Closing Bell: Smug ASX ends Tuesday higher, but not much better

Via Getty

- The ASX benchmark has ended Tuesday higher

- 8 of 11 sectors in the green

- Small caps led by Plenti Group (ASX:PLT), InteliCare (ASX:ICR)

The local market has trimmed some of its early gains (wussed out) after jumping out of the blocks in morning trade.

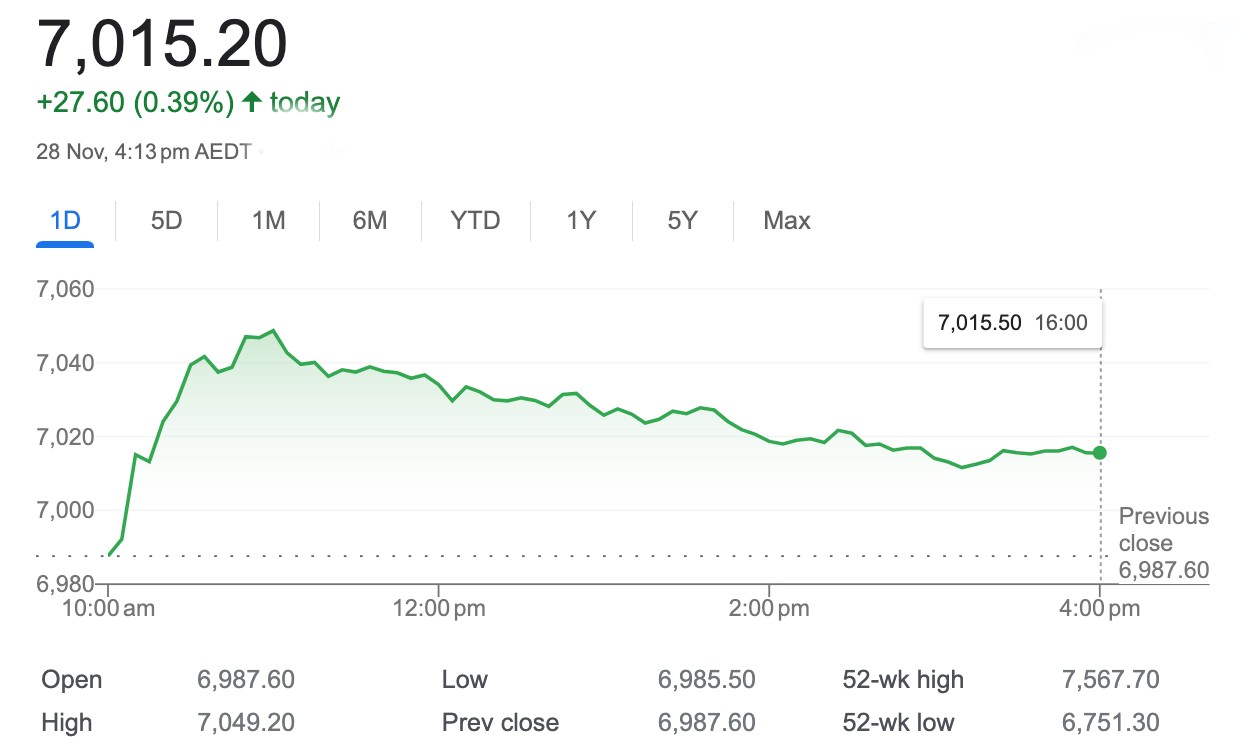

At match-out on Tuesday November 28, the S&P/ASX 200 (XJO) index was up 27.6 points, or +0.39%:

Local traders took the easy runs in the morning session while they were there, seeing a Monday-sized hole in a fair few blue chip stocks.

The major banks, the heavyweight iron ore miners and the supermarkets among a slew of household names to offer buying opportunities on Tuesday.

But, as often happens on the local bourse, the cold light of afternoon trade illuminated a few harsh realities.

Monthly CPI data drops tomorrow, and while Reserve Bank of Australia governor M. Bullock might be out of town (she’s at a big central bank thing in Hong Kong) the pressure on prices never sleeps.

Certainly it’s hard to when everyone keeps dropping significant commentary on it.

The local UBS economic team for example reckons that the RBA will hold and not hike in December – which everyone’d already agreed over – but then suggested there’s “now a material risk of a 25 basis point hike in February”.

