Fe Ltd is trying to get its hands on two lithium projects that fellow explorer Cauldron snubbed last year

Mining

Mining

Early stage explorer Fe Limited (ASX:FEL) wants to pick up two lithium projects in the Pilbara – the same ones fellow explorer Cauldron (ASX:CXU) rejected last year because they weren’t up to scratch.

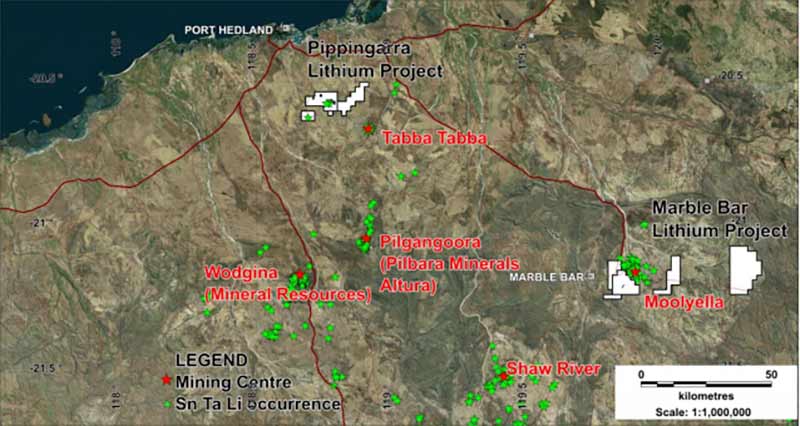

Like Cauldron before them, Fe Limited has entered into an agreement to buy the Pippingarra and Marble Bar lithium projects from private explorer Mercury Resources for cash and shares.

The deal includes 15 million shares, 15 million options, a 1 per cent net smelter royalty and $200,000 in cash payable in instalments.

Cauldron was going to pay 40 million shares, 40 million options, 60 million performance shares, and $500,000 in cash in two instalments before the deal fell apart.

In November, Cauldron shares dropped 10 per cent to 3.6c on news that its proposed acquisition of the projects – announced 5 October – would not proceed.

“The acquisition was subject to conditions, some of them which have not been satisfied,” Cauldron told investors at the time.

“As a result, the parties have agreed to terminate the agreement.”

Cauldron chief executive Jess Oram told Stockhead the deal fell through because at that time “the tenements were not in good standing”.

“We weren’t prepared to take the risk on running with that,” Mr Oram says.

The amount of time required to get those tenements into “good standing” was about now, Mr Oram says.

“I assume that’s why Fe were able to go with it,” he says.

Fe Limited could not be reached for comment.

Mr Oram says high profile Perth businessman Tony Sage — who is also chairman of Fe Limited — brought the original lithium deal to the Cauldron board.

Mr Sage resigned as Cauldron non-exec chairman about the same time the original deal fell through.