You might be interested in

Mining

Explorers Podcast: Arizona Lithium optimistic on bountiful brine

TSX

Canada Unearthed: TSX targets ASX companies for dual-listings in conviction mining juniors can prosper in Canada

Mining

Peter Strachan is a capital markets veteran, resources analyst and lover of the oil and gas game. The brains behind the popular weekly StockAnalysis investment letter, which launched in 2003, Peter has worked in capital markets for over 35 years, and is a qualified metallurgist and geologist. He also features weekly on Stockhead’s RockTalk podcast series.

Today’s market for lithium and its compounds is vastly different from that prevailing just 20 years ago.

At the turn of the Century, investors looking at lithium uses would have seen ceramic cooktops, thermal glassware, grease, and other industrial applications as well as the pharmaceutical industry.

Legendary usage as an anti-depressant even emerged as the “refreshing” soda called 7-UP, where the number 7 referred to the atomic weight of the drink’s key ingredient in early versions!

It is worth remembering that the Prius was the first truly commercial hybrid-electric vehicle, but employed a Ni-Metal Hydride battery, as Li-ion battery technology was still not mature.

However, as Li-ion battery technology advanced, costs fell and energy density rose so that by 2010, the technology overtook early mobile battery technologies like Nickel-Metal Hydride and Ni-Cd.

Massive expansion in the use of Li-ion batteries for mobile equipment, tools and telecommunication, plus pioneering work in electric vehicle (EV) development by Tesla, demonstrating to the market how the future of automobiles would look, saw a speculative bubble develop for lithium in the 20-teens.

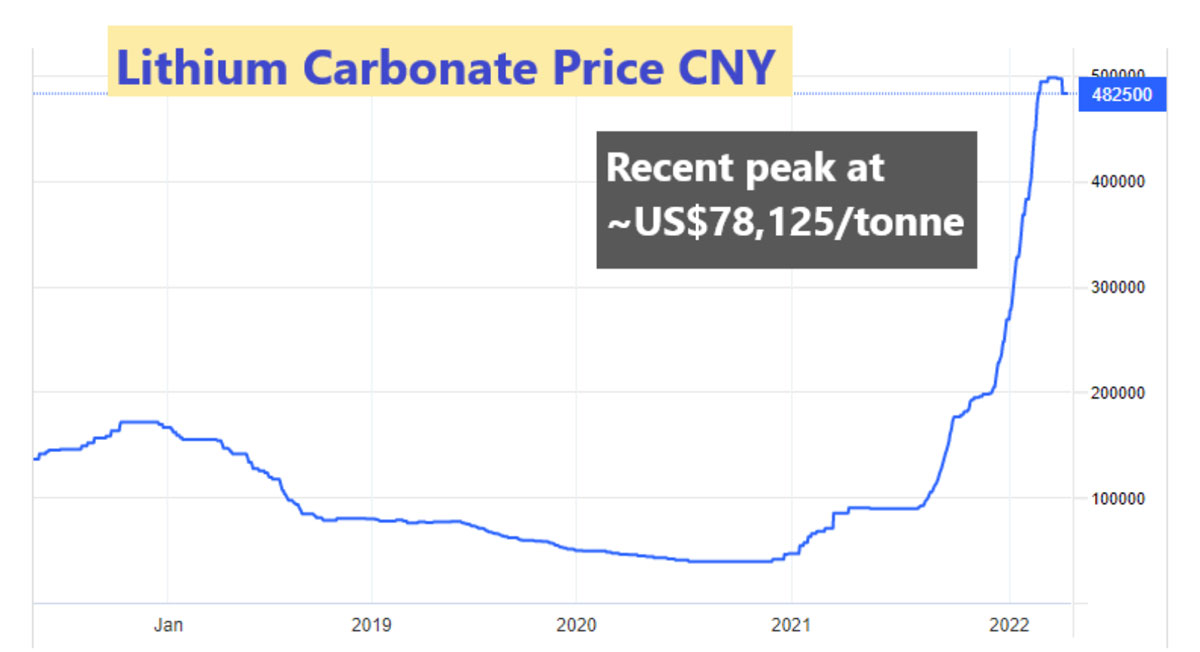

Speculation on a boom in demand lifted pricing for lithium chemicals from ~US$5,000 to ~US$19,000 per tonne for carbonate, while 6% lithia (Li2O) spodumene concentrate jumped from around US$400 to over US$700 per tonne, only to see chemicals retreat to around US$7,000 per tonne during 2020 as supply overwhelmed demand.