The monthly CPI read is a big part of that puzzle and the data looms – if not quite like the Sword of Damocles, then at least like the aluminium cricket bat of Dennis Lillee – over free-handed local trading.

“UBS’s base case remains the RBA will remain on hold at 4.35 per cent and raise rates only if ‘forced’ by the data.”

In Honkers, according to News Ltd, M. Bullock’s made a speech which seems to complain that the bank’s 13 hikes in 18 months have stirred up “a lot of political noise and a lot of noise from the general public.”

I’m sure – like the haircuts – that’s being taken out of context.

‘Speaking at a conference in Hong Kong alongside other senior central bankers from Europe, UK and Asia, Ms Bullock told the audience that 45 per cent of Australians had a mortgage, either over their own home or an investment property.

“And that’s created a lot of noise. People are very unhappy,” she reportedly said.

I’m sure – like the haircuts – people won’t go on and on about it.

In company news, let’s play one up and one down.

Firstly, and let me be plain – Collins Foods (ASX:CKF) is a franchisee that operates 270 of the approximately 750 KFC stores in Australia.

However, it does not own KFC. The lucky business to make that claim globally is the appropriately entitled YUM! I think it could be YUM! Brands, but as long as the exclamation’s in there, I think we’re good.

As a consequence, Drew O’Malley is the CEO of Collins Foods, the largest franchisee of KFC stores in Australia. He is not the CEO of KFC Australia (of which there are circa 750 stores in Australia).

That clarified, it’s been a finger lickin’ good set of results for the franchisee which is not KFC but does run some 270 of the circa 750 KFC stores in Australia.

In a first half earnings bonanza, revenue from continuing operations are up 14.3% to $696.5 million (HY23: $609.4 million) with strong growth across all business units.

Statutory NPAT of $50.5mn looks particularly good against the $11mn in HY23, which does include the payout on the sale of Sizzler Asia (of $20.2 million in HY24).

A fully franked interim dividend of 12.5 cents per ordinary share (cps) is the gravy on the mash.

