Gold Digger: Don’t expect a rally soon but H2 could be golden, agree top analysts

Mining

Mining

The price of gold has inched its way back to a fairly comfortable zone right now, after taking a bit of a beating post Fed chattering last week.

The US labor market pulled a bit of a swifty on us all last week, showing surprising strength and actual creation of real-life jobs of real-life importance for real-life people.

Nice for that lot and their families, perhaps not quite as nice for self-centred, portfolio-checking, world-turmoil-embracing, safe-haven gold investors across the globe. It’s all about us them, you see.

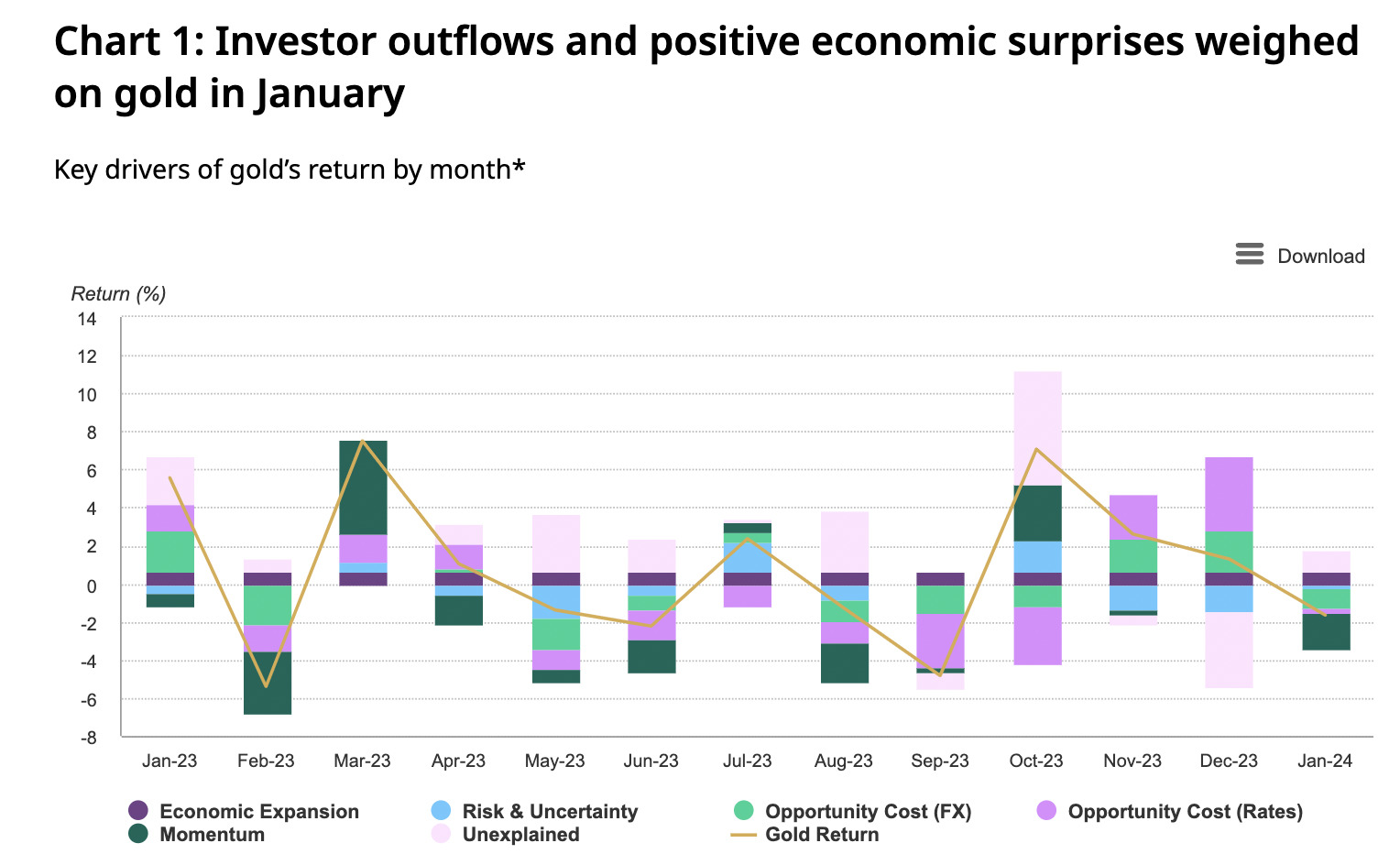

Here’s a World Gold Council chart, tracking the precious metal’s return of late. (It finished the month 1% lower.)

