You might be interested in

News

Closing Bell: ASX rebounds as soft CPI bolsters August rate cut hopes; OSX and TLM lead today's winners

News

ASX Small Cap Lunch Wrap: Who's breaking down global barriers with pictures of cats today?

News

News

If you thought the Nasdaq jumping 7% late last week was cute, how about shares in Magellan Financial soaring some 10% before lunch on Friday?!

As the history books show, on September 20, 1519, five ships carrying about 270 screaming Spaniards led by explorer Ferdinand Magellan left the port of Sanlúcar de Barrameda sailing west — and just kept going.

Fast forward 500 years and, to be fair, if that original epic journey was tough, then October – nay 2022 – has merely been a continuation of those struggles in what’s been an absolute blood fest for the Hamish Douglass-less Aussie team at Magellan Financial (ASX:MFG).

…240 men began Magellan’s voyage around the world… only 18 finished it’ – (Nat Geographic) – Granted special powers and privileges by the King of Spain, talismanic explorer Hamish Doug… I mean, Ferdinand Magellan led his Armada from Sanlucar de Barrameda, southwest across the Atlantic Ocean, to the eastern coast of South America, and down to Patagonia…

It’s not been a season of riches for listed fundies by any stretch of the imagination.

What we’re calling the ‘equity de-risking’ abandonment of the listed fund manager sector has been a cruel time for the formerly formidable names of Platinum AM (ASX:PTM), Janus Henderson, T Rowe Price and Blackrock, which have all seen their stock price defenestrated between about 35% to 40%.

Unfortunately for the troubled Magellan, those numbers are admired with some greed and much envy.

It’s been tough sailing at MFG by comparison.

UBS notes that while the Aussie subsidiary of Florida-based global wealth advisor GQG Partners (ASX:GQG) marked its second month of outflows, they reckon the bulk of the lately hit listed asset managers “were more insulated relative to Magellan and Platinum, both of which saw much sharper impacts with net outflows experienced sector-wide as client de-risking continued.”

UBS says structural outflows are the problem for both MFG and PTM and they’re pretty much likely to be “persistent and painful”, (whilst GQG, for example) should see a quicker return to normalised inflows once cyclical de-risking abates, which UBS assume occurs into 2023.

“On investment performance, GQG remains the standout given energy exposures while MFG/PTM underperformed,” the investment bank said in a note to clients late last week.

…Despite a series of storms and mutinies, the expedition – led unerringly by Key Man, fearless helmsman, Hamish D… I mean F Magellan… successfully passed through the Strait of Magellan into the Mar del Sur, which Ha… Magellan renamed the “Peaceful Sea” (the modern Pacific Ocean).

Of course, the bleeding over at Magellan comes from more than just structural wounds – or as several analysts have put it the headline drama of MFG co-founder and part-time legend Hamish Douglass flogging shares can’t be a welcome sight for investors.

Thursday last week, despite laying out a pathway back to $100bn in Funds Under Management at their AGM, Magellan crashed a further 5% and until Friday’s burst of vigour, didn’t look like getting anywhere off the mat until the board can deliver a less disastrous performance.

Let’s quickly recap how it came to this.

December 2021: Douglass assures he and newly ex-wife have “no intention to sell” which would be “absurd.”

February 2022: Douglass off on medical leave.

February: MFG’s flagship global fund cops first of a series of ratings downgrades courtesy of Zenith.

March: Douglass exits MFG board “due solely to his medical leave of absence”.

June: Douglass formally ends tenure as MFG employee.

June: Incoming CEO/CIO David George announces he will fast-track a Douglass resurrection as a consultant supposed to kick off last month to provide “valuable investment insights, including geopolitical and macroeconomic views.”

STILL June: ASX says MFG stock to exit S&P/ASX 100 index triggering a single day 14% horror movie crash.

July: George officially takes over as CEO.

