IPO Watch: This junior explorer spurned Rio and is now bringing its West Arunta copper and rare earths targets to the ASX

CGN has good neighbours indeed at its Webb project. Pic: Christopher Winton-Stahle/Tetra Images via Getty Images

- CGN Resources opened its IPO on Wednesday, chasing IOCG, rare earths and nickel targets in the hot West Arunta district of WA

- Holding ground previously explored for diamonds in Australia’s biggest kimberlite field, CGN is chasing $8-10m to explore six readymade targets

- Rio Tinto, IGO and sought-after niobium explorers WA1 and Encounter are among CGN’s neighbours

When Rio Tinto (ASX:RIO) comes calling it’s hard to imagine it hears the word no very often.

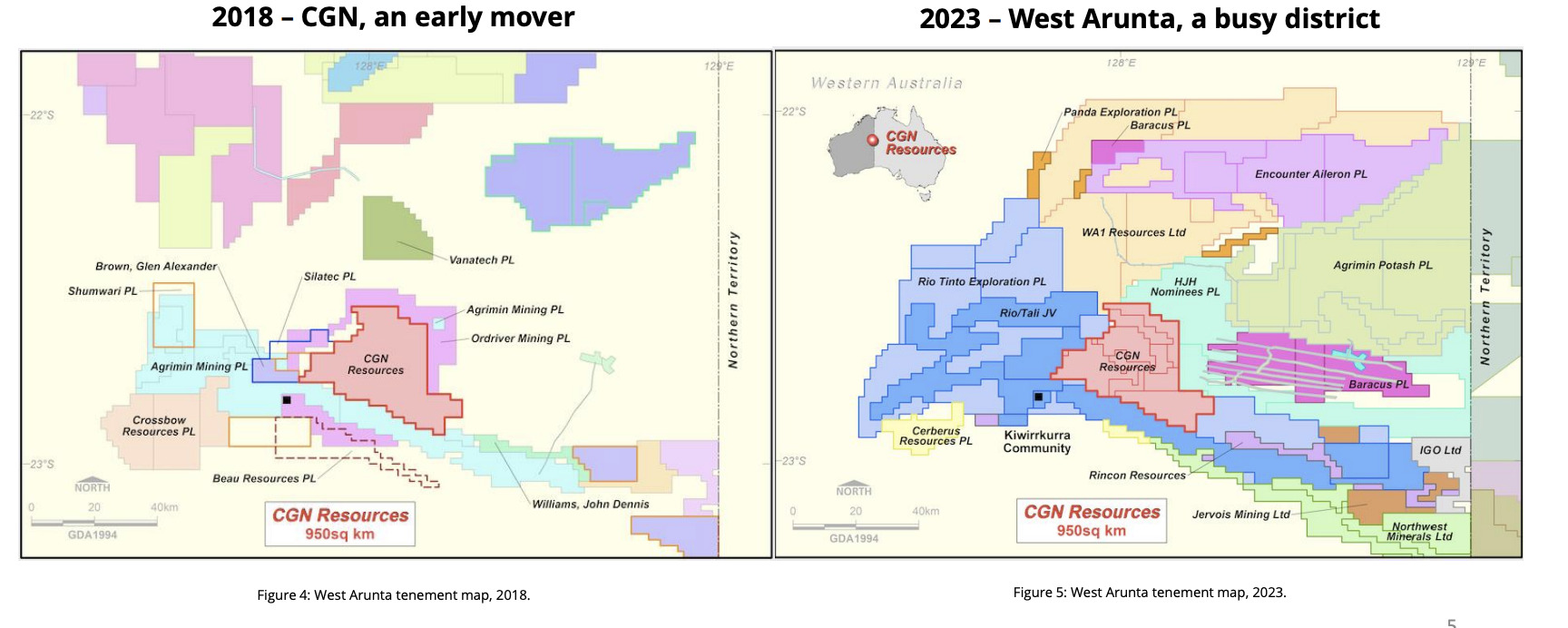

That is exactly what the boss of IPO hopeful CGN Resources, an early mover in the hot West Arunta region on WA’s border with the NT, claims happened around five years ago.

Long before WA1 Resources (ASX:WA1) made the shock niobium discovery that drew prospectors far and wide to what is regarded as potentially Australia’s last true exploration frontier, CGN’s forebears pegged almost 950km2 at what is called the Webb project where previous prospectors explored for diamonds.

