You might be interested in

News

Lots of people think the Reserve Bank Board of Australia will do something to the cash rate today. They're often wrong.

News

Traders' Diary: Everything you need to get ready for the week ahead

News

Aaaand, it’s Decision Day!

Welcome back to sunny Martin Place in Sydney for the first time this month, where smarty pants financial markets and unerring economists alike are pricing in an absolute zero per cent, put-my-negatively-geared-condos-against any wee chance of a rate hike today.

As a consequence, Stockhead commentators (me) are forecasting that another ‘pausing for longer’ call at Governor P. Lowe’s final Monetary Policy meeting this arvo will unlikely move local equity markets more than, say, the love songs of Danni Minogue.

And over on the FX side of life, such a call is also likely to have a negligible impact on the already awful AUD. That is unless – as CBA’s fab FX fiend, the redoubtable Joseph Capurso says – a notable and unexpected shift of tone emerges from the eagerly anticipated (by me) post‑meeting post-mortem statement.

Anyway, at 4.10%, the RBA’s cash rate is lower than most of the other major central banks out there.

The Bank of England (BoE) for example has raised the UK base interest rate to 5.25%. Tee-hee.

Then there’s Turkey’s central bank, (the Central Bank of the Republic of Türkiye) whose motto “Rate hike? That’s not a rate hike…” was on full display last week when it raised the official cash rate to 25%… from 17.5%

That was a round 750 basis point rise and followed the previous month’s 250 bps rocket.

Of course, comparisons are odious.

How high the US Federal Reserve or Christine Lagarde’s European Central Bank plunge is of diddly-squat importance to the 1 in every 2 Australians with a mortgage who are “now under serious financial stress”, according to the financial comparison site Mozo.com.au.

Mozo says its consumer research team earlier this year asked homeowners at what interest rates they would be under “serious financial stress” and 46% of those surveyed answered 5 per cent (13%), 6 per cent (15%), and 7 per cent (18%).

They say, regardless of what comes out of Lowe’s Last Lap today, 50% of mortgage holders are in enough pain not to notice whether P. Lowe offers another departing slap or just waves in the direction of the Members Stand.

That’s because the rubber is hitting the road for consumers, not at the RBA, but at the discretion of their lenders. And their lenders are going rogue, as per.

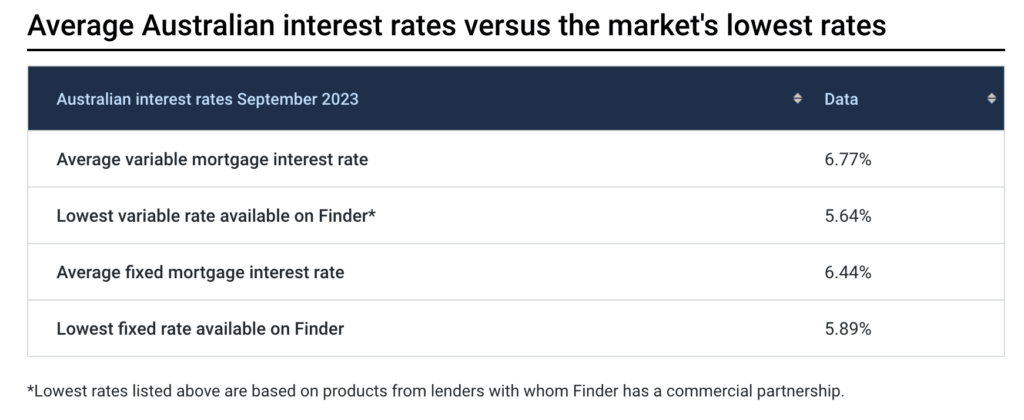

According to Mozo’s industry analysis of rate changes in August, advertised rates starting with 5%, 6% and 7% are now the norm, and despite two consecutive cash rate pauses, variable rate hikes on home loans have continued.