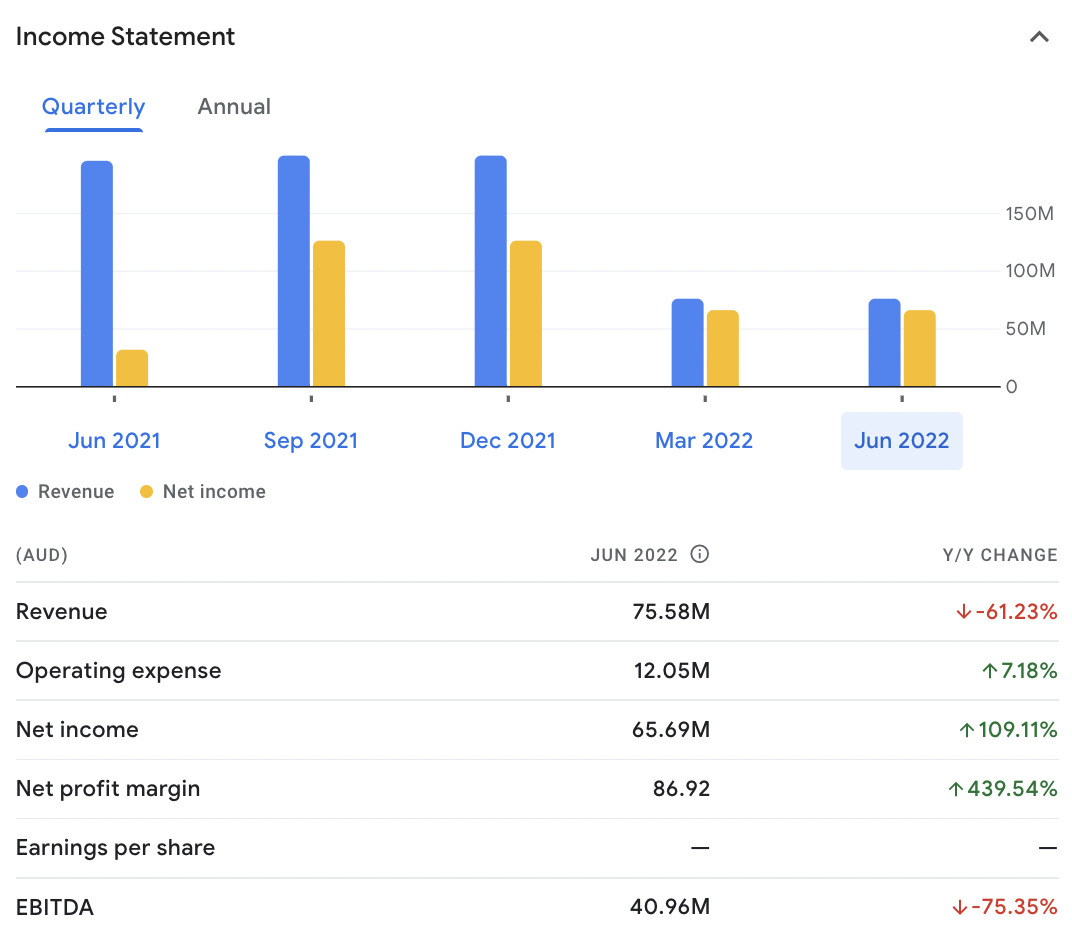

August: Officially fronts shareholders after a 46% FY22 crash in FUM, (to $61bn), an 11% fall in funds management profit. Stock falls a further 8.5 % in one session. Is down 68% y-o-y. Says no more surprises.

August: George surprises shareholders saying he’ll also be chief investment officer as well as CEO, instantly enhancing ‘key person risk’.

September: Institutional clients desert ship, pull billions from MFG funds.

