Graphite stocks guide: Here’s everything you need to know

Pic: Getty

Most people are familiar with graphite because of its use in the humble pencil or in anodes for lithium-ion batteries, but it seems graphite has plenty more to offer.

Several new and diverse applications, as well as a global supply squeeze has experts predicting demand for the material is about to soar.

Graphite is a naturally occurring form of crystalline carbon with properties often associated with technology metals including excellent electrical conductivity and temperature resistance above 3,500 degrees Celsius.

In this guide, Stockhead explains the factors that have been driving ASX graphite stocks, and what will spur demand — and stock prices — into the future.

What is driving demand?

Traditionally, the graphite industry’s bread and butter has been its use in refractory (or “heat-resistant”) bricks, which line the inside of blast furnaces to protect them from the heat generated in steelmaking.

This falls under the ‘metallurgy’ segment which also includes electrodes, casting, and foundries.

Graphite electrodes are used in electric arc furnaces (EAF) and ladle furnaces (LFP) for steel production, ferroalloy production, silicon metal production, and smelting.

Natural graphite is traded in four major flake size fractions:

- -100 mesh;

- +100 mesh;

- +80 mesh; and

- +50 mesh.

It is the -100-mesh product used in the production of spherical graphite for anodes that has analysts predicting the graphite market will enter a period of unprecedented growth.

“Established lithium-ion technologies will dominate over the coming decade and graphite will play a leading role,” Benchmark Mineral Intelligence says.

An EV lithium-ion battery requires around 60kg of graphite – more than twice the amount of lithium needed.

However, Benchmark says natural flake and smaller flake sizes will move into a structural deficit by 2023 as global demand growth for spherical graphite begins to outstrip supply.

