Lots of people think the Reserve Bank Board of Australia will do something to the cash rate today. They’re often wrong.

Very smart. Via Getty

Dr P. Lowe and his confederates on the board of the Reserve Bank of Australia (RBA) had fun skewing market bets in May and most particularly last month.

At its June meet, Dr Lowe et al really caught the market off guard for a second straight time, raising the cash rate target and delivering an unexpectedly hawkish flavour to the after-party commentary.

But truth be told, there’s very little consensus on this one.

The big banks are torn in twain – Bloomers says 14 of its surveyed banks expect the RBA to hold at 4.1%, while 13 “including Goldman Sachs Group Inc. and the three other major banks” forecast another quarter-point increase.

CBA is not among them. Although Belinda Allen reckons there’s still one in the chamber for August.

Traders are pricing a 52% chance of a pause following back-to-back hikes the RBA had described in its minutes as “finely balanced” calls.

Aussie inflation: Not the worst, not the best

Lowe himself noted “some further tightening may be required to ensure that inflation returns to target in a reasonable timeframe”.

The rider was we’ll see how things pan out – ie: all this depends on what the indicators indicate and upon how the economy and inflation evolve.

In what was a self-declared close call, the RBA added another 25 basis points (bps), at its last get together on the official cash rate (OCR) in June, lifting it from 3.85% to 4.10%.

In short the bank retained its tightening bias and repeated for the hopelessly optimistic that the monster is far from dead, and nobody should get back in their cryopods for a comfy hyper sleep return to Earth.

Some punters thought that the RBA could slam the hike button due to the rebound in the monthly year-on-year inflation print for April and the increase in the country’s minimum wage by 5.75%, but by and large economists were expecting officials to stay sidelined just after the May hike.

Tony Sycamore at IG Markets says while the move surprised the broader market, it aligned with his team’s expectation due to the RBA’s “increased concern around elevated inflation, rising unit labour costs, wages, and poor productivity”.

The bank said in its June statement on monetary policy (SOMP):

“While goods price inflation is slowing, services price inflation is still very high and is proving to be very persistent overseas. Unit labour costs are also rising briskly, with productivity growth remaining subdued.”

Inflation slows in May

But since then, GDP data showed that the economy slowed by more than expected in Q1, but also that the labor market gained more jobs than forecast in May, which pushed the unemployment rate down to 3.6% from 3.7%.

Tony says both the preliminary manufacturing and services PMIs came in better than expected, but with the manufacturing index staying in contractionary territory and the services one sliding to just seven-tenths of a point above the 50-stagnation mark.