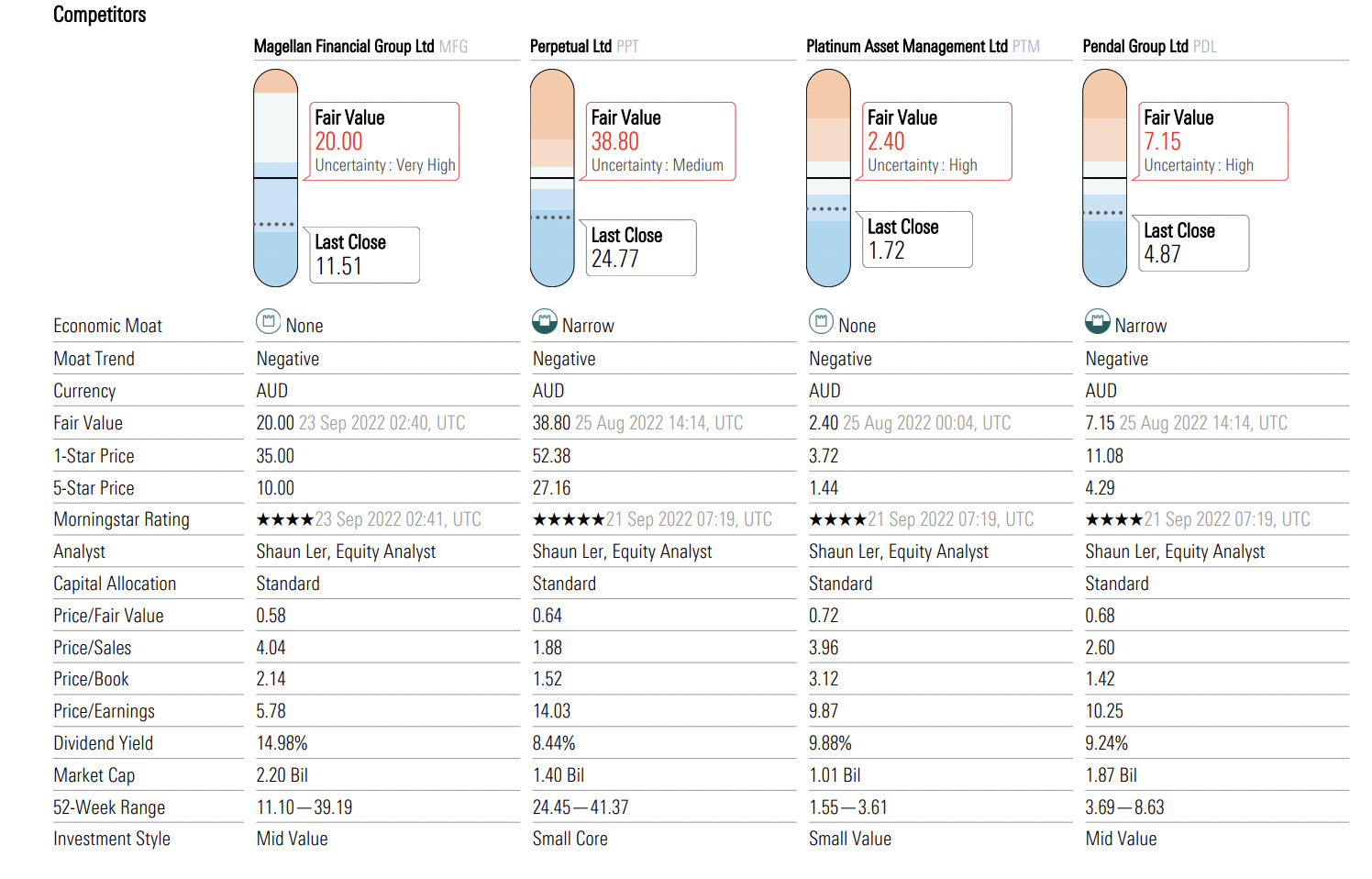

September: Morningstar’s Shaun Ler downgrades MFG, citing heaps of problems, but key person risk was right up there.

October: Following above revelations MFG bleeds out a further 8.5% to 12 month low of $10.75.

October: MFG market cap sinks below $2bn, an 80% haircut on July 2020 market cap of $10bn.