Recent market dynamics have reversed, as accelerated demand for lithium chemicals in China played out against limited incremental supply. The price of 6% lithia concentrate lifted from a 2020 nadir low of around US$380 per tonne to over US$3,000 and according to Fastmarkets, up to US$5,750 per tonne for small volumes at spot sales.

Meanwhile, recent spot lithium hydroxide monohydrate 56.5% battery grade (CIF China) has traded at around US$81,500 per tonne, and producers expect contracted sales prices will lift to around US$35,000 per tonne FOB by mid-2022. A strong spot market for both concentrates and chemicals is now seeing miners and processors who had been delivering on contract arrangements, gradually lifting sales prices as contracts expire.

A rapid transition towards renewable energy and power storage gathered pace as the price of oil moved from sub-US$40 to over US$100 per barrel over the past two years. This action is adding to demand for EVs and stationary power storage applications, along with lithium and other battery metals.

Chinese EV auto makers lead the way globally with sales of 3.2 million units in 2021, set to rise over 5 million in 2022.

Supporting these projections are numbers from Allkem (AKE.ASX) for the March 2022 quarter, wherein global EV sales are estimated at ~2 million units, up ~70% compared to last year. EV sales in China alone were estimated at ~1.1 million units during the March quarter, representing a 150% increase over the same period last year.

China’s growth in output is supported by expansion of the lithium, iron, phosphate battery (Li-FeP) format in its domestic market, which now represents more than 55% of battery chemistries and demonstrates how rapidly the market can change.

Remarkably, Deloitte forecasts ongoing, 29% compound annual growth in global EV sales, resulting in a market share of 32% of global new car sales by 2030, which may prove to be too conservative.

Strong prices are being maintained by low inventories of lithium raw materials, even as global suppliers ramp up new production and recommission facilities that were mothballed in 2019. However, technical hurdles remain for new processes to source lithium from brines, leaving potential producers unable to match rising demand.

Market price action has led Tesla co-founder and chief executive officer Elon Musk to remark (on Twitter, of course) that the soaring lithium price “has gone to insane levels”.

A notable response to market uncertainty is ongoing consolidation in the lithium value chain as automakers reach upstream to make investments in the supply of battery metals and in downstream lithium chemical supply.

Russia’s invasion of the Ukraine along with logistics constraints resulting from the Covid-19 pandemic, have hastened a move to expand battery materials capacity in North America and Europe. Governments globally have realised the importance of developing local supply of critical battery materials including lithium.

Allkem estimates that global supply of lithium carbonate equivalent (LCE) will rise from about 0.55 million tonnes in 2022 to 1.8 million tonnes in 2030, while demand rises to at least 2.4 million tonnes over that period. Quoting Wood Mackenzie, Allkem says that demand is set to be driven by a lift in Li-ion battery making capacity from 1,000 GWh in 2021 to a projected 4,700 GWh by 2030.

Battery technologies are developing rapidly. New chemistries for existing technology are being trialled as well as completely new battery technologies.

High prices for lithium chemicals and other cathode metals have already favoured use of Li-FeP for city-based vehicles. Meanwhile, the world’s largest battery maker, Contemporary Amperex Technology (CATL) has just commissioned a sodium-ion (Na-ion) battery manufacturing line, essentially using the same manufacturing technology as is used to make Li-ion batteries.

These Na-ion batteries will be heavier than their Li-ion cousins, but should have similar technical performance, making them suitable for EVs and stationary power storage applications, over mobile equipment uses.