ASX Small Caps and Weekly IPO Wrap: Thanks for the Memory (and the gains) 4DS

The InfoTech sectors swingy performance gave this little guy something to smile about. Pic via Getty Images.

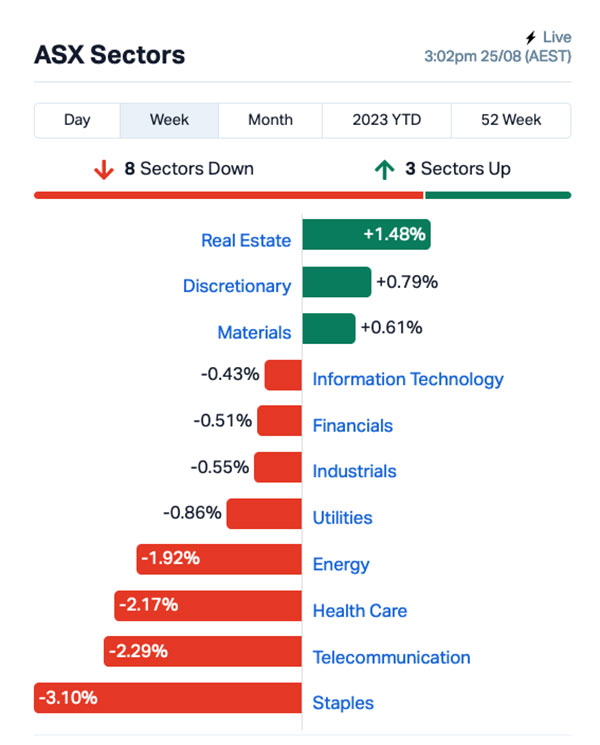

By the time the bell rang this afternoon, the benchmark had settled at -0.43%, which came as something of a surprise thanks to how volatile things have been since Monday.

That said, it’s important to understand that the nausea you’re probably experiencing is entirely normal, given that the market’s been pretty much strapped to the back of an InfoTech sector that has been swinging harder than a sex pest in a backyard spa all week.

Perhaps the most infuriating thing about the tech sector’s wild meanderings is that, despite a weekly progress chart that looks like someone cornered a skittish child and demanded they “draw a monster’s mouth”, the sector really didn’t end up moving all that much from where it finished last week.

The best performer for the five days this week was Real Estate, which managed to climb 1.61% higher, and right down the bottom was Consumer Staples, which banked a stinker at -3.0%.

As is often the case when the bridge starts to disappear beneath the troubled waters, the XGD All Ords Gold index dazzled, climbing close to 4.5% for the week for a YTD gain of 10.6%.

Which is lovely and all, but barely a patch on the market’s wild child of the week, because the XTX ASX All Tech index has managed to grow a prickle over 27% in that same period.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks for the week 21-25 August, 2023:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| 4DS | 4Ds Memory Limited | 0.1325 | 165% | $179,579,754 |

