You might be interested in

News

ASX Small Caps Lunch Wrap: Inflation a little higher than expected, but then so is the ASX

Mining

FMG Results: Fortescue stunned by 'mind-blowing' China renewables rollout, says steel demand is diversifying

Mining

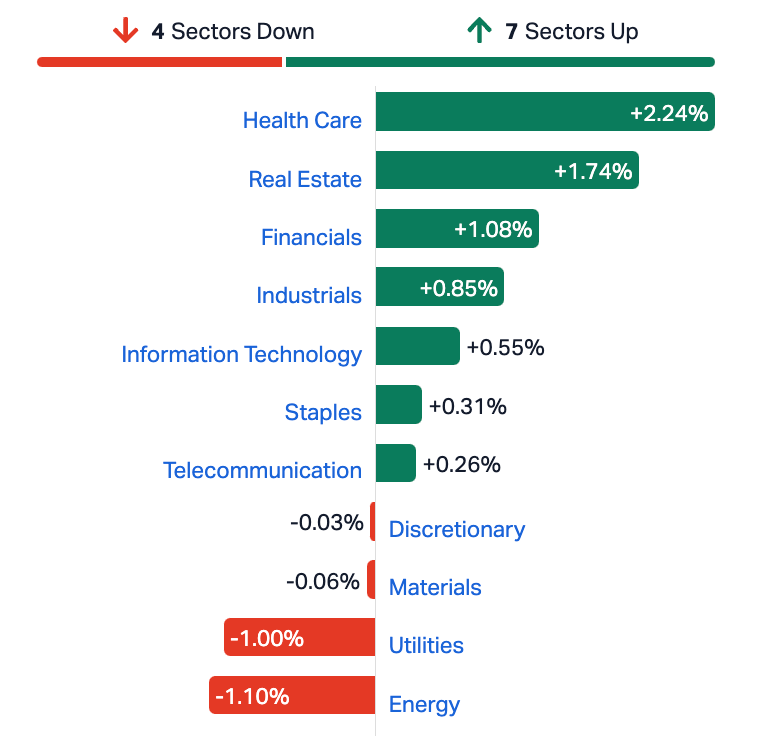

Helped by strong gains on Wall Street and a CPI read which suggested an easing in the homegrown inflation the Reserve Bank governor was only moments earlier worrying about, Aussie equity markets ended last week circa +0.5% in the green.

The benchmark ASX ended November ahead by circa +5.0.

In fact most major markets made money last week as comparatively good news abounded on hints of softening price pressures sent traders everywhere into their Own Private Idahos on the prospect that The War vs Inflation is over and interest rates may soon come down off the mountain.

According to data compiled by AMP, the last week of November saw US shares up +0.8%.

EU equity markets rose +1.2%, as the Stoxx enjoyed its best month since January.

Closer to home Japanese shares fell -0.6% and some contradictory reports over monthly Chinese factory activity hasn’t helped the shot confidence of Chinese traders, with mainland markets down -1.6%.

Oil prices fell circa -2% despite a new OPEC+ oil production cutback as traders were also full of doubts that voluntary cuts will be policed

Copper and iron ore rose. And the Aussie dollar seems to be cheering on further commodities strength, nudging $US0.66 cents.

And gold.

The price of gold smooshed into a new record high on Friday during US trade. The previous metal closed the day up almost 2%, at $2,089.70 an ounce.

Last week’s trade in New York was supercharged by a notably dovish flavour in the Fedspeak. Topping them all was Fed Chair J. Powell who conceded that US monetary policy is sufficiently restrictive.

The yield on the US 10-year Treasury wobbled a bit ahead of those comments then crashed to 4.2%, almost smacking headlong into a 3-month low on the way.

That’s the punters believing the hype that J. Powell et al are done tightening.

Wall Street welcomed another signal last week when core PCE inflation fell to 3.5% and continuing US jobless claims rose to a 2-year high.

Encouraged by these few favourable inflation prints, some quasi-proof of easing economic activity and – boom – traders doubled-down on bets the US Fed is done hiking rates and could start slicing and dicing the mountain they’ve made of cash rates as soon as 1H 2024.

So last week we saw largely a broad-based rally on the NYSE (led of course, by the so-called Magnificent Seven) leaving the US benchmark S&P 500 up +9.5% in November and ahead by +20 for the year-to-date, closing Friday very close to a new index high for the year.

European markets also closed higher Friday after finishing their best month since January. The Stoxx 600 index closed November ahead by circa +6.8%, following three straight monthly declines.

Back in the States, futures pricing has the odds of another Fed rate pause for both the December meeting at about 99.7%. I, for one, like those odds.

In the US a big US labor report backed up by the JOLTS Jobs openings thingy and then a Services PMI should go a long way to convincing anyone still on the fence about US inflation and the softening US economy.

They’ve also got preliminary consumer confidence, factory orders, and trade numbers to back up.

