Nickel the priority for Azure, but it hasn’t forgotten its Mexican silver play

Pic: Tyler Stableford / Stone via Getty Images

Special Report: Azure Minerals is keen to follow-up on the Creasy Group’s nickel discoveries at their Andover project, at a time where demand for the metal is growing.

Work by renowned prospector Mark Creasy’s Creasy Group over the past 12 years has firmed up Andover’s ‘company making’ potential, with surveys and sampling cumulating in a 2018 drilling program that hit nickel and copper mineralisation in three out of four targets.

Azure Minerals (ASX:AZS) managing director Tony Rovira says this was a very strong success rate.

“It is an advanced stage exploration project and that is why we have planned a very intensive drilling campaign including a 3,000m diamond drilling program that will begin in mid-September and about 5,000m of reverse circulation drilling to be done next year,” he told Stockhead.

The company is currently carrying out a geophysical survey over 10 different priority targets in areas where the Creasy Group intersected nickel and copper mineralisation.

“The results of those geophysical surveys will be used to refine our targeting for the drilling,” Rovira added.

Azure is looking to drill the best looking targets first to build on the initial successes of the Creasy Group.

Good time to be in nickel

Azure reached an agreement in mid-July to acquire 60 per cent in the 70sqkm Andover project from the Creasy Group in return for a free carry on the Creasy Group’s remaining 40 per cent interest until the execution of a mining venture agreement.

The deal also makes Mark Creasy one of the two biggest shareholders in the company.

Rovira believes the acquisition is well timed given the increased usage of nickel into batteries for electric vehicles and home energy storage systems.

This is best highlighted by Tesla founder Elon Musk who famously called for miners to produce more nickel.

“The nickel price is up significantly in the last few months and it looks like that strength is going to be continuing,” he added.

Nickel is currently trading at about $US14,880 a tonne, up 21 per cent from just six months ago.

“Therefore it is a great time to be in nickel exploration and in the game of making nickel discoveries.”

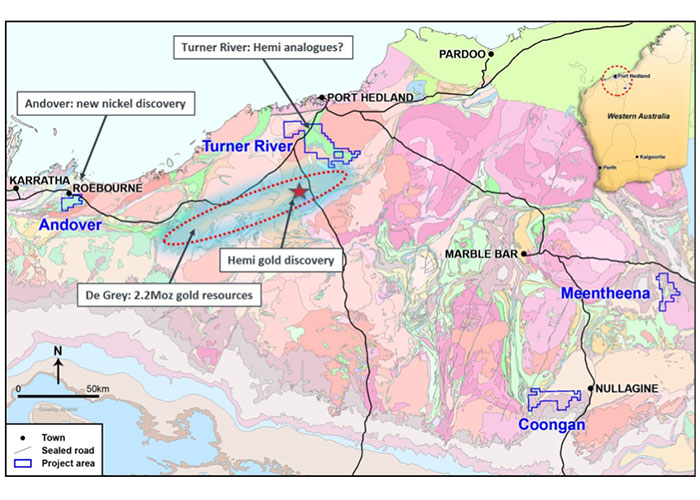

Rovira also noted that Andover was in an excellent location just half an hour from Karratha and next door to the town of Roebourne.

“The infrastructure you possibly want for a project is right there. This is actually a really well located, well resource project and it is going to make exploration relatively simple and beats being in the outback of Australia or somewhere overseas,” he added.

Creasy deal is not all about nickel

While the Andover nickel project is certainly at the core of the deal with the Creasy Group, it is not the only project that Azure is excited about.

The deal also include three gold projects and Rovira singled out the Turner River project due to its location right next to De Grey Mining’s (ASX:DEG) Mallina gold project and Hemi discovery in the central Pilbara.

“The two tenements we got are still in the application stage, but once they are granted, which we hope will be later this year, we will be out on the ground doing some exploration,” he said.

“It is very much a greenfields project because it has never been drilling, but it is right next door to an area where they are making lots of gold discoveries.

“So you couldn’t get a better proximity play then our Turner River gold project.”

High-grade Mexican silver project still very much of interest

Azure recently reported that it had managed to boost recoveries from the very high-grade Mesa de Plata deposit at its Alacrán project in Mexico to about 90 per cent through the use of advanced metallurgical test work.

This is good news on several different fronts.

Firstly, silver prices have doubled since March as the precious metal plays catch up with gold.

Mesa de Plata also boasts extremely high grades of up to 1,832 grams per tonne (g/t) silver and lastly, but perhaps most importantly, while activity had been curtailed of late the Alacrán project remains one of Azure’s core projects.

“We have a great project at Alacrán, it has got 32 million ounces of silver, 200,000 ounces of gold. It has a new copper discovery on it as well,” Rovira said.

“It is a wonderful project in an incredibly mineral-rich province.”

At the current silver price of $US26.36 an ounce, the in-ground value of the silver alone is worth more than $US840m ($1.17bn).

He added that while homebound, the company’s team of Mexican geologists spent two or three months interrogating the database and developing new targets.

“More recently, they have been out on the ground, they have inspected those zones, they have identified the targets on the ground and I am expecting that we will be able to start drilling again for the silver and gold in the fourth quarter of this year, probably October,” he explained.

“This project and also some other silver projects in Mexico are generating enormous amounts of interest, particularly in Canada, and there has been some great silver discoveries and drill hole intersections that have been announced in the last month or so out of Mexico.

“We want to be able to continue to, with our exploration, continue to add value and to grow the deposit with more drilling.”

This article was developed in collaboration with Azure Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.