E-buses will be the fastest electric vehicles on the road, says Bloomberg

Mining

Mining

Aussie battery metal miners looking to e-vehicles for their meal ticket need to be thinking bigger than a deal with electric car maker Tesla.

They need to be thinking e-bus.

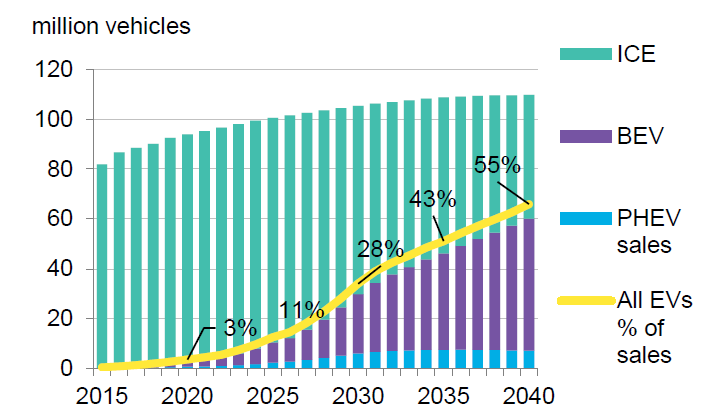

Bloomberg New Energy Finance’s latest Electric Vehicle Outlook is picking e-buses as a faster growing market than electric cars.

The report expects the electrification of road transport to start kicking into gear in the second half of the 2020s, and e-buses to make up 84 per cent of all bus sales globally by 2030.

Like the rest of the electric vehicle (EV) industry that transition is being led by China.

“Currently there are over 300,000 e-buses (99 per cent of the world total) on the road in China, and electric e-bus models are on track to dominate the global market by the late 2020s,” the report said.

“China has led this market in spectacular style, accounting for 99 per cent of the world total last year. The rest of the world will follow, and by 2040 we expect 80 per cent of the global municipal bus fleet to be electric,” said Colin McKerracher, Bloomberg’s lead analyst on advanced transportation.

Electric cars are expected to make up 24 per cent of global cars sales by then — that’s 30 million cars.

A record 1.1 million e-cars were sold last year.

“Developments over the last 12 months, such as manufacturers’ plans for model roll-outs and new regulations on urban pollution, have bolstered our bullish view of the prospects for EVs,” Mr McKerracher said.

Bloomberg says sales of electric EVs in China will account of 39 per cent of the global market by 2030.

Last year Morgan Stanley estimated that 1 billion electric vehicles (EVs) would be on roads worldwide by 2050.

Their more ambitious estimates considered that EVs generally would make up a whopping 80 per cent of the global road transport fleet by then.

Metals shortages

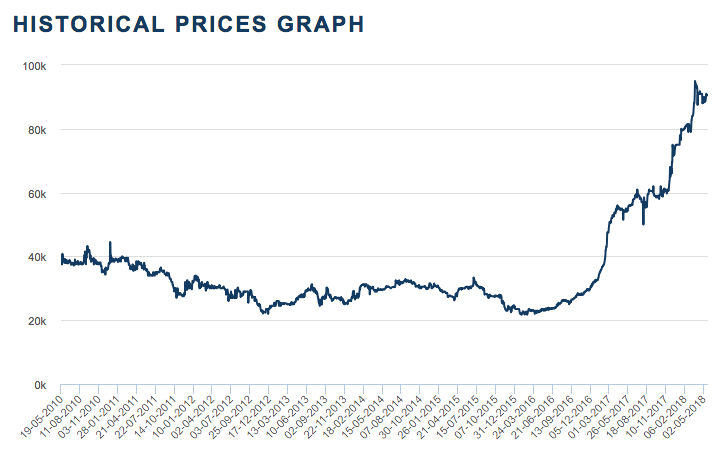

Bloomberg is also forecasting cobalt shortages in the early 2020s.

“While we’re optimistic on EV demand over the coming years… In the short term, we see a risk of cobalt shortages in the early 2020s that could slow down some of the rapid battery cost declines we have seen recently,” said Bloomberg’s senior transportation analyst Salim Morsy.

Electric car makers are focusing on two battery technologies: nickel-cobalt-aluminium which has been favoured by Tesla, and nickel-cobalt-manganese.

Morgan Stanley also pointed to cobalt as the metal that could cause battery-makers supply risks.

Where companies like Tesla are reducing the amount of cobalt they use, Morgan Stanley says the trend in China is to use more of the metal “as new regulations drive an industry shift towards higher energy density batteries”.

But with shortages come higher prices and, potentially, deals as battery makers rush to lock in supply.

Cobalt on Monday was trading at $US41.28 a pound, or $US91,000 a tonne, on the London Metals Exchange. It’s the highest price since 2008.

Macquarie is picking lithium, cobalt and nickel to be strong price performers over the next five years, while UBS thinks nickel prices could be 40 per cent higher in 2025 as battery makers begin to overtake stainless steel as an offtaker.

While lithium miner Kidman Resources (ASX:KDR) is the first Australian company to sign a supply deal with a major like Tesla, there are plenty of opportunities for others — in China.

Bloomberg says China is a dominant producer of lithium-ion batteries already, with 59 per cent global share of production, set to rise to 73 per cent in 2021.

Which means Australia’s miners — as Lithium Australia (ASX:LIT) boss Adrian Griffin says — should be on the lookout as battery makers are likely to come a-calling.