Thick, high-grade copper hits suggest Antilles is barely scratching the surface of its El Pillar porphyry system

Antilles Gold is scoring the copper wins in Cuba. Pic: via Getty Images.

- Antilles Gold intersects high-grade porphyry copper at the El Pilar deposit in Cuba

- The intersection of intense porphyry style veining indicates the porphyry system is potential larger to the southeast than expected

- Drilling in the oxide domain will be reflected in upcoming resource estimate for Nueva Sabana

Special Report: Antilles Gold has intersected high grade copper – including a top hit of 11m grading 4.7% copper according to pXRF readings – at the El Pilar copper-gold porphyry deposit in central Cuba.

El Pillar’s near-surface oxide domain is central to the proposed Nueva Sabana mine, one of two near-term projects that Antilles Gold (ASX:AAU) has in its pipeline for development in conjunction with Cuban government mining company and equal JV partner GeoMinera.

Construction of Nueva Sabana, which is planned as a copper project that will benefit from a high-grade gold cap, is expected to begin in May or June 2024 with production of a 55 grams per tonne (g/t) gold concentrate starting just 10 months later.

This is expected to cost just US$20m for the mine with a proposed mining rate of 500,000-650,000tpa due to availability of HT power, rail and highway links to a container port, water supply, and skilled labour being close to the mine site, together with low pre-stripping costs and hiring necessary mine equipment rather than purchasing a new fleet.

La Demajagua mine – the other near-term project – already has a resource of 905,000oz of gold equivalent for the first stage open pit.

A 75,000tpa two-stage fluid-bed roaster, and a 100,000tpa CIL circuit will be constructed at the mine to process 50,000tpa of gold arsenopyrite concentrate, and 35,000tpa of oxide ore from La Demajagua, and 25,000tpa of imported gold pyrite concentrate to produce ~100,000oz Au per year of gold doré.

7,600tpa of a gold-antimony concentrate from La Demajagua will be sold to a Chinese smelter.

The 9 year LoM could be doubled with following underground operations.

Developing both these near-term gold projects will help (or completely) fund the company’s goal to define the type of large copper porphyries that are responsible for ~60% of the world’s copper, most of its molybdenum, and significant amounts of gold and silver.

Porphyry copper giant emerging

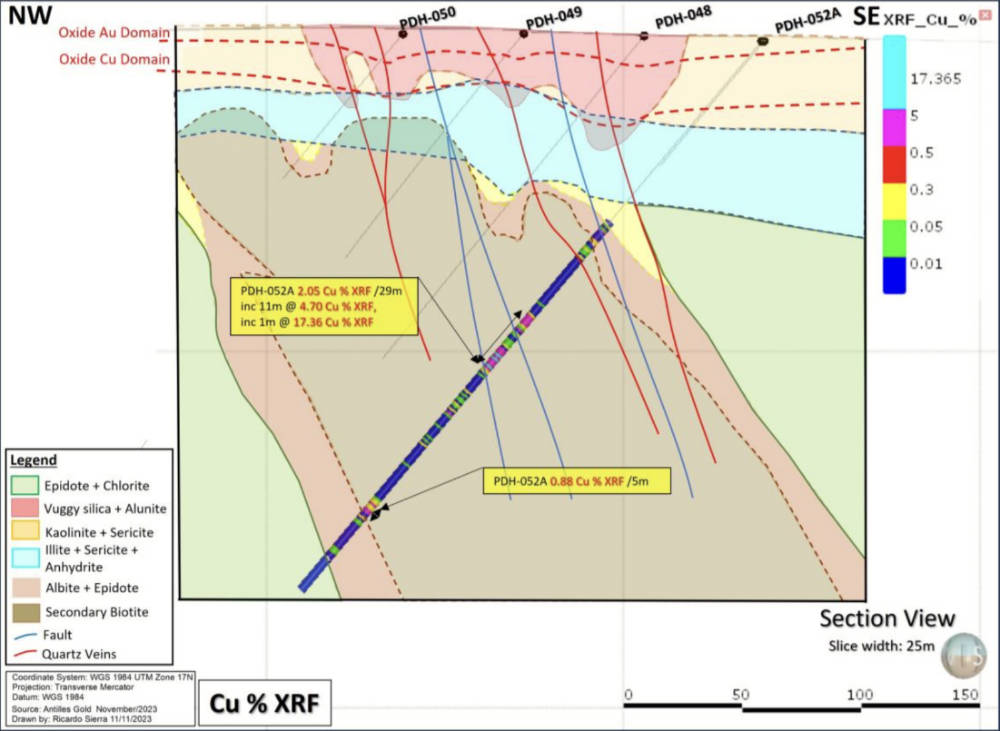

El Pillar porphyry cross section. Pic: Supplied (AAU).

That’s not to say that AAU hasn’t already been dipping its toes into exploring for porphyry mineralisation at El Pillar.

Its latest diamond drill hole (PDH-052A) into the sulphide mineralisation at the extreme southeastern part of the deposit displayed intense porphyry style veining, that is overprinting a mineralized diatreme breccia.

This is hugely encouraging as copper mineralisation is associated with both porphyry style veining and also as breccias within the diatreme and the intersection indicates that the system is potentially larger to the southeast than expected.

Further support has come from the portable XRF analysis, which returned a 29m zone grading 2.05% copper from a down-hole depth of 151m that includes the 11m interval at 4.7% copper.

While no replacement for laboratory analysis, the pXRF reading still provides an indication of what to expect.

“PDH-052A has shown highly encouraging porphyry style copper mineralisation and now we are seeing this associated with diatreme breccia hosted mineralization occurring together, increasing the quantity of mineralization from multiple overprinting hydrothermal events,” exploration director Dr Christian Grainger said.

“We are now confident that the system is growing to the southeast, where no drilling to date has occurred, and where we are seeing both high grades and widths of mineralisation expanding.

“The intersection of high-grade copper mineralisation in sulphides in the southern part of the El Pilar prospect confirmed by the pXRF readings gives us great encouragement for the potential of this prospect.

“Given the drillhole terminated in chalcopyrite in a fault zone, the porphyry remains open at depth, and future drilling will be aimed at targeting the core of the porphyry body.”

Oxide drilling to back coming resource estimate

Meanwhile, drilling in the overlying gold-copper deposit continues to return significant assays.

In the gold domain, hole PDH-041 returned a 15m zone at 2.1g/t from surface and a further 6m at 1.19g/t gold from 20m.

The same hole struck 5.5m at 0.6% copper from 48m in the deeper copper domain.

Other holes in this domain also returned hits such as 25m at 0.9% copper from 45m and 16m at 0.71% from 4m.

Chairman Brian Johnson added that the continued high copper grades in the El Pilar oxide deposit will be reflected in the resource estimate for the proposed Nueva Sabana gold-copper mine when published in January 2024.

It is also expected to reinforce the company’s confidence in commencing construction of the low capex mine in May/June 2024.

This article was developed in collaboration with Antilles Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.