LME nickel trade resumes, prices ‘limit down’ immediately, trade stops. What happens now?

Pic: Getty

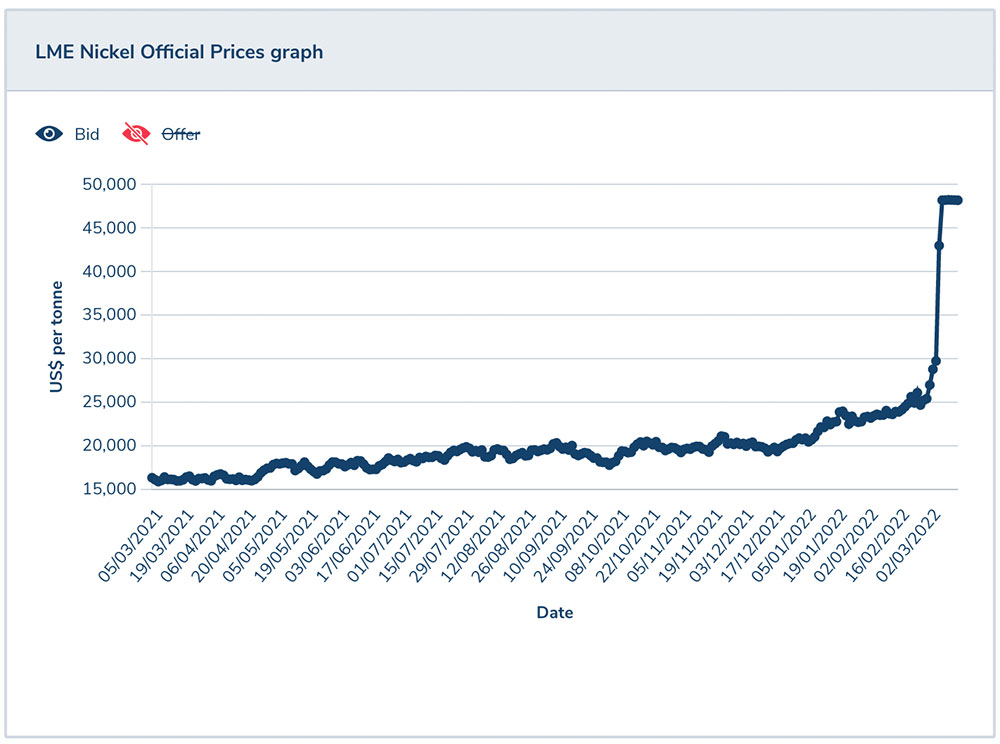

Last night, nickel trading on the London Metals Exchange resumed for the first time since March 7, when three-month nickel prices closed at $US50,300 per tonne.

On March 8 a colossal short squeeze saw nickel touch a truly ridiculous $US100,000 a tonne before the market was halted.

The LME decided to ignore that part, and is working off the previous day’s prices.

But to make sure these spikes don’t happen again, it has now applied a 5% ‘trading limit’ to cap how far prices can rise/fall in a single day. That means any drop in prices would be capped around the $US47,200 per tonne mark.

Which happened almost immediately when trade resumed Wednesday night, Aussie time. Trade is again in a halt.

LME shut downs (again) trading in nickel “to investigate a potential technical issue with the limit down band,” the exchange says in statement | #nickelsqueeze

— Javier Blas (@JavierBlas) March 16, 2022

It looks like the LME is still ironing out the bugs.

What happens now to nickel prices?

Fastmarkets Head of Base Metal and Battery Research William Adams yesterday predicted nickel prices to ‘limit down’ on open.

(Although he foresaw a trading limit of 10% which, in retrospect, could’ve been a better play by the LME).

Eventually – over several days – nickel will return to price levels around where it was trading before the short squeeze turned the market disorderly, he says.

“Such a corrective return-to-normal behaviour is often the case when markets experience sudden technical spikes,” Adams says.

“We continue to expect round numbers to provide targets – including $50,000, $40,000 and $30,000 per tonne – as well as the major moving averages broadly in the $20,000-25,000 per tonne range, and the two-year-old uptrend line that also puts trend support around $20,000 per tonne.”

The LME has a good track record of price discovery and 99% of the time it works seamlessly, Adams says.

“Last week was a rare exception – normally we have year after year where billions of tonnes of metal are efficiently priced via LME price discovery,” he says.

“Our price forecasts beyond the short-term technically-driven correction remain unchanged and continue to be grounded in the fundamentals, which for nickel still look strong.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.