That said, the yellow metal appears more or less stable again this week, holding above the psychological $2k mark, even as its inversely correlated foe, the US dollar, also seems to be holding at a reasonably strong level for now.

At the time of writing, gold trading for US$2,037 and in Aussie dollars – $3,139, actually just a shade under its all-time-high $3,139.

Some analysis of round-the-traps analysis for you…

In its latest Precious Metals Weekly update, London-based independent precious metals consultancy Metals Focus poses the question: “In the current climate, can gold re-test its all-time highs?”

Our bead on their answer appears to be… not any time soon, but play the long game.

“With the US economy maintaining a decent growth momentum and the labour market still broadly healthy, we believe that there is scope for a hawkish re-pricing of interest rate expectations, which in turn could prevent gold from attempting a new peak in the near term and also open up the possibility of a modest price correction,” said the analysts.

Regarding recent optimism in markets about Fed rate cuts, Metals Focus notes this has cooled off recently, tempered by strong economic data from the US, and the re-emergence of slightly more hawkish rhetoric from the Fed than was perhaps expected. Less rate cuts are now anticipated than the originally optimistic six.

“All of this has helped prevent gold from moving higher so far this year,” notes Metals Focus, “as the timing of the first rate cut has now been pushed back from March to May, effectively implying five rate cuts this year compared to market expectations of six at the beginning of 2024.”

In fact, at the January FOMC meeting, the Fed suggested they actually envision just three rate cuts in 2024. And, according to Metals Focus, that more hawkish stance from the Fed, a US recession now unlikely and aggressive loosening of monetary policy probably off the cards, too, could “push gold below the long held $2,000 level in the short term”.

The safe-haven gold schtick amid ongoing Middle Eastern and Eastern European concerns, conflicts and rising body counts and geopolitical temperatures elsewhere around the world… is still alive and kicking.

Gold investors tends to benefit, whether they feel middle-class safe-haven guilt about it or not.

There are other uncertainties, too, here are some takes from the excellent X account Gold Telegraph…

Janet Yellen is warning that high commercial real estate vacancies are expected to create stress for smaller banks.

Better late than ever?

What a movie playing out in real-time.

— Gold Telegraph ⚡ (@GoldTelegraph_) February 8, 2024

Legendary investor Paul Tudor Jones is now warning that a debt bomb could be on the verge of exploding.

When it rains, it pours.

Meanwhile,

Central banks are stockpiling gold.

— Gold Telegraph ⚡ (@GoldTelegraph_) February 8, 2024

And regarding such complexities – geopolitical, macroeconomic, which have tended to keep gold elevated in recent times, Metals Focus adds:

“On balance, we believe that even as uncertainties abound, gold may not be able to re-test its all-time highs in the near future. At best, the presence of uncertainties will underpin safe haven demand for gold and help ensure that any price corrections are modest.

“That said, notwithstanding the risk of a short-term price fall, as we outline in our latest 5-Year Gold Forecast, with the increasing likelihood of rate cuts later this year, this will set the stage for a more sustainable price rally.”

Scouting around for more takes, Japan’s largest bank MUFG is pretty darn positive on the most precious one this year, also caveating range-bound prices tied to Fed decision-making.

“We believe downside to the price will be limited by robust support from the other two channels, namely, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort,” the bank noted this week.

“Gold is our most bullish call this year. Bullion is set to hit record levels on a trifecta of Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort.”

And here’s a further opinion this week from gold market analyst Christopher Lewis over at FXEmpire, who is also “bullish longer term”, suggesting gold, at a reasonably sized position, can make up a strong part of portfolios.

“Gold is something that I do not want to sell right now due to the fact that we have so much in the way of geopolitical concerns,” he said. “And of course, central banks around the world will be cutting rates this year.

“It’s a bit of a perfect storm for gold given enough time, but do keep in mind that this is a contract that tends to be very noisy and therefore don’t be surprised at all to see a lot of volatility.”