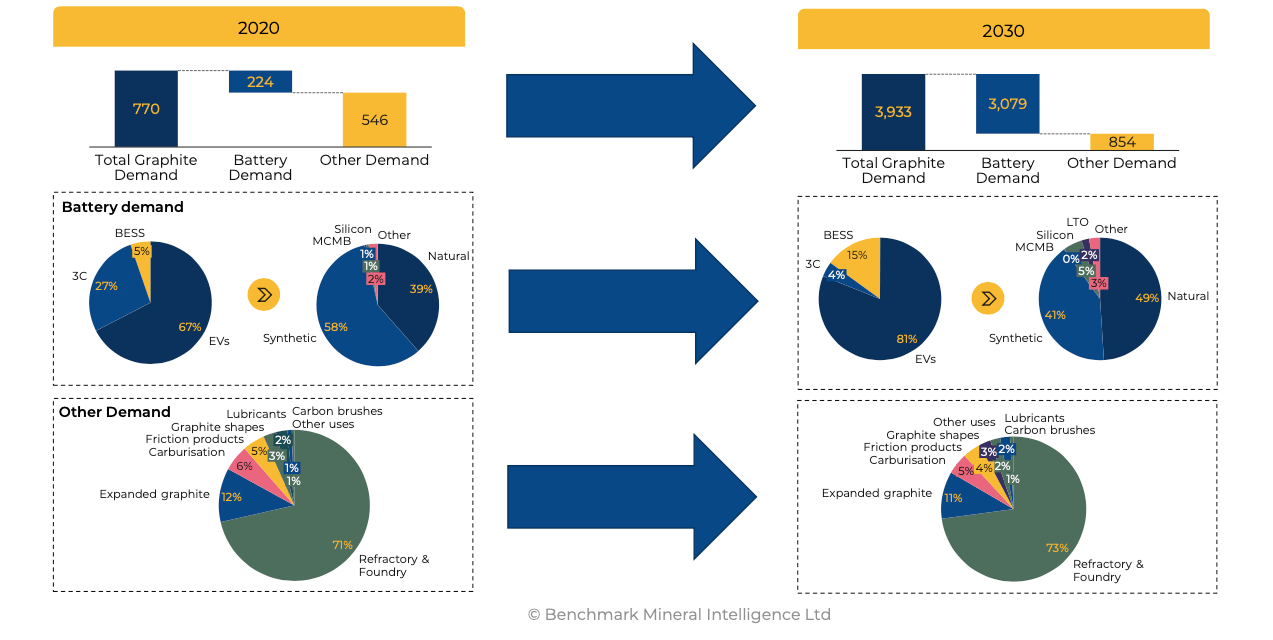

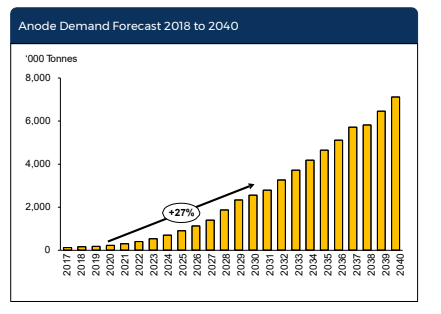

Over the next decade, anode demand is expected to grow on an average of around 27% each year through to 2040.

But major battery makers such as BYD and Panasonic have very specific quality requirements for their batteries, and industry watchers see that market as hard to break into, given China is the main producer of spherical graphite.

In 2021, China will produce more than 700,000 tonnes of flake graphite which accounts for 70% of global flake graphite production.

Meanwhile, graphite’s unique ability to withstand extreme heat and prevent fire from spreading is opening up many new market opportunities — with demand growing much more quickly than expected.

A great fire retardant

When treated with acid and heat, graphite flakes split apart and increase in volume by up to 300 times.

This “expandable graphite” can be pressed into sheets and used for heat and fire protection in applications ranging from building materials to consumer electronics and fuel cells.

Fire safety is rapidly becoming a global issue in commercial and residential construction, driven by disasters such as the London Grenfell Tower tragedy and an explosion at China’s Tianjin Port in December 2015.

The cladding on the Grenfell Tower is believed to have contributed to the rapid spread of the fire that killed 71 people and gutted the 24-storey building in west London.

Similar fires have occurred in Australia and the United Arab Emirates.

New legislation in China, the European Union, Japan, and Korea has either required flame retardants in building codes and/or banned brominated and asbestos-based flame retardants.

Australia is also placing restrictions on the use of non-flame retardant materials in aluminium cladding on buildings.

Annually, China needs 40 million tonnes of flame-retardant building materials that will contain 5 per cent expandable graphite.

That’s 2 million tonnes of expandable graphite required each year just by China’s construction industry.

BlackEarth Minerals (ASX:BEM), owner of the Maniry Graphite Project in southern Madagascar, is one company looking to produce expandable graphite.

In October the graphite junior signed a joint venture agreement to develop an expandable graphite plant in India with Metachem Manufacturing Company Pvt Ltd.

The two companies already have an offtake agreement for 2500tpa with Austria’s Grafitbergbau Kaisersberg – a company that has mined and produced graphite products for over 50 years, and a Tier 1 buyer of expandable graphite.

A feasibility study is due in the second quarter of 2022 and the company hopes to be in production by mid-2023.

Lucrative graphene market

Graphite can also be turned into graphene — an atom thin sheet of carbon, noted for its incredible strength and conductivity.

Two professors at the University of Manchester discovered the material in 2004 during a “Friday night experiment” session when they used sticky tape to separate graphite fragments and created graphene flakes one atom thick.

They were later awarded the 2010 Nobel Prize in Physics.

Graphene is 1 million times smaller than the diameter of a single hair, yet it is 200 times stronger than steel and still lightweight and flexible.

The material is now used in electronics, sensors, aircraft, green tech solutions, industrial robotics and sporting equipment – possibly even wallpaper that can generate electricity.

Researchers at the University of Massachusetts have also proven that graphene has eight to 10 times the stopping power of steel and is twice as effective as Kevlar at stopping bullets.

Because graphene is extremely lightweight, researchers are now looking into creating fabrics from woven carbon nanotubes (essentially a tube of graphene) for military grade and high-performance combat and sports clothing.

Chinese researchers have even found a use for graphene in protecting ancient wall paintings.

The graphene industry rocketed from US$85m in 2017 to US$200m in 2018 — marking a 135 per cent increase.

Market researchers predict it will surpass US$1 billion by 2023 thanks to its many uses.

Graphite price heading north

Graphite pricing is not as transparent or as simple as traditional commodities like nickel, copper, and gold.

