Small Cap Lunch Wrap: ASX keeps cool as jobs shock mutes Fed Euphoria

News

News

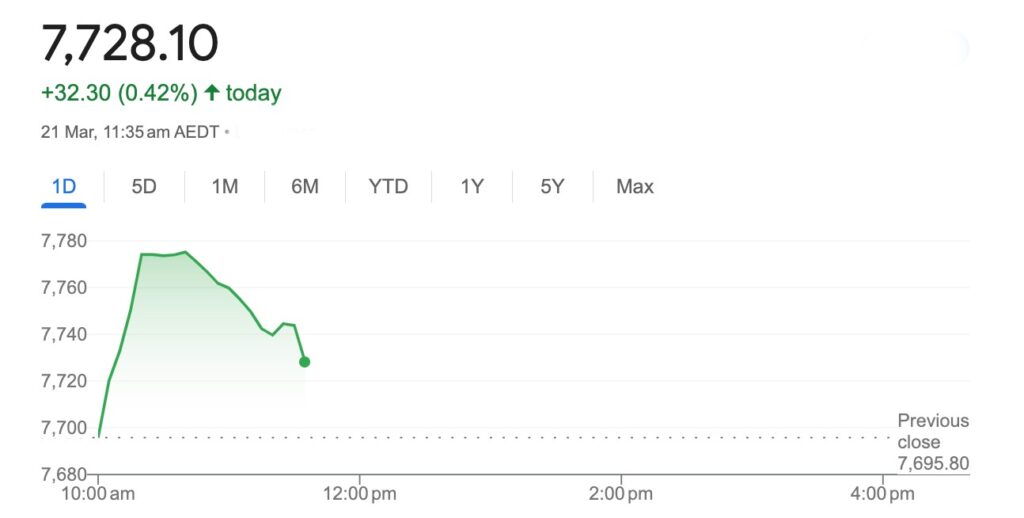

Aussie markets bounced higher out of the gate at the open after US indices did the same following the US Federal Reserve’s overnight decision to keep rates on hold.

At 11.40am in Sydney on Thursday March 21, the S&P/ASX 200 was thusly:

Early on Thursday morning the clear signals from US Fed officials that they’re foreseeing a 2024 featuring three interest rate cuts had an equally clear effect on the usual suspects.

The S&P500 closed at a new, new record high – above 5200 points – The Dow Jones nudged new, new highs and the Nasdaq Composite finished up 1.25%.

In Tokyo, the Japan Stock Market Index (JP225), zoomed to a new, new all-time high. Although, being up more than 45% over the last 12 months, the heavy lifting had largely been done prior to the US rates call.

Bitcoin has started rising again, up 1.1% since 5am (AEST) and the price of gold almost immediately surged to a fresh record high of $US2,224. Local gold miners rallied, with Evolution adding over 4% and Northern Star adding 3%.

But outside of Fed Euphoria, there’s a fair bit else going on for local traders to absorb on Thursday morning.

While the Wall Street response to the FOMC decision to hold the federal funds rate (FFR) steady at 23-year highs of 5.25% – 5.5% sent the SPI Futures into overdrive, the reality in Sydney has been tempered by several mitigating factors.

We’ve had an extra session to absorb a largely baked in RBA decision to hold, private sector activity expanded for a second straight month and the unemployment rate just went off like a firecracker.

The jobless rate in February evaporated to a surprise 3.7%, adding 116,500 jobs and certainly making the argument for faster rate cuts at home harder after the Australian Bureau of Statistics dropped the bombshell at 11.15am.

Almost all the forecasts were grossly inadequate.

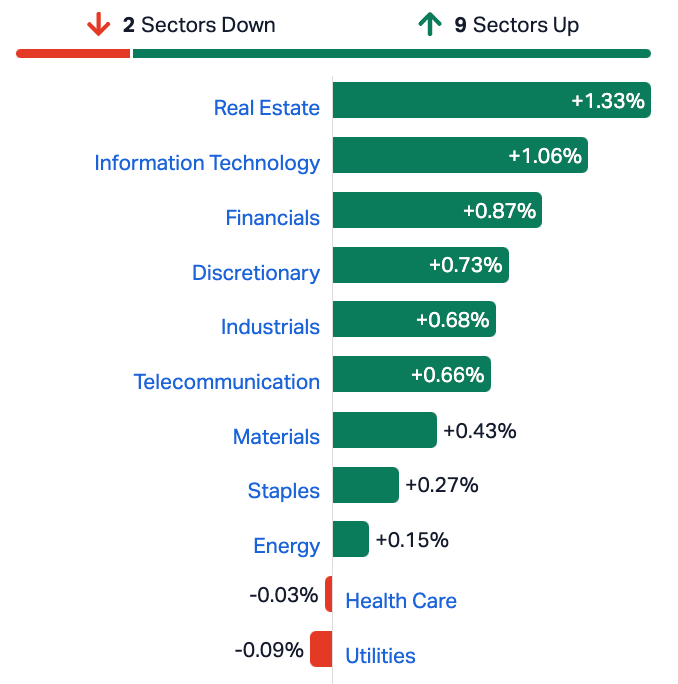

The news has trimmed gains, although almost all sectors were in the green at lunch.