Here’s how ASX-listed precious metals stocks are performing, circa midday Feb 9:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.012 | -8% | -14% | -68% | $13,018,410 |

| NPM | Newpeak Metals | 0.014 | 8% | -22% | -86% | $1,499,276 |

| ASO | Aston Minerals Ltd | 0.017 | 6% | -26% | -81% | $22,016,093 |

| MTC | Metalstech Ltd | 0.17 | -23% | -26% | -66% | $32,122,280 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.043 | 10% | -4% | -57% | $4,620,894 |

| G88 | Golden Mile Res Ltd | 0.013 | 0% | -32% | -39% | $4,282,064 |

| DCX | Discovex Res Ltd | 0.002 | 0% | 0% | -50% | $6,605,136 |

| NMR | Native Mineral Res | 0.021 | -22% | 5% | -74% | $4,404,761 |

| AQX | Alice Queen Ltd | 0.005 | -9% | 0% | -85% | $3,454,921 |

| SLZ | Sultan Resources Ltd | 0.014749 | 15% | -21% | -77% | $2,185,729 |

| MKG | Mako Gold | 0.024 | 71% | 140% | -43% | $14,573,007 |

| KSN | Kingston Resources | 0.081 | 1% | 4% | -16% | $39,338,985 |

| AMI | Aurelia Metals Ltd | 0.11 | -4% | -4% | -11% | $194,323,251 |

| PNX | PNX Metals Limited | 0.006 | 50% | 100% | 100% | $32,283,748 |

| GIB | Gibb River Diamonds | 0.033 | -6% | 14% | -48% | $6,979,812 |

| KCN | Kingsgate Consolid. | 1.195 | -11% | -6% | -25% | $305,435,755 |

| TMX | Terrain Minerals | 0.005 | 0% | 25% | -23% | $7,158,353 |

| BNR | Bulletin Res Ltd | 0.085 | 5% | -39% | -29% | $23,489,066 |

| NXM | Nexus Minerals Ltd | 0.04 | 18% | -5% | -80% | $14,395,225 |

| SKY | SKY Metals Ltd | 0.032 | 7% | -11% | -37% | $14,764,739 |

| LM8 | Lunnonmetalslimited | 0.245 | -16% | -58% | -74% | $55,548,240 |

| CST | Castile Resources | 0.09 | 0% | 13% | -7% | $21,529,316 |

| YRL | Yandal Resources | 0.13 | 44% | 13% | 40% | $32,861,662 |

| FAU | First Au Ltd | 0.003 | 20% | 0% | -33% | $4,985,980 |

| ARL | Ardea Resources Ltd | 0.385 | 0% | -19% | -45% | $79,791,851 |

| GWR | GWR Group Ltd | 0.089 | -6% | -3% | 51% | $28,588,282 |

| IVR | Investigator Res Ltd | 0.0365 | -1% | 1% | -9% | $58,603,544 |

| GTR | Gti Energy Ltd | 0.011 | 5% | 22% | 2% | $24,599,365 |

| IPT | Impact Minerals | 0.011 | -8% | -8% | 5% | $31,511,743 |

| BNZ | Benzmining | 0.165 | -15% | -27% | -69% | $18,365,486 |

| MOH | Moho Resources | 0.006 | -25% | -40% | -71% | $3,215,647 |

| BCM | Brazilian Critical | 0.026 | 0% | 8% | -81% | $19,238,877 |

| PUA | Peak Minerals Ltd | 0.003 | 50% | 0% | -40% | $3,124,130 |

| MRZ | Mont Royal Resources | 0.1 | -9% | -23% | -59% | $8,502,979 |

| SMS | Starmineralslimited | 0.043 | 23% | 8% | -41% | $3,264,680 |

| MVL | Marvel Gold Limited | 0.009 | -10% | -18% | -61% | $7,774,116 |

| PRX | Prodigy Gold NL | 0.004 | 0% | -33% | -67% | $7,004,431 |

| AAU | Antilles Gold Ltd | 0.021 | 0% | 0% | -43% | $19,742,843 |

| CWX | Carawine Resources | 0.095 | -21% | -10% | -12% | $23,612,545 |

| RND | Rand Mining Ltd | 1.305 | -3% | -5% | -7% | $74,223,129 |

| CAZ | Cazaly Resources | 0.022 | 16% | -24% | -33% | $10,001,999 |

| BMR | Ballymore Resources | 0.125 | -4% | -7% | -22% | $22,041,323 |

| DRE | Dreadnought Resources Ltd | 0.018 | -5% | -33% | -84% | $69,581,459 |

| ZNC | Zenith Minerals Ltd | 0.115 | -15% | -15% | -49% | $42,285,706 |

