A resurgent resources IPO market is on the cards as 2023 races to a conclusion

Mining

Mining

Back in 2021 investment bankers could have closed a junior mining IPO selling shares to mourners at a wake.

As many as 105 companies entered the ASX looking for lithium, gold, copper, rare earths, graphite, iron ore and everything in between as exuberance and freewheeling cash coming out of Covid set a fire under the market. That was the most since 2007.

Within a year that flood had slowed to a trickle. But there are early signs that a taste for lithium and everything else needed for the energy transition is bringing the flow of cash back into the industry.

And one expert is predicting a big lift in the junior resources IPO market as 2023 draws to a close.

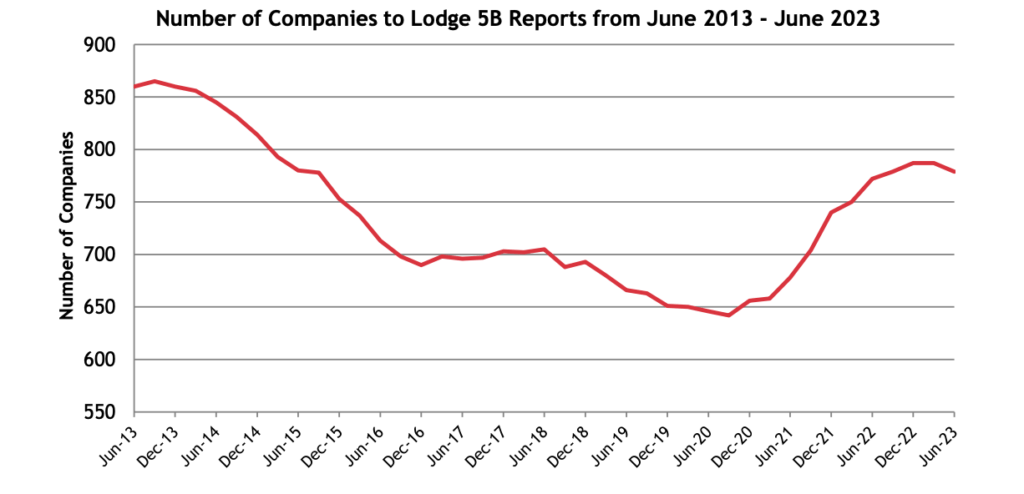

According to the latest edition of BDO’s Explorers Quarterly Cash Update, a dearth of IPOs and rise in merger activity has seen the number of companies making 5B reports fall for the first time since September 2020 from 787 in March to 779 in the June quarter.

While M & A is likely to continue, BDO head of global natural resources Sherif Andrawes says IPO interest is starting to come thick and fast, while a 111% lift QoQ in capital raisings to $2.84 billion showed battery metals demand was fuelling investment in what has otherwise been a tough business environment.

“I think in the December quarter, we’ll see quite a few IPOs all at the bottom end of the market, all sub-$10 million raises,” Andrawes said.

“Nothing substantial in this space, in the mining space, but hopefully that leads to a stronger market going into 2024.

“I think that what we’ll see is a whole lot more IPOs, a lot more companies have money raised in the space of what we broadly call critical minerals, basically battery minerals and all the rare earths.

“I think that’s a trend we’re going to see in future reports, future quarters, future years. There’s no doubt there’s not enough money going into it yet and there’s going to be a whole lot more coming, that’s going to be a growth area for some time to come.”

While he is predicting bigger and brighter days ahead, Andrawes noted there were just four new reporting mining explorers in the June quarter — all up, there were around a dozen or so new floats on the whole ASX in the first six months of the year.

There have only been a small number in September though a handful of explorers who think they have a story worth selling have been trying their hand.

Gold explorer Novo Resources (ASX:NVO), which hopped from the TSX to claim a secondary listing in Australia with a $7.5m float yesterday, showed enthusiasm remains in some quarters by rising 27.5% as of 3.30pm AEST on its debut.

Of the $2.24 billion raised in the June quarter by 53 companies that secured financing inflows of over $10 million, $851.57m was raised by gold companies while $588.14m was secured by lithium juniors.

The next most successful capital raisers were in graphite ($154m, mainly down to a single large raise by Syrah Resources (ASX:SYR)), nickel, copper ($76.42m & $71.65m respectively) and rare earths ($66.31m).

