Errawarra hopes to hit copy on Pilbara neighbour’s nickel success

Mining

The 2022 commodity narrative has been dominated by the growing importance of battery metals – a story which Mac Equity says puts ASX minnow Errawarra Resources right in the spotlight.

A recent equity update on Errawarra (ASX:ERW) by MAC Equity Partners highlighted the significance of the company’s newly-acquired Andover West nickel project in the Pilbara.

Even from the outset the appeal of the thing is obvious – hot commodity, stable jurisdiction, an explorer with a low market capitalisation.

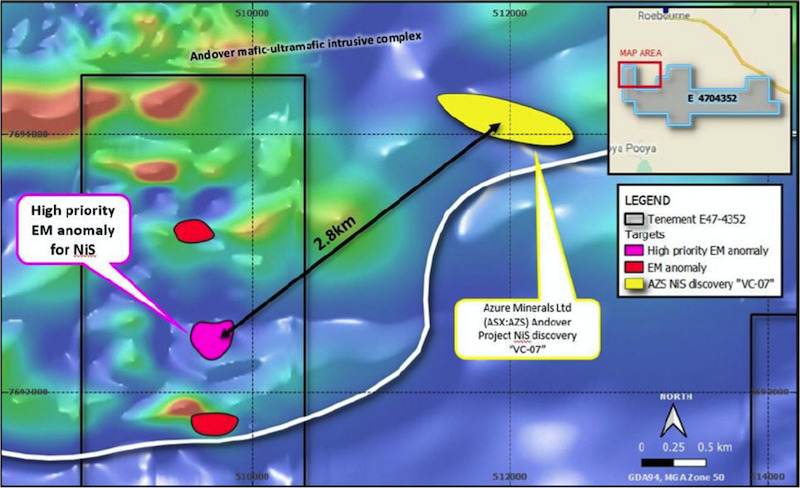

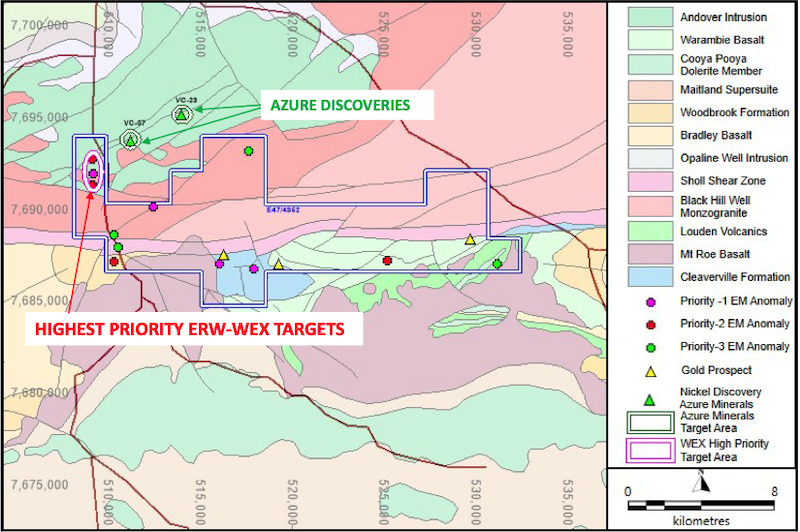

But the MAC Equity analysts point to the experience of the project’s immediate neighbour, JV nickel discoverer Azure Minerals (ASX:AZS), and the fact that ERW’s yet-to-be-drilled nickel targets at Andover West are considered to have lookalike electromagnetic signatures to Azure’s.

Azure’s nickel-copper sulphide discovery is obviously much further along than ERW is – the company recently delivered a maiden mineral resource (MMR) at its Andover project of around 75,000 tonnes of contained nickel, with ample room to grow.

That’s a long way from EM targets, and AZS has enjoyed significant price appreciation along the way. When maiden drilling at Andover in October 2020 hit mineralisation the company’s value soared 5x – from 18c to 99c in just a month.

The company currently has a market capitalisation of $85.45 million, with its 60% stake in Andover its flagship asset. Legendary explorer Mark Creasy’s Creasy Group holds the remaining 40%.

Creasy’s been in the headlines this week after his stake in Galileo Mining (ASX:GAL) spiked some 220% following a massive palladium strike.

While Creasy’s involvement always bodes well, ERW, by contrast, has a market cap of $8.2 million, and has acquired 80% of Andover West.

It’s this comparison which has attracted the attention of MACEquity Partners, which highlighted similarities between the EM targets at Andover West and what was ultimately mineralisation for the AZS JV at Andover next door.

“The Andover West EM targets look to be a continuation of the southern mineralised corridor of the Andover Intrusive Complex defined by Azure Minerals/Creasy Group & have geological features consistent with a potentially significant nickel sulphide body,” MAC Investment Advisor Hugh Pilgrim said.

If that were the case, the ERW value proposition would appear to be particularly compelling.

In all, ERW has identified more than a dozen targets at Andover West. There’s a nickel-copper processing plant 30km away at Artemis Resources’ (ASX:ARV) Radio Hill project, currently on care and maintenance.

The Andover West site has a heritage agreement finalised – a significant step in the exploration process as ERW works towards having rigs on the ground in August 2022.

We all know about the nickel squeeze that pushed the commodity’s price above $100,000/t earlier in the year – so high that the London Metals Exchange suspended trading.

While that movement was attributed to traders trying to cover short positions, the longer-term price movements for the metal are overwhelmingly positive.

Around 70% of current demand goes to steel mills for the manufacture of stainless steel, though the growth area is electric vehicles, where demand is expected to rise from around 296,000 metric tonnes in 2021 to 855,000t by 2026 according to HSBC.

According to MAC Equity, geopolitical issues relating to the Ukraine crisis have led to nickel supply disruptions, while Indonesian restrictions on some commodity exports have led to fears they may reintroduce nickel export bans which would further constrict global supply.

Meanwhile, the world’s high-quality nickel sulphide discoveries are on the wane – something which should prove lucrative for ERW should it replicate neighbour Azure’s Pilbara exploration success.

This article was developed in collaboration with Errawarra Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.