Traders’ Diary: ASX earnings without guidance, China without stimulus and interest rates without inflation

Via Getty

The Week On Markets

After an angsty August of market selling, Australian shares ended around -0.5% lower last week, with some OK earnings results but some cautious (bordering on paranoid) corporate forward guidance.

China’s flailing economy hasn’t been thrown a lifeline from Beijing, despite some scary holes appearing in places they should not and that never helps.

The ASX200 fell hard, down -1% on Friday, taking the benchmark’s losses for the week to -0.5%, with falls in consumer staples, health, utility and energy shares leading the retreat

“It felt like a tough week,” said Shaw and Partners’ James Gerrish from his Market Matters HQ. “And given only two sectors finished in the black, the selling was fairly broad-based, however, it was far from aggressive and there were plenty of stocks that did well.”

The ASX Small Ordinaries Index (XSO) fell by circa -1.2% on Friday losing circa -0.3% for the week, while the ASX Emerging Companies Index (XEC) lost -1.1.%, to close the week -0.9% the worse.

The memory breaking local tech name, 4DS Memory (ASX:4DS) had a memorable week.

In a trading halt Monday, few could’ve predicted that when 4DS revealed testing on its Fourth Platform Lot produced results that are “significantly better than the board and management team at 4DS were expecting,” the share price might react by jumping about 140% in 50 minutes.

At the other end of the sector Iress (ASX:IRE) is looking ripe for a takeover, after ordinary numbers, reminding private equity it could be a useful asset.

The company lost almost one third of its market cap this week, now splashing wildly with arms in the air at circa $1.3bn with its share price closing at $6.44.

Trusting is hard: What to do with the ASX Tech Sector?

Well. The local technology sector played us all like violins at the annual saps convention every other day last week, applying the brakes hard on Friday for what could’ve been a très positive week for the benchmark.

Local tech tracked a weak Thursday session for the Tech-Heavy Nasdaq Composite in New York, while unpleasantness regarding some of the many earnings reports exacerbated things.

Major names like Wisetech (ASX:WTC) and Xero (AS:XRO) added further to recent reversals of fortune, but they were not alone.

That said, investing in the ASX Tech Sector (ASX:XIJ) has reaped some handsome rewards year-to-date, but my gentle heart bleeds for the rapid ageing that it brings to those who do it.

First, here’s why they do it.

Below is a comparison of the last 6 months for the XIJ (+23%) with the wee red line the ASX All Ordinaries (XAO) (-1.2%) over the same period.

XIJ vs XAO (6 months)

That’s a fair performance.

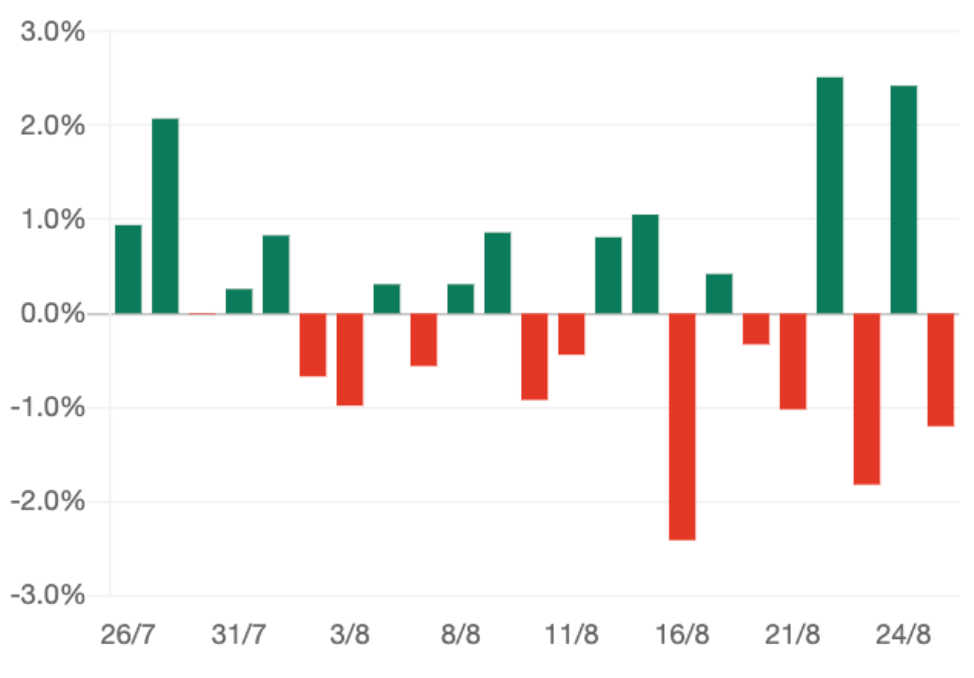

But – as people seem to say lately – if one takes a more granular perspective – the fine print reveals the daily emotional rollercoaster that is the XIJ.

XIJ Daily Movement (%)

Stateside last week, Wall Street traders had a lot of trouble juggling mixed economic signals, renewed global strains from out of China and Russia, and hawkish commentary from Federal Reserve Chairman Jerome Powell, who warned and then delivered what was a hawkish address at the annual Jackson Hole shindig for central bankers, warning of more rate hikes to stave off stubborn inflation. In the middle of it all was Nvidia, up a bazillion bps and bearing Q2 proof that semiconductors and AI would make them all rich.

In the end, hope overcame angst and the Nasdaq ended three long weeks of consecutive losses on Saturday morning Sydenham time, as did the S&P 500.

