The Ethical Investor: We ask Seven Advisory’s Mary Delahunty — how can ESG investors quantify the ‘S’ in ESG?

News

News

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is Seven Advisory’s Mary Delahunty.

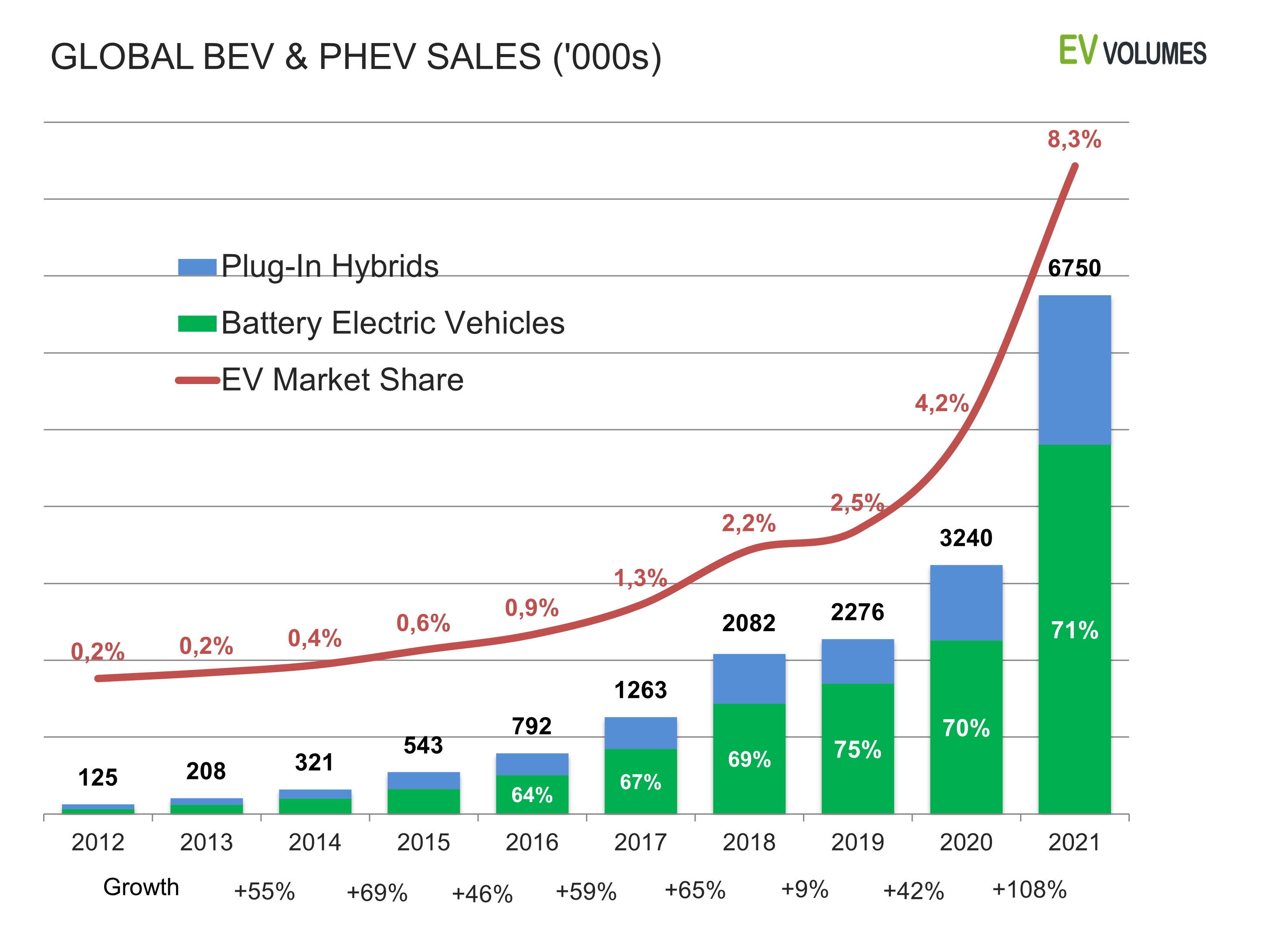

There’s no question the world is moving toward 100% electric vehicles (EV) in the coming decades as we scramble to meet 2050 net carbon emission targets.

