Canadian uranium, lithium share top billing as Trinex Minerals shifts into exploration gear

Mining

Mining

Pivoting from one sector to another is not a decision to be made lightly by a junior resources company, though their smaller size and ability to make quick decisions makes them ideally suited for doing so if the situation warranted.

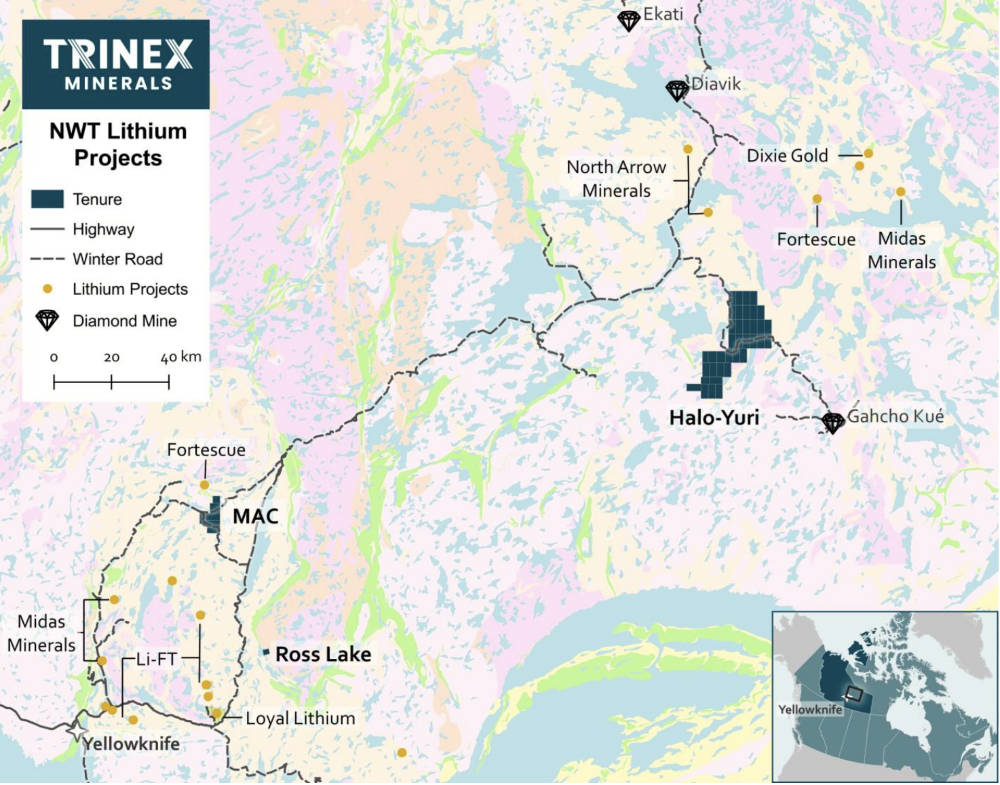

That’s exactly the decision that former base metals-focused Todd River Resources embraced after acquiring what it described then as a “transformational” package of three lithium exploration projects in Canada’s Northwest Territories late in 2023.

Accompanying this switch towards critical minerals was a change in name to Trinex Minerals (ASX:TX3) to reflect this change in direction.

Since then, the company has further affirmed its commitment to critical minerals with the acquisition of the Gibbons Creek uranium project in the Athabasca Basin

Managing director Will Dix told Stockhead that while the company (as Todd River) had been working on base metals in the Northern Territory and WA from 2017, it decided as a board about a year ago to pivot into critical minerals and pursue opportunities both onshore and offshore.

“We ended up signing a deal on some Canadian lithium assets in the Northwest Territory towards the end of September last year,” he noted.

“That was the start of the new company, up until that point, we were called Todd River Resources. It was the catalyst for the name change and the rebranding.

“We have a commitment to Canada and focused over there. Other opportunities have come through the door since then, one of which has culminated in this, us doing the uranium deal in the Athabasca.”

He added that while the company retained its Australian assets, it was very much focused on Canada for at least the next 18 months to two years with both Gibbons Creek and the Northwest Territory lithium assets sharing equal priority.