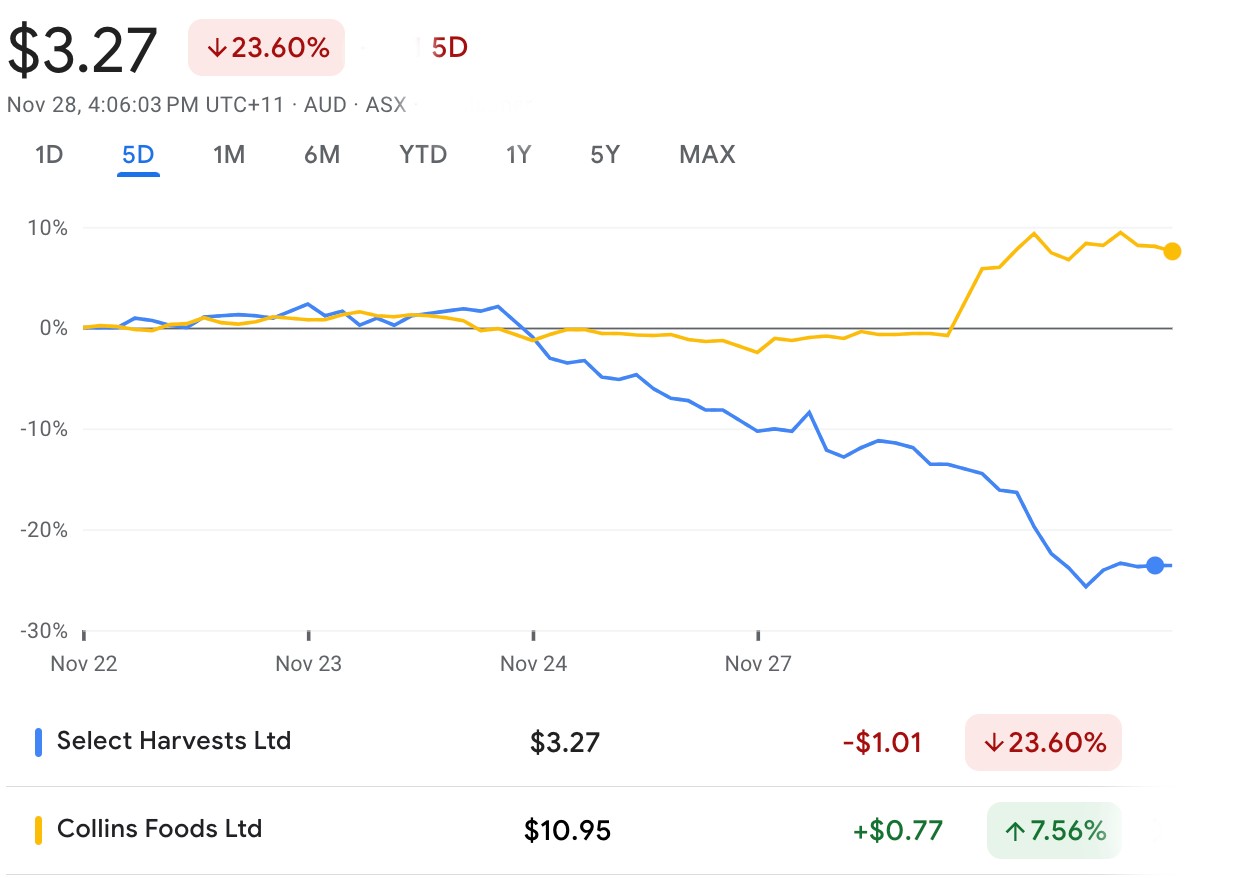

On the other side of the discretionary coin, Select Harvests (ASX:SHV) just cannot win a trick, shedding another -10%, after dropping FY23 numbers of uncommon ordinariness last week.

The Aussie almond grower with orchards here and in California copped a $115mn loss as the global almond market has been smashed by unseasonally wet weather and the Verroa mite concurrently and literally eating into output.

After seeing its share price whittled away over the last few sessions, the heavily shorted stock looks like it’s moving into phase 2 of selling – the one where investors look under the hood and realise SHV operates on thin margins with an upside down balance sheet almost to the tune of $200mn.

CKF vs SHV 5 days

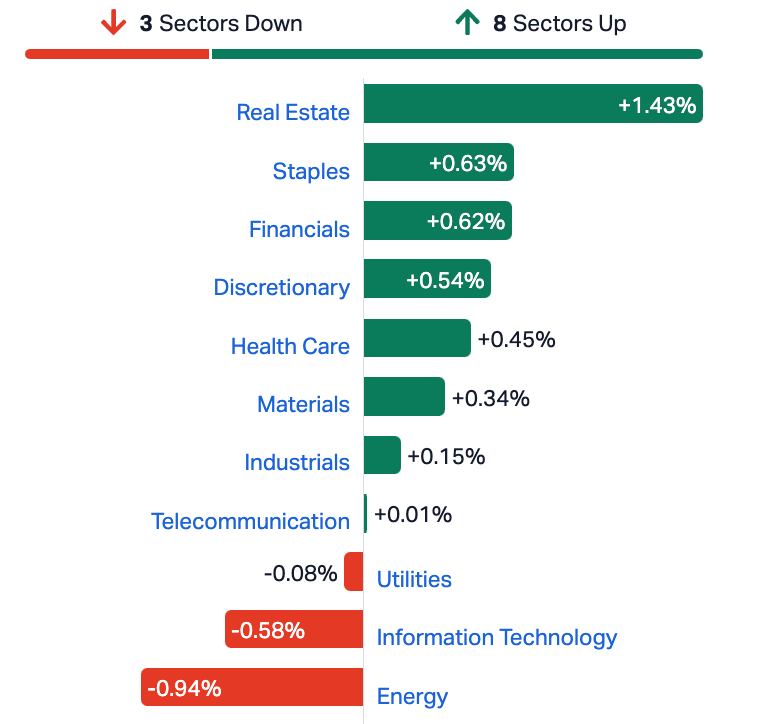

Eight of the 11 ASX sectors closed higher on Tuesday, with volatile oil prices escalating losses in the Energy Sector, while consumer stocks, Financials and Real Estate led the gains.

