Rise and Shine: Everything you need to know before the ASX opens

Via Getty

Good morning everyone. On Stockhead today, the ASX battery geniuses going beyond li-ion, why emerging markets are a no-brainer right now, and which Canadian stocks could get the Tanzanian windfall?

But first the day ahead.

TRADING HALTS

These companies went into Trading Halts on Monday and should be out in the next days

Dotz Nano (ASX:DTZ) – Pending a proposed share placement announcement.

Oneview Healthcare (ASX:ONE) – Capital raising.

AnteoTech (ASX:ADO) – Capital raising.

Adavale Resources (ASX:ADD) – Pending an announcement about the nickel sulphide drilling at its Kabanga Jirani nickel project.

Bionomics (ASX:BNO) – Pending an announcement regarding an application to be removed from the Official List of the ASX.

Austal (ASX:ASB) – Pending an announcement regarding potential downwards adjustment to earnings guidance arising out of the T-ATS program at Austal’s USA operations.

Mount Burgess Mining (ASX:MTB) – Capital raising.

Sacgasco (ASX:SGC) – Pending an announcement in relation to a material asset divestment.

Lycaon Resources (ASX:LYN) – Capital raising.

Eclipse Metals (ASX:EPM) – Pending an announcement regarding assay results from trenching completed at Grønnedal, Greenland.

COMMODITY/FOREX/CRYPTO MARKET PRICES

Gold: $US1954.67 (-0.28%)

Silver: $US24.33 (-0.97%)

Nickel (3mth): $US21,420/t (+3.13%)

Copper (3mth): $US8525.50/t (+0.87%)

Oil (WTI): $US78.88 (+2.34%)

Oil (Brent): $US82.83 (+2.17%)

Iron 62pc Fe: $US112.51/t (+0.04%)

AUD/USD: 0.6740 (+0.1%)

Bitcoin: $US29,167 (-2.63%)

What got you talking?

Gallant showing from Galan…

Galan Lithium is well on its way from explorer to producer, with the successful delivery of a premium quality 6% lithium chloride concentrate product from its Hombre Muerto West (HMW) pilot plant in Argentina. https://t.co/KwAuAKB6wX #ad #ASX $GLN @GalanLithium

— Stockhead (@StockheadAU) July 24, 2023

For all you crypto lovers Stockhead’s Coinhead Twitter is the place to share your views, insights, tips and ideas.

Also, be sure to check in preopen each day for ‘Market highlights and 5 ASX small caps to watch’, and 10.30am for our daily ‘10 at 10’ column — a live summary of winners & losers at the opening bell.

MONDAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| JAL | Jameson Resources | 0.071 | 42% | 107,747 | $19,575,555 |