| REZ | Resourc & En Grp Ltd | 0.012 | 20% | 0% | -14% | $5,997,669 |

| LEX | Lefroy Exploration | 0.135 | -7% | -21% | -44% | $26,964,535 |

| ERM | Emmerson Resources | 0.051 | -4% | -6% | -34% | $27,780,199 |

| AM7 | Arcadia Minerals | 0.066 | 20% | -4% | -71% | $7,197,307 |

| ADT | Adriatic Metals | 3.41 | -5% | -5% | -1% | $860,630,504 |

| AS1 | Asara Resources Ltd | 0.012 | 0% | 9% | -64% | $9,512,771 |

| CYL | Catalyst Metals | 0.53 | -5% | -18% | -59% | $114,481,923 |

| CHN | Chalice Mining Ltd | 0.985 | -3% | -25% | -85% | $392,852,937 |

| KAL | Kalgoorliegoldmining | 0.024 | 9% | -11% | -64% | $3,487,016 |

| MLS | Metals Australia | 0.0305 | -5% | -10% | -46% | $19,033,104 |

| ADN | Andromeda Metals Ltd | 0.023 | -4% | -4% | -50% | $71,536,231 |

| MEI | Meteoric Resources | 0.185 | 6% | -36% | 61% | $378,122,771 |

| SRN | Surefire Rescs NL | 0.012 | 9% | 33% | -14% | $21,594,736 |

| SIH | Sihayo Gold Limited | 0.0015 | 0% | 0% | -25% | $18,306,384 |

| WA8 | Warriedarresourltd | 0.04 | -9% | -23% | -80% | $20,416,876 |

| HMX | Hammer Metals Ltd | 0.035 | 0% | -22% | -53% | $32,797,072 |

| WCN | White Cliff Min Ltd | 0.018 | 13% | 100% | 64% | $24,045,468 |

| AVM | Advance Metals Ltd | 0.036 | -3% | 0% | -83% | $1,443,058 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | -3% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.0055 | -8% | -21% | -61% | $9,818,974 |

| MCT | Metalicity Limited | 0.0025 | 25% | 25% | -17% | $11,212,634 |

| AME | Alto Metals Limited | 0.028 | -7% | -33% | -62% | $20,202,649 |

| CTO | Citigold Corp Ltd | 0.005 | 0% | 0% | -17% | $15,000,000 |

| TIE | Tietto Minerals | 0.6175 | 0% | 2% | -20% | $689,233,175 |

| SMI | Santana Minerals Ltd | 1.41 | -1% | 42% | 72% | $256,077,372 |

| M2R | Miramar | 0.02 | -13% | -13% | -73% | $3,126,260 |

| MHC | Manhattan Corp Ltd | 0.0035 | -13% | -13% | -50% | $10,279,429 |

| GRL | Godolphin Resources | 0.038 | -3% | -5% | -56% | $6,431,197 |

| SVG | Savannah Goldfields | 0.037 | -14% | -16% | -79% | $8,322,883 |

| EMC | Everest Metals Corp | 0.08 | 5% | -1% | -11% | $13,306,932 |

| GUL | Gullewa Limited | 0.055 | 0% | 0% | 8% | $11,262,521 |

| CY5 | Cygnus Metals Ltd | 0.077 | 12% | -38% | -84% | $22,450,054 |

| G50 | Gold50Limited | 0.1 | -5% | -23% | -47% | $10,929,000 |

| ADV | Ardiden Ltd | 0.18 | 0% | -3% | -44% | $11,253,151 |

| AAR | Astral Resources NL | 0.07 | 8% | -1% | -4% | $53,930,632 |

| VMC | Venus Metals Cor Ltd | 0.1 | -5% | 0% | 27% | $18,972,868 |

| NAE | New Age Exploration | 0.004 | 0% | -20% | -43% | $7,175,596 |

| VKA | Viking Mines Ltd | 0.014 | 17% | -13% | 8% | $14,353,618 |

| LCL | LCL Resources Ltd | 0.011 | -12% | -31% | -72% | $11,413,759 |

| MTH | Mithril Resources | 0.002 | 0% | 0% | -43% | $6,737,609 |

| ADG | Adelong Gold Limited | 0.0045 | -10% | -10% | -55% | $2,798,623 |

| RMX | Red Mount Min Ltd | 0.003 | 20% | 0% | -50% | $8,020,728 |

| PRS | Prospech Limited | 0.03 | -17% | -9% | 16% | $8,104,462 |

| TTM | Titan Minerals | 0.018 | -5% | -28% | -74% | $32,134,118 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -54% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.037 | 3% | -8% | -63% | $19,412,460 |