Average financing inflows per company rose 8.5% to $3.65m.

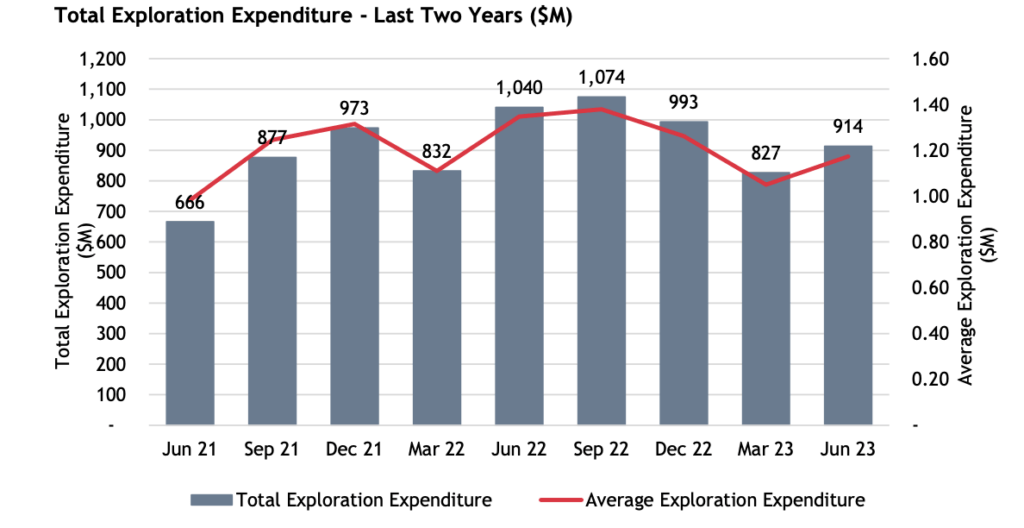

Andrawes said even more capital would need to head into the industry to underpin the energy transition, given the intensity of metals needed to feed EV and renewable demand outlooks, with exploration expenditure also lifting 10% to $914m and spend per company rising 12% to $1.17m.

Led by gold, lithium and a revival in copper drilling, those figures suggest explorers are not concerned about conserving cash and feel they can tap investors for more money down the line.

“There’s money going back into exploration and money being raised which is healthy and as you know, companies won’t spend money on exploration unless they have some confidence that it can be replaced,” Andrawes said.

“So it was a strong quarter in that respect definitely.

“In general, we know that there has to be a lot more investment in energy transition minerals, and rare earths and things to meet all the net zero things we have to have.

“Even what we’re seeing now is still way under what it ought to be.”

According to BDO’s numbers 82% of companies boasted cash balances in excess of $1m, up 1% on the March quarter.

In 2015 and 2016 that dropped below 50%, indicating the financial health of the ASX resources sector remains resolute despite pressures from inflation, weak Chinese commodity demand and rising interest rates.

With cash balances historically high, commodity prices coming off and equity valuations heading into discount territory, the likelihood of more M&A remains high.

Seven explorers and small miners left the ASX in the June quarter, with Breaker Resources acquired by Ramelius, Mincor swallowed by Wyloo, Tulla merged with Pantoro, Octanex acquired by Albers Group, Norwest taken by MinRes, Kingwest picked up by Brightstar and Duke Exploration merged with backdoor listee True North Copper.

“I think from what I’m hearing, there’s quite a lot more in the pipeline,” Andrawes said.

While the market has been abuzz with lithium consolidation news including MinRes’ potential purchase of Bald Hill and its support of Develop’s (ASX:DVP) takeover of Essential Metals (ASX:ESS), Allkem’s (ASX:AKE) tie-up with Livent, and Albemarle’s possibly contested $6.6 billion approach for Liontown (ASX:LTR), activity is picking up all across the industry.

“Definitely some lithium stuff but we’re seeing many others,” Andrawes said.

“For example, one of the ones we’re working on is a uranium one, which is A-Cap (ASX:ACB) and Lotus (ASX:LOT) coming together.

“So it’s not just in that space. We’re working on Talon and Strike and that’s in the oil and gas sector.”