| FNX | Finexia Financialgrp | 0.28 | 27% | 25,406 | $10,552,427 |

| LGM | Legacy Minerals | 0.165 | 27% | 64,605 | $6,997,571 |

| YOW | Yowie Group | 0.033 | 27% | 57,211 | $5,682,765 |

| GLH | Global Health Ltd | 0.19 | 27% | 69,892 | $8,707,430 |

| ME1 | Melodiol Glb Health | 0.012 | 26% | 84,403,837 | $25,541,261 |

| WNR | Wingara Ag Ltd | 0.032 | 23% | 84,875 | $4,564,105 |

| AJQ | Armour Energy Ltd | 0.003 | 20% | 25,410 | $12,303,355 |

| CPT | Cipherpoint Limited | 0.006 | 20% | 13,865,251 | $5,796,209 |

| HLX | Helix Resources | 0.006 | 20% | 84,166 | $11,615,729 |

| SFG | Seafarms Group Ltd | 0.006 | 20% | 1,943,560 | $24,182,996 |

| TIG | Tigers Realm Coal | 0.006 | 20% | 2,470,587 | $65,333,512 |

| CWX | Carawine Resources | 0.13 | 18% | 7,407 | $21,649,921 |

| TOY | Toys R Us | 0.013 | 18% | 42,671 | $9,493,953 |

| GCY | Gascoyne Res Ltd | 0.235 | 18% | 7,024,793 | $175,402,621 |

| AVE | Avecho Biotech Ltd | 0.007 | 17% | 15,074,536 | $12,972,982 |

| EDE | Eden Inv Ltd | 0.0035 | 17% | 40,081 | $8,990,833 |

| PRX | Prodigy Gold NL | 0.007 | 17% | 875,000 | $10,506,647 |

| SI6 | SI6 Metals Limited | 0.007 | 17% | 1,567,006 | $8,972,368 |

| NFL | Norfolkmetalslimited | 0.145 | 16% | 34,337 | $3,790,625 |

| FFF | Forbidden Foods | 0.022 | 16% | 516,068 | $2,787,880 |

| RMI | Resource Mining Corp | 0.045 | 15% | 342,825 | $20,502,591 |

| MGL | Magontec Limited | 0.6 | 15% | 56,682 | $40,721,482 |

| ASP | Aspermont Limited | 0.015 | 15% | 105,199 | $31,703,928 |

| OLI | Oliver'S Real Food | 0.015 | 15% | 68,809 | $5,729,515 |

Aussie-based cannabis company, Melodiol Global Health (ASX:ME1): found 26% with a new report, saying it’s acquired subsidiary Health House International in May and delivered strong first half revenue.

Digital healthcare solutions provider Global Health (ASX:GLH): also found 26% on a very healthy report, noting its Australian operations return to positive cashflow; overseas cashflow deficit reduced and total cashflow deficit reduced by 64%.