| KZR | Kalamazoo Resources | 0.115 | 24% | -4% | -41% | $21,627,228 |

| BCN | Beacon Minerals | 0.022 | -12% | -14% | -29% | $90,162,436 |

| MAU | Magnetic Resources | 1 | 1% | 2% | 26% | $244,667,260 |

| BC8 | Black Cat Syndicate | 0.215 | -14% | -9% | -48% | $62,726,234 |

| EM2 | Eagle Mountain | 0.061 | -6% | -23% | -72% | $18,602,979 |

| EMR | Emerald Res NL | 3.055 | 0% | 1% | 104% | $1,913,852,453 |

| BYH | Bryah Resources Ltd | 0.011 | -8% | -27% | -54% | $4,336,073 |

| HCH | Hot Chili Ltd | 1.11 | 8% | 11% | 19% | $132,584,179 |

| WAF | West African Res Ltd | 0.85 | -12% | -8% | -17% | $867,255,675 |

| MEU | Marmota Limited | 0.051 | 19% | 24% | 13% | $55,057,630 |

| NVA | Nova Minerals Ltd | 0.27 | -18% | -24% | -57% | $56,940,309 |

| SVL | Silver Mines Limited | 0.135 | -21% | -16% | -31% | $189,584,839 |

| PGD | Peregrine Gold | 0.27 | -14% | -7% | -45% | $18,089,050 |

| ICL | Iceni Gold | 0.041 | -9% | -37% | -61% | $9,862,442 |

| FG1 | Flynngold | 0.053 | -7% | 0% | -43% | $8,699,468 |

| WWI | West Wits Mining Ltd | 0.012 | 9% | -8% | -25% | $29,164,700 |

| RML | Resolution Minerals | 0.003 | 0% | -14% | -57% | $3,779,990 |

| AAJ | Aruma Resources Ltd | 0.019 | -10% | -27% | -75% | $3,740,939 |

| AL8 | Alderan Resource Ltd | 0.004 | 14% | -20% | -50% | $4,427,445 |

| GMN | Gold Mountain Ltd | 0.003 | 0% | -33% | -45% | $7,941,775 |

| MEG | Megado Minerals Ltd | 0.015 | -17% | -40% | -63% | $3,816,833 |

| HMG | Hamelingoldlimited | 0.071 | -3% | -5% | -43% | $11,182,500 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | 0% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.14 | -7% | -32% | -78% | $13,764,048 |

| TBR | Tribune Res Ltd | 2.95 | 0% | 3% | -20% | $154,780,827 |

| FML | Focus Minerals Ltd | 0.17 | 0% | -3% | -11% | $48,714,970 |

| GSR | Greenstone Resources | 0.0055 | -21% | -45% | -80% | $8,208,681 |

| VRC | Volt Resources Ltd | 0.005 | -9% | -17% | -62% | $20,650,533 |

| ARV | Artemis Resources | 0.019 | 46% | 6% | -21% | $27,059,138 |

| HRN | Horizon Gold Ltd | 0.275 | 0% | 10% | -18% | $39,830,979 |

| CLA | Celsius Resource Ltd | 0.012 | 9% | 0% | -29% | $24,706,568 |

| QML | Qmines Limited | 0.076 | -12% | -6% | -58% | $16,371,136 |

| RDN | Raiden Resources Ltd | 0.024 | 0% | -37% | 359% | $61,101,457 |

| TCG | Turaco Gold Limited | 0.115 | -2% | -12% | 95% | $67,630,222 |

| KCC | Kincora Copper | 0.036 | 3% | -12% | -57% | $6,936,177 |

| GBZ | GBM Rsources Ltd | 0.009 | -10% | 13% | -81% | $7,195,052 |

| DTM | Dart Mining NL | 0.0135 | -4% | -16% | -72% | $3,186,115 |

| MKR | Manuka Resources. | 0.073 | -13% | -3% | -17% | $45,173,640 |

| AUC | Ausgold Limited | 0.027 | 0% | -7% | -48% | $61,995,813 |

| ANX | Anax Metals Ltd | 0.02 | -13% | -33% | -71% | $11,391,407 |

| EMU | EMU NL | 0.001 | -33% | 0% | -76% | $2,024,771 |

| SFM | Santa Fe Minerals | 0.043 | 0% | 0% | -39% | $3,131,208 |

| SSR | SSR Mining Inc. | 14.5 | 1% | -7% | -36% | $79,627,634 |

| PNR | Pantoro Limited | 0.041 | 0% | -16% | -54% | $223,773,312 |

| CMM | Capricorn Metals | 4.355 | -3% | 0% | -1% | $1,648,888,452 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | -5% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.0045 | 0% | 0% | -10% | $8,972,367 |