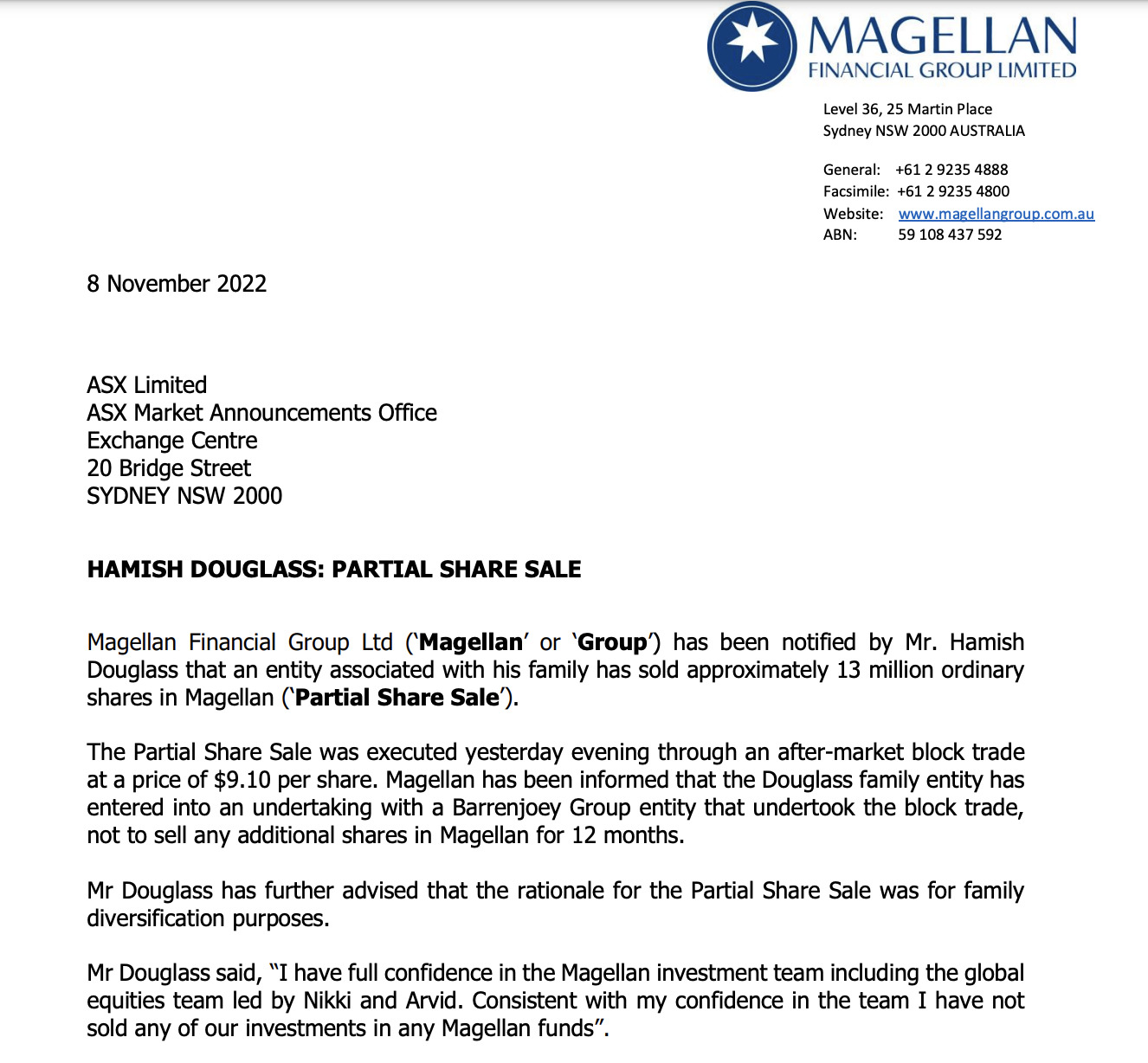

MFG has taken back some ground, despite Douglass selling $118m of stock at $9.10 to a bunch of institutions. That said, (and don’t tell the kids), his tranche of stock was worth circa $730m about two years ago.

UBS – being delicate – says the sales and the press the move garnered is likely to continue to further weigh on the stock.

“A fundamental turnaround appearing some years away.”

When the new, former Future Fund CEO and CIO David George spoke at MFG’s (AGM) annual general meeting last month, he reassured shareholders that Magellan’s funds under management would be back above the $100bn mark lickety-split.

“Through growth of our existing strategies and new products, I believe we will be a fund manager of global scale once more with over A$100 billion of funds under management after five years,” he said.

He cited the strong balance sheet and capacity to return to AUM growth. George also clarified that the growth to come will be more diversified in nature as Magellan moves away from its reliance on the global equities business.

He sees the company offering a diversified range of products that are attractively positioned in growing segments to meet client demand.

UBS does not.

Neither does Morningstar.

Morningstar’s Shaun Ler’s late September excoriating – and often painful – note was a landmark moment in fiscal truth telling.

Ler’s trademark, straight-shooting style hovers between black and comedy.

