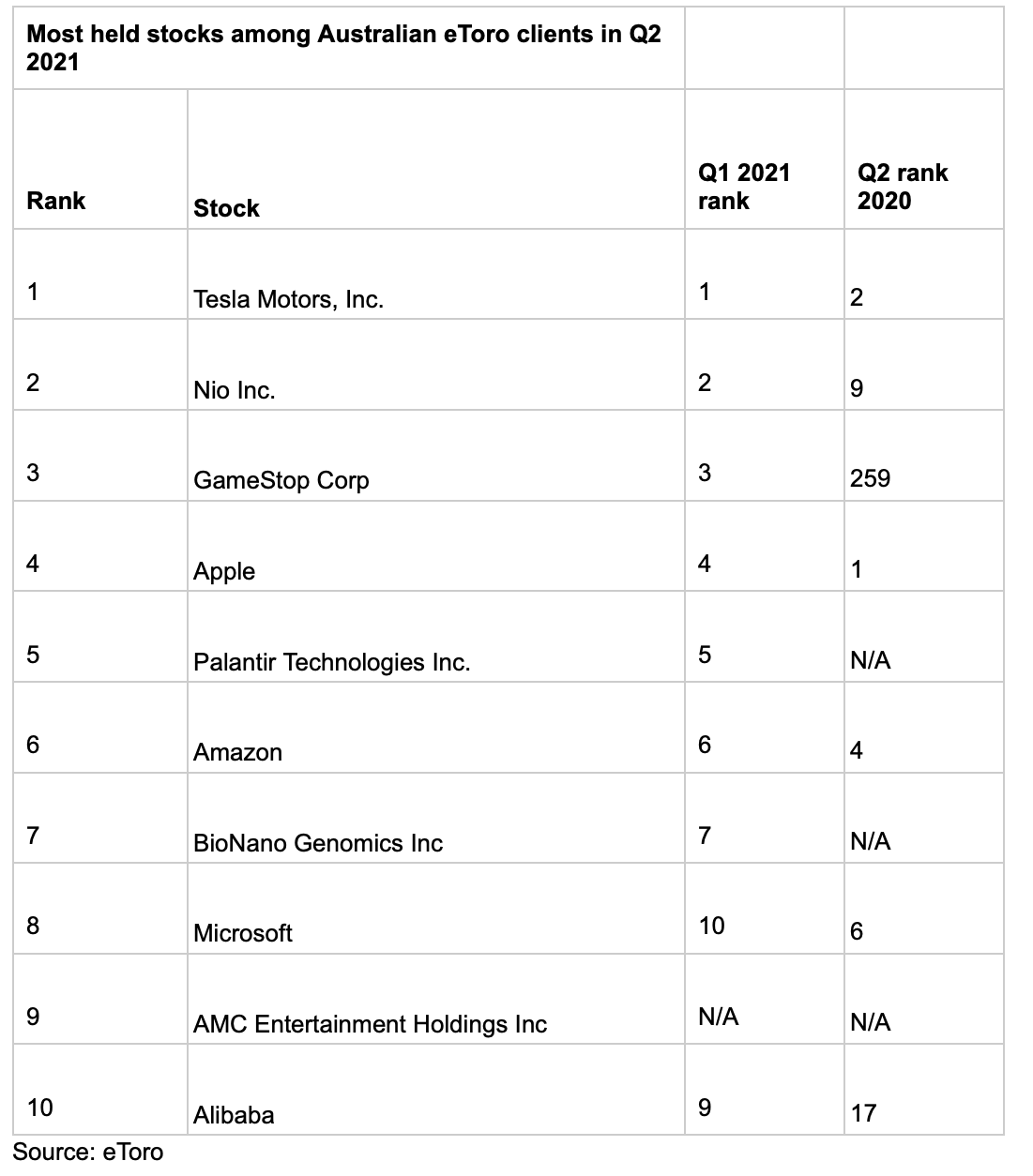

The top 10 global stocks held by Aussies in the June quarter, according to trading platform eToro

News

News

Whilst the ASX has performed strongly in 2021, rising by around 9 per cent, Australian investors have also been looking abroad to diversify their portfolio.

The US stock market obviously offers the best opportunity in this regard, providing access to some of the best and well-known companies in the world.

Global investing platform eToro has just shared below its figures on the most held stocks in Q2 2021 by Australian investors.

The data suggests a clear preference for growth stocks, with EV stocks Tesla and Nio Inc being the two most popular shares held by investors not only in Australia, but also globally.

The list also shows that Aussie investors have a big appetite for giant tech plays Apple, Amazon, and Microsoft.

Perhaps unsurprisingly, Reddit meme stocks Gamestop and AMC were also in the top 10 stocks held by Australians in Q2.

Tesla is the most held stock on the eToro platform in the second quarter, leapfrogging its Chinese rival Nio Inc to take the top spot globally.

Despite recent price struggles experienced by EV stocks and difficulties in sourcing microchips, retail investors have remained bullish about the industry.

“We can see that Australian investors are adapting to a long-term buy-and-hold strategy with both these assets, anticipating that the EV space will dominate the automotive industry for many years to come,” says Australian market analyst, Josh Gilbert.

With regards to comparison between Tesla and Nio, Gilbert argued that Tesla has slightly more skin in the game than Nio, and that’s why Australian Investors are opting for Tesla shares right now.

Over the last six months, fears about encroaching inflation have steered investors away from the hot growth stocks in 2020, such as tech and EVs.

The rotation from growth to cyclical stocks, known as the reflationary trade, has been a big winner in the past six months as the market anticipates an imminent reopening of the economy and with it, rising inflation.

This so-called reflationary trade has led to a slump in tech and EV stocks over this period.

But according to eToro’s Global Markets Strategist, Ben Laidler, the fact that Tesla, Nio, Apple, and Microsoft – all in what are generally considered growth sectors – remain in the 10 most-held stocks in Q2 suggests investors see long-term value in these companies.

Laidler also suggested that investors might be pricing in a temporary rise in inflation, instead of a long term structural increase.

However, he encouraged investors to stick to the well-beaten path of long term success.

“eToro has long advocated the importance of investing in companies that you know and understand, and it’s clear from our data that investors are doing just that,” Laidler said.

Meme reddit darling GameStop Corp was the third most-held stock in Q2 by Aussie investors, and the fact it remains in the top 10 suggests it is more than just a passing fad among investors.

Earlier this month, eToro facilitated a pilot scheme allowing investors to vote at GameStop’s AGM.

Around 63 per cent of GameStop shareholders on eToro’s platform participated in the voting, highlighting this community’s dedication to this particular stock.

Gamestop has last week sold five million additional shares, raising an extra $1.1 billion to fund its growth plans.

Recently-listed crypto exchange Coinbase Global meanwhile, was the only new entrant in eToro’s most-held stocks list, debuting at number nine.

Coinbase allows investors to gain indirect exposure to cryptocurrency through the stock market, rather than investing in the digital tokens directly.

Although the data suggests that investors are currently sticking to a long term strategy, Laidler provided a word of caution on potential rising inflation.

“We may start to see more investors diversify their holdings if central banks such as the Federal Reserve, Bank of England and European Central Bank change their tune on inflation,” he said.