| HAW | Hawthorn Resources | 0.083 | -14% | -21% | -14% | $27,806,296 |

| BGD | Bartongoldholdings | 0.245 | 7% | -6% | 0% | $49,145,494 |

| SVY | Stavely Minerals Ltd | 0.033 | 10% | -27% | -89% | $12,604,023 |

| AGC | AGC Ltd | 0.072 | 7% | 3% | 18% | $15,555,556 |

| RGL | Riversgold | 0.009 | -18% | -25% | -67% | $8,708,953 |

| TSO | Tesoro Gold Ltd | 0.026 | 8% | 0% | -16% | $34,428,260 |

| GUE | Global Uranium | 0.135 | 8% | 29% | -23% | $30,770,301 |

| CPM | Coopermetalslimited | 0.295 | -8% | -17% | 0% | $20,272,030 |

| MM8 | Medallion Metals. | 0.06 | 11% | 0% | -58% | $18,459,099 |

| FFM | Firefly Metals Ltd | 0.465 | -11% | -19% | -33% | $172,279,764 |

| CBY | Canterbury Resources | 0.027 | 0% | 8% | -33% | $4,637,004 |

| LYN | Lycaonresources | 0.2 | -2% | -2% | -29% | $8,811,250 |

| SFR | Sandfire Resources | 7.05 | -2% | 4% | 10% | $3,262,925,765 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | -71% | $4,881,018 |

| TAM | Tanami Gold NL | 0.033 | 0% | -6% | -20% | $38,778,203 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.026 | 8% | -19% | -60% | $7,476,807 |