Since the start of 2018, the price of large flake graphite has climbed more than 17 per cent, according to Benchmark Minerals Intelligence.

China’s coarse flake graphite reserves have largely diminished, and supply is also threatened by environmental restrictions forcing mine closures.

Benchmark says that with Chinese production closures imminent and ongoing restrictions on processing in the country’s main areas of production – Shandong and Heilongjiang – any significant uptick in demand threatens to force a response in pricing.

Supplies of large flake graphite are tight and producers of the product are receiving a significant premium compared to those that produce smaller flake graphite.

“In November, graphite prices rose on seasonally short supply, driving the Benchmark Flake Graphite Price Index upwards by 8.3% m-o-m,” Benchmark Minerals Intelligence says.

This was driven upwards by domestic Chinese pricing for -100 mesh flake graphite on strong demand from the anode value chain, which recorded a price rise of 20.8% m-o-m.

ASX stocks

Here’s a list of stocks with exposure to graphite/graphene.

Graphite producers include Greenwing Resources (ASX:GW1), Syrah Resources (ASX:SYR), Mineral Commodities (ASX:MRC), and Volt Resources (ASX:VRC).

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| RNU | Renascor Res Ltd | 0.11 | -4 | -12 | 45 | 900 | $ 207,748,877.60 |

| NVX | Novonix Limited | 9.1 | -24 | 4 | 299 | 713 | $ 4,391,332,054.20 |

| EGR | Ecograf Limited | 0.665 | -15 | 12 | 4 | 280 | $ 299,471,750.24 |

| EV1 | Evolutionenergy | 0.43 | -7 | $ 46,200,000.00 | |||

| BKT | Black Rock Mining | 0.225 | 25 | -6 | 32 | 165 | $ 194,736,191.85 |

| MNS | Magnis Energy Tech | 0.46 | -4 | -37 | 59 | 163 | $ 444,990,209.66 |

| BEM | Blackearth Minerals | 0.11 | -6 | -12 | -4 | 150 | $ 23,913,479.37 |

| VRC | Volt Resources Ltd | 0.026 | -10 | -7 | -26 | 136 | $ 69,583,206.03 |

| AXE | Archer Materials | 1.16 | -10 | -27 | 59 | 117 | $ 287,177,960.12 |

| GW1 | Greenwing Resources | 0.43 | -4 | -8 | 43 | 115 | $ 50,812,662.69 |

| WKT | Walkabout Resources | 0.195 | 3 | -3 | 3 | 34 | $ 83,559,901.82 |

| HXG | Hexagon Energy | 0.077 | -5 | -30 | -13 | 17 | $ 34,343,064.68 |

| SYR | Syrah Resources | 1.15 | -3 | -10 | 11 | 13 | $ 571,051,257.84 |

| LML | Lincoln Minerals | 0.008 | 0 | 0 | 0 | 0 | $ 4,599,869.49 |

| TLG | Talga Group Ltd | 1.38 | -8 | -33 | -3 | -27 | $ 420,492,236.22 |

| TON | Triton Min Ltd | 0.036 | -8 | -16 | 3 | -36 | $ 44,739,387.11 |

| BAT | Battery Minerals Ltd | 0.013 | -7 | 0 | -35 | -41 | $ 27,345,099.59 |

| MRC | Mineral Commodities | 0.099 | 6 | -21 | -58 | -73 | $ 52,964,072.77 |

AXE is developing a biochip that would allow droplets of biological specimens to be processed and analysed using graphene-based sensor devices integrated in on-chip devices.

Archer’s lab-on-a-chip technology is based on two key technologies, micro- and nanofabrication, and biochemical reactions for potential application in disease detection.

Talga is a vertically integrated company focusing on anode and graphene additive products.

It owns several of the largest resources of natural graphite in Europe comprising multiple deposits, all of which are in Norrbotten Country, north Sweden.

The main graphite deposit, Nunasvaara, which forms part of Talga’s flagship Vittangi Project, is the highest grade JORC/NI 43-101 resource in the world with 19.5Mt at 24% graphite.