ASX Sectors On Tuesday

US Futures for the Dow Jones Industrial Average, the S&P 500 and the Nasdaq Composite were mixed ahead of trade on Tuesday morning in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ICR | Intelicare Holdings | 0.028 | 87% | 4,339,961 | $3,133,731 |

| EQN | Equinoxresources | 0.395 | 58% | 1,987,302 | $23,875,001 |

| PLT | Plenti Group Limited | 0.53 | 56% | 1,802,767 | $58,534,455 |

| BP8 | Bph Global Ltd | 0.0015 | 50% | 1,985,393 | $1,615,563 |

| CLE | Cyclone Metals | 0.0015 | 50% | 47,424,402 | $10,264,505 |

| MCT | Metalicity Limited | 0.0015 | 50% | 120,000 | $4,251,086 |

| VPR | Volt Power Group | 0.0015 | 50% | 1,578,027 | $10,716,208 |

| AX8 | Accelerate Resources | 0.058 | 41% | 47,116,986 | $19,352,090 |

| LBT | LBT Innovations | 0.007 | 40% | 3,054,322 | $5,779,502 |

| NAM | Namoi Cotton Ltd | 0.475 | 34% | 797,573 | $72,810,627 |

| CTN | Catalina Resources | 0.004 | 33% | 2,500,000 | $3,715,461 |

| OAR | OAR Resources Ltd | 0.004 | 33% | 126,251 | $7,879,948 |

| ODY | Odyssey Gold Ltd | 0.028 | 33% | 363,971 | $16,076,294 |

| TSO | Tesoro Gold Ltd | 0.025 | 32% | 2,932,118 | $21,868,817 |

| MCP | McPherson's Ltd | 0.49 | 26% | 462,631 | $56,140,165 |

| RGL | Riversgold | 0.0175 | 25% | 29,420,869 | $13,317,660 |

| ACP | Audalia Res Ltd | 0.015 | 25% | 666,779 | $8,305,634 |

| ME1 | Melodiol Glb Health | 0.0025 | 25% | 82,338,563 | $8,436,084 |

| ARD | Argent Minerals | 0.011 | 22% | 1,555,498 | $10,610,831 |

| OKJ | Oakajee Corp Ltd | 0.023 | 21% | 9,766 | $1,737,475 |

| ASQ | Australian Silica | 0.06 | 20% | 46,570 | $14,093,019 |

| CT1 | Constellation Tech | 0.003 | 20% | 55,499 | $3,678,001 |

| ESR | Estrella Res Ltd | 0.006 | 20% | 1,014,996 | $8,795,359 |

| NRX | Noronex Limited | 0.012 | 20% | 25,046 | $3,783,018 |

| OAU | Ora Gold Limited | 0.006 | 20% | 151,586 | $28,110,838 |

Romping it in on Tuesday: InteliCare (ASX:ICR), after securing a rather terrific non-binding Memorandum of Understanding (MoU) with Bolton Clarke – hopefully a staging ground for a full-on Strategic Partnership.

ICR is a medtech of sorts, with a fair bit of SaaS and other stuff thrown in. It’s been developing predictive analytics hardware and software for use in the aged care sector.

In this case its MOU partner also happens to be Australia’s largest independent not-for-profit aged care provider, with ICR saying its platform will find a home somewhere across Bolton Clarke’s various sites and services.

What amounts to a pilot project will assess how ICR gels within the Bolton Clarke operating environment and help ICR assess and identify areas of possible enhancement.

The non-bank lender Plenti Group (ASX:PLT) has dropped some decent results for the first half of its 2024 (6-months to September 30), but it’s entirely possible investors have come for the PLT’s results, but stayed for its shiny new partnership with National Australia Bank, one which actually involves money and integration into the bank’s embrace.

PLT says, the tie-in… ” initially launching a “NAB powered by Plenti” car and electric vehicle (EV) loan and then making Plenti renewable energy finance available to NAB customers.”

There’s also an equity investment deal – allowing NAB to ‘acquire up to 15% of Plenti’s share capital’ through placements and market purchases and such.

That, in fintech parlance, is commitment.

Meanwhile, the books look strong for Plenti – its closing loan portfolio for the first half was at $2bn – up +29% on the pcp. The key measurement for these chaps – loan originations – amounted to $624mn, a +12% improvement on the same time last year.

Plenti’s CEO and founder Daniel Foggo was probably more chuffed than he lets on here:

“We’ve had a productive first half, building on the great momentum in our business, and further demonstrating the benefits of our strengths across our technology, our credit capabilities, the ever-increasing diversity of our activities and our team.”

Half-year revenue was $97 million, up 52% on pcp. Cash NPAT was $1.5 million, up 10% on pcp. The company had a strong credit performance in the half, with a 0.99% net loss rate.