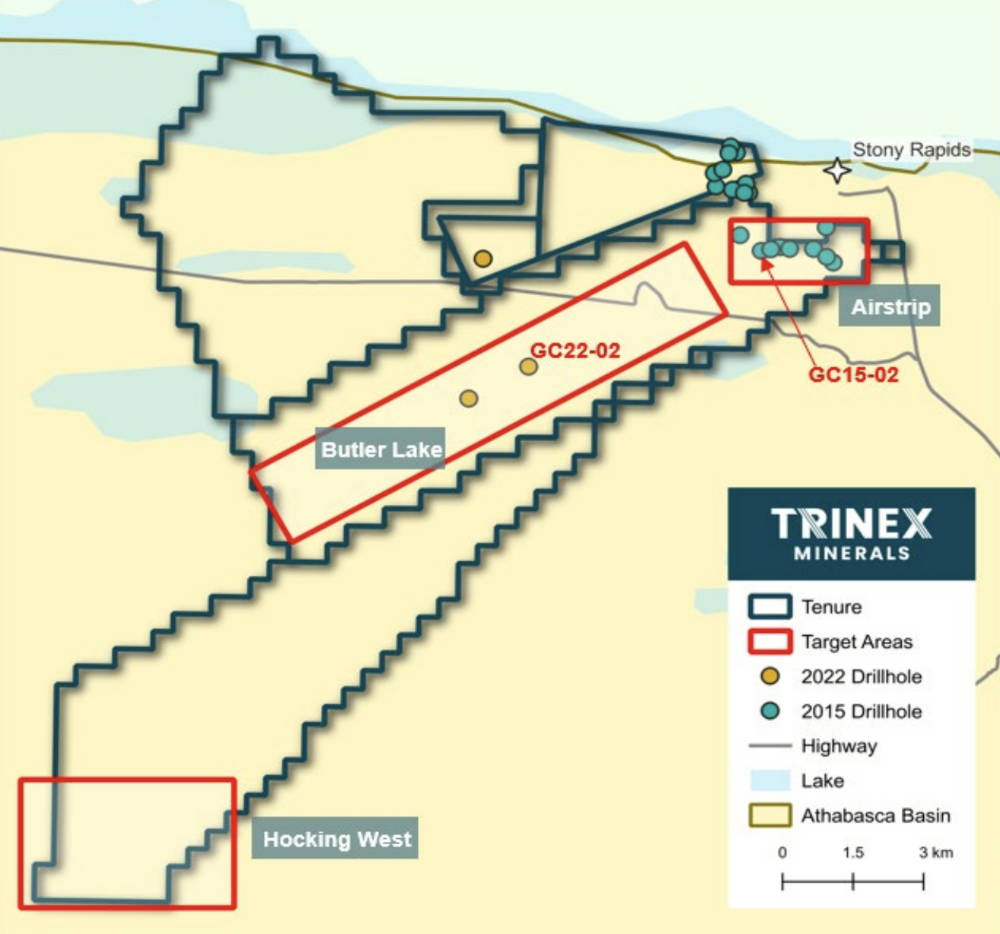

TX3 executed a binding letter of intent in February 2024 to acquire an initial 51% interest in the 139km2 Gibbons Creek project on the northern flank of the highly prospective Athabasca Basin, which is known to host a sizeable number of the world’s best uranium mines.

Dix said the decision to acquire Gibbons Creek was equal parts opportunistic – with the project being offered to the company – and strategic due to the recognition that there would be ups and downs in the lithium market and that it was important to have “a second string to our bow”.

“Long-term the uranium industry will grow. There’s a recognition globally that while we want to be part of this energy transition from fossil fuels to renewables or less impactful energy sources, from a pollution or CO2 emissions point of view, I think uranium has a very big role to play in that,” he said.

He added that while Australia was a great jurisdiction for uranium, there were political impediments to its development, adding that he was not a huge fan of going into developing countries to look for uranium.

By contrast, the Athabasca basin was an area that the company had its eye on for a long time and the project came along at a good time for it.

“Gibbons Creek, it is really close to infrastructure and that adds value, we can literally drive out from where we stay at Stony Rapids and we will be on site with the drill rig in 20 minutes,” Dix noted.

