‘Financial projections indicate very high returns’: Construction of Antilles high-grade Nueva Sabana copper gold mine to begin mid 2024

Mining

Mining

Antilles has reason to be upbeat about its upcoming maiden resource estimate for its proposed Nueva Sabana mine in Cuba after diamond drilling returned high-grade gold and copper hits.

Standout results such as 25m grading 3.35% copper from a down-hole depth of 53m — including 9m at 7.86% copper and 3m at 37.54 grams per tonne (g/t) gold from 20m — in the El Pilar oxide deposit add confidence to the development of the low-capex Nueva Sabana mine.

Nueva Sabana is one of two near-term projects that Antilles Gold (ASX:AAU) has in its pipeline for development in conjunction with Cuban government mining company GeoMinera, its equal joint venture partner.

Construction of Nueva Sabana, which is planned as a copper project that will benefit from the high-grade gold cap, is expected to begin in May or June 2024 with production of a +50g/t gold concentrate starting just 10 months after.

This is expected to cost just US$20m for a mine with a proposed mining rate of 500,000-650,000tpa due to availability of HT power, rail and highway links to a container port, water supply, and skilled labour being close to the mine site, together with low pre-stripping costs and hiring necessary mine equipment rather than purchasing a new fleet.

La Demajagua mine – the other near-term project – already has a resource of 905,000oz of gold equivalent for the first stage open pit, which will produce approximately 80,000ozpa gold equivalent.

This consists of 50,000tpa of a 32g/t gold concentrate and 5,500tpa of concentrate containing 49g/t gold, 46% antimony, and 2,200g/t silver, for nine years.

Bringing the proposed Nueva Sabana and La Demajagua mines into production will provide the company with the cashflow to fund exploration of major copper deposits.

This includes the broader El Pilar copper-gold porphyry system where aeromagnetic, ground magnetic, and IP surveys have a cluster of intrusives such as El Pillar and Gaspar that represent major exploration targets.

Drilling in the gold domain at the El Pilar deposit returned notable results such as:

Likewise drilling in the deeper copper domain returned hits such as:

25m at 3.35% copper from 53m including 9m at 7.86% copper;

32m at 0.89% copper from 30m and 5m at 1.14% copper from 97m; and

10m at 0.55% copper from 44m and 8m at 0.61% copper from 69m.

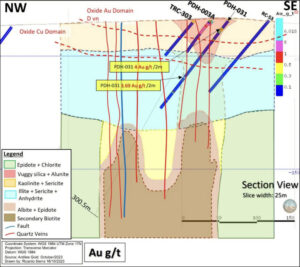

The results outline outstanding grades in the gold domain from surface to a depth of 40-50m and robust grades in the underlying copper domain for a further 50m to 70m.

Antilles notes that the gold zone within the oxide deposit is well defined while the copper zone is increasing in volume both laterally and vertically with continuing exploration, and projects into the underlying porphyry sulphide and breccia- hosted mineralisation.

The current 7,000m drill program will be completed next month and a resource estimate expected in January 2024.

Cross section of the El Pilar oxide deposit. Pic: Supplied (AAU).

Executive chairman Brian Johnson said the Nueva Sabana mine is expected to have low operating costs as well as low development costs due to its location, terrain, very low waste to ore ratio, and simple metallurgy.

“The company has already contributed its equity for a 50% interest in the Nueva Sabana mine, and financial projections indicate very high returns, and a significant NPV for the project which will be confirmed soon after receipt of the MRE and mine plan early next year,” he added.

“Even though only a small project, the commencement of a reasonable cash flow around Q2 2025 would be most welcome.”

Planning and permitting of the proposed mine is well advanced and negotiations have started to arrange an advance on sales of the gold concentrate for a similar amount to an international commodities trader, in order to fund the project.

This article was developed in collaboration with Antilles Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.