On Wall Street overnight, US markets continued to rally with the S&P 500, Nasdaq and Dow Jones index all closing at new highs after the Fed reaffirmed its intention to cut rates at least three times this year.

The S&P 500 closed up 0.9 per cent to finish above the 5,200 level for the first time. The Nasdaq Composite closed up 1.3 per cent, and the Dow Jones rose 1 per cent, to finish at a record high.

As expected the Fed left interest rates unchanged and gave the market an additional boost by saying that it plans to cut rates three times before the end of the year. However, the Fed also tempered expectations by flagging that it still needs more evidence in the short term that inflation is easing.

Mega tech and the US banking sector led the gains after the 2pm (New York) Fed decision.

American Express gained almost 3% while the S&P Regional Banking ETF closing up 3.5%.

In the tech sector Alphabet, Amazon, Microsoft, Apple and Nvidia all rallied circa 1% with Meta closing 2% higher.

Oil prices are about 0.5% higher.

Iron ore has added almost 4%.

Gold is higher and copper is too.

The Aussie dollar has gained after the Fed call.

And Bitcoin is up 1%.

Eastern Resources (ASX:EFE) has returned several high grade lithium hits from drilling at its Lepidolite Hill project, including a highlight 11m at 2.27% Li2O from 49m (incl. 5m at 3.87% Li2O).

Most of the lithium appears related to lithium silicates petalite and/or spodumene, it says.

Meanwhile, Ausmon Resources (ASX:AOA) has returned “very encouraging” rare earths drill results from the Parrakie exploration licence in South Australia.

Here are the best performing ASX small cap stocks for March 21 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AOA Ausmon Resorces 0.003 50% 350,000 $2,117,999 AYM Australia United Mining 0.003 50% 1,359,547 $3,685,155 SIH Sihayo Gold Limited 0.0015 50% 250,000 $12,204,256 SIT Site Group International 0.003 50% 17,361 $5,204,980 CLZDC Classic Min Ltd 0.019 36% 2,570,686 $3,609,224 LNU Linius Tech Limited 0.002 33% 2,054,907 $7,795,111 MRZ Mont Royal Resources 0.085 29% 86,825 $5,611,966 ATH Alterity Therapeutics 0.005 25% 200,000 $20,952,072 EFE Eastern Resources 0.01 25% 25,626,219 $9,935,572 RNT Rent.Com.Au Limited 0.048 23% 2,372,192 $24,556,333 AKG Academies Australasia Group 0.245 23% 4,004 $26,522,893 CST Castile Resources 0.077 20% 161,675 $15,481,755 BDG Black Dragon Gold 0.03 20% 404,109 $5,016,751 LDR Lode Resources 0.085 20% 214,530 $7,581,674 ILT Iltani Resources Lim 0.155 19% 1,000 $4,421,366 NAM Namoi Cotton Ltd 0.59 19% 1,505,256 $101,524,678 ALV Alvomin 0.16 19% 188,530 $12,572,592 CKA Cokal Ltd 0.084 18% 1,376,633 $76,605,378 CC9 Chariot Corporation 0.26 18% 129,937 $17,992,999 ASM Ausstrat Materials 1.4 18% 1,725,901 $198,482,459 ILA Island Pharma 0.07 17% 160,000 $4,876,108 EXL Elixinol Wellness 0.007 17% 265,071 $3,797,230 GMN Gold Mountain Ltd 0.0035 17% 3,883,055 $8,926,517 HHR Hartshead Resources 0.007 17% 117,900 $16,852,093 TTT Titomic Limited 0.052 16% 2,855,276 $41,073,377

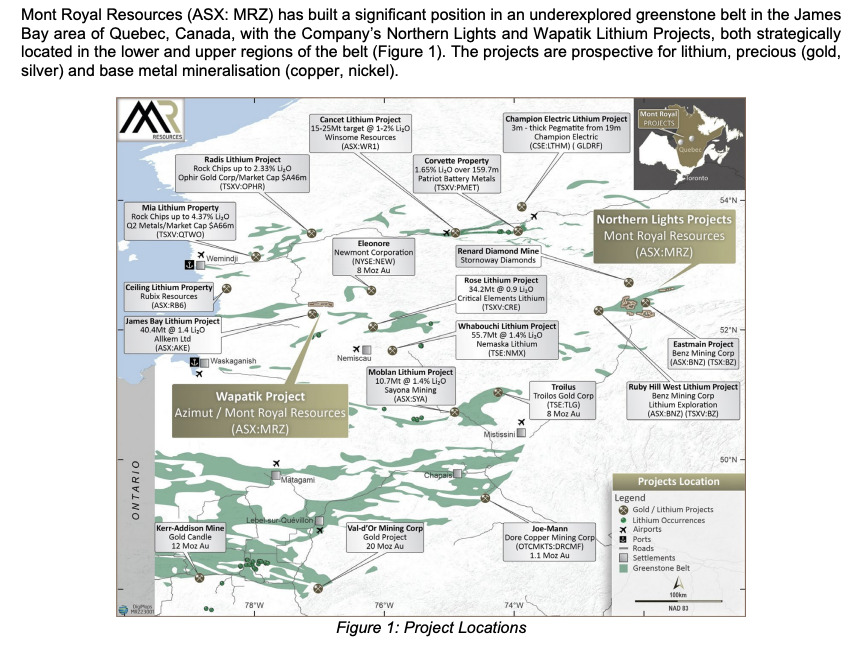

Something fine is happening over in Quebec for Aussie-listed Mont Royal Resources (ASX:MRZ).