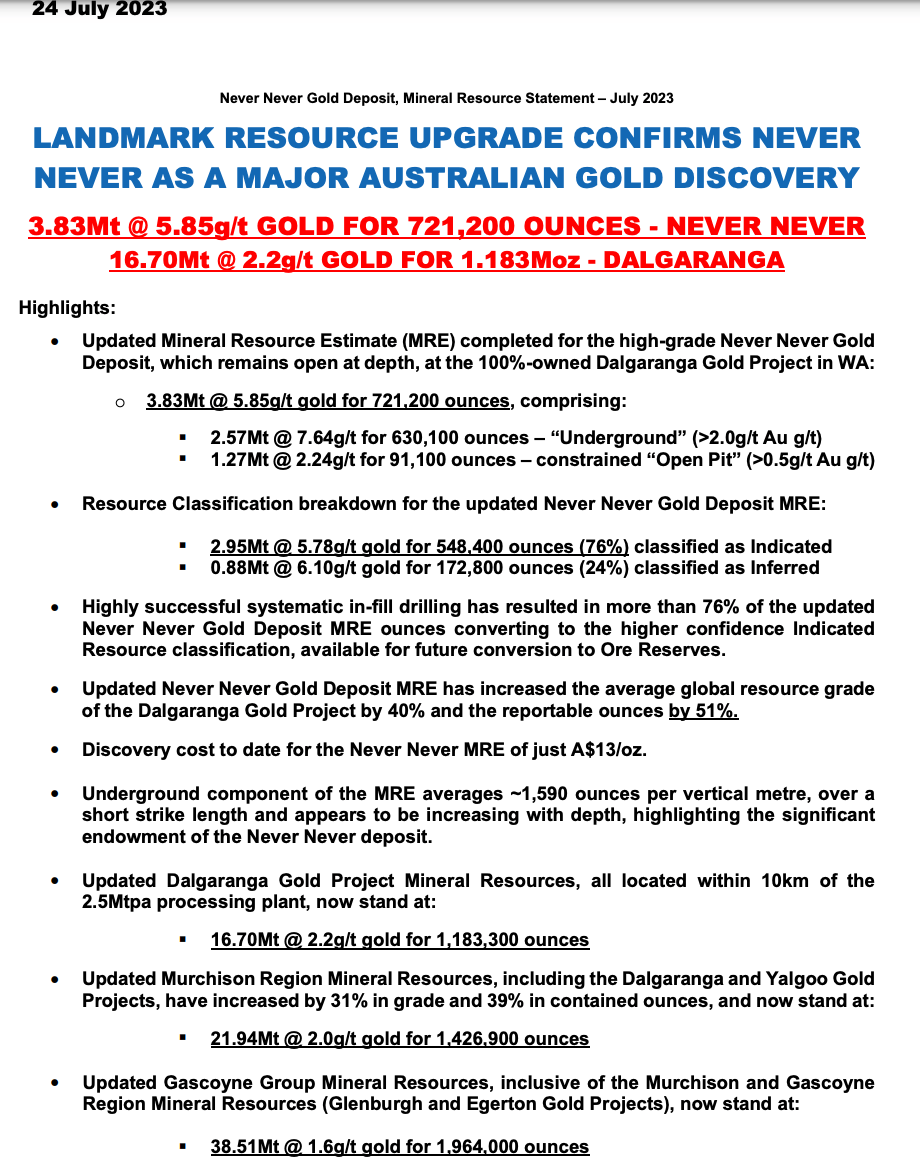

Up 20% following a corker of an update is Gascoyne Resources (ASX:GCY)*.

I could write it out or I could do this – which speaks more volumes than even I, and has colour coordination:

About a year ago, Gascoyne’s Never Never deposit announced itself as one of the country’s top new gold finds.

Resources more than doubled in under 12 months to 721,000oz at 5.85 g/t, thanks to hits like 31m at 2.5g/t gold from 6m out of the under-explored Never Never prospect.

As the brochure says, with a previous maiden resource estimate of 303,000oz at 4.64g/t, the company’s shift to targeted and cost-effective exploration has apparently been gold. (*They’re a client apparently, but they got nuthin’ to do with this, we tell it like it is and numbers need friends too. In fact I bet the boss still adds a disclaimer at the bottom of this article later tonight about it, making me feel awkward. I probs missed another client disclosure as well.)

MONDAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BKY | Berkeley Energia Ltd | 0.38 | -45% | 4,183,658 | $307,599,733 |

| MCT | Metalicity Limited | 0.0015 | -25% | 292,631 | $7,472,172 |

| TTT | Titomic Limited | 0.012 | -25% | 9,824,131 | $5,023,839 |

| XTC | Xantippe Res Ltd | 0.0015 | -25% | 7,251,081 | $22,960,199 |

| COY | Coppermoly Limited | 0.011 | -21% | 100,735 | $7,421,777 |

| MDI | Middle Island Res | 0.023 | -21% | 4,279,864 | $4,079,088 |

| AUK | Aumake Limited | 0.004 | -20% | 12,270,377 | $7,436,297 |

| BP8 | Bph Global Ltd | 0.002 | -20% | 1,027,067 | $3,336,824 |

| DCX | Discovex Res Ltd | 0.002 | -20% | 1,000,000 | $8,256,420 |

| ENT | Enterprise Metals | 0.004 | -20% | 5,855,179 | $3,747,355 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 1,110,000 | $19,462,207 |

| PV1 | Provaris Energy Ltd | 0.07 | -20% | 3,008,684 | $47,787,408 |

| GSR | Greenstone Resources | 0.013 | -19% | 4,443,963 | $19,504,998 |

| XF1 | Xref Limited | 0.175 | -17% | 53,640 | $39,097,021 |

| LBT | LBT Innovations | 0.02 | -17% | 346,552 | $8,299,096 |

| MXC | Mgc Pharmaceuticals | 0.0025 | -17% | 11,186,506 | $11,677,079 |

| ROO | Roots Sustainable | 0.005 | -17% | 455,006 | $832,333 |

| TSL | Titanium Sands Ltd | 0.005 | -17% | 1,994,839 | $9,704,145 |

| WCN | White Cliff Min Ltd | 0.01 | -17% | 8,340,297 | $14,734,223 |

| CBY | Canterbury Resources | 0.026 | -16% | 230,000 | $4,480,229 |

| EMP | Emperor Energy Ltd | 0.013 | -16% | 898,803 | $4,167,368 |

| CXO | Core Lithium | 0.7325 | -16% | 54,106,315 | $1,616,909,611 |

| FME | Future Metals NL | 0.039 | -15% | 2,003,188 | $19,007,386 |

| PEC | Perpetual Res Ltd | 0.018 | -14% | 9,501,616 | $11,455,163 |

| OLL | Openlearning | 0.03 | -14% | 86,410 | $9,375,418 |

At Stockhead, we tell it like it is. While Gascoyne Resources and Melodiol Global Health are Stockhead advertisers, they did not sponsor this article.

(*Damn he’s good.)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.