| NMR | Native Mineral Res | 0.056 | 124% | $8,523,962 |

| RDN | Raiden Resources Ltd | 0.025 | 108% | $51,381,723 |

| IGN | Ignite Ltd | 0.073 | 70% | $6,539,499 |

| OXT | Orexploretechnologie | 0.078 | 70% | $8,707,792 |

| WYX | Western Yilgarn NL | 0.2325 | 60% | $11,669,513 |

| RDM | Red Metal Limited | 0.12 | 58% | $29,471,009 |

| MEB | Medibio Limited | 0.0015 | 50% | $9,151,116 |

| MTL | Mantle Minerals Ltd | 0.0015 | 50% | $9,221,169 |

| LAM | Laramide Res Ltd | 0.695 | 46% | $883,451 |

| WC8 | Wildcat Resources | 0.33 | 43% | $206,327,196 |

| RLG | Roolife Group Ltd | 0.01 | 43% | $7,205,581 |

| SBR | Sabre Resources | 0.051 | 42% | $13,116,878 |

| BVS | Bravura Solution Ltd | 0.7075 | 40% | $224,177,001 |

| ERW | Errawarra Resources | 0.175 | 40% | $11,193,240 |

| NC1 | Nicoresourceslimited | 0.535 | 37% | $41,324,751 |

| STP | Step One Limited | 0.5 | 37% | $84,329,832 |

| ICR | Intelicare Holdings | 0.015 | 36% | $3,133,731 |

| AD8 | Audinate Group Ltd | 13.82 | 36% | $1,033,208,599 |

| ARV | Artemis Resources | 0.031 | 35% | $43,957,714 |

| MSB | Mesoblast Limited | 0.495 | 34% | $419,315,485 |

| AHN | Athena Resources | 0.008 | 33% | $8,563,740 |

| AVW | Avira Resources Ltd | 0.002 | 33% | $4,267,580 |

| AXP | AXP Energy Ltd | 0.002 | 33% | $11,649,361 |

| GCR | Golden Cross | 0.004 | 33% | $4,389,024 |

| OAU | Ora Gold Limited | 0.008 | 33% | $37,518,359 |

| SAN | Sagalio Energy Ltd | 0.012 | 33% | $2,455,922 |

| YPB | YPB Group Ltd | 0.004 | 33% | $2,973,846 |

| YRL | Yandal Resources | 0.059 | 31% | $7,574,548 |

| FTL | Firetail Resources | 0.15 | 30% | $14,918,750 |

| AVE | Avecho Biotech Ltd | 0.009 | 29% | $19,459,473 |

| AWJ | Auric Mining | 0.054 | 29% | $5,365,243 |

| MAU | Magnetic Resources | 0.95 | 28% | $225,106,333 |

| ANX | Anax Metals Ltd | 0.065 | 27% | $26,654,043 |

| CR1 | Constellation Res | 0.14 | 27% | $6,487,705 |

| IEC | Intra Energy Corp | 0.007 | 27% | $9,724,690 |

| KKO | Kinetiko Energy Ltd | 0.115 | 26% | $85,861,987 |

| MLS | Metals Australia | 0.039 | 26% | $21,841,267 |

| R3D | R3D Resources Ltd | 0.054 | 26% | $7,865,185 |

| AL8 | Alderan Resource Ltd | 0.01 | 25% | $6,166,946 |

| BP8 | Bph Global Ltd | 0.0025 | 25% | $3,336,824 |

| BPP | Babylon Pump & Power | 0.005 | 25% | $12,288,857 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | $14,368,295 |

| ICN | Icon Energy Limited | 0.005 | 25% | $3,840,068 |

| IMI | Infinitymining | 0.125 | 25% | $10,094,680 |

| NNG | Nexion Group | 0.015 | 25% | $3,034,618 |

| NRX | Noronex Limited | 0.02 | 25% | $7,187,733 |

| PIL | Peppermint Inv Ltd | 0.01 | 25% | $20,378,568 |

| ROC | Rocketboots | 0.12 | 25% | $3,904,620 |

| ROG | Red Sky Energy. | 0.005 | 25% | $31,813,363 |

It turned out to be a pretty big week for the top 3 on the Small Caps ladder, after all of them broke the triple-digit mark on their way into the market’s good graces.

Leading the way was 4DS Memory (ASX:4DS), after its breakthrough in ReRam tech funnelled a ton of investment back into the company once more to push it 165% higher for the week.

In second place, it’s a bit of a sleeper – Native Mineral Resources (ASX:NMR) put in a quiet-achiever effort to climb 124% this week, despite not featuring very heavily at the pointy end of our reportage for the week.

NMR managed that through a slick combination of commitments under a placement to sophisticated and institutional investors to raise $640,913 by the issue of 21,363,767 fully paid ordinary share at $0.03, and stated plans to commence diamond drilling at the Maneater Eastern Anomaly in first week of September.

Maneater’s looking pretty tasty, after Pole Dipole Induced Polarisation surveying delineated a new 900m long chargeability high anomaly. All of those are real words that actually mean stuff, even when they’re in that particular order.

And in third spot for the week was Raiden Resources (ASX:RDN) on 108% – the beneficiary of very positive news surrounding a pegmatite outcroppings of up to 30m width at surface at its prized Andover South project, which is near Azure’s Andover project, Errawarra’s Andover project, and Sabre’s Andover project.