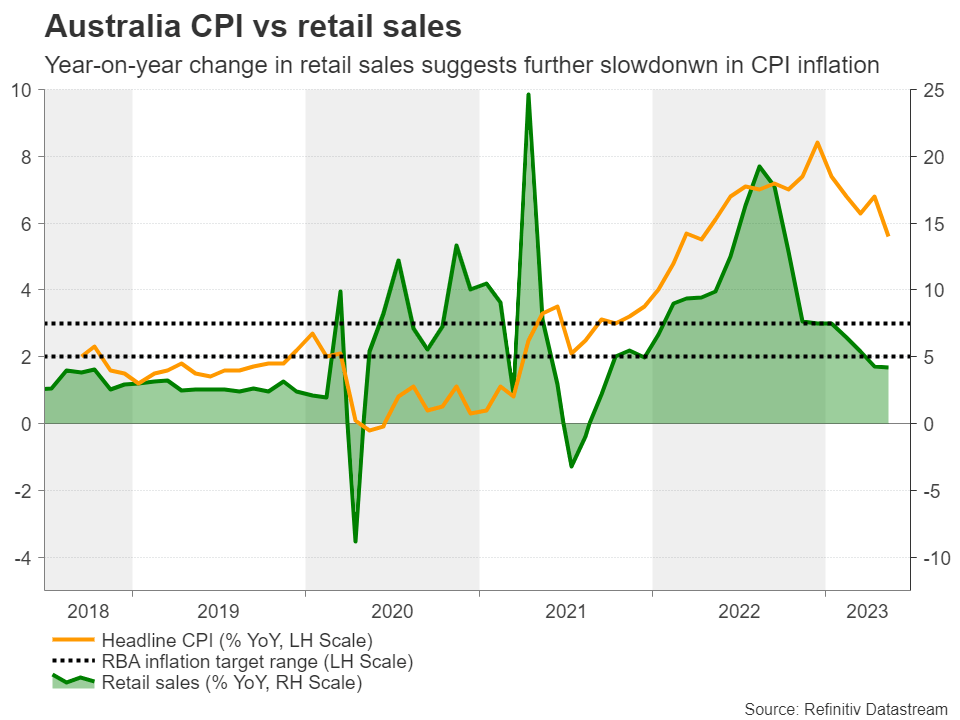

Most importantly, according to Peter McGuire, XM CEO, the monthly y/y CPI rate for May dropped to 5.6% from 6.8%, extending the downtrend that started after the rate peaked at 8.4% in January.

“Yes, retail sales for the same month grew 0.7%, but the y/y rate slightly dropped to 4.22% from 4.25%, which is the slowest annual increase since September 2021.”

Investors see an August hike as more likely

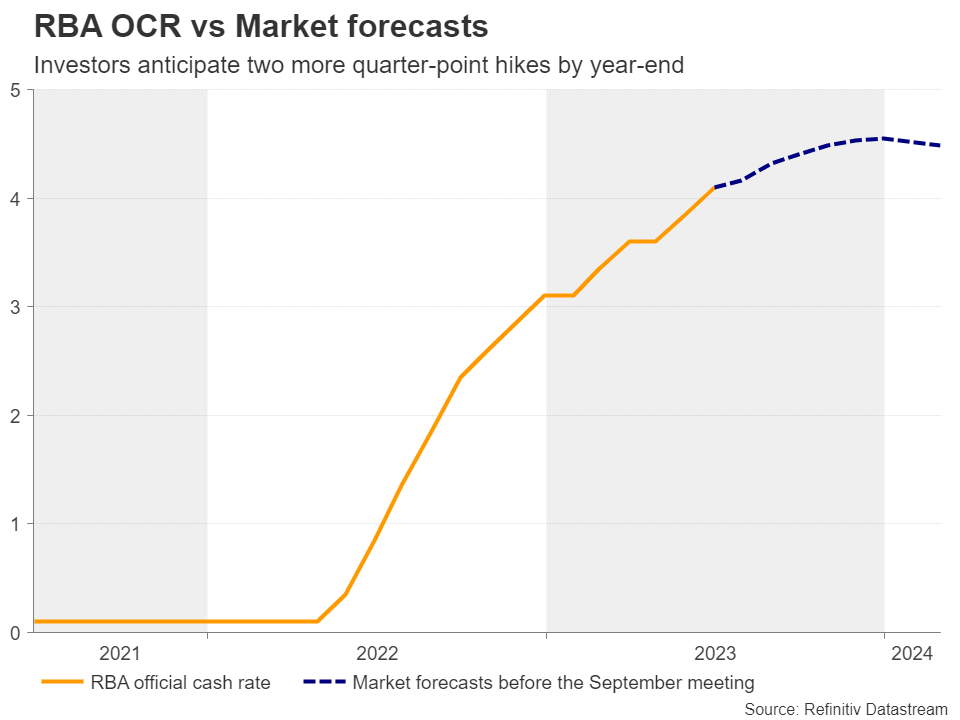

According to the stats, investors are confident there’s x2 more quarter-point hikes may be on the cards, but they reckon there’s only 37% chance for a hike at today, according to Refinitiv.

“The remaining 63% probability points to no action, which appears reasonable pricing given the abrupt slowdown in inflation in May,” Peter McGuire adds.

“Although the headline CPI rate is still well above the upper bound of the RBA’s 2-3% target range, officials may prefer to wait for more data to see whether past hikes could still weigh on price pressures.”

This again from the June minutes:

“Members recognised the strength of both sets of arguments, concluding that the arguments were finely balanced. They judged, though, that the case to raise the cash rate at this meeting was the stronger one.

”Ultimately the decision to lift the cash rate in June was firmly centred on inflation risks moving to the upside:“members observed that the monthly indicator of headline inflation had surprised on the upside in April and that