You might be interested in

Mining

Monsters of Rock: MinRes has 'seen the bottom' in lithium prices, Lynas tightens the screws on rare earths supply

News

Closing Bell: ASX loses its bottle, but Gold50 shows some Gallium to advance 50pc

Mining

Mining

Red River (ASX:RVR) has a history of buying distressed mining assets and transforming them into money makers.

In late 2014, Red River purchased the Thalanga zinc operations from a bankrupt Kagara Mining for $6.5m.

Production restarted in the fourth quarter of 2017. Now, after a slow start, Thalanga looks like hitting its straps once again.

In the March quarter this year, zinc, lead and copper concentrate production was up substantially as the company recorded EBITDA of $12.5m – a $10.8m increase on the prior quarter.

At the end of March, Red River had a comfortable cash balance of $21.2m plus financial assets of $8.5m (cash backed security bond deposits).

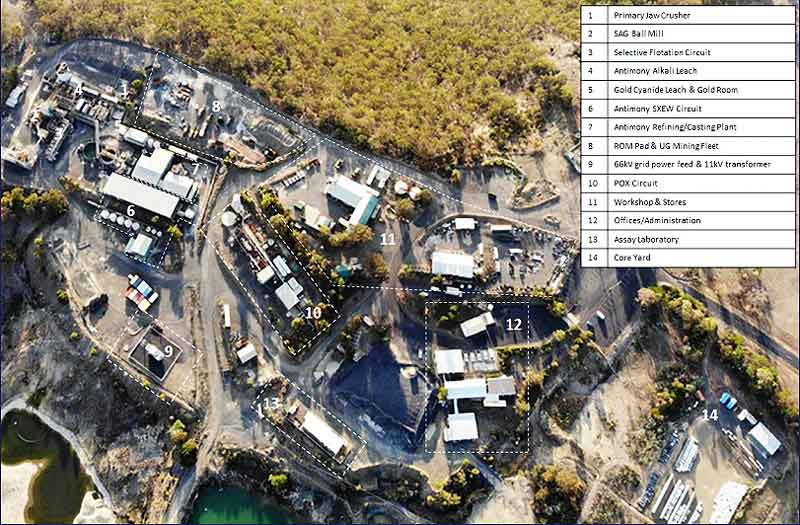

Now the miner wants to do it again, announcing the purchase of the failed high-grade Hillgrove gold-antimony mine in NSW for $4m worth of shares.

More than $180m was invested in the underground development, surface infrastructure and processing plant by Straits Resources between 2004 and 2009, Red River says.

Private company Bracken Resources then paid Straits $33.2m for the asset before investing a further $40m on upgrading and recommissioning Hillgrove.

Production of antimony-gold concentrates restarted in 2014 before the mine was placed back into care and maintenance in 2016 “due to low prevailing antimony prices”, says Red River.

Red River managing director Mel Palancian says the miner has been working on the acquisition for over six months.

“We love gold and bringing mining assets back to life cheaply,” he says.

“It’s rare to find a high-grade gold asset that is close to production with quality resources and infrastructure.”

And the beauty of having an existing profitable mine at Thalanga is that Red River can fund near term commitments at Hillgrove from existing cash reserves.

“We will continue to focus on production and growth at Thalanga as there is an exciting future ahead with significant growth potential,” says Palancian.

“For Hillgrove, we will ensure a smooth transition of the asset and evaluate the opportunities by upgrading and growing resources and developing an optimised restart study.”

Chalice Gold Mines (ASX:CHN) is selling its Canadian gold projects for about $13.1m in shares, plus a 1 per cent royalty on all future production.

The buyer is O3 Mining, a new venture spearheaded by one of the most recognised names in the Quebec gold industry, Osisko Mining. To be involved in Osisko’s O3 Mining is a great opportunity for shareholders, says Chalice managing director Alex Dorsch.

“O3 Mining will be well capitalised and hold a substantial portfolio of high potential gold assets, with a focus on the Val-d’Or gold district in Quebec,” he says.

“The sale will [also] further enhance the company’s strong balance sheet and will enable Chalice to focus on its high-profile Australian exploration opportunities at the Pyramid Hill gold project in Victoria and the King Leopold nickel project in the Kimberley.”

The share price was up about 17 per cent in early trade.