It now boasts six targets with high tenor iron-oxide copper gold and rare earths potential, a story MD Stan Wholley hopes will help raise $8-10 million in an IPO kicked off yesterday.

“We felt we had enough to go on with ourselves and about a week later they went and pegged all that ground around us to the west,” he told Stockhead.

“We probably should have had a better NDA in place to stop them doing that, but it doesn’t really matter.

“Having good neighbours who are committing — they’re committing 50 million bucks to that ground to go and explore it — WA1’s raised probably $30m now and is spending lavishly as we speak. So it’s a really hot district.”

Good neighbours

Lithium and nickel giant IGO (ASX:IGO), known to be keen on copper and rare earths, holds a lot of ground in the NT, while Encounter Resources (ASX:ENR) has made the Aileron discovery near WA1’s landmark Luni find.

CGN, which has tapped 708 Capital and Oracle Capital for the float and plans to list in October with the code CGR, holds ground initially explored not for IOCGs or niobium.

Wholley said a company called Geocrystal identified Australia’s biggest kimberlite field but never struck it lucky.

“They found like micro diamonds and Australia’s biggest kimberlite field, did a whole bunch of programs over the ground but could never find diamonds in kimberlites,” he said.

That drilling information has proven invaluable for CGN.

At Hathi drill hole W14RC045 hit a 37m zone at 0.38% total rare earth oxide and up to 0.71% from 93-94m deep with drilling planned there in 2024.

Another hole at the Shep target struck 2m at 1.15% nickel from 66-68m, within a broader zone with a partial sample from 68-80m at over 0.5% Ni.

But of the six targets CGN is chasing, the two most alluring are of the IOCG nature.

That is the sort of mineralisation that feeds many of Australia’s largest copper and gold mines, including Evolution’s (ASX:EVN) Ernest Henry in Queensland and BHP’s (ASX:BHP) Prominent Hill, Carrapateenaa and Olympic Dam mines in South Australia.

They include Tantor, an anomaly similar in size and scale to Prominent Hill which boasts a 2km by 1km gravity high at a target depth of 200-600m beneath a copper-cobalt surface geochem anomaly.

Drilling is expected to start in September 2023, with $180,000 already committed in co-funding from the WA Government’s Exploration Incentive Scheme.

Nearby the Surus target — a 3km by 2km gravity target within an anomalous regional copper zone based on surface geochem and kimberlite drilling – is also anticipated to be tested in September with $220,000 from the EIS committed to maiden diamond drilling.

“The idea was that perhaps these explosive Kimberlite events are pushing through the deeper-seated copper mineralisation somewhere lower in the rocks,” Wholley said.

“It was really geology based, I’m a geologist by background and I rate good quality geoscience as something that is essential to make a discovery.

“You can’t have a true discovery without having a really good model in mind. So we went there looking for these and then found lookalikes so it wasn’t like we found a lookalike and then made that puzzle fit.

“We actually sort of actively went looking for targets like that.”

Marching as one on the road to the …

While the WA1 and Encounter niobium discoveries have shone a big light on the West Arunta region near the remote Aboriginal community of Kiwirrkurra and no doubt drawn interest to CGN, Wholley says a big IOCG discovery would be the “Holy Grail”.

“The chance of finding an IOCG to me that would be the Holy Grail, I think; copper is in a long term supply deficit. And it looks like it gets worse out over time,” he said.

“It’s not getting a great deal of love right now. But going forward, if you have a good copper discovery on your books, it’s easy to get money to develop it yourself, it’s easy to get partners in, majors will take it off your hands if it’s good enough.”

Nickel and rare earths will be getting love too.

“I think that to me would be the thing that I would most like, but that said our nickel target I think is really exceptional. I think there’s a really good chance that that could lead to another discovery in base metals there,” Wholley said.

“And our rare earths, that was a little bit opportunistic if I’m honest. When WA1 made their discovery it was niobium, but also rare earths, we sort of went back through our geological and drilling database and just sort of said, are there any holes that stand out in there?

“And there were a couple that had quite high rare earths.

“And so we went back and resampled some old pulps that we had and ended up with a 37m intercept at sort of half a per cent, and it gets up to near a per cent.

“Which to have just sort of as bycatch, looking for diamonds was really impressive.

“And it just turns out that it sits right adjacent to this very interesting magnetic feature with a gravity signature as well, and a bunch of dykes.”

CGN is seeking $8-10m at 20c, which would give the explorer an implied market cap of $20-22m on listing and EV of $11.8m.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.