… I think there might be a pattern in there somewhere, but I can’t quite make it out.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks for the week 21-25 August, 2023:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.001 | -50% | $15,642,574 |

| ALV | Alvomin | 0.165 | -37% | $12,264,438 |

| SPT | Splitit | 0.043 | -35% | $24,344,497 |

| IRE | IRESS Limited | 6.615 | -34% | $1,152,491,055 |

| CYQ | Cycliq Group Ltd | 0.004 | -33% | $1,430,067 |

| KEY | KEY Petroleum | 0.001 | -33% | $1,967,928 |

| OSM | Osmondresources | 0.1 | -33% | $4,689,604 |

| VPR | Volt Power Group | 0.001 | -33% | $10,716,208 |

| ARN | Aldoro Resources | 0.135 | -33% | $27,597,867 |

| MKL | Mighty Kingdom Ltd | 0.016 | -30% | $6,850,611 |

| THR | Thor Energy PLC | 0.0035 | -30% | $5,837,166 |

| AKG | Academies Aus Grp | 0.25 | -30% | $33,153,617 |

| CI1 | Credit Intelligence | 0.125 | -29% | $12,524,874 |

| MSG | Mcs Services Limited | 0.02 | -29% | $3,968,359 |

| QPM | Queensland Pacific | 0.067 | -28% | $120,498,007 |

| BAT | Battery Minerals Ltd | 0.07 | -28% | $7,774,292 |

| PEB | Pacific Edge | 0.095 | -27% | $81,036,522 |

| IMU | Imugene Limited | 0.0695 | -26% | $456,035,777 |

| ATV | Activeportgroupltd | 0.1 | -26% | $17,655,743 |

| BDX | Bcaldiagnostics | 0.115 | -26% | $24,521,760 |

| JDO | Judo Cap Holdings | 0.925 | -25% | $1,122,102,670 |

| AOA | Ausmon Resorces | 0.003 | -25% | $2,907,868 |

| BXN | Bioxyne Ltd | 0.012 | -25% | $22,819,745 |

| SIT | Site Group Int Ltd | 0.003 | -25% | $7,807,471 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| EMS | Eastern Metals | 0.04 | -25% | $2,528,513 |

| GNM | Great Northern | 0.025 | -24% | $4,484,243 |

| LM1 | Leeuwin Metals Ltd | 0.29 | -24% | $13,659,425 |

| NGS | NGS Ltd | 0.013 | -24% | $3,265,956 |

| NHE | Nobleheliumlimited | 0.195 | -24% | $38,683,993 |

| MNS | Magnis Energy Tech | 0.081 | -23% | $99,077,845 |

| CXM | Centrex Limited | 0.085 | -23% | $52,234,967 |

| HIQ | Hitiq Limited | 0.021 | -22% | $6,402,703 |

| RIM | Rimfire Pacific | 0.007 | -22% | $14,736,713 |

| VSR | Voltaic Strategic | 0.035 | -22% | $15,795,507 |

| TMR | Tempus Resources Ltd | 0.018 | -22% | $5,924,927 |

| SIX | Sprintex Ltd | 0.022 | -21% | $6,768,239 |

| CHR | Charger Metals | 0.215 | -20% | $13,354,589 |

| ADH | Adairs Limited | 1.395 | -20% | $242,271,375 |

| ADR | Adherium Ltd | 0.004 | -20% | $19,997,633 |

| DCL | Domacom Limited | 0.02 | -20% | $8,710,035 |

| DCX | Discovex Res Ltd | 0.002 | -20% | $6,605,136 |

| ELE | Elmore Ltd | 0.004 | -20% | $4,198,151 |

| EMU | EMU NL | 0.002 | -20% | $1,450,021 |

| GTG | Genetic Technologies | 0.002 | -20% | $23,083,316 |

| HT8 | Harris Technology Gl | 0.012 | -20% | $3,589,626 |

| MRD | Mount Ridley Mines | 0.002 | -20% | $15,569,766 |

| MXC | Mgc Pharmaceuticals | 0.002 | -20% | $11,677,079 |

| NSX | NSX Limited | 0.04 | -20% | $16,047,922 |

| OLH | Oldfields Holdings | 0.04 | -20% | $7,990,238 |

HOW IT ALL PLAYED OUT THIS WEEK

Monday, 21 August: ASX down 0.35%

Up well over 30% was exploration minnow Western Gold Resources (ASX:WGR), after revealing it’s set to acquire a high-grade REE prospect and two high-grade graphite projects in Sweden.

