Four reasons why Hawkstone won’t fly under the radar for very long

Mining

Special Report: US-based lithium explorer Hawkstone Mining (ASX:HWK) is rapidly moving its low cost Big Sandy lithium project towards a maiden JORC Resource and beyond.

But ‘big’ doesn’t really do Big Sandy justice.

>> Learn more about Hawkstone Mining

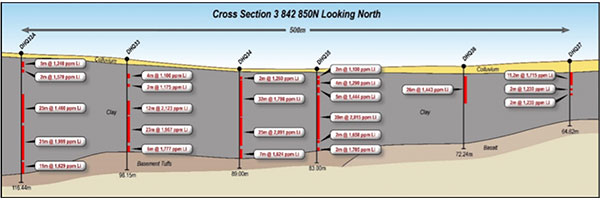

We’re talking about a lithium-bearing sedimentary horizon which is 11km long, 2km wide and up to 60m deep essentially from surface.

And there’s other advantages. Being located in the mining-friendly jurisdiction of Arizona means Hawkstone is spoilt for infrastructure, and then there’s the strategic US push to establish its own EV supply chains — from raw materials through to EV production.

Here’s a few reasons why the $9m market cap Hawkstone may not be flying under the radar for much longer.

The 25.2sqkm Big Sandy project is shaping up as a bit of a monster.

The project’s 11km-long by 2km wide sedimentary-hosted lithium horizon is defined by simple geology and lithium mineralisation from surface to a depth of 60m:

With a maiden JORC Resource due end of September, recent mapping and sampling in the underexplored southern claim area has resulted in a 15 percent boost to the project’s overall exploration target to between 280.1 and 492.6 million tonnes grading 1,000 to +2,000ppm (parts per million) lithium.

Managing director Paul Lloyd says the explorer has touched less than 10 per cent of the soil anomaly identified so far.

“There’s a lot of lithium in those hills; you’re talking about a soil anomaly that is 11km by 2km,” he says.

“That is a big area when you are getting consistent high-grade lithium intercepts to the depth that we are [up to 90m].”

Importantly, the project mineralisation is very visual and from surface, which means Hawkstone knows exactly where to drill:

“When we take people out to Big Sandy they are very impressed by the amount of [lithium-rich sediment] you can see in the cliff faces, which gives you an indication of what is below surface,” Lloyd says.

With a “crazy” strip ratio – something like 0.1 (overburden) to 1 (ore) — mining costs will be very low.

And the proposed sulphuric acid vat leach process is a very well-known and well tested process, already used widely by copper producers in Arizona.

“We aren’t reinventing the wheel here,” Lloyd says.

“We are using standard technology.”

“If you look at the cost curve for lithium, it’s clear that the sedimentary projects are going to fit right in the middle — well below the spodumene producers in WA, and above the brine producers in South America.”

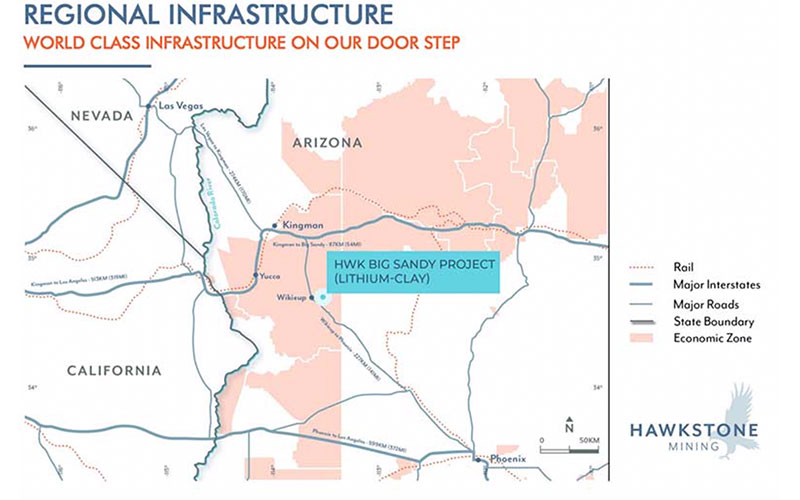

Because Big Sandy is located in an established mining friendly jurisdiction, a lot of the crucial infrastructure required by a new operation is already established, says Lloyd.

“There is a large interstate, a large railway running parallel to that, gas pipelines, and an established workforce,” he says.

“We have all the general infrastructure in the area we require to produce lithium.”

Hawkstone enjoys another strategic benefit — Big Sandy is located within an area that has recently been designated as an economic opportunity zone, allowing companies to access tax concessions from state and federal authorities.

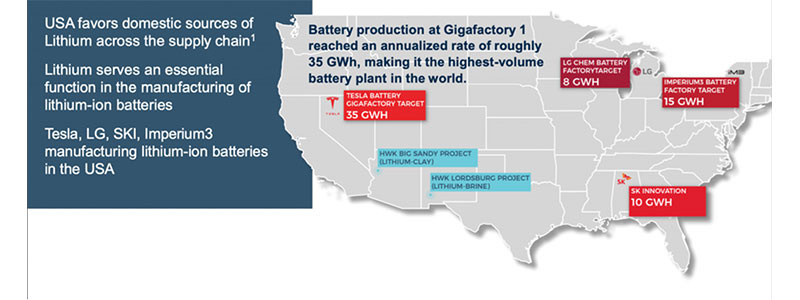

Recently, the US Commerce Department designated lithium as a mineral critical to US national security and the economy– part of a move by the US to establish its own EV supply chain, from raw materials through to EV production.

But it’s going to need some in-country lithium mines; right now, the US only produces a nominal amount and exports all of it.

“The only US production is from a brine project owned by Albemarle; about 6000tpa LCE, which is very little,” Lloyd says.

“There’s a lot of publicity in regard to the senate enquiry into producing critical minerals within the US.”

“There’s a number of ASX listed companies, including us, that are working towards [meeting that need.”

“We are already getting a lot of encouragement from the bureaucrats in Washington. They have basically said ‘let us know when you need assistance’.”

Hawkstone is about two to three years behind fellow US lithium developer ioneer, which has a market cap of around $250m.

Right now, Hawkstone has a market cap of just under $9m.

“There’s a value proposition there for incoming shareholders,” Lloyd says.

“We do have critical mass here at Big Sandy. This is a large deposit over a large area, and we plan to deliver.”