Talga’s Electric Vehicle Anode (EVA) qualification plant is being constructed in Sweden and will produce its flagship lithium-ion battery anode material, Talnode®-C, for large scale customer qualification trials.

The EVA is understood to be the first Li-ion battery anode production plant in Europe.

FGR has identified several market opportunities for its PureGRAPH products — the latest of which is cement production.

Earlier this month the company filed a patent specification with the United Kingdom Intellectual Property Office that describes a novel method of scaling up the production of graphene suspensions for use in cement additives and concrete admixtures.

Through recent lab tests and field trials, it has been shown that FGR’s PUREGRAPH product provides a successful means to produce the admixtures in a robust and consistent manner.

This opens up opportunities for First Graphene in a major global market segment, with a solution that not only improves the base material’s physical performance, but also significantly improves the industry’s carbon footprint.

The global cement and concrete market is predicted to be valued at US$774 billion by 2027.

Behind water, cement is the most widely used man-made material and the second-most used resource on earth.

Commercial applications are also being progressed in composites, elastomers, fire retardancy, construction and energy storage.

Battery materials player Novonix is the first and only US supplier of synthetic graphite to be qualified with a Tier 1 battery cell manufacturer (Phillips 66).

Synthetic graphite is a manufactured product made by high-temperature treatment of amorphous carbon materials.

The primary feedstock used for making synthetic graphite is calcined petroleum coke and coal tar pitch, which is more energy intensive and generates a higher overall carbon footprint.

The company opened its material plant in Chattanooga, Tennessee at the end of November in which US Secretary of Energy Jennifer Granholm along with federal, state, and local officials attended.

Novonix aims to produce 10,000t per year by 2023 and 40,000 tonnes by 2025.

The Chattanooga facility was once owned by GE, where the company made nuclear turbines, but it closed operations in 2016. Novonix’s acquisition, retrofitting and production plans represent an overall $160 million investment.

Graphite-rich Africa a hot spot

Africa has become the focus of many new graphite mine developments because it is known for its large, high quality graphite deposits.

According to Benchmark, Mozambique is set to develop as a key flake graphite producing region, with forecasts anticipating that the country will grow its flake graphite production by five times by 2030 from 2021 levels.

“With Chinese graphite production expected to increase by 45% in the same period, and downstream demand set to scale further, non-integrated Chinese market participants may increasingly look to overseas supply to meet their feedstock needs, which will see Africa increasingly act as an alternative hub of flake graphite supply,” it said.

Benchmark anticipates African flake production will capture 44.3% of the market by 2030, compared to 12.5% in 2021.

One company that is looking to grab a piece of this pie is Triton Minerals (ASX:TON).

TON is advancing its Ancuabe Graphite Project in the East African country of Mozambique.

The company announced it had signed a binding offtake agreement with Chinese graphite products manufacturer Yichang Xincheng Graphite (Xincheng) in November.

Under the agreement, Triton will supply Xincheng with up to 10,000 tpa of flake graphite concentrate from its commercial pilot plant at Ancuabe.

The deal, which will last five years, has the potential to be increased to a larger volume following the full construction of the Ancuabe project which has a target nameplate capacity of 60,000tpa, should the initial phase be successful.

Triton received a $19.5 million investment in December 2019 by Jinan Hi-tech, to commence early construction activities, detailed engineering, and placement of long lead time orders for its project, but it is yet to be seen whether Triton’s delayed path to production will prove successful.

Syrah Resources (ASX:SYR) began production from its Balama project in Mozambique in November 2017.

The project produced 25,000t of natural graphite during the September 2021 quarter, with production being constrained by disruption in the global container shipping market.

Walkabout Resources (ASX:WKT) secured a mining licence for its Lindi Jumbo graphite project in Tanzania in 2018, which has the “highest grade reported graphite mineralisation” in the country.

Black Rock Mining (ASX:BKT) owns the Mahenge graphite project in Tanzania.

The company completed the operation of a large-scale qualification plant campaign earlier this month, which processed 500 tonnes of bulk graphite.

Located in Shandong province, China, the plant commenced operations in August 2021 with ore parcel samples processed composited from 18 locations across the entire strike length of the Ulanzi orebody at Mahenge.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.