WGR, which holds the Gold Duke Project in WA, is also taking a moment to throw its hat in the rare earths game, entering into a conditional agreement to acquire Euro Future Metals (EFM), a Swedish-Euro mob with the exploration permit applications over not en; not två; but tre (3) high-grade prospects in Sweden – the Holmtjarn REE, Loberget Graphite and Rullbo Graphite Projects.

On the medtech front, 1ST Group (ASX:1ST) rose by more than 20% in early trade after its virtual care technology company, Visionflex, received an order with an initial value of $1.1m in upfront revenue.

The WA Primary Health Alliance (WAPHA) wants 1ST to deliver virtual healthcare to 75 Commonwealth-funded Residential Aged Care Facilities (RACF) across WA.

Western Yilgarn (ASX:WYX) is declaring go on exploration at its West Julimar project for the very first time, and that saw the company gain 32% for the day. The dig is within spitting distance of Chalice’s monster Gonneville nickel deposit, trending into the ground next door.

Tuesday, 22 August: ASX up 0.05%

Western Yilgarn (ASX:WYX) backed up the previous day’s winnings with a jump of close to 25%, after identifying ‘multiple targets’ for drilling at its Bulga mining project in WA.

WYX is on the go for a gaggle of minerals, including nickel, copper, gold and, yep, some lithium, too.

Red Metal (ASX:RDM) closed the day 18% higher, with excitement still fresh regarding the company’s potential world-first rare earths discovery at its Sybella project in north-west Queensland.

The discovery follows assay results from proof-of-concept drilling regarding 19 percussion holes (for 2,280m) across a large tranche of granite, which suggest high-quality grades inside some substantial width.

RDM describes the find as full of the EV-worthy REE’s like neodymium and praseodymium (NdPr) as well as yttrium (Y) and dysprosium (Dy), and best of all, MD Rob Rutherford says its all near-surface REO mineralisation.

Kinetiko Energy (ASX:KKO) put on 32% for the day, on news that its subsidiary Afro Energy has inked a deal with with the Industrial Development Corporation of South Africa (“IDC”) to co-develop a new joint venture for the appraisal and production of LNG to deliver 50MW growing to 500MW gas equivalent energy.

Excitingly for Kinetiko, the deal sets Afro Energy with the largest on shore LNG project in South Africa, with the IDC intending to fund 30% of the second stage development.

Wednesday, 23 August: ASX up 0.3%

Closing at almost +100%, Aussie semiconductor-friendly 4DS Memory (ASX:4DS) took the small-cap cake, ate it and then laughed at the other kids today in a massive performance critics called massive.

Also killing it softly was Raiden Resources (ASX:RDN) on news the digger’s found a ~3.5km long, 600m wide pegmatite field at its Andover South tenements with individual pegmatites outcropping up to 30m widths.

The Andover South project is right next door to where Azure Minerals (ASX:AZS) has been drilling out lithium for fun just lately. Wake-riding and nearology a-go-go.

As Stockhead’s gallant crypto-commods guru and man about town Robert Badman noted, Raiden has completed its latest fact-finding mission, confirming the go-ahead to acquire an 80% interest in five more lithium tenements – nearby the privately held Welcome Exploration project and adjoining the stupendously-hot-right-now Azure Minerals Andover lithium discovery in the Pilbara.

Thursday, 24 August: ASX up 0.6%

Andromeda Metals (ASX:ADN) jumped nicely on news of an updated Definitive Feasability Study for its Great White Project (GWP), at Streaky Bay on the Eyre Peninsula in South Australia.

The Great White Project Net Present Value (NPV) has apparently increased by 65% to $1,010mn, and average annual earnings before interest tax depreciation and amortisation (EBITDA) is up by circa 60% to $130mn.

“The 2023 DFS represents the outcome of a rigorous commercial and business strategy review for commercialising our construction ready project, to meet rising market demand,” said Bob Katsiouleris, CEO and Managing Director of Andromeda.

