Battery metals for the win: Here are 2017’s top 100 ASX small cap winners

Battery metals won 2017 in a knockout. Pic: Getty

How many five-baggers did you bag this year? How about ten-baggers? Or even a twenty-bagger?

It’s what we love about small caps: the exhilarating feeling when you’re on a skyrocketing stock — a feeling you just don’t get with the boring old ASX-200.

The ranks of ASX small caps produced at least eight ten-baggers this year and even a twenty-bagger.

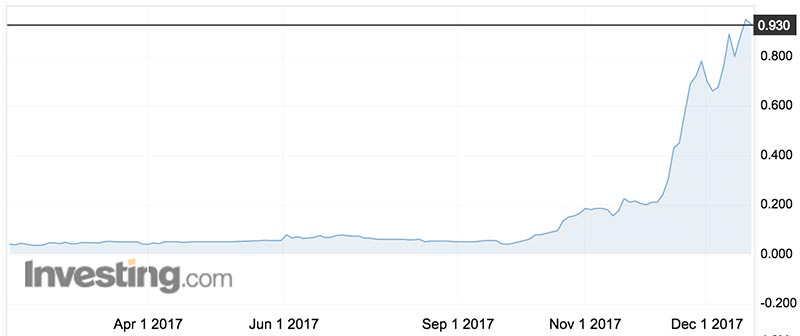

Body shape app Myfiziq (ASX:MYQ) closed at 93c on Friday — up more than 2000 per cent on the 4c it was fetching at the start of January.

This week we analysed the year’s 100 biggest gainers among ASX small caps — stocks with a market cap of $300 million or less.

The analysis — which looks at share price movement from the start January to December 12 — confirms that resources are well and truly back.

Junior explorers accounted for two-thirds of the best-returning 100 small cap stocks.

Catch up with the latest ASX small cap news

Follow us on Facebook or Twitter

Discuss Stockhead small cap news in our Facebook group

Tech and health-related stocks were well out of the running this year. Tech accounted for about 13 per cent of the top 100 and health/biotech about 11 per cent.

Cannabis saved the health sector from complete embarrassment.

Not including pot stocks, health and biotech managed only five companies in the top 100 performers. And that includes MyFiziq.

Battery metals for the win

Battery metals were undoubtedly the theme of the year — particularly cobalt.

One quarter of the top 100 small caps had exposure to battery metals such as cobalt and lithium that are in high demand from electric car battery makers.

If you throw in copper — which is used in great amounts for electric car motors and recharge stations — about 30 per cent of the top 100 were driven by the Elon Musk factor.

Among the cobalt stocks, Collerina Cobalt (ASX:CLL) is up a glorious 1400 per cent for the year, Jervois Mining (ASX:JRV) has gained more than 1300 per cent and European Cobalt (ASX:EUC) has climbed 1100 per cent.

All that glitters

Gold explorers were the next best performing theme, accounting for 17 of the top 100.

Of these, seven were Pilbara gold nugget explorers.

An Australian gold nugget rush kicked off July 13 when Artemis Resources (ASX:ARV) and Canadian partner Novo Resources made a legendary announcement regarding a gold nugget find at their Purdy’s Reward site in the Pilbara region of Western Australia.

The mention of “Witwatersrand-style” and “conglomerate-hosted” gold has had investors salivating ever since. (Witwatersrand refers to the Witwatersrand Basin in South Africa — a geological formation that houses the world’s biggest known gold reserves).

In 2018 we will find out if the rush merits the fuss. Meantime, investors are making hay.

Artemis has fallen considerably from its 2017 high of 59c — down to 33.5c on Friday. But it was still up 625 per cent for the year when we did our analysis earlier this week (and in fact was up 738 per cent at Friday’s close).

Other winning Pilbara explorers include Southern Hemisphere (ASX:SUH) up more than 400 per cent and De Grey (ASX:DEG) with a 360 per cent gain.

Crypto and blockchain big in tech

As investors shifted back into resources, tech wilted somewhat — with the exception of crypto and blockchain stocks.

