Arizona Lithium splashes $80 million for Canada’s highest grade lithium brine resource

Mining

Mining

Arizona Lithium has entered into a binding pre-acquisition agreement to acquire Prairie Lithium – which holds the highest quality Inferred lithium brine resource in Canada discovered to date.

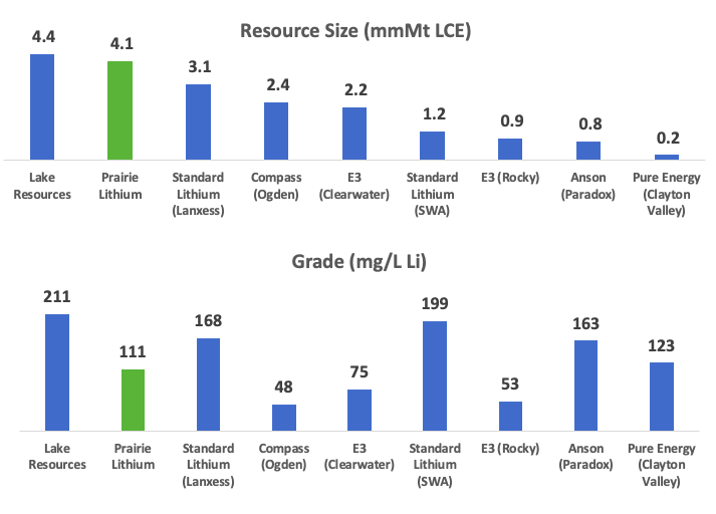

Prairie’s project located in the Williston Basin of Saskatchewan has 4.1MT LCE total JORC Inferred Mineral Resources at 111mg/L Li, with significant expansion potential.

It’s also located in one of the world’s top mining friendly jurisdictions, and has easy access to key infrastructure including electricity, natural gas, fresh water, paved highways and railroads.

Plus, Prairie also has a proprietary direct lithium extraction (DLE) process technology – called the Prairie Lithium Ion Exchange (PLIX) – that selectively removes lithium from brine using equipment which is anticipated to be readily available at commercial scale.

The PLIX process may have a global application, and it’s currently being tested on lithium resources from around the world, including encouraging results at Arizona Lithium’s (ASX:AZL) Big Sandy project in Arizona.

Either directly or indirectly through its wholly owned subsidiary CanCo, AZL will acquire all of the shares of Prairie Lithium for $40,000,000 Canadian dollars and 500,000,000 AZL shares.

MD Paul Lloyd says the acquisition is “transformational” for the company, and represents a 1,200% increase to AZL’s global lithium Resource, now 4.4MT of LCE (inferred and indicated).

“Prairie’s Board and management team have significant experience in lithium processing and technology, which will further bolster AZL’s team and expedite the sustainable development of the Big Sandy Lithium Project in Arizona, through the application of Prairie’s processing technology expertise,” he said.

“The modular, direct lithium extraction process is a which selectively extracts lithium from Brine, thereby also providing significant potential benefits to the development of the company’s Lordsburg Lithium Brine Project in New Mexico.”

Prairie currently operates a pilot plant of its DLE technology in Emerald Park, Saskatchewan.

“The acquisition strongly complements AZL’s strategy of developing a world class Lithium Research Centre in Tempe Arizona, which will function as a technology incubator focussed on the extraction of lithium from a variety of ores and brines,” Lloyd added.

“The expectation is for Big Sandy ore, Prairie Lithium brine and other ore bodies to be tested and refined in the Lithium Research Centre.”

Notably, Prairie’s resource size and grade is comparable to $1.1B market cap company Lake Resources (ASX:LKE) and the Kachi resource which hold 4.4MT LCE.

The companies are also comparable in their pursuit of DLE technology to extract lithium with a lower carbon footprint, lower water usage and in a quicker timeframe.

After the transaction, it’s expected that current director and CEO of Prairie Zach Maurer will join the board of AZL.

“We believe we have progressed our project to be primed for hypergrowth over the next few years and see the next twelve months as being an inflection point in the development of the resource and the DLE technology,” Maurer said.

“We are looking forward to delivering successful feasibility studies, working on commercial scale modules for the project and undertaking additional testing in the Lithium Research Centre in Phoenix with support from the Arizona Lithium technical team.”

This article was developed in collaboration with Arizona Lithium Limited (ASX:AZL), a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.