Antipa serves up a new high-grade gold discovery in the Paterson

Mining

Mining

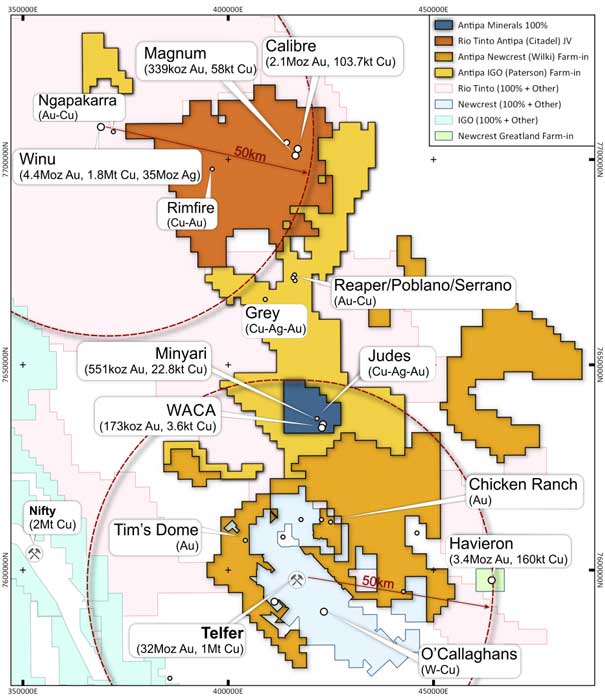

Antipa Minerals has made a significant new high-grade gold discovery outside of the existing resource at its wholly owned Minyari Dome Project in the highly fertile Paterson Province of WA.

Drilling at Antipa Minerals’ (ASX:AZY) 100% owned Minyari deposit has uncovered a new high-grade find, returning extremely thick intersections and grades of up to nearly 60 grams per tonne (g/t) gold.

Notable results from the new Minyari East target were 31m at 3.2g/t gold and 0.26% copper from 383m, including 1m at 32.1g/t gold, 2.29% copper and 3.83g/t silver from 391m; and 6m at 16.83g/t gold, 0.5% copper and 0.96g/t silver from 335m, including 1m at 58.9g/t gold, 0.75% copper and 1.88g/t silver from 339m.

Anything above 3-5g/t is considered high-grade, and at the current high gold price, grades of even just 1-2g/t are considered economic.

The significant additional high-grade gold-copper mineralisation was intersected immediately east of the Minyari resource, where drilling hit high grades of up to 60g/t gold, 14% copper, 25g/t silver and 1.2% cobalt.

Adding to the exploration upside is the fact that the mineralisation at Minyari East remains open and has only been intersected along 140m of strike and 150m down dip so far.

‘Open’ just means Antipa hasn’t hit yet the edges of this potentially large system, which sits within 35km of Newcrest Mining’s (ASX:NCM) huge Telfer gold-copper-silver mine and processing facility and 54km along strike from Greatland Gold and Newcrest’s Havieron 3.4Moz gold and 160kt copper project.

And initial drill results have shown similarities to the gold-copper style of mineralisation at Havieron.

Managing director Roger Mason says the first batch of results from the recent drilling at Minyari confirm the potential for significant resource growth and a stand-alone development opportunity based on an open pit and underground mining operation close to Telfer.

“The newly discovered Minyari East mineralisation remains open in all directions, as do the existing Minyari and WACA resources which, when combined with several untested Minyari geophysical anomalies, demonstrates the potential for this year’s Minyari Dome project exploration program, which will be the largest program we have ever undertaken at Minyari, to identify additional gold-copper mineralisation that can materially enhance project economics,” he said.

Results have so far been received for eleven drill holes (3,129m) and compare favourably to the Minyari resource of 723,000oz of gold at 2.0g/t and 26,000 tonnes of copper at 0.24%.

Antipa has completed 13,000m of the 21,000m of drilling planned, with three rigs currently on site.

The company is in an enviable position, with major partners doing the heavy lifting on three of its projects in the Paterson and significant drill programs in progress at all of its projects.

Nine rigs are in operation undertaking 62,000m of diamond core, reverse circulation (RC) and air core drilling at its four Paterson Province precious and base metals projects.

But three of those projects are being taken care of by heavyweights Rio Tinto (ASX:RIO), Newcrest and IGO (ASX:IGO), with Newcrest and IGO owning 9.9% and 4.9% of Antipa respectively.

“With nine rigs currently drilling across our four Paterson Province projects, we are in the middle of the most active drilling year in Antipa’s history,” Mason said.

The phase one drilling program was due to be completed by mid-August, but because of the promising initial results Antipa plans to undertake additional drilling to fast-track the evaluation of the high-grade Minyari East lode and broader eastern Minyari target area.

This article was developed in collaboration with Antipa Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.