Blockchain is a technology that provides a public ledger of transactions used to underpin “cryptocurrencies” such as bitcoin.

The price of bitcoin is up more than 1600 per cent for the year — and any ASX stocks with a whiff of related technology have gone with it.

Tech plays accounted for 13 of the top 100 — including three related to blockchain or cryptocurrency.

Yojee (ASX:YOJ) and DigitalX (ASX:DCC) are up around 400 per cent for the year, while Byte Power (ASX:BPG) is up some 700 per cent.

Interestingly there were no other consistent tech trends in the top 100 such as social media or Internet of Things.

The only other two big tech movers were video networker Elsight (ASX:ELS) and educational gamer Kneomedia (ASX:KNM) — both up around 650 per cent.

Pot’s hot

It must be depressing for all those Aussie biotechs chasing cancer cures… but when it came to the health sector, investors were far more interested this year in medicinal cannabis.

Six of the top 100 small caps were pot stocks.

Queensland Bauxite (ASX:QBL) shareholders are sitting on a ten-bagger following the company’s move into hemp seed food.

Australia legalised hemp seed foods in November, and Bauxite’s Medical Cannabis subsidiary has been an aggressive first-mover.

Cann Group (ASX:CAN) recently raised $60 million to find local marijuana production because it expects Australia to soon allow cannabis exports.

Local pot stocks are salivating at the thoughts of exporting high-quality Aussie pot to Canada — which is expected to legalise recreational marijuana from July.

Cann Group is up 700 per cent for the year.

Feeding China’s babies

China-bound infant formula was the other big trend among 2017’s top 100 gaining ASX small caps.

Five of the top 100 were in the game, attracted by high demand in China for top quality Aussie baby food.

Chinese demand for Australian infant formula is so high that prices can reach more than five times the local price.

China’s most popular shopping site, Tmall, sells an 800g tin of Bubs organic infant milk powder for 799 yuan (roughly $150) compared to just $33 in Australia.

Bubs Australia (ASX:BUB) is up more than 1000 per cent since transforming from Hillcrest Litigation Services into a baby formula exporter at the start of the year.

Rivals Wattle Health (ASX:WHA), Bioxyne (ASX:BXN) and Jatenergy (ASX:JAT) have also made strong gains.

Diagou retailer AuMake (ASX:AU8) — which focuses on Aussie Chinese sending products back home — has gifted shareholders with a stunning nine-fold return on its 8c offer price in little more than two months.

AuMake has been quick to take advantage of its share price growth, now offering new shares at 63c — almost eight times its initial public offering price.

Here are 2017’s 100 best performing ASX Small Caps to Dec 12:

| ASX code | Name | 2017 gain (Jan 1-Dec 12) | Theme | Market Cap |

|---|---|---|---|---|

| 3DP | POINTERRA | 3.6 | Tech - 3D data | 42991848 |

| CLL | COLLERINA COBALT | 14.000001 | Battery Metals | 80386504 |

| JRV | JERVOIS MINING | 13.558503 | Battery Metals | 121157624 |

| EUC | EUROPEAN COBALT | 11.5 | Battery Metals | 152339472 |

| RIE | RIEDEL RESOURCES | 10.215282 | Battery Metals | 33519028 |

| AUZ | AUSTRALIAN MINES | 9.999999 | Battery Metals | 235646720 |

| RMI | RESOURCE MINING CORP | 7.5 | Battery Metals | 10073090 |

| GED | GOLDEN DEEPS | 7 | Battery Metals | 7981704 |

| AGY | ARGOSY MINERALS | 6.931035 | Battery Metals | 205504208 |

| ARL | ARDEA RESOURCES | 6.05 | Battery Metals | 113792952 |

| MEI | METEORIC RESOURCES NL | 5.916666 | Battery Metals | 44446976 |

| CLA | CELSIUS RESOURCES | 5.428572 | Battery Metals | 78970024 |

| LPD | LEPIDICO | 3.868711 | Battery Metals | 143626048 |

| GME | GME RESOURCES | 3.814815 | Battery Metals | 60267528 |

| ARE | ARGONAUT RESOURCES NL | 3.571429 | Battery Metals | 37442044 |

| CCZ | CASTILLO COPPER | 2.769231 | Battery Metals | 28406254 |

| QUR | QUANTUM RESOURCES | 2.642857 | Battery Metals | 35541480 |

| CFE | CAPE LAMBERT RESOURCES | 2.538461 | Battery metals | 40053116 |

| EUR | EUROPEAN LITHIUM | 2.416667 | Battery Metals | 105797552 |

| GSC | GLOBAL GEOSCIENCE | 2.409091 | Battery Metals | 294949152 |

| COB | COBALT BLUE HOLDINGS | 2.05 | Battery Metals | 71804472 |

| ASN | ANSON RESOURCES | 2.035714 | Battery Metals | 29031290 |

| TAW | TAWANA RESOURCES NL | 2 | Battery Metals | 173976928 |

| LKE | LAKE RESOURCES NL | 1.966102 | Battery Metals | 40887528 |

| GBR | GREAT BOULDER RESOURCES | 1.96 | Battery Metals | 26076068 |

| CRL | COMET RESOURCES | 1.75 | Battery Metals | 15004000 |

| RLC | REEDY LAGOON CORP | 1.573183 | Battery Metals | 8186463 |

| BPG | BYTE POWER GROUP | 7 | Blockchain / crypto | 17880560 |

| YOJ | YOJEE | 4.625 | Blockchain / crypto | 153998992 |

| DCC | DIGITALX | 3.893617 | Blockchain / crypto | 109645224 |

| CPH | CRESO PHARMA | 2.851064 | Cannabis | 98807160 |

| AC8 | AUSCANN GROUP HOLDINGS | 2.0625 | Cannabis | 199458992 |

| CAN | CANN GROUP | 7.3 | Cannabis | 292554016 |

| THC | HYDROPONICS CO/THE | 2.45 | Cannabis | 82239000 |

| SCU | STEMCELL UNITED | 2 | Cannabis | 17473582 |

| QBL | QUEENSLAND BAUXITE | 9.666667 | Cannabis | 96985152 |

| AU8 | AUMAKE INTERNATIONAL | 9 | China-bound infant formula | 173458592 |

| BXN | BIOXYNE | 6.063493 | China-bound infant formula | 56211752 |

| WHA | WATTLE HEALTH AUSTRALIA | 7.1 | China-bound infant formula | 245513920 |

| JAT | JATENERGY | 4.490197 | China-bound infant formula | 21064728 |

| BUB | BUBS AUSTRALIA | 10.775 | China-bound infant formula | 215316192 |

| CKA | COKAL | 1.95 | Coal | 37630376 |

| MRV | MORETON RESOURCES | 2 | Coal | 31232390 |

| AL8 | ALDERAN RESOURCES | 6.75 | Copper | 179220080 |

| ODM | ODIN METALS | 3.363636 | Copper | 33292640 |

| KLH | KALIA | 2 | Copper | 29262710 |

| VAL | VALOR RESOURCES | 2 | Copper | 26432386 |

| DRG | DRAIG RESOURCES | 8.090909 | Gold | 70610104 |