Black Mountain Energy (ASX:BME), is cash-richer by circa $10.7mn, and the stock jumped by more than a third, following the sale of 100% of its acreage and its title and interest in the MIA 64 FEE 2H well in the Permian basin.

BME dropped about US$2 million for the site in January of this year, spent about US$1.4 million poking around the project, before off-loading it for a weirdly precise US$6,873,308 this week.

Math guru Gregor reckons that makes for a 102% profit, but he’s as good with numbers as he is at swallowing cars, so it might be worth double-checking.

Carrying on up the ASX is Wednesday’s warrior Raiden Resources (ASX:RDN) adding 32% today on the news that it’s all over an outcropping and interpreted pegmatites of up to 30m width at surface at its prized Andover South project. Yes, it’s the one right next door to all the excitement at, Azure Minerals (ASX:AZS).

And it didn’t take long for Errawarra Resources (ASX:ERW) to find another 20% after merely flying a helicopter over its E47/4352 tenement in the West Pilbara region of Western Australia.

Friday, 25 August: ASX down 0.93%

Bravura Solutions (ASX:BVS) finished the day on top, after early leader Sabre Resources ran out of puff mid-afternoon. BRV added +42% thanks to an earnings report that starts out with “achieved guidance across all metrics with a significant closing cash balance”, before explaining why it’s not all good news by any reasonable measure.

Bravura’s operating expenses rose from $221.3 million to $257.7 million, operating EBITDA declined $53.4m, from $45.3 million in the pcp to a deficit of $8.1 million and an adjusted NPAT of -$23.1 million, which represents a $48.8m decline against the pcp figure of $25.7 million.

“Because of headwinds”, Bravura said, gustily. “We don’t care,” said investors.

Australian Mines (ASX:AUZ) finished up 25% on zero news – the last time the market heard from AUZ was when we all got told last week that CEO Michael Holmes is exiting the company to “pursue other interests” at the end of October.

And in third place for the day, after a solid post-lunch surge, was the week’s best performer 4DS Memory (ASX:4DS) – a climb that was technically on ‘no news’ for the day, but after its announcement from earlier in the week, it really didn’t need another excuse.

ASX IPO listings That Happened

CurveBeam AI (ASX:CVB) listed this on 22 August, but paid the price of launching into the middle of one of the most variable tech markets in the history of both space, and time.

The company, based in Melbourne, is a leader in cone beam CT imaging, paving new frontiers in AI-based bone and joint analysis.

At the close of day, CVB’s stock price slumped to $0.34 with a market cap of around $80m, down from the $0.48 IPO price.

Meanwhile, Cleo Diagnostics (ASX:COV) – a medical diagnostics and devices development company focusing on ovarian cancer, listed on 22 August as well.

Early detection is the name of the game for COV, which made its debut on the ASX after raising $12 million at $0.20 per share.

On its first day at Big School, COV was tipping the scales at $0.21, but it fell back to $0.20 for a day or so, and now it’s back at around $0.21 a pop this arvo.

ASX IPO listings That Didn’t Happen Yet

Expected listing: September 7

IPO: $6m at $0.20

At listing, James Bay Minerals will have 100% ownership of 22,438 Ha (224km2) of prospective lithium projects within the James Bay region of Quebec.

The La Grande Project is located between 50km to 190km east of Radisson in northwest Quebec.

The Project comprises three key prospects:

Joule Prospect – 50km south-east of Radisson, 205 claims covering ~10,498 hectares;

Aero Prospect – 150km east of Radisson, 89 claims covering ~4,366 hectares; and

Aqua Prospect – 190km east of Radisson, 63 claims covering ~3,225 hectares.

Expected listing: September 14

IPO: $7.5m at $0.20

Novo is a Canadian gold explorer listed on the TSX and OTCQX.

It owns one of the largest prospective gold and battery metals land packages in the Pilbara.

The Nullagine Gold Project is located approximately 185 km north of Newman, and within the Mosquito Creek Basin.

The Project includes the 1.8 Mtpa CIL processing facility, an onsite laboratory, 10 MW power station, and fully permitted TSF along with a facility to process mechanical sorter products.

NB: All dates are sourced from the ASX website. They could change without notice.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.