We’re not the only punters with central banks to worry about this week – India, Canada, and Poland all face rates decisions, while fresh inflation reads will be worrying punters in China, Switzerland, South Korea, the Philippines, Mexico, and Russia. They drop in Turkey too, but those guys might be beyond worrying about either inflation or rates.

South Korea, South Africa, Brazil join us for quarterly GDP growth reads.

Germany, China, and France join us for the quarterly reads on foreign trade jazz… import/exports and current accounts and all that.

By the books at home, we have inventory and profit data which lands at 11.30am today.

The numbers team at CBA pegs inventories falling by -0.3%, according to senior economist Belinda Allen.

“We also expect a fall in profits as commodity prices retreated in the quarter.”

A rather big data dump day on Tuesday reveals Australia’s latest Balance of Payments, Q3 GDP and RBA decision.

Net exports should detract from GDP as quarterly import volumes outpaced exports, Belinda says.

“We also expect the Current Account Surplus to shrink to $3.8bn as the trade surplus narrowed in the quarter.”

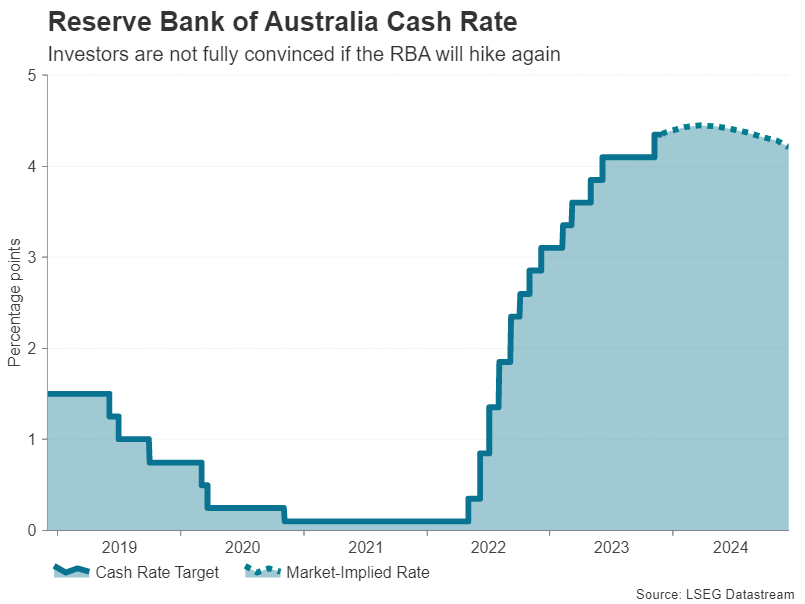

The Reserve Bank meets on Tuesday for the final argument around the official cash rate (OCR). (And yes, I’m assuming they have a closed-door, profanity-laden, honest exchange of opinions, otherwise it’s the guv’nah and daylight and then what’s the point of a Board?)

According to XM Australia CEO Peter McGuire, the Aussie economy’s been gradually losing steam all year and GDP – data which also drops December 6 – is ‘likely to show that growth slowed further over Q3.’

“Rising borrowing costs for households and businesses, combined with the patchy recovery in China, were a major factor why former RBA Governor Philip Lowe was more comfortable to stand pat than his successor Michele Bullock,” Pete says.

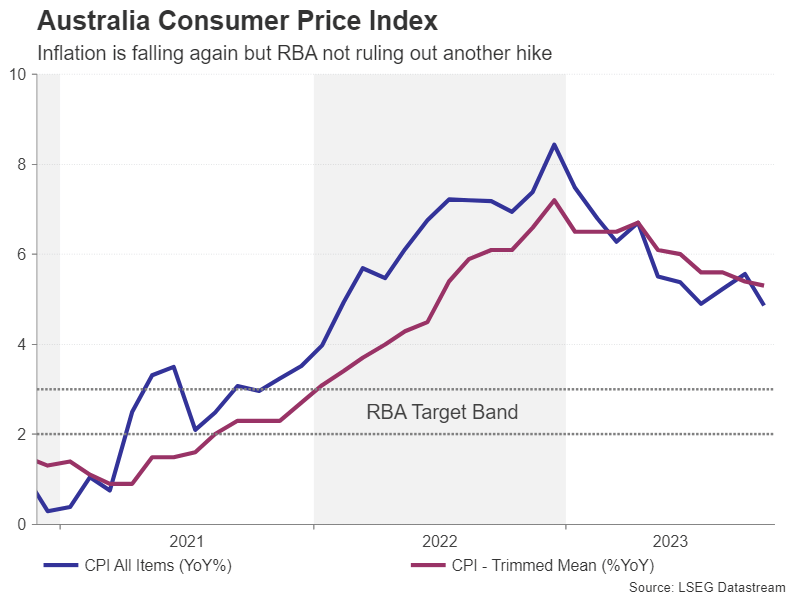

“Under Bullock’s leadership, which began in mid-September, there’s been a very notable hawkish tilt in RBA policy even though the economic data has been mixed. It’s fair to say that the recent uptick in the consumer price index as well as the acceleration in wage growth have been at the forefront of policymakers’ minds.”