| ALK | Alkane Resources Ltd | 0.5475 | -5% | -16% | -23% | $325,856,151 |

| BMO | Bastion Minerals | 0.0115 | 5% | -28% | -75% | $3,581,607 |

| IDA | Indiana Resources | 0.084 | 2% | -1% | 47% | $51,679,913 |

| GSM | Golden State Mining | 0.012 | -8% | -8% | -73% | $3,352,448 |

| NSM | Northstaw | 0.048 | 0% | -2% | -70% | $6,714,038 |

| GSN | Great Southern | 0.019 | -5% | -5% | -27% | $15,092,704 |

| RED | Red 5 Limited | 0.32 | -3% | 10% | 60% | $1,143,054,181 |

| DEG | De Grey Mining | 1.2 | 0% | -3% | -15% | $2,212,262,302 |

| THR | Thor Energy PLC | 0.031 | -6% | 7% | -38% | $5,944,708 |

| CDR | Codrus Minerals Ltd | 0.05 | -2% | -21% | -57% | $4,619,375 |

| MDI | Middle Island Res | 0.017 | 0% | 6% | -67% | $3,917,772 |

| WTM | Waratah Minerals Ltd | 0.1 | 6% | -13% | -17% | $15,683,272 |

| POL | Polymetals Resources | 0.26 | -2% | -4% | 37% | $40,980,630 |

| RDS | Redstone Resources | 0.004 | -20% | -20% | -60% | $3,701,514 |

| NAG | Nagambie Resources | 0.025 | 0% | -11% | -53% | $18,322,621 |

| BGL | Bellevue Gold Ltd | 1.3275 | 3% | -12% | 13% | $1,554,091,243 |

| GBR | Greatbould Resources | 0.055 | -10% | -18% | -37% | $32,927,796 |

| KAI | Kairos Minerals Ltd | 0.014 | -7% | 0% | -27% | $36,692,771 |

| KAU | Kaiser Reef | 0.13 | 24% | -10% | -26% | $21,380,487 |

| HRZ | Horizon | 0.034 | -3% | -8% | -42% | $25,235,412 |

| CAI | Calidus Resources | 0.165 | -8% | -21% | -35% | $101,062,948 |

| CDT | Castle Minerals | 0.007 | 0% | -13% | -70% | $8,571,451 |

| RSG | Resolute Mining | 0.36 | -11% | -13% | 36% | $777,103,255 |

| MXR | Maximus Resources | 0.033 | -6% | -3% | -18% | $10,591,210 |

| EVN | Evolution Mining Ltd | 3.08 | -3% | -19% | -5% | $6,116,320,540 |

| CXU | Cauldron Energy Ltd | 0.049 | 26% | 58% | 610% | $63,438,430 |

| DLI | Delta Lithium | 0.29 | 0% | -17% | -37% | $213,545,893 |

| ALY | Alchemy Resource Ltd | 0.009 | 13% | -10% | -47% | $10,602,686 |

| HXG | Hexagon Energy | 0.013 | 18% | 8% | -28% | $6,667,907 |

| OBM | Ora Banda Mining Ltd | 0.235 | 7% | -2% | 147% | $401,147,815 |

| SLR | Silver Lake Resource | 1.09 | -9% | -6% | -9% | $1,046,913,653 |

| AVW | Avira Resources Ltd | 0.002 | 0% | 0% | -33% | $4,267,580 |

| LCY | Legacy Iron Ore | 0.017 | 0% | 0% | 0% | $102,509,219 |

| PDI | Predictive Disc Ltd | 0.2 | -5% | -5% | 11% | $415,248,818 |

| MAT | Matsa Resources | 0.029 | 4% | -17% | -19% | $14,364,721 |

| ZAG | Zuleika Gold Ltd | 0.017 | -15% | -11% | -11% | $12,513,454 |

| GML | Gateway Mining | 0.022 | -15% | 10% | -62% | $7,489,149 |

| SBM | St Barbara Limited | 0.1625 | -4% | -17% | -47% | $130,875,261 |

| SBR | Sabre Resources | 0.023 | -8% | -23% | -43% | $8,608,024 |

| STK | Strickland Metals | 0.09 | -7% | -25% | 143% | $149,427,251 |

| ION | Iondrive Limited | 0.009 | 0% | -25% | -63% | $4,376,568 |

| CEL | Challenger Gold Ltd | 0.077 | 8% | 7% | -52% | $97,109,965 |

| LRL | Labyrinth Resources | 0.006 | 0% | -14% | -63% | $7,125,262 |

| NST | Northern Star | 13.125 | -2% | 2% | 4% | $15,296,133,054 |

| OZM | Ozaurum Resources | 0.065 | -7% | -43% | -12% | $10,318,750 |

| TG1 | Techgen Metals Ltd | 0.033 | -20% | -57% | -63% | $3,941,110 |

| XAM | Xanadu Mines Ltd | 0.05 | 0% | -4% | 67% | $86,741,855 |

| AQI | Alicanto Min Ltd | 0.025 | -17% | -26% | -47% | $15,383,420 |

| KTA | Krakatoa Resources | 0.017 | -15% | -53% | -61% | $8,025,823 |

| ARN | Aldoro Resources | 0.115 | -4% | 15% | -50% | $15,481,730 |

| WGX | Westgold Resources. | 1.9775 | -12% | 3% | 77% | $951,981,687 |

| MBK | Metal Bank Ltd | 0.022 | -4% | -19% | -32% | $7,418,727 |

| A8G | Australasian Metals | 0.12 | 20% | -20% | -35% | $5,159,929 |

| TAR | Taruga Minerals | 0.009 | 13% | -25% | -55% | $6,354,241 |

| DTR | Dateline Resources | 0.01 | -23% | 0% | -68% | $13,295,562 |

| GOR | Gold Road Res Ltd | 1.4275 | -3% | -16% | -9% | $1,567,981,048 |

| S2R | S2 Resources | 0.14 | 0% | -10% | -7% | $63,400,119 |

| NES | Nelson Resources. | 0.004 | 33% | -20% | -50% | $2,454,377 |

| TLM | Talisman Mining | 0.18 | -8% | -38% | 9% | $33,897,663 |