In Europe, a leader when it comes to EV uptake, sales of electric vehicles in 2021 increased to 1.2 million, making up 10% of all vehicle sales that year.

A COP26 statement has even put that EV target in black and white, declaring that all sales of new cars and vans to be zero emission globally by 2040, and by no later than 2035 in leading markets.

But as the ethical investor will have noticed, nowhere in that statement does it touch on the social costs we have to pay to get there.

Batteries in EVs like the ones Tesla makes require many components including cobalt, a mineral found in abundance in the Democratic Republic of Congo (DRC).

In fact about 70% of the world’s cobalt come from the DRC, a country where child slave labour is a real problem. A recent report by the Guardian revealed that a Congolese child has to toil in the cobalt mines for the equivalent of US$3.50 a day.

China, another country accused of human rights violations, practically controls the EV supply chain.

By all reckoning, the country has control of 80% of the worlds’ raw material refining, 80% of the world’s cell capacity and 60% of the world’s component manufacturing.

Last month, the US Senate finally acted and introduced a bill that required a study of the “impact of forced labor in China on the electric vehicle supply chain.”

“People are being enslaved in part of the world in order to get the resources that we seem to want to be out of sight, out of mind, and we just say, ‘Well, we have an electric vehicle,’” said US Senator Manchin.

Ironically, Tesla and other EV stocks are mostly included in many ESG funds’ portfolio.

So to put these matters in perspective, and whether investors could reasonably put a risk number around these social issues, Stockhead reached out to ESG expert, Mary Delahunty.

Delahunty is the former Head of Impact for Aussie super fund HESTA, and has stepped out of the superfund industry to start her own consultancy firm, Seven Advisory.

The consultancy focuses on authentic and responsible decisions in investments, social progress, equality and the environment. Here’s an except of the interview.

“In the ESG world, I think we’ve rightly paid a lot of attention to climate,” Delahunty says.

“But I also think that as we reconstruct our post pandemic world, there’s a gap in how we could build those social risk conversations to the point where environmental risk conversations are currently.

“There’s a lot to be done there when it comes to good data, good analysis, and good understanding of definitions.

“So in terms of new frontiers, I believe the “S” in ESG is perhaps under resourced and researched, and an under quantified part of ESG.”

“It’s very subjective, and I think it does become problematic when companies begin to say: what is the risk?” Delahunty says.

“But it’s not an insurmountable problem, because companies look at nebulous risks all the time.

“One of the things that’s happened with the “S” component is that it’s been almost sidelined into a different category.

“In Australia, Rio Tinto is a really good example. Rio released a Reconciliation Action Plan that agreed to advance the voices of indigenous people.

“But in the agreements that they held with the traditional owners in the Pilbara in for example, they actually had gag orders, so those two things don’t match.

“Now, that would have been sidelined into an “S” issue, but it’s actually a financial risk when you’ve got an integrity gap between something that you have publicly said, versus something that you are actually doing.

“And that leads to potential compensatory issues, which should land squarely at the feet of the risk committee and the board.

“So I think for too long, we’ve seen these issues as just side notes as opposed to a genuine financial risk, because it’s not as easy as looking at environmental transition issues.”

“There’s a real focus on stewardship recently, and a genuine maturing of how people are expecting authenticity to go across the board,” Delahunty says.

“So stakeholders will not just be looking at the company’s environmental report for example, but they’ll also be looking at whether or not that company does what they say they’re doing, in every aspect.

“So you just can no longer just put something bright and shiny up there, and hope nobody notices what the left hand is doing.”

“Apart from the Rio example I mentioned, I think the Banking Royal Commission was a really interesting example of inauthentic and tokenism in financial services,” Delahunty says.

