007 | 0% | 17% | -55% | $8,312,806 |

| NST | Northern Star | 12.95 | -6% | 0% | 13% | $14,710,030,285 |

| OZM | Ozaurum Resources | 0.14 | -3% | 22% | 112% | $22,225,000 |

| TG1 | Techgen Metals Ltd | 0.084 | 17% | 1% | -2% | $7,977,801 |

| XAM | Xanadu Mines Ltd | 0.055 | 2% | 4% | 90% | $96,946,779 |

| AQI | Alicanto Min Ltd | 0.034 | -6% | -24% | -32% | $20,921,451 |

| KTA | Krakatoa Resources | 0.04 | 18% | -7% | -5% | $18,884,289 |

| ARN | Aldoro Resources | 0.12 | -8% | 45% | -37% | $16,154,849 |

| WGX | Westgold Resources. | 1.9825 | -10% | -9% | 111% | $961,454,142 |

| MBK | Metal Bank Ltd | 0.028 | 4% | -7% | -17% | $10,932,860 |

| A8G | Australasian Metals | 0.15 | -12% | -12% | -21% | $7,818,074 |

| TAR | Taruga Minerals | 0.013 | 18% | 18% | -43% | $8,825,335 |

| DTR | Dateline Resources | 0.01 | 0% | 0% | -71% | $13,129,455 |

| GOR | Gold Road Res Ltd | 1.725 | -15% | -13% | -3% | $1,859,666,133 |

| S2R | S2 Resources | 0.155 | -3% | -23% | -11% | $72,297,279 |

| NES | Nelson Resources. | 0.004 | 14% | 0% | -43% | $2,454,377 |

| TLM | Talisman Mining | 0.285 | 21% | 39% | 111% | $56,496,105 |

| BEZ | Besragoldinc | 0.135 | -10% | -18% | 160% | $56,443,622 |

| PRU | Perseus Mining Ltd | 1.77 | -8% | -13% | -19% | $2,410,604,743 |

| SPQ | Superior Resources | 0.0125 | -4% | -34% | -77% | $24,014,645 |

| PUR | Pursuit Minerals | 0.008 | 0% | 0% | -50% | $26,495,743 |

| RMS | Ramelius Resources | 1.655 | -4% | -5% | 67% | $1,875,685,315 |

| PKO | Peako Limited | 0.005 | 0% | 0% | -62% | $2,635,424 |

| ICG | Inca Minerals Ltd | 0.012 | 20% | 9% | -50% | $7,013,226 |

| A1G | African Gold Ltd. | 0.036 | 33% | 6% | -55% | $6,095,204 |

| OAU | Ora Gold Limited | 0.006 | -8% | -8% | 20% | $34,136,928 |

| GNM | Great Northern | 0.019 | 0% | -5% | -64% | $3,247,211 |

| KRM | Kingsrose Mining Ltd | 0.04 | -5% | -9% | -43% | $30,101,061 |

| BTR | Brightstar Resources | 0.015 | -6% | 7% | -6% | $35,555,683 |

| RRL | Regis Resources | 2.11 | -5% | 7% | 0% | $1,586,211,497 |

| M24 | Mamba Exploration | 0.06 | 20% | 100% | -61% | $3,524,525 |

| TRM | Truscott Mining Corp | 0.055 | 0% | -10% | 12% | $9,535,188 |

| TNC | True North Copper | 0.105 | -5% | -13% | 98% | $33,067,478 |

| MOM | Moab Minerals Ltd | 0.008 | 14% | 33% | -11% | $5,695,708 |

| KNB | Koonenberrygold | 0.054 | 13% | 69% | -10% | $6,586,200 |

| AWJ | Auric Mining | 0.125 | 9% | 81% | 95% | $17,011,747 |

| AZS | Azure Minerals | 3.7 | 1% | 0% | 1474% | $1,683,354,040 |

| ENR | Encounter Resources | 0.355 | 15% | 18% | 97% | $134,754,012 |

| SNG | Siren Gold | 0.07 | 8% | 37% | -60% | $11,101,075 |

| STN | Saturn Metals | 0.22 | 22% | 52% | 33% | $40,195,477 |

| USL | Unico Silver Limited | 0.11 | -12% | -12% | -29% | $34,045,933 |

| PNM | Pacific Nickel Mines | 0.083 | 0% | -1% | 2% | $34,715,008 |

| AYM | Australia United Min | 0.003 | 0% | 50% | 0% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | $25,143,441 |