| ORM | ORION METALS | 5.928571 | Gold | 37354452 |

| BCN | BEACON MINERALS | 4.230772 | Gold | 34237340 |

| AAR | ANGLO AUSTRALIAN RESOURCES | 4.2 | Gold | 21909726 |

| MAU | MAGNETIC RESOURCES NL | 2.859649 | Gold | 32586774 |

| OKU | OKLO RESOURCES | 2.227273 | Gold | 108776728 |

| AIV | ACTIVEX | 1.666667 | Gold | 28356544 |

| EHX | EHR RESOURCES | 2.111111 | Gold | 14777823 |

| LFR | LONGFORD RESOURCES | 2.333333 | Gold | 38110136 |

| EQE | EQUUS MINING | 1.692308 | Gold | 26137472 |

| ZNO | ZOONO GROUP | 2.809524 | Health/Biotech | 52163784 |

| MYQ | MYFIZIQ | 18.777777 | Health/Biotech | 70344312 |

| NEU | NEUREN PHARMACEUTICALS | 1.571429 | Health/Biotech | 293297248 |

| PAB | PATRYS | 2.666667 | Health/Biotech | 17149108 |

| IVX | INVION | 2 | Health/Biotech | 25235792 |

| COI | COMET RIDGE | 2.538462 | Oil and Gas | 154910976 |

| TEG | TRIANGLE ENERGY GLOBAL | 2.67647 | Oil and Gas | 24103286 |

| BUL | BLUE ENERGY | 2.809524 | Oil and Gas | 182702704 |

| GEV | GLOBAL ENERGY VENTURES | 2.777778 | Oil and Gas | 91589136 |

| REY | REY RESOURCES | 2.470588 | Oil and Gas | 62686100 |

| FDM | FREEDOM OIL AND GAS | 2.214286 | Oil and Gas | 214650032 |

| PPY | PAPYRUS AUSTRALIA | 2.333333 | Banana veneer | 4188728.5 |

| ACK | AUSTOCK GROUP | 1.57 | Insurance | 160036640 |

| GPS | GPS ALLIANCE HOLDINGS | 2.529411 | Property | 5157750 |

| OLH | OLDFIELDS HOLDINGS | 2.333333 | Paint maker | 8217620 |

| EGL | ENVIRONMENTAL GROUP/THE | 2.034483 | Water treatment | 19001990 |

| POZ | POZ MINERALS | 1.8 | Diamonds | 9389427 |

| HEG | HILL END GOLD | 7 | High Purity Alumina | 24178186 |

| KFE | KOGI IRON | 3.368421 | Iron Ore | 49148836 |

| EPM | ECLIPSE METALS | 2.2 | Manganese | 18298786 |

| IMA | IMAGE RESOURCES NL | 1.659575 | Mineral sands | 71411248 |

| HAS | HASTINGS TECHNOLOGY METALS | 4 | Rare earths | 244981216 |

| TGN | TUNGSTEN MINING NL | 2.42857 | Tungsten | 52966704 |

| PEX | PEEL MINING | 2.529412 | Zinc | 110301584 |

| AKG | ACADEMIES AUSTRALASIA GROUP | 2.181818 | Training / education | 62743268 |

| ARV | ARTEMIS RESOURCES | 6.249999 | Gold (Pilbara) | 166339184 |

| SUH | SOUTHERN HEMISPHERE MINING | 4 | Gold (Pilbara) | 11720421 |

| DEG | DE GREY MINING | 3.594595 | Gold (Pilbara) | 53974228 |

| SPX | SPECTRUM RARE EARTHS | 2.333333 | Gold (Pilbara) | 5965155 |

| TAR | TARUGA GOLD | 2.233334 | Gold (Pilbara) | 10079972 |

| RTR | RUMBLE RESOURCES | 2.157895 | Gold (Pilbara) | 21130894 |

| DGO | DGO GOLD | 2.039473 | Gold (Pilbara) | 11036635 |

| TTT | TITOMIC | 3.15 | Tech - 3D printer | 90638576 |

| IXU | IXUP | 1.6 | Tech - Data collaboration | 90334312 |

| KNM | KNEOMEDIA | 6.499999 | Tech - Educational games | 71727784 |

| EGN | ENGENCO | 1.866667 | Tech - Engineering | 134753808 |

| JCS | JCURVE SOLUTIONS | 1.642857 | Tech - Enterprise software | 12204705 |

| FZO | FAMILY ZONE CYBER SAFETY | 2.351351 | Tech - Internet | 70080912 |

| LVH | LIVEHIRE | 2.323529 | Tech - Recruitment | 273285056 |

| SHO | SPORTSHERO | 2 | Tech - Sports fantasy | 14630122 |

| ELS | ELSIGHT | 6.55 | Tech - Video networking | 105060552 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.