Across all lenders in the Mozo database, the average variable rate for an owner-occupier home loan now sits at 6.60%, while the average variable rate for a Big Four bank home loan is 7.21%

“There were a number of ‘out of cycle’ rate rises in August putting more pressure on household budgets,” says Mozo’s money expert Rachel Wastell.

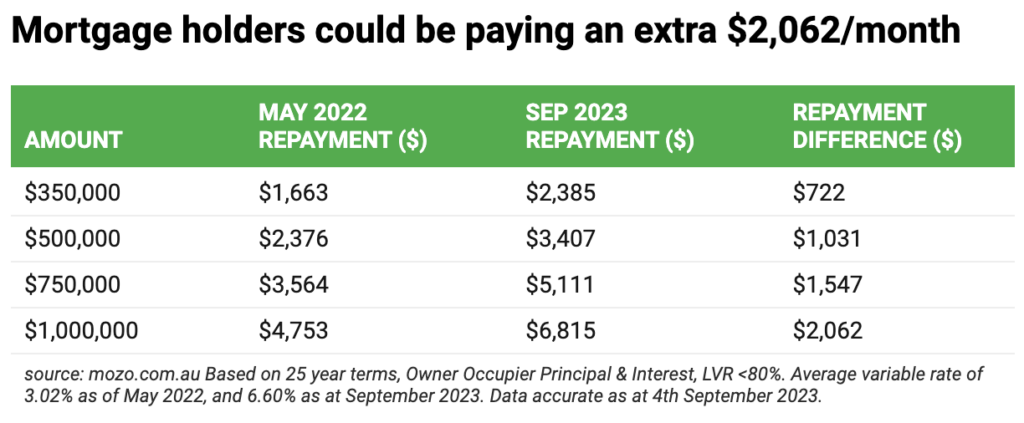

“Homeowners are now scrambling to find thousands more every month to cover the jump from 2 per cent rates just a year ago, to rates starting with 5%, 6%, and 7% today.”

Based on the average variable rate of 6.60% across all lenders in the Mozo database, monthly home loan repayments have now risen by more than $1,031 a month for Australians with a home loan of $500,000.

For those with a million dollar mortgage, that jumps to over $2,000.

This month, CoreLogic data suggests the average Sydney home now goes for $1.1mn.

So someone is making money. It’s just not you.

Mozo, unsatisfied with merely the dry numbers, deployed its team to really get in under the skin and into the mind of the average Aussie mortgage holder.

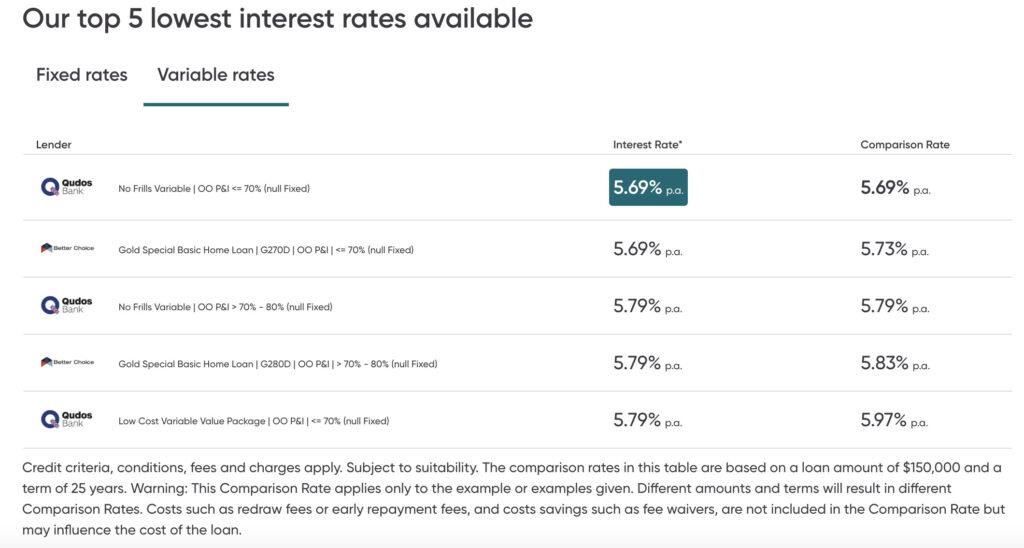

Though borrowers could save thousands of dollars in interest by shopping for a lower rate, hardly any have, according to the survey.