Imugene (ASX:IMU) – everyone’s fav ‘clinical stage immuno-oncology’ stock – was higher this arvo, after announcing that its ‘MAST (Metastatic Advanced Solid Tumours) clinical program evaluating the safety and efficacy of novel cancer-killing virus CF33-hNIS (VAXINIA)’, has been given the sought-after “Fast Track Designation (FTD)” from the US Food and Drug Administration (FDA).

The FDA’s FTD for IMU’s Bile Duct Cancer CF33-hNIS (VAXINIA) MAST clinical program is of course great news for the company, according to Imugene CEO and MD Ms Leslie Chong.

“The Fast Track process of drug development is designed to facilitate the development, and the review of drugs to treat serious conditions and fill an unmet medical need, with Fast Track status often leading to earlier drug approval and access by patients.”

The designation provides closer cooperation with the FDA to expedite the MAST clinical program and subsequent potential approval processes, the set up also makes IMU’s MAST program eligible for the FDA’s Accelerated Approval and Priority Review.

Ms Chong says Imugene will utilise the opportunity to work with the FDA “on advancing this important drug program towards patients on an accelerated timeline.”

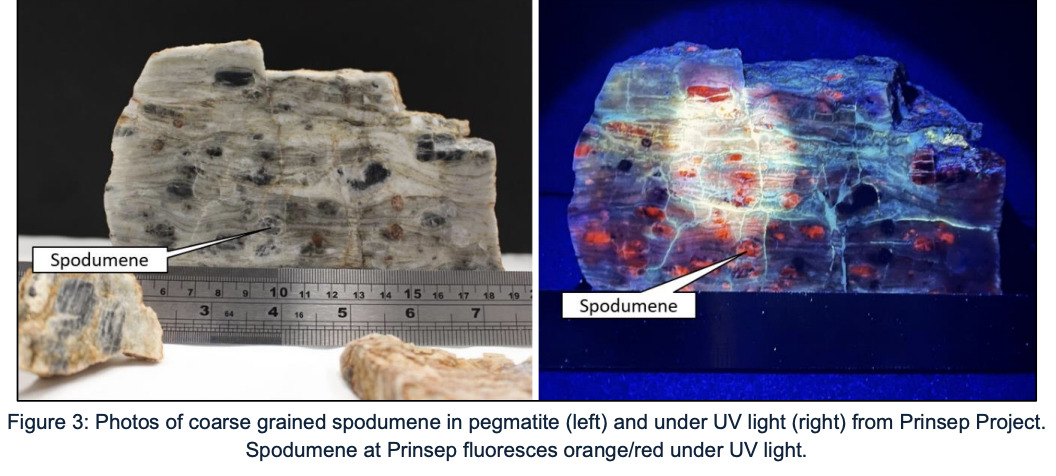

Accelerate Resources (ASX:AX8) says it’s just completed the first phase of geological mapping and follow up rock chip sampling across the Prinsep Lithium Project, which is Under Agreement to acquire 100%.

AX8 says the campaign has ‘confirmed extensive strike continuation of lithium-prospective pegmatites up to 60m in width on multiple trends within the project area’.

Accelerate’s Prinsep lithium project is situated within the emerging 40km long hard-rock lithium belt between Karratha and Roebourne, West Pilbara, and the belt hosts the Andover discovery (ASX:AZS) with a number of other ASX listers nearby.

Detailed mapping and follow-up sampling confirms and extends individual outcropping pegmatites within the Northern Pegmatite System up to 1.8 kilometres, with outcrop widths up to 60m.

The company says it’s IDed ‘significant’ new rock samples from Prinsep, including:

▪ 2.06% Li2O – Sample ID AA351

▪ 1.63% Li2O – Sample ID AX03083

▪ 1.14% Li2O – Sample ID AX03074

▪ 1.07% Li2O – Sample ID AX03071

▪ 1.05% Li2O – Sample ID AX03084

▪ 1.02% Li2O – Sample ID AX03085

That’ll be spodumene:

Namoi Cotton (ASX:NAM) says it is the recipient of a non-binding, indicative and conditional offer from Louis Dreyfus Company Asia (LDC) – Namoi’s joint venture partner in Namoi Cotton Alliance and Namoi Cotton Marketing Alliance also holding a 17% shareholding ownership stake in Namoi.