“We always see the banks talking about customer centricity, but the investigation revealed that it didn’t happen.

“We also saw in the Royal Commission a phrase coined by Hayne, where he talked about non-financial risks.

“I would argue that there’s no such thing. There are risks that are hard to quantify, but they’re never non-financial.

“It is quantifiably financial, but it might just be really hard to see. The authenticity gap or the what I call tokenism, is the real risk.”

“There is a greater chance than inevitable that we will have regulation that will deal with what could be described as greenwashing,” Delahunty says.

“It might come in the form of a regulator-led process, we know that ASIC is currently looking at this closely. ASIC is already meeting with their US and European counterparts on potential taxonomies and a common regulation or language.

“But at the moment, we’re also almost seeing regulation being developed through the courts. Integrity in decision making on the basis of climate factors has been a growing area for the courts.

“In Australia and the US, we’re seeing a number of mining licenses being challenged in the courts, and so I think it’s interesting to see how regulation will come – will it be regulator-led, or through the interpretation of court processes.”

“Yes, executive remuneration should be linked to strategic plans, and this should be done by aligning shareholder expectations and executive behaviour over the long term,” Delahunty says.

“If executive behaviour is not being fairly incentivised or remunerated, then you’ve got a misalignment between the shareholders and the executive behaviour.

“More broadly, patient capital like super is looking for the behaviour that helps in the long term.

“I worry that executive teams may be getting mixed messages from a shareholder group that traditionally might have been looking at next quarter’s results.

“ESG investors want to know about the plans for the long term, and that’s where executives should be focused.”

“As an investor, we understand that gender diversity can add to the performance of a company,” Delahunty says.

“Our advisory looks at a company’s board and their executive, and I’m quite interested in what an understanding of gender diversity does to the system.

“So Seven Advisory is the enabler to allow that conversation to mature a little bit.

“We also provide a verification service of product claims that comes with a legal assurance in partnership with a law firm.

“One of the biggest issues facing people in the investment community who want to incorporate ESG is probably the lack of consistent data in order to do so,” Delahunty says.

“We’ve seen jurisdictions across the world including New Zealand that have made ESG data and reporting mandatory, and I think we should see that in Australia as well.

“The biggest challenge for the company is defining what that “S” actually is, and quantifying how it is a risk to the business.

“For example, I’m sure AMP wouldn’t have had gender diversity or gender equality as a major risk on their risk register. But as we saw, their lack of attention to gender issues internally has had a material impact on the share price.

“These things are often not unquantifiable, sot it’s difficult to start the conversation and that’s a challenge.

“So at Seven Advisories, we’re focused on helping companies understand those risks, and being able to really bridge the gap between what looks like shareholder activism, which is just an attempt to have a conversation, and the company’s behaviours and actions.”

As reported by Stockhead’s Jessica Cummins:

Iron ore giant Fortescue Metals Group (ASX:FMG) has applied for clearance from the West Australian Environmental Protection Authority as part of a multibillion-dollar plan to construct and operate a renewable energy generation hub in Western Australia’s Pilbara region.

Set to rival the state’s Southwest grid, the Uaroo Renewable Energy Hub would see the electrical generation of up to 5.4 gigawatts from 340 wind turbines and a solar farm

Kalamazoo Resources (ASX:KZR) has become the first gold-lithium company operating in Australia to be certified ‘carbon-neutral’ under the Federal Government’s Climate Active Program.

Climate Active – the certification KZR has received – is the “most rigorous and credible” carbon natural certification within Australia.

Marvel Gold’s (ASX:MVL) spinout Evolution Energy Minerals (ASX:EV1) has been given a ‘B’ ESG rating from Digbee’s independent ESG experts at both a corporate and project level.

The research platform has provided the graphite-focused stock with numerous recommendations for improvement, which if applied, would deliver a substantially higher score of at least an ‘A’ by the second half of 2022 and attract “ESG funds looking to invest in battery minerals.”