UBS: The ASX small caps that could deliver ‘upside surprises’ this reporting season

News

News

February ASX reporting season is upon us, and UBS has highlighted some stocks to watch as results flow in.

While a few companies will report annual results for 2020 year, most of the results will be half-year updates for companies with a financial year-end of June 30.

Australia is on track to recover strongly from the pandemic, and UBS is broadly bullish this year.

The bank said earnings per share (EPS) growth on the ASX is expected to jump by 23 per cent in FY21. (That’s up from a 24.4 per cent fall in FY20.)

And within that headline figure, they highlighted a few ASX small caps with the potential to deliver “upside surprises”.

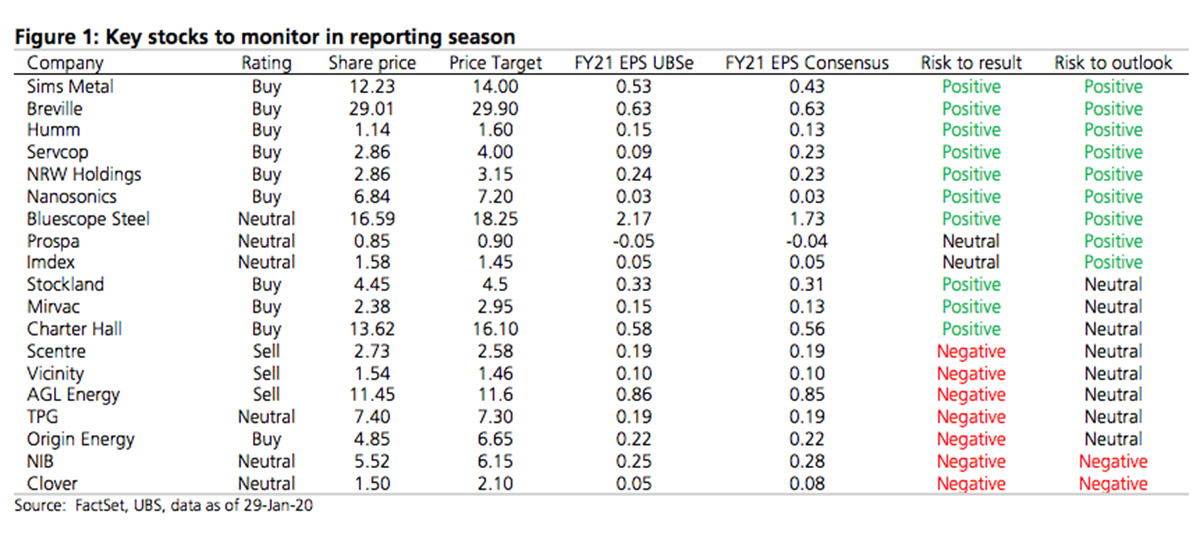

Here’s a summary of the bank’s “key stocks to monitor” this ASX reporting season:

Among them was SME lending platform Prospa (ASX:PGL), which has struggled for traction as a public company.

After raising $110m from investors at $3.78 in 2019, shares in the company are currently trading below $1.

However, UBS said PGL may flag some “positive outlook statements” in the wake of some positive loan growth momentum, given that the economic recovery in Australia has been better than anticipated.

The analysts also picked out fintech BNPL player Humm Group (ASX:HUM), where they forecast “upside risk” to the company’s half-year net profit forecast of $36m.

Humm Group reported its half-year trading update yesterday and the result was higher, with cash net profits after tax of $43.4m.

The market reaction was fairly muted (HUM shares edged lower), although the stock did climb by around 8.5 per cent through the first week of February.

Elsewhere, UBS is bullish on steel manufacturers and commercial property development, with key overweight positions in the following companies:

Sims Metal (ASX:SGM), BlueScope Steel (ASX:BSL), Stockland, Mirvac (ASX:MGR) and Charter Hall (ASX:CHC).