And when delivered in such a chillingly frank and observational style it needs be shared largely verbatim below. The note is so disarmingly alarmist that it may trigger some history minded readers back to that fateful day on April 27, 1521, when Ferdinand Magellan himself was skewered by a poison arrow during a skirmish and left to die a slow and agonising death on an obscure island in the Philippines.

…The expedition reached Guam and, shortly after, the Philippine islands. There Magellan was killed in the Battle of Mactan in April 1521. Under the command of captain Juan Sebastian Elcano, the expedition later reached the Spice Islands.

Meanwhile, the Swiss investment bank only this week further reduced the price targets for MFG by -9% (for PMT it was -6%), putting things this way, and they don’t get much clearer:

“GQG remains our top-pick in the funds management sector with PTM/MFG least preferred.”

To navigate back to Spain and avoid seizure by the Portuguese, the expedition’s two remaining ships split, one attempting, unsuccessfully, to reach New Spain by sailing eastwards across the Pacific, while the other, commanded by Elcano, sailed westwards via the Indian Ocean and up the Atlantic coast of Africa, finally arriving at the expedition’s port of departure and thereby completing the first complete circuit of the globe…

In the analyst equivalent of the Battle of Mactan, Ler downgraded M’star’s proprietary “economic moat” rating to None. This measurement refers to the chances a company can keep competitors at bay over the mid-term – so None is not a terrific start.

“The erosion of Magellan’s moat stemmed from performance. But it was amplified by key person risk coming to pass and inadequate efforts to restore investor sentiment. Collectively, these events dented the firm’s reputation,” Ler wrote.

Ler also downgraded Morningstar’s capital allocation to Standard, from Narrow and Exemplary, in a note which reads more like a thoughtful essay, and which began “We believe Magellan has outlived its grace period with investors”. And really, things only got worse from there.

“We cut our fair value estimate on Magellan to AUD 20.00 per share from AUD 28.50,” Ler said shaving 30% or so off the target in one minty breath:

“Unforeseen management issues and underperformance have meant an erosion of the moat. We expected Magellan to perform and clients to stay through occasional bouts of underperformance. But we underestimated the market disruption to Magellan’s investment style, and performance has not materially improved since it began in late 2020. We also understated the downside from the dilution of Magellan’s brand, evidenced by mandate losses and outflows.”

Even if Magellan were to improve its track record, Morningstar says the fundie’s competitive position is shot and “unlikely to be regained”.

“Some funds, such as its global fund, were almost a default for advisers and money managers. Combined with an abundance of alternatives, Magellan has matured in the global investing space, in the Australian context.”

The days of MFG’s saucy, above-average retail fees are starting to look a bit on the nose and are “becoming difficult to justify”.

“We underestimated the downside from investors’ loss of trust in Magellan,” Ler wrote.

In the 12 months from when the first net outflows started, MFG may’ve lost some $50bn; that’s circa half of all Magellan’s starting FUM.

While Magellan has sizeable FUM, likely redemptions and expense growth diminish its ability to compound earnings.

“The building blocks that helped fortify Magellan’s moat — like its distribution reach and positive fund ratings — are redundant if its reputation is dented or if it does not deliver satisfactory investment returns.”

Evidently, they failed to prevent the large bouts of redemptions that we saw over 2021-22.

“We also underestimated the current market cycle’s disruption on Magellan’s investment approach,” Ler adds.

“We believed Magellan’s underperformance was transient and it could promptly return to outperforming to support FUM and earnings growth. This did not happen.”

Like the sharp selloff in MFG’s China names.

“But other culprits are the high-quality (in Magellan’s lens), long-duration investments that Magellan favours, which often trade at relatively higher multiples, such as the high growth technology names. They are very sensitive to rising interest rates, which explains why the flagship Global Equity portfolio has failed to materially improve performance since November 2020.”

“We don’t know when external conditions will help Magellan’s investment style, but many investors are opting to move on. In the retail channel, net outflows often persist and can take years to reverse.”

Even if Magellan’s track record improves, it needs to contend with better-rated peers. In Australasia itself, Morningstar’s manager research team rates more than 40 global, large cap “growth” or “blended” strategies as Gold/Silver/Bronze medallists.

“We no longer believe the group will compound earnings at high rates. It’s clear that Magellan’s brand has deteriorated.”

“It will take time for its new portfolio managers to build credibility and for new management to restore its growth.”