When prompted why they haven’t refinanced, Mozo reports that 1 in 3 ticked the “too much of a hassle,” box.

Personally, I’d like to know what the other boxes said.

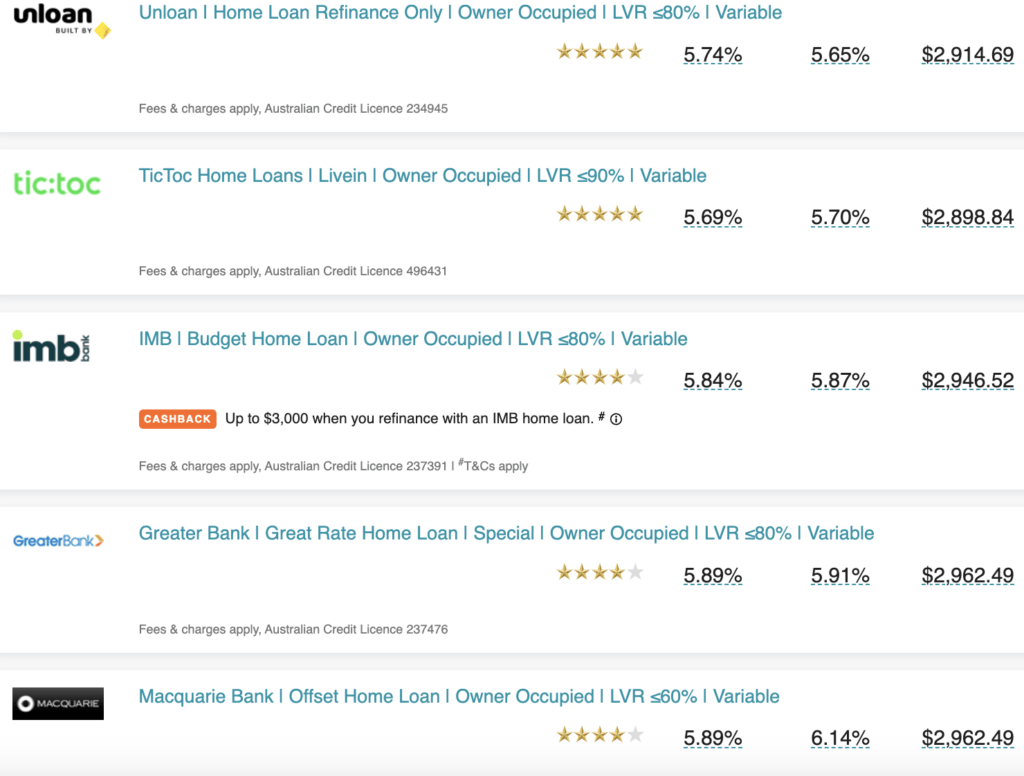

Mozo, whose business, BTW, is to literally help you compare the price of things, says this ‘hassle’ could be well worth it.

And, well, they’re not wrong.

For example, refinancing a $500K home loan from a starting rate of 7.21%, to a rate of 6.60%, would save you exactly $58,144 over a standard 25-year loan term.

That’s like one free Qantas flight to BrisVegas every decade, or 1 Tesla in 2021, or 2x Teslas today.

“Borrowers should be keeping an eye on the market to see if they can get a better deal on their rate,” Wastell advises.

Wait, there’s more:

“Refinancing may seem like a hassle, but with online applications speeding up the process and the potential to save tens of thousands of dollars in interest, it’s definitely worth investigating.”

There’s a few of these comparison sites about the place, most of them have partnerships with various lenders, so do the leg work yourself.