I’ll do some digging, because as far as I can tell, while they have been, they’ve not dug anything up of outrageous note lately.

The principal activity of the MRZ group over the six months to the start of this month was the farm-in and exploration of the Wapatik Gold-Copper Project and the exploration on the Northern Lights Minerals projects in the Upper Eastmain Greenstone Belt in Quebec, Canada…

I’ll hit the phones and see what Josh or Reuben know, although, it’s not a terrible time to be in the lithium, gold and copper business.

Another early winner on Thursday is Australian Strategic Materials (ASX:ASM).

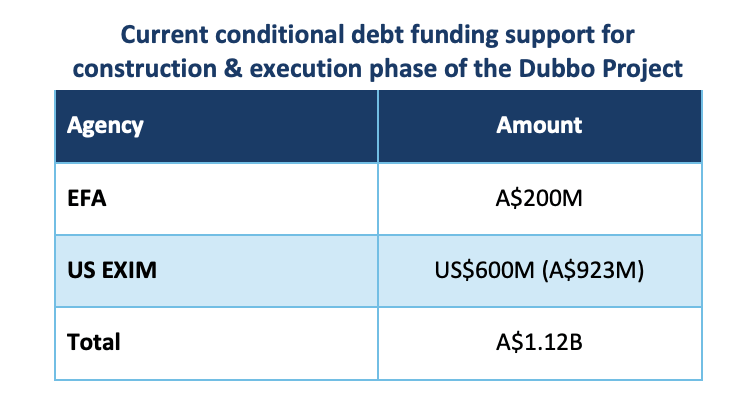

The diversified miner says it’s received a non-binding Letter of Interest from the Export-Import Bank (EXIM) of the United States for debt funding up to US$600m ($923m) to build the Dubbo rare earths and critical minerals project.

The US EXIM is the official export credit agency of the US federal government and a fine friend to have throwing money your way when it comes to strategic partners.

ASM says that US government support is “a catalyst to increase customer and financing focus” in North America.

Certainly, there’s movement at the funding station in Dubbo…

The company says funding follows Export Finance Australia’s previous conditional finance support of $200 million debt funding.

And just quickly, Namoi Cotton (ASX:NAM) has been thwacked with a surprise 59¢ a share takeover bid from Olam Agri Holdings.

The Olam offer comes after the Louis Dreyfus Company popped the question previously at a mere 51¢ a pop.

NAM’s board has told shareholders to stay put. It’s a bit of a quandry actually, as NAM’s directors will need to think hard about the latest offer in the context of its exclusivity obligations to Louis Dreyfus.

Here are the most-worst performing ASX small cap stocks for March 21 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SCT Scout Security Ltd 0.008 -33% 3,387 $2,789,129 MPK Many Peaks Minerals 0.06 -29% 100,000 $3,397,334 CTN Catalina Resources 0.003 -25% 50,000 $4,953,948 LSR Lodestar Minerals 0.0015 -25% 2 $4,046,795 MRD Mount Ridley Mines 0.0015 -25% 1,019,608 $15,569,766 TTI Traffic Technologies 0.006 -25% 3,756,497 $6,061,361 1CG One Click Group Ltd 0.008 -20% 64,542 $6,881,788 HLX Helix Resources 0.004 -20% 20,541,764 $11,615,729 ME1 Melodiol Global Health 0.004 -20% 162,201 $1,964,980 ROG Red Sky Energy 0.004 -20% 269,375 $27,111,136 MXO Motio Ltd 0.023 -18% 168,651 $7,509,554 MHC Manhattan Corp Ltd 0.0025 -17% 431,225 $8,810,939 PNX PNX Metals Limited 0.005 -17% 4,443 $32,283,748 BPM BPM Minerals 0.08 -16% 472,176 $6,376,610 BNL Blue Star Helium Ltd 0.006 -14% 18,806,788 $13,595,857 OSL Oncosil Medical 0.006 -14% 11,940,486 $13,821,788 EAX Energy Action Ltd 0.195 -13% 15,931 $6,775,560 AML Aeon Metals Ltd. 0.007 -13% 225,888 $8,771,205 RIE Riedel Resources Ltd 0.0035 -13% 5,008 $8,895,343 RDG Res Dev Group Ltd 0.035 -13% 464,434 $118,034,325 ESK Etherstack PLC 0.22 -12% 7,641 $32,996,751 PPL Pureprofile Ltd 0.023 -12% 3,748,285 $30,132,961 PEC Perpetual Res Ltd 0.008 -11% 1 $5,760,265 PUR Pursuit Minerals 0.004 -11% 90,410 $13,247,871