Is the surprise drop in CPI a game-changer?

But last week’s monthly CPI crept lower to 4.9% y/y in October, after rising by 5.6% in September.

“The October picture isn’t entirely positive, however, as one of the core metrics – trimmed mean CPI – fell only modestly to 5.3%,” Pete adds.

The labour market remains super tight. The jobless rate remains <4% since April 2022, while wages are rising at the fastest pace since 2009, hitting 4% y/y in the third quarter.

Allen says the array of data made available since the November rate decision hasn’t so far warranted a consecutive rate hike.

The monthly CPI, Q3 23 Wage Price Index, labour force for October and retail trade – have more or less dropped in-line or softer-than-expected.

Allen: A bias for tightening

“We expect the RBA to retain their tightening bias and expect no changes to current forward guidance.

“A no change decision is anticipated to be accompanied by the line, “whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks.”

Investors see a less than 5% probability of a rate increase in December, which rises to around 40% by March.

But that’s sharply lower than the more than 60% probability priced in before the latest CPI numbers came out.

Josh Gilbert, market analyst at eToro, shares his key focus points for the week ahead

Australian GDP

This coming Wednesday marks the release of the quarterly Gross Domestic Product (GDP) rate by the ABS. Markets will be hoping for another set of relatively positive results following September’s data matching the forecast 0.4% rate.

September’s results were welcome news after June produced the weakest result since the COVID-19 Delta lockdown contraction in September 2021.

There are some potential impacts to consider ahead of Wednesday’s reading; retail sales have slowed following a relatively quiet October and a seemingly underwhelming Black Friday period, with plenty of households keeping the purse straps tight as supermarket prices continue to climb. Economists broadly will be expecting GDP growth of around 0.4%, which right now, seems more than tenable.

Chinese Inflation

Last month, China fell into deflation for the second time in 2023 as consumers continue to hold back their spending due to a deepening property crisis in the region. The region’s bad news continues to stack, with weaker-than-expected manufacturing data being handed down this week.

However, bleak outlooks from China isn’t always as bad as it seems, as it often kickstarts chatter around more stimulus measures being rolled out. Recent stimulus measures for the property sector are good news on inflation, given that they should help to reduce the impact on household pressures such as wages and employment and therefore improve consumption.

That said, the expectation for now is that the region will remain in deflation. The consensus is for CPI to come in at -0.2%, reflecting the ongoing struggles and solidifying China as the market disappointment of 2023.

RBA Rates Decision

There was an early Christmas surprise for the RBA this week, with inflation coming in under expectations and retail sales slowing, taking some weight off Michele Bullock to hike rates again.

The RBA still has the potential to be the Grinch next week, should they decide to deliver one final hike to see out 2023. Right now, the likelihood of that is fairly low – but the Governor has maintained a hawkish tone in recent weeks. Specifically, Bullock has spoken about homegrown inflation being more persistent than expected, which will certainly keep markets on edge heading into Tuesday’s decision.

The good news for investors is that overall, markets still see a very low chance of there being a hike next week. However, that doesn’t mean there isn’t the potential for another hike early next year if key data points don’t move in the right direction. Given that a hike is unexpected, the focus is likely to be on the statement following the decision. We’re unlikely to see any lighter tone from the RBA and Michele Bullocks’ hawkish rhetoric may be front and centre once again.

All sources: Commsec, Westpac, Trading Economics, S&P Global Intelligence and IG Markets

MONDAY

TD-MI Inflation Gauge

Company Gross Profits

Home Loans MoM October

Investment Lending for Homes

ANZ-Indeed Job Ads

Business Inventories

Retail Sales MoM Final October

TUESDAY

RBA Interest Rate Decision

Judo Bank Services PMI Final November

Current Account Q3

Net Exports Contribution to GDP Q3

RBA Interest Rate Decision

WEDNESDAY

Ai Group Industry Index, Construction Index, Manufacturing Index Nov

GDP Growth Rate Q3

Capital Expenditure

RBA Chart Pack

THURSDAY

Balance of Trade

Building Permits

Exports/Imports

Private House Approval

FRIDAY

Nope

MONDAY

US factory orders (October)

TUESDAY

China Caixin services PMI (November)

US ISM services PMI (November)

WEDNESDAY

UK construction PMI (November)

US ADP employment report (November)

US EIA crude oil inventories (w/e 1 December)

THURSDAY

China trade data (November)

US initial jobless claims

FRIDAY

US non-farm payrolls (November)

US Michigan confidence index (December, preliminary)