You might be interested in

ESG

The Ethical Investor: Why Australian Ethical Investment dumped Lendlease, but loves Woolies

News

The Ethical Investor: The problem with ESG ratings, and an interview with ClearBridge's Mary Jane McQuillen

News

News

Recently published data shows that modern slavery globally has risen to 50 million, meaning that nearly one in every 150 people in the world are in some form of forced labor or forced marriage.

These disturbing figures, released in a report by the UN’s International Labor Organization, show that 10 million more people are in modern slavery in 2021 compared to 2017 global estimates.

The report vividly demonstrates how far we still have to go to achieve the Sustainable Development Goals (SDGs) target of ending modern slavery universally by 2030.

Modern slavery is a global issue and no region is untouched by modern slavery practices, even in developed countries like Australia.

The Global Slavery Index estimates that 15,000 people in Australia lived in conditions of modern slavery in 2018, and this number is likely to have increased over the last four years.

Cases of forced labour exploitation in Australia predominantly occur in industries considered at risk – including agriculture, construction, domestic work, meat processing, cleaning, hospitality, and food services.

Many of these industries employ a high percentage of migrant workers who enter Australia through its temporary visa scheme designed to fulfil Australia’s labour shortages.

In addition, the realities of global trade make it inevitable that Australia, like many other countries globally, will also be exposed to the risk of modern slavery through the global supply chains and the products we import.

Here’s the top five products imported by Australia from countries which are at risk of using modern slavery in the production of these goods:

A report by Monash University revealed that more than a third of Australia’s largest listed companies have poor modern slavery disclosures.

According to the scathing 2021 report, a big part of the problem was that these companies don’t understand the risks in their supply chains.

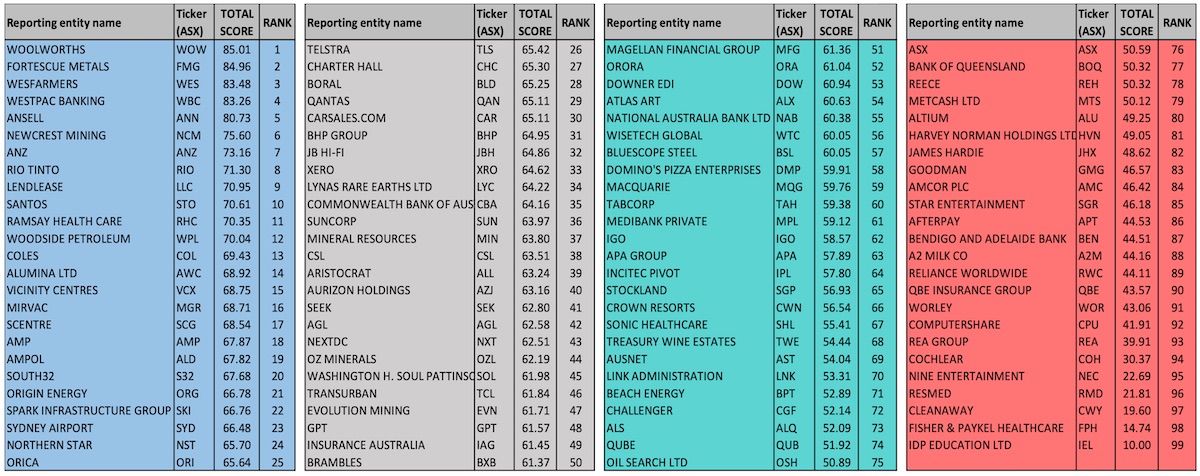

Lead researcher, Dr Nga Pham, said the findings revealed that larger companies with large employee numbers and big supply chains tend to score better in the ranking.

Here are the Modern Slavery Disclosure (MSD) scores for the ASX’s largest 100 companies – showing that Woolworths (ASX:WOW) and Fortescue (ASX:FMG) are leading the way.

Ndevr Environmental is a Melbourne head-quartered climate change and human rights advisory firm, focused on accelerating the economy’s transition to a sustainable, net zero future.

The firm is a certified B-Corp since 2017, and is also certified carbon neutral under the Australian Government’s Climate Active program since 2017.

We ask Brian Kraft, the company’s Principal Consultant, about the importance of modern slavery for investors.

WHY IS MODERN SLAVERY CRITICAL FOR COMPANIES TO ADDRESS?

“I’ll explain that in two ways,” Kraft told Stockhead.

“The first is the regulatory issue about why you’re seeing all those ASX companies respond to the Australian Modern Slavery Act.

“There’s a clause in the Act that obligates companies to ultimately be responsible for their supply chain’s sources.

“They are ultimately held responsible by that piece of legislation for ethical sourcing all the way down to the source materials, so that’s a huge challenge.

“What I’m seeing is that most companies don’t have that sorted yet. No one really knows their supply chain to the source in Australia, so that’s really the struggle.

“But the other perspective is the human perspective.

“To see that, we have to take into mind that one in 170 humans on Earth are in conditions of slavery right now. That’s a preposterously high number, and it’s so easy to forget about that when we’re living in Australia.

“People here feel like it’s not an issue, but there are some 15,000 slaves in Australia, and maybe around 3000 in New Zealand.

“That may not be a lot compared to India or China, but 15,000 is 15,000 too many, especially here in Australia.

“The real struggle here is our imports, the stuff that we bring in from overseas, which have a social cost to it. And we’re not currently factoring in that social cost.”

WHERE DOES MODERN SLAVERY SIT IN ESG?

“Typically modern slavery will sit in the ‘S’, or in other words, in the social aspects of ESG,” said Kraft.

“It’s interesting because the S has been fairly well ignored and neglected for a very long time.

“In the past when people thought of ESG, they mostly thought about carbon or ecological impacts like waste or recycling.

“But now, ‘ignore the S at your own peril’ is something I often say to my clients.

“Because no one’s going to ignore 50 million humans in slavery, particularly when half of those are in the supply chains that we use every day, including in Australia.”

WHAT OTHER ISSUES ARE IN THE ‘S’ ?

“It’s not just modern slavery, there’s also discrimination in diversity and inclusion, fair wages, reconciliation, health and safety, land rights,” explained Kraft.

“Working hours for example, is a big issue now in Australia.

“And these are just a few issues that have increasingly come to the fore during COVID-19, and stakeholders are now starting to demand more maturity around these issues.

“Companies can’t ignore the ‘S’ anymore, because it’s a really important issue.

“There are elements of good governance that can help mitigate your exposure to the issue of modern slavery.

“But ultimately, this is an issue of humanity – it’s a social issue.”

CAN COMPANIES ‘GREENWASH’ THEIR ESG SHORTCOMINGS, INCLUDING MODERN SLAVERY?

“That’s an important question that consultants like us ask ourselves every day,” said Kraft.

“It’s something that we as consultants seriously consider all the time. But I would say that I am seeing a pretty significant shift.

“In the past, investors used to seek companies that simply had a sustainability report or maybe some disclosed ESG-related stuff – and that was enough at that time.

“But now, 80% of companies that KPMG recently surveyed, for example, have sustainability reports in some form. That’s a pretty big change. It’s the base standard now.

“So what we’re seeing is investors and stakeholders including employees and communities wanting better evidence of ESG maturity.

“They want sustainability to be better integrated into the corporate strategy, and they want more evidence that the data is actually improving for the company.

“So the good thing is, it’s getting harder to greenwash and it’s getting harder to social wash.

“These days, you can’t just declare yourself a sustainable company anymore, you have to prove that things really are heading in the right direction,” said Kraft.