With only a few sessions of August trade left before Subdued September intervenes, Wall Street has only some jobs data and macroeconomic reports to help light the way out of their monetary policy nightmare.

The Economic Week That Was

It was a happily quiet economic week at home, which was just as well because earnings reports dropped at a rate of four or five a minute from what I saw.

While PMIs dropped at a similar rate around the world, at home Wednesday offered up the Judo Bank flash PMIs were released on Wednesday, suggesting a decent cooling in economic activity. Which is good. (See, inflation vs RBA/rates).

AMP Capital’s Dr Shane Oliver:

Weaker economic data is good news for now, but correction risks remain high. Slowing business conditions PMIs for August have provided confidence in the last week that central banks won’t have to increase interest rates further and this has taken some pressure off bond yields and supported global share markets.

However, it’s too early to conclude that the correction in shares is over: the risk of recession remains high; China’s economy is still slowing; there is a risk that the disinflation process could pause in response to higher energy prices and sticky services inflation; central banks are still at risk of more hikes; there is a high risk of another US Government shutdown from 1 October; high bond yields are still pressuring share market valuations; and the weak seasonal period for shares goes out to October.

We would regard further falls as part of a correction though and we retain a positive 12-month view on shares as inflation is likely to continue to trend down taking pressure off central banks and any recession is likely to be mild.

Judo Bank’s composite and services index were near 18-month lows and came in well under the contracting 50 point mark.

AS CBA’s Harry Otley remarked on Friday that ‘this was a theme globally’ with PMIs in Europe and the US also weakening.

Bond yields eased back a touch after recent rises helped by softer global economic data. Oil prices also fell but metal and iron ore prices rose. The $A was little changed despite a further rise in the $US.

The Week that Will be

The Jackson Hole Economic Symposium is still an ongoing concern since Monday morning here is Sunday eve in Wyoming where so far the various US Fed Speakers have maintained their infuriating spectrum of disconnected and ultimately ambiguous signals. Surely, aside from the spas they could just skip these things in favour of some plain speakin’ monetary policy.

At least Fed Chair Powell and the Boston Fed’s Susan Collins did enough to say you can bake in another hike, which is what they want, rather than actually hiking themselves next month.

Elsewhere this week it’ll be further inflation data reads for the US and Europe.

Non‑farm payrolls in the US will be an important number. Resilient labour markets have been a key problem for The Fed.

At home we play economic indicator catch-up. After a dearth of local indicators Australia has market moving data every morning of the week.

Retail trade will kick things off on Monday.

Michelle Bullock will deliver her final speech as RBA Deputy Governor on Tuesday.

Wednesday, the monthly CPI indicator and building approvals are out.

“We forecast total construction work done to increase by 1.2% in the June quarter, driven by strength in engineering and non‑residential construction,” says the CBA.

“For the July monthly CPI, we see inflation increasing by just 0.1% in the month, taking the annual rate down to 4.7%. Strong growth in rents will remain a driver of inflation, but falls in household goods and petrol prices can provide an offset.”

Thursday is private sector credit and Australia’s Q2 2023 capex.

Friday is CoreLogic’s latest read on property prices.

New housing lending data is also out on Friday. CBA’s internal lending data suggests another fall in new housing lending in July.

The Australian Economic Calendar

Monday August 28 – Friday September 1

All sources from Commsec, Trading Economics, S&P Global Research, AMP

Monday

Australia Retail Sales (Jul, prelim)

Tuesday

Australia Building Permits (Jul, prelim)

Wednesday

Building Approvals (Jul)

Thursday

Private Credit (Jul)

Australia Capex Q22023

Friday

Australia Home Loans (Jul)

CoreLogic house prices (Jul)

The Everyone Else Economic Calendar

Monday August 28 – Friday September 1

Monday

United Kingdom, Philippines Market Holiday

Malaysia PPI (Jul)

Japan Leading Economic Index (Jun, final)

Tuesday

Japan Unemployment Rate (Jul)

Germany GfK Consumer Confidence (Sep)

United States S&P/Case-Shiller Home Prices (Jun)

United States House Price Index (Jun)

United States JOLTs Job Openings (Jul)

United States CB Consumer Confidence (Aug)

Wednesday

Japan Consumer Confidence (Aug)

United Kingdom Mortgage Lending and Approvals (Jul)

Eurozone Economic Sentiment (Aug)

Eurozone Consumer Confidence (Aug, final)

Germany Inflation Rate (Aug, prelim)

United States ADP Employment Change (Aug)

United States Goods Trade Balance (Jul, adv)

United States Wholesale Inventories (Jul, adv)

United States Q2 GDP (2nd est.)

United States Pending Home Sales (Jul)

Thursday

Malaysia Market Holiday

South Korea Industrial Production (Jul)

Japan Industrial Production (Jul, prelim)

Japan Retail Sales (Jul)

China (Mainland) NBS PMI (Aug)

Thailand Industrial Production (Jul)

Japan Housing Starts (Jul)

Germany Retail Sales (Jul)

France Inflation and Q2 GDP

Germany Unemployment (Aug)

Eurozone Inflation (Aug, flash)

India GDP (Q2)

United States Core PCE (Jul)

United States Personal Income and Spending (Jul)

Friday

Worldwide Manufacturing PMIs, incl. global PMI* (Aug)

South Korea Trade (Aug)

Indonesia Inflation (Aug)

Switzerland Inflation (Aug)

Canada GDP (Q2)

United States Non-farm Payrolls, Average Earnings,

Unemployment Rate (Aug)

United States ISM Manufacturing PMI (Aug)

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.