| HAV | Havilah Resources | 0.19 | 0% | -31% | -40% | $60,161,450 |

| SPR | Spartan Resources | 0.495 | -7% | 0% | 196% | $477,031,573 |

| PNT | Panthermetalsltd | 0.06 | 0% | 9% | -68% | $5,101,500 |

| MEK | Meeka Metals Limited | 0.037 | -8% | -16% | -40% | $46,918,939 |

| GMD | Genesis Minerals | 1.625 | -12% | -14% | 29% | $1,787,276,663 |

| PGO | Pacgold | 0.19 | -5% | -10% | -46% | $16,829,088 |

| FEG | Far East Gold | 0.15 | 0% | -6% | -68% | $25,284,869 |

| MI6 | Minerals260Limited | 0.33 | 3% | 10% | 0% | $78,390,000 |

| IGO | IGO Limited | 8.69 | -5% | 8% | -36% | $6,580,657,295 |

| GAL | Galileo Mining Ltd | 0.27 | -2% | 2% | -70% | $50,394,356 |

| RXL | Rox Resources | 0.185 | 0% | -16% | 3% | $66,483,767 |

| KIN | KIN Min NL | 0.064 | -2% | -3% | 0% | $77,757,936 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -88% | $12,357,082 |

| TGM | Theta Gold Mines Ltd | 0.115 | 5% | -8% | 69% | $84,849,001 |

| FAL | Falconmetalsltd | 0.125 | -14% | -17% | -56% | $22,125,000 |

| SXG | Southern Cross Gold | 1.15 | -12% | 10% | 60% | $104,014,245 |

| SPD | Southernpalladium | 0.365 | -3% | 9% | -57% | $15,077,414 |

| ORN | Orion Minerals Ltd | 0.015 | 7% | 7% | 0% | $87,675,520 |

| TMB | Tambourahmetals | 0.12 | 4% | -23% | 14% | $9,952,842 |

| TMS | Tennant Minerals Ltd | 0.033 | -3% | -6% | 10% | $24,456,424 |

| AZY | Antipa Minerals Ltd | 0.017 | -11% | 21% | -23% | $70,291,735 |

| PXX | Polarx Limited | 0.009 | 29% | 20% | -63% | $11,477,317 |

| TRE | Toubaniresourcesinc | 0.14 | -3% | -10% | -13% | $19,410,522 |

| AUN | Aurumin | 0.028 | 17% | 17% | -55% | $9,319,520 |

| GPR | Geopacific Resources | 0.016 | -6% | -20% | -49% | $13,147,478 |

| FXG | Felix Gold Limited | 0.049 | 2% | -2% | -59% | $5,816,614 |

| ILT | Iltani Resources Lim | 0.165 | 18% | 14% | 0% | $5,611,733 |

| ARD | Argent Minerals | 0.01 | 0% | -23% | -33% | $12,917,590 |

The week’s biggest gainers 🚀

Strickland Metals (ASX:STK) +39%

MetalsTech (ASX:MTC) +33%

Cauldron Energy (ASX:CXU) +29%

The US-dollar-fading collection of BRICS nations are reportedly growing…

Saudi Arabi, UAE, Egypt, Iran and Ethiopia have officially joined BRICS.

Welcome to the new year.

— Gold Telegraph ⚡ (@GoldTelegraph_) January 1, 2024

The dollar had its worst year since 2020 last year.

Now, countries that are commodity powerhouses are coming together within BRICS to shift the global order.

Many people will remain asleep until they feel the effect in real time.

— Gold Telegraph ⚡ (@GoldTelegraph_) January 1, 2024