The CEO Show: Building stuff still the emerging market no-brainer, says 4D Infrastructure’s Sarah Shaw

Via Getty

Emerging Markets (EM) are on a stealth rally, according to BlackRock’s research arm and the Aussie CEO/CIO of 4D Infrastructure, Sarah Shaw, reckons the US giant’s biggest brains might be onto something.

Actually, Shaw herself must be doing something right in any case – the 4D Emerging Markets Infrastructure Fund returned more than 19.5% over the year to June 30 2023.

She told Stockhead over the weekend that for investors looking to take advantage of the opportunities in emerging markets, infrastructure is an attractive way to do so and there is no better time than now.

“Population growth, the emergence of the middle class and the energy transition are three thematics in infrastructure that are contingent on emerging markets,” Shaw says.

“The majority of population growth globally is coming from the emerging world, which is placing pressure on emerging market governments to invest in infrastructure to support those growing populations and their needs.

“The emergence of the middle class in developing economies is also a significant opportunity within infrastructure. Not only is it a driver, but it is also a first beneficiary of improved living standards.”

And then there’s the wee energy transition.

“The global goal of net-zero carbon emissions is not achievable without the right forms of infrastructure investment across both the energy and transport sectors in both the developed and emerging worlds – the emerging markets must be on board.

“As an investor, I’m keen to capitalise on these thematics and a superior demand outlook while mitigating key risks to emerging market investment. Infrastructure allows us to do this.”

Just ignoring EMs would probs be a bit ignorant…

This week Blackrock’s team go even further, suggesting EMs now have no less than five “big structural forces transcending the macro backdrop.”

- digital disruption and artificial intelligence (AI)

- geopolitical fragmentation

- the low-carbon transition

- ageing populations;

- and the future of finance.

“We see abundant EM equity opportunities through these mega forces – what matters is what markets have priced.”

For example Blackrock’s BlackRock Investment Institute (BII), say they’ve preferred EM debt to DM long-term peers for some time.

In last week’s BII Weekly Market Commentary:

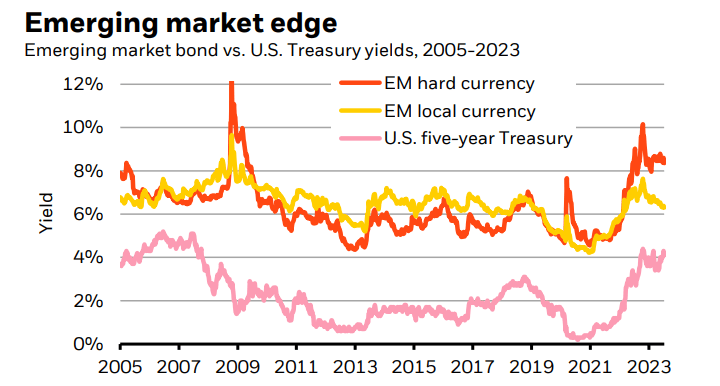

We went tactically overweight EM local currency debt in March, picking up higher yields for carry and benefiting from a broadly weaker U.S. dollar plus tightening spreads this year (yellow line in chart).

Higher EM yields remain attractive, but tightening spreads with Treasuries (pink line) lead us to consider switching to hard currency peers typically issued in U.S. dollars (orange line). But peaking DM policy rates should support EM currencies, bolstering EM local debt for now.

DM rate hikes have hit EM hard in the past, but the BII think they’re in a different spot now thanks to improved external balance sheets.

“We think that’s why we’re not seeing the EM asset volatility as in the 2013 taper tantrum.”

The Fed’s plan to taper bond purchases then sparked sharp EM capital outflows and currency depreciation. BII claims it’s the opposite now: capital inflows and stronger currencies are boosting returns in EM local currency bonds.

A brighter EM macro and policy picture may also be underappreciated, in their view:

DM central banks inching toward the end of rapid hikes is good for EMs – but a key difference is we think EM peers are closer to rate cuts as inflation falls. EM central banks were well ahead of DM peers in hiking – and some have hiked much more to bring inflation down quickly.

Take Brazil

Policy rates have risen to just under 14% from 2% in 2021.

When it comes to EM investing this year, so much hooplah has been on China’s economy losing steam.

But outside China, EM equities have staged what BII calls “a stealth rally” with double-digit gains across Latin America and other parts of Asia.

We see more upside there and more attractive valuations relative to DM economies as the policy picture and EM economic growth prospects improve, even as China’s restart sputters.

That’s the first layer of our new playbook in action: our macro take in the context of what’s in the price.

Shaw also reckons that in a global portfolio, emerging markets are just too important to ignore.

“Infrastructure is 100 per cent correlated to the in-country domestic demand story, while at the same time hedging against key emerging market risks including inflation and sovereign risk. In order to successfully invest in emerging markets, you must be on top of what is happening in these markets.

“At 4D we have a unique integrated process for investment, whereby country risk analysis is combined with individual stock analysis in a single analytical cycle,” she told Stockhead.

“An investor willing to capitalise on the opportunity via direct investment into emerging markets is currently accessing this theme at very attractive valuations, both on an absolute basis (compared to their developed peers) but also relative to historical ranges.

“We expect further outperformance as the market starts to recognise the disconnect between share price and fundamentals.

“The opportunities emerging markets are offering are just too attractive to ignore when you’re looking at a global portfolio allocation. We believe there is still a significant amount of growth potential and strong absolute performance to come,” says Shaw.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.