| BEZ | Besragoldinc | 0.16 | -3% | 19% | 214% | $64,805,640 |

| PRU | Perseus Mining Ltd | 1.685 | -5% | -3% | -20% | $2,341,926,545 |

| SPQ | Superior Resources | 0.011 | 10% | -21% | -83% | $22,013,425 |

| PUR | Pursuit Minerals | 0.005 | 0% | -41% | -78% | $14,719,857 |

| RMS | Ramelius Resources | 1.4975 | -5% | -8% | 61% | $1,721,113,742 |

| PKO | Peako Limited | 0.003 | 0% | -40% | -79% | $1,581,254 |

| ICG | Inca Minerals Ltd | 0.008 | -6% | -16% | -62% | $4,702,611 |

| A1G | African Gold Ltd. | 0.039 | -3% | 5% | -57% | $6,603,137 |

| OAU | Ora Gold Limited | 0.006 | 0% | -25% | 20% | $34,440,005 |

| GNM | Great Northern | 0.017 | -11% | -11% | -68% | $2,628,694 |

| KRM | Kingsrose Mining Ltd | 0.034 | 3% | -15% | -51% | $24,833,375 |

| BTR | Brightstar Resources | 0.012 | 0% | -20% | -40% | $28,444,546 |

| RRL | Regis Resources | 1.9475 | -1% | -9% | -6% | $1,461,580,593 |

| M24 | Mamba Exploration | 0.035 | -34% | -44% | -82% | $8,099,620 |

| TRM | Truscott Mining Corp | 0.05 | 0% | -9% | -57% | $8,668,353 |

| TNC | True North Copper | 0.083 | -8% | -17% | 57% | $32,787,683 |

| MOM | Moab Minerals Ltd | 0.007 | 0% | 0% | -22% | $4,983,744 |

| KNB | Koonenberrygold | 0.041 | -7% | -25% | -18% | $4,909,713 |

| AWJ | Auric Mining | 0.115 | 0% | 0% | 80% | $14,394,555 |

| AZS | Azure Minerals | 3.64 | 0% | -1% | 1074% | $1,669,593,653 |

| ENR | Encounter Resources | 0.26 | 4% | -16% | 58% | $104,585,203 |

| SNG | Siren Gold | 0.058 | -5% | -17% | -64% | $9,331,338 |

| STN | Saturn Metals | 0.165 | 22% | -18% | -4% | $35,753,441 |

| USL | Unico Silver Limited | 0.097 | -8% | -12% | -25% | $29,013,056 |

| PNM | Pacific Nickel Mines | 0.042 | -16% | -46% | -44% | $17,148,377 |

| AYM | Australia United Min | 0.003 | 0% | -25% | -25% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | $25,143,441 |

| HAV | Havilah Resources | 0.16 | 7% | -14% | -53% | $49,079,078 |

| SPR | Spartan Resources | 0.4375 | -7% | -11% | 162% | $429,564,350 |

| PNT | Panthermetalsltd | 0.049 | -2% | -18% | -73% | $4,271,142 |

| MEK | Meeka Metals Limited | 0.036 | -3% | -3% | -36% | $46,918,939 |

| GMD | Genesis Minerals | 1.58 | -2% | -3% | 26% | $1,770,778,725 |

| PGO | Pacgold | 0.16 | -6% | -20% | -56% | $14,304,725 |

| FEG | Far East Gold | 0.145 | 12% | 7% | -64% | $26,187,900 |

| MI6 | Minerals260Limited | 0.165 | -6% | -47% | -49% | $39,780,000 |

| IGO | IGO Limited | 7.11 | -2% | -17% | -52% | $5,459,900,932 |

| GAL | Galileo Mining Ltd | 0.21 | 0% | -18% | -76% | $42,489,359 |

| RXL | Rox Resources | 0.16 | -11% | -11% | -14% | $64,636,996 |

| KIN | KIN Min NL | 0.062 | 3% | -9% | 17% | $73,045,334 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -86% | $12,357,085 |

| TGM | Theta Gold Mines Ltd | 0.13 | 18% | 8% | 91% | $64,750,125 |

| FAL | Falconmetalsltd | 0.125 | 0% | 4% | -43% | $22,125,000 |

| SXG | Southern Cross Gold | 1.1425 | -5% | 1% | 69% | $103,113,688 |

| SPD | Southernpalladium | 0.385 | 17% | 10% | -47% | $17,877,506 |

| ORN | Orion Minerals Ltd | 0.014 | 0% | -7% | -18% | $81,847,986 |

| TMB | Tambourahmetals | 0.082 | 3% | -25% | -22% | $6,801,109 |

| TMS | Tennant Minerals Ltd | 0.028 | -10% | -13% | -30% | $22,170,884 |

| AZY | Antipa Minerals Ltd | 0.012 | -20% | -25% | -47% | $49,617,695 |

| PXX | Polarx Limited | 0.013 | 18% | 86% | -43% | $21,315,018 |

| TRE | Toubani Res Ltd | 0.12 | -4% | -8% | -40% | $14,725,223 |

| AUN | Aurumin | 0.038 | 27% | 31% | -41% | $15,054,609 |

| GPR | Geopacific Resources | 0.016 | 7% | -6% | -13% | $12,325,761 |

| FXG | Felix Gold Limited | 0.041 | 3% | -5% | -66% | $8,495,820 |

| ILT | Iltani Resources Lim | 0.18 | 0% | 3% | 0% | $6,121,891 |

| ARD | Argent Minerals | 0.009 | 13% | -5% | -47% | $11,625,831 |

The week’s biggest gainers 🚀

Mako Gold (ASX:MKG) +71%

PNX Metals (ASX:PNX) +50%

Artemis Resources (ASX:ARV) +46%

Yandal Resources (ASX:YRL) +44%

Nelson Resources (ASX:NES) +33%

Aurumin (ASX:AUN) +27%

Cauldron Energy (ASX:CXU) +26%

Metalicity (ASX:MCT) +25%