EV metals explorer Eastern Metals just had to shut the door on its IPO offer a week early

Mining

Mining

Early-stage mineral exploration company Eastern Metals is another step closer towards listing on the ASX after receiving IPO applications for more than the maximum subscription of $6 million.

The offer was oversubscribed with more than 30 million shares issued at a price of 20c each.

That saw the company, which will operate under the ticker EMS, and its lead manager Panthea Capital agree to bring forward the closing date of the offer to 5pm AEST on Tuesday, September 21 – more than a week earlier than was anticipated when the prospectus was released in August.

With base metals in high demand by the fast-moving electric vehicle market, EMS has amassed a set of assets positioned to capitalise on the growing thematic. And according to managing director Wayne Rossiter, it will be ready to drill for them as soon as early Q4.

The base and precious metals stock has built its collective experience with the mineral systems of the NT and central Western NSW over more than 50 years.

Eastern Metals has a portfolio of three core projects in the Northern Territory and New South Wales mineral provinces with walk-up drill targets ready for testing.

These include the Arunta Project in the Northern Territory, where its flagship EL 23186 Barrow Creek hosts the Home of Bullion deposit and Prospect D, and the Cobar and Thomson Projects in New South Wales.

Home of Bullion has a total indicated and inferred copper dominated massive sulphide mineral resource estimate of 2.5 million tonnes averaging 1.8% copper, 2% zinc, 36g/t silver, 1.2% lead and 0.14g/t gold.

Eastern Metals plans to spend more than $1.4 million growing this resource with further drilling as well as continue testing other base metals targets along strike from Home of Bullion and at Prospect D.

The company also intends to conduct regional geological reconnaissance mapping and rock chip sampling of pegmatites for lithium.

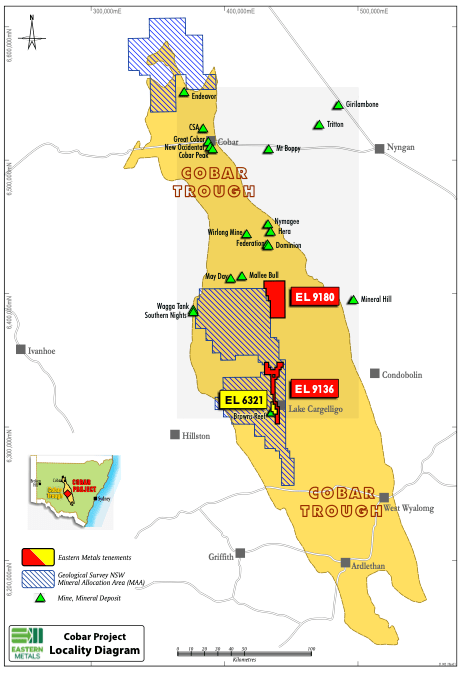

EMS’ Cobar Project, within NSW’s Cobar Trough, includes the Brown Reef deposit, which comprises an exploration target between 27 to 37 million tonnes averaging 1.3–1.4% zinc, 0.6–0.7% lead, 9–10 g/t silver and 0.2–0.3% copper.

Targets have been identified both within and outside the exploration target zone at Browns Reef, where an additional two exploration licences have been taken out by EMS.

In addition to EL 6321 Browns Reef, Eastern Metals also holds two other tenements – Tara and Brothrooney – which together with Browns Reef form the Cobar project.

Eastern Metals plans to spend more than $1.3 million over two years on drilling and sampling at the Cobar project as exploration in the region continues to heat up.

Key players include Peel Mining with its Malle Bull, May Day and Wirlong Mines nearby and Aurelia Metals’ Hera and Federation Mines.

Unlike its other projects, the Thomson Project contains targets in basement rocks beneath younger cover.

Limited drilling has revealed the rocks could be similar to those in the Cobar area. Plans are in place to work up these targets through analysis of high-quality data already available.

Overall, Eastern Metals believes early target testing could enhance its scope for achieving success in preference to greenfield exploration, which can be costly and time consuming.

EMS managing director Wayne Rossiter said it was gratifying to know the investment community found Eastern Metals’ assets and its business plans attractive.

“We are looking forward to commencing the drilling programs at both the Home of Bullion and Browns Reef in early Q4,” he said.