Azure continues growth in WA with addition of Barton Gold

Mining

Mining

Special Report: Azure continues expansion of WA portfolio with acquisition of Barton gold project.

Following several majority-held joint-venture agreements with Mark Creasy and the Creasy Group in July, the explorer announced it had entered into a new contract with 30 Well Pty Ltd to acquire 100 per cent ownership of the Barton gold project.

Azure Minerals (ASX:AZS) considered the acquisition an important addition to the company’s growing range of projects in WA and that the largely unexplored area had strong promise for gold exploration.

“Azure is committed to growing its WA-focused portfolio of gold and nickel projects and this large and almost totally unexplored exploration licence, which is located in the heart of the gold-rich Kookynie district, is exactly the type of highly prospective project we’re looking for,” Azure managing director Tony Rovira told Stockhead.

“Given the many recent exploration successes in the Kookynie district by other companies, and the number of gold prospects and historical gold mining operations that are nearby to our project, we are confident that our comprehensive and targeted exploration approach has good potential for the discovery of significant gold mineralisation.”

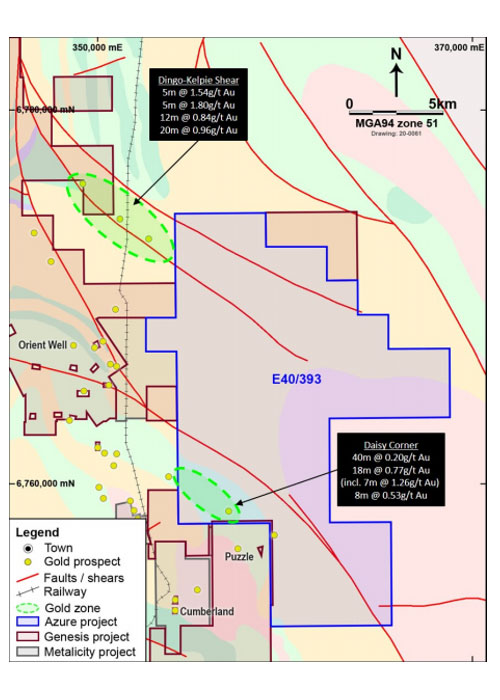

The 200sqkm gold project is located in the growing Kookynie-Ulysses region, 40km southeast of Leonora, and adjoins several other prominent gold deposits, in what Rovira has described as “a very exciting exploration and mine development area”.

Azure secured the purchase of the exploration licence with the exchange of 1,150,000 fully paid ordinary shares, plus $20,000 and confirmed its plan to start exploration in the area immediately, once the tenement had been granted.

Situated adjacent to the historically rich gold mining town of Kookynie, the Barton project lies within the Kookynie-Ulysses Gold Corridor with a coverage of 200.5sqkm.

Initially, Azure plans to focus on the southwest corner of the region, at Daisy Corner, where so far, the only drilling into bedrock has occurred.

The most notable results from that drilling included 7m at 1.26 grams per tonne (g/t) gold from 42m within 18m at 0.77g/t gold, 40m at 0.2g/t from 20m and 8m at 0.53g/t from 48m.

Azure will conduct follow-up drilling in the vicinity of Daisy Corner to test along strike and for depth extensions.

Another section of interest enters at the northwest part of the Barton project, named the Dingo-Kelpie Shear, where numerous drill holes have shown strong anomalous gold mineralisation over significant widths.

Rovira believes the project offers plenty of opportunity, considering the success other companies have had in the area.

While the latest acquisition represents an exciting prospect within Azure’s strategy of targeting projects with the potential for significant gold discoveries, Rovira says Azure remains committed to its existing Mexican resources.

Azure recently reported that it had managed to boost recoveries from its very high-grade silver Mesa de Plata deposit, part of its Alacrán project in Mexico.

“Meanwhile, we’re not neglecting our Mexican assets, with target identification and drill planning finalised for the Alacrán silver-gold-copper project and drilling is expected in Q4 2020,” Rovira said.

Field exploration is also underway at the 60 per cent-owned Andover nickel-copper project in WA, starting with ground electromagnetic surveying to discover nickel sulphide mineralisation.

This article was developed in collaboration with Azure Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.