“That is pretty unusual for any kind of exploration project.”

The project is fully permitted for exploration with three high-priority target areas – Airstrip, Hocking West and Butler Lake – that have been identified for immediate follow-up work and drilling.

“Gibbons Creek is a relatively well understood uranium system in that it is an unconformity-related, or basin-related mineralisation,” Dix said.

“We have got a number of targets that we generated there. The first and easiest to explore is the Airstrip prospect.

“That’s where we just completed drilling and we have already announced a couple of weeks ago that we have got good indications of uranium mineralisation in the first couple of holes there.”

Two of the first three holes drilled by TX3 at the prospect had intersected uranium mineralisation with assays expected in late April.

Dix adds that the company will carry out more geophysics before testing other opportunities within the project with drilling.

“Butler Lake is the central prospect and we will definitely do more geophysics on it this year and then I would imagine that next winter we will drill it and then Hocking West next January.

TX3 also has plans to progress its lithium projects, which collectively cover ~500km2 of ground, this summer.

This will be focused primarily on the large, ~350km2 Halo-Yuri project that is the northernmost of the three plays.

It has already fast-tracked planned on-ground exploration to determine the prospectivity of its pegmatite systems of which there are hundreds according to fresh satellite imagery.

“There are good indications already that there’s spodumene-bearing pegmatites there, there’s one confirmed in the northern part of that project,” Dix said.

“What that work program will be is very much boots on the ground, reconnaissance sampling, mapping, getting a really good feel for where the opportunities at Halo-Yuri might be and then we will look at drilling that 12 months later.

“The other two projects, we have got spodumene at Ross Lake, pegmatite that’s several hundred metres long by 25-30m wide.

“We are in the process of finalising the drilling permit application, which should get lodged in the next week or so.

“At our third lithium project, the MAC project, we have got some new tenure that we have added on to the original piece of land that we acquired and we need to do again some first pass work, especially on the southern part.”

“That will happen in the Canadian summer as well.”

Dix noted that the company continues to look for opportunities in Canada, particularly in the lithium and uranium spaces

“Obviously the name of the game is to create shareholder wealth and value,” he added.

“That only happens to us through good science and good geology and good exploration practices with the ultimate ambition being to make a discovery.”

TX3 has also started initial discussions with several companies about some of its Australian projects with Dix saying that while it was still early days, it would certainly consider the right proposal.

“Some of them – given the current state of the market – are going to be hard to do anything with and we might end up divesting some of those,” he noted.

“But the ones that have intrinsic value such Mount Hardy, it would need to be the right kind of opportunity for us, preferably one that lets us retain exposure to it, otherwise we are happy to hold.”

Companies are not just about their projects though, their leadership plays an equally important role.

Dix is a geologist with 23 years’ experience in base metals, gold and uranium exploration and mining including seven years with successful international nickel producer LionOre Mining International.

Executive director Su-Mei Sain is a chartered accountant with 20 years’ experience much of which comes from the mining sector.

Dix notes that she has worked with the company for many years and adds a lot of strength to its financial planning.

“Edward Fry, our chairman, has been instrumental in a lot of the work we have done in Australia from a land access and indigenous liaison point of view and he is doing that same role with Canadian First Nations,” he added.

Fry is currently an executive director of Gimbulki, a native title access company he established in 2002 and has held senior executive roles with Normandy Mining and was manager of international logistics and marketing for that company’s base metal portfolio.

The remaining non-executive director is Geoffrey Crow, who has been with Todd River since the beginning and adds a capital markets angle to the board thanks to his 28 years’ in corporate finance, stockbroking and investor relations.

“We feel that we have all the disciplines covered and we work very well together. There’s a lot of trust between the four of us,” Dix said.

“We are always discuss things until everyone is in agreeance and that tends to be fairly straightforward for the four of us.”

TX3 is also well-funded with about $4m in the bank, which Dix says is enough to get all of its planned work programs completed for at least the next 12 months.

“That differentiates us from a lot of juniors out there that are going to have to raise money to keep on working,” he concluded.

At Stockhead we tell it like it is. While Trinex Minerals is a Stockhead advertiser, it did not sponsor this article.