Collerina says it can make its anti-exploding battery material cheap – and make a profit

Mining

Mining

High Purity Alumina (HPA) small cap Collerina Cobalt reckons a study shows its “HPA First” project will be profitable even at low prices.

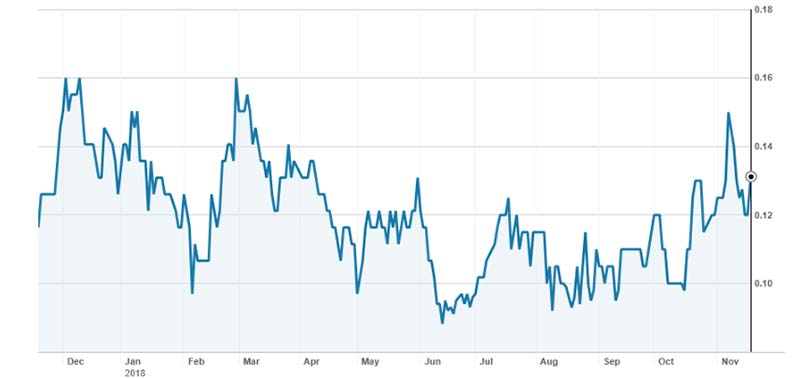

Investors agreed, pushing the share price of Collerina (ASX:CLL) up 11.5 per cent to an intraday high of 14.5c.

Collerina, which is looking to change its name to Alpha HPA, released a pre feasibility study on building a $215 million process plant to treat a “blended chemical feedstock” from third parties to produce 10,200 tonnes per annum of HPA. This means, unlike many of its ASX-listed peers, Collerina’s process doesn’t require a mining operation.

It estimated annual revenues of $384 million, based on a ‘4N HPA’ price assumption of $33,333/t.

4N HPA – or 99.99 per cent purity – is the largest market segment and fetches between $34,250 and $54,800 per tonne.

It’s a “highly resilient project”, the company said.

Even if the price of HPA drops from $34,250 to $13,700, earnings before tax would still be $47.1 million.

And if the price of HPA increases to $54,800, earnings would surge to $513.8 million a year.

Collerina is immediately kicking off a “higher confidence” definitive feasibility study to position the company for a final investment decision next year, managing director Rimas Kairaitis told investors.

The DFS will be based on a Brisbane-based pilot-scale processing plant (a smaller version of the real thing) which is scheduled to run between March and May next year.

Demand for HPA, a critical safety material in lithium batteries, is expected to grow dramatically as battery component makers invest in new production capacity.

One of HPA’s fastest growing applications is coating the separators that keep apart the cathode and anode electrodes in a lithium battery to prevent explosions.