The offer, by way of a scheme of arrangement and the total cash consideration of $0.51 per share, is for the remaining 83% of issued shares in Namoi that it doesn’t currently own.

The LDC bid also allows Namoi to pay a dividend of $0.01 per share to Namoi shareholders prior to the Scheme implementation, which is nice and also not conditional on the Scheme proceeding (and which would reduce the cash consideration to $0.50 per share), according to maths.

The offer represents a premium of 44% to the last closing share price of $0.355 per share and a premium of 37% to the three-month VWAP of $0.372 per share. Again, maths.

According to NAM, the NBIO was submitted by LDC following Namoi’s strategic review process, begun at the end of June this year.

Namoi Cotton Executive Chairman Tim Watson says this is the most preferred outcome of the detailed strategic review:

Combining Namoi’s ginning business with LDC is designed to create a strengthened and sustainable business for our grower customers and staff. This proposal builds on our existing relationship with LDC in our lint marketing and warehousing joint venture business for the past 10 years.

As the most preferred outcome of a detailed strategic review, LDC values the capability and relationships built by Namoi over the past 60 years and intends to operate all Namoi’s gins in the normal course, maintain an office in Toowoomba and retain the Namoi Cotton brand name.”

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| WEL | Winchester Energy | 0.002 | -33% | 532,835 | $3,061,266 |

| POD | Podium Minerals | 0.041 | -25% | 1,677,462 | $20,038,513 |

| ADS | Adslot Ltd. | 0.003 | -25% | 1,355,217 | $12,897,982 |

| NZS | New Zealand Coastal | 0.0015 | -25% | 284,657 | $3,334,020 |

| GIB | Gibb River Diamonds | 0.031 | -21% | 65,028 | $8,248,868 |

| IEC | Intra Energy Corp | 0.004 | -20% | 130,952 | $8,303,908 |

| EOF | Ecofibre Limited | 0.105 | -19% | 99,162 | $49,166,940 |

| CC9 | Chariot Corporation | 0.69 | -19% | 3,220,651 | $62,331,833 |

| NNG | Nexion Group | 0.013 | -19% | 493,222 | $3,236,926 |

| TSL | Titanium Sands Ltd | 0.013 | -19% | 1,204,382 | $28,348,875 |

| NFL | Norfolkmetalslimited | 0.34 | -17% | 2,533,083 | $12,433,248 |

| ADR | Adherium Ltd | 0.0025 | -17% | 40,000,000 | $15,004,781 |

| BIM | Bindimetalslimited | 0.16 | -16% | 65,000 | $5,496,225 |

| KNB | Koonenberrygold | 0.032 | -16% | 351,983 | $4,550,465 |

| AHX | Apiam Animal Health | 0.275 | -15% | 117,520 | $58,501,770 |

| XST | Xstate Resources | 0.011 | -15% | 129,146 | $4,179,749 |

| REE | Rarex Limited | 0.028 | -15% | 3,296,462 | $22,551,757 |

| PVT | Pivotal Metals Ltd | 0.017 | -15% | 1,318,577 | $10,957,366 |

| CTE | Cryosite Limited | 0.55 | -15% | 20,000 | $31,482,168 |

| AUE | Aurumresources | 0.18 | -14% | 30,000 | $7,665,000 |

| LML | Lincoln Minerals | 0.006 | -14% | 8,153,333 | $11,856,917 |

| LNR | Lanthanein Resources | 0.006 | -14% | 368,307 | $7,851,029 |

| TMR | Tempus Resources Ltd | 0.006 | -14% | 3,885,596 | $2,400,460 |

| DGH | Desane Group Hldings | 0.82 | -14% | 38,162 | $38,864,491 |

| PPY | Papyrus Australia | 0.019 | -14% | 50,000 | $10,839,237 |

TRADING HALTS

IPD Group (ASX:IPG) – Pending an announcement in relation to a proposed capital raising comprising an institutional placement and pro rata accelerated non-renounceable entitlement offer

Provaris Energy (ASX:PV1) – Pending an announcement regarding a capital raising

LCL Resources (ASX:LCL) – Pending an announcement regarding a capital raising

88 Energy (ASX:88E) – Pending an announcement regarding a capital raising

Cooper Metals (ASX:CPM) – Pending an announcement regarding material exploration results

Euro Manganese (ASX:EMN) – Pending an announcement to the market in relation to a financing transaction, for which the documents are just being signed today

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.