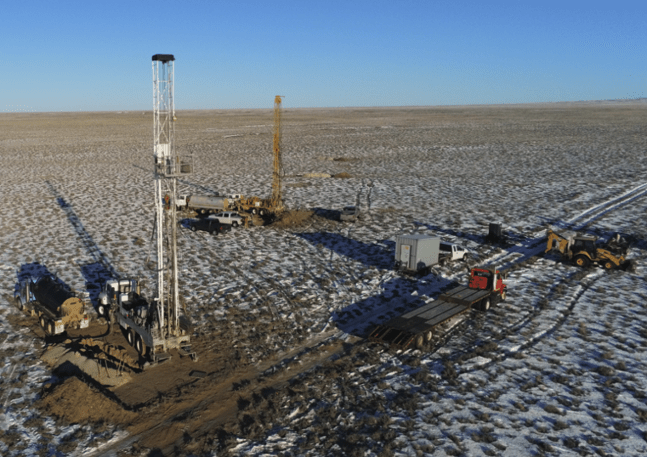

Back in the big game: Two rigs at GTI’s Thor to test Great Divide Basin uranium system

Mining

Mining

GTI hopes to complete the remaining 60 holes in the coming weeks, where results so far have confirmed a significant uranium system with strong economic potential.

The total 100-hole for 15,000m drill program in Wyoming’s Great Divide Basin has so far discovered mineralisation that demonstrates characteristics supporting in-situ recovery (ISR). Mineraliastion discovered to date compares favourably with the neighbouring 18 Mlbs Lost Creek production deposit, held by UR Energy (TSX:URE).

Back in December, the first 39 holes of the program encountered a well-mineralised sand unit at around 200 feet that is 110 – 120’ thick where three or more sandstone fronts were identified.

At the time GTI (ASX:GTR) said the drill holes met typical Great Divide Basin cut-off criteria for grade and thickness, after recording the following features:

GTI’s projects in Wyoming’s Great Divide Basin span some 22,000 acres across several groups of underexplored mineral lode claims and two state leases, which are prospective for sandstone hosted uranium.

This article was developed in collaboration with GTi Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.