Azure eyes nickel on WA ground acquired from Mark Creasy

Mining

Mining

Special Report: Taking your company in a new direction can be challenging, so when you acquire attractive projects from a well-regarded mining personality for shares, people tend to sit up and take notice.

And this is exactly what Azure Minerals (ASX:AZS) has done with its deal to acquire the Andover nickel-copper project and three gold projects – all in Western Australia’s Pilbara region – from legendary prospector Mark Creasy.

Managing director Tony Rovira told Stockhead that the formerly Mexico-focused company had made the decision to focus on projects in WA due to how badly the COVID-19 pandemic had hit the Latin American country.

“It has become very difficult and unsafe to work there. We still have a small crew who are able to do low key exploration, but they can’t do extensive exploration like drilling, which would mean that we would have no news flow,” he said.

Rovira then decided to shift to WA as mining and exploration was still going ahead with little or no disruption from the pandemic.

“I reached out to Mark Creasy and put forward a proposal that if he had some projects that he could vend into Azure and take stock in the company, he would become one of the biggest shareholders and we could jointly work the project,” he said.

“He knew about my strong background in nickel and gold exploration in Western Australia from my early and middle years of working in the industry and was happy to vend some very good projects into the company.”

While Creasy has been a shareholder of the company since its IPO in 2003, the deal will make him one of two biggest shareholders in the explorer with a 19.1 per cent stake.

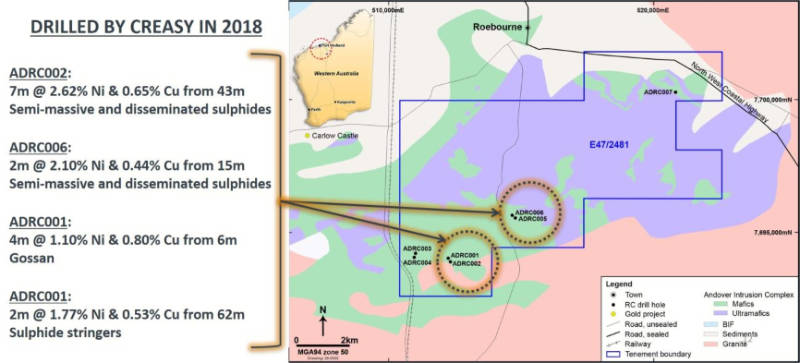

Azure’s new flagship project is the 70sqkm Andover nickel-copper project southeast of Karratha that sits just 3.5km from Artemis Resources’ (ASX:ARV) Carlow Castle gold-copper-cobalt deposit and 28km northeast of the shuttered Radio Hill nickel-copper mine.

“It’s very exciting because Andover is a layered mafic, ultramafic intrusive complex similar to some areas in the Fraser Range and to the Gonneville Intrusive Complex where Chalice Gold Mine’s (ASX:CHN) made its exciting Julimar nickel-copper-PGE discovery,” Rovira explained.

While the geology is certainly interesting, it is the fact that the Creasy Group already carried out limited drilling in 2018 that returned some very wide intersections of high-grade nickel and copper mineralisation.

Hits like 7m grading 2.62 per cent nickel and 0.65 per cent copper from a depth of 26m within a broader 26m interval at 1.03 per cent nickel and 0.46 per cent copper. And this mineralisation remains open in all directions.

“We believe this could be one of the really great nickel-copper projects going forward in Western Australia as the success rate of Creasy Group’s targeting and drilling was very high,” Rovira said.

Andover is the most advanced of the four projects that Azure acquired as it already has walk-up drill targets where potentially economic widths and grades of nickel and copper have already been intersected.

“The Creasy Group identified 14 high priority targets from its surveys – the first time modern exploration was used in the region – and only drill tested four of them,” Rovira said.

He added that with both nickel and copper prices strengthening, this was exactly the right time to return to WA and jump into the nickel exploration game.

“Once this acquisition is approved by the shareholders, we will be on the ground drilling,” Rovira said.

Azure plans to follow up on the holes that the Creasy Group drilled and drill some of the untested electromagnetic targets.

Besides the Andover project, the suite of assets that Azure is acquiring includes the Turner River, Meentheena and Coongan gold projects.

“The gold projects are a little more grassroots, but they are in really good locations,” Rovira said.

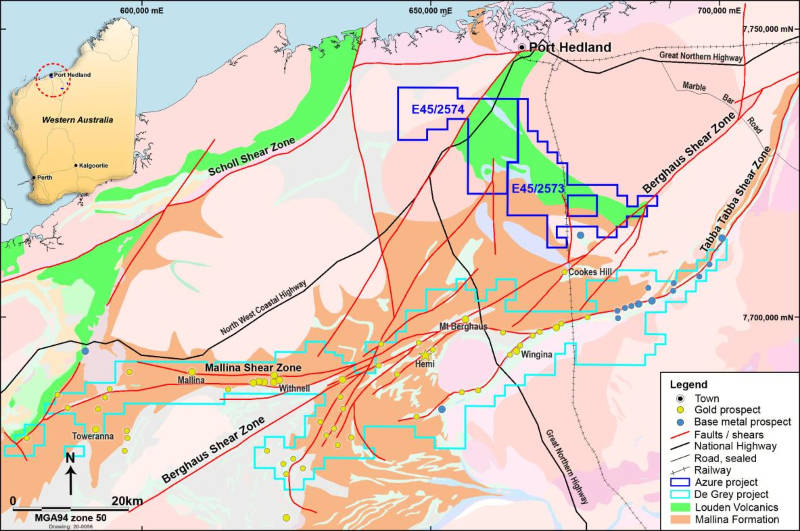

He highlighted the 450sqkm Turner River project as the priority among the gold plays, noting that it is close to De Grey Mining’s (ASX:DEG) Mallina project that hosts 2.2 million ounces of gold and the exciting Hemi discovery.

“It is a strongly mineralised gold province up there and now we have 450sqkm of land right next door that has never ever been drilled,” Rovira added.

“Some of the big structures and shear zones that host the De Grey gold deposits, run straight through our ground.”

Azure plans to initially carry out some airborne geophysics and ground exploration.

Once the two licence applications that make up Turner River are granted, the project will become a high priority for Azure.

Rovira also touched on the Coongan project, which borders Novo Resources’ Beaton’s Creek conglomerate gold project.

“Our ground adjoins theirs on the western boundary and the geological unit that hosts the gold mineralisation extends into the Coongan property where it has never really been chased up,” he explained.

“That’s another priority for us to be looking at over the next 12 months.”

Azure’s remaining project is the 223sqkm Meentheena project, where geological mapping and geochemical sampling over several years has defined a large zone of alteration at surface.

The Creasy Group drill-tested this zone with five reverse circulation holes totalling 2,204m and one 706m diamond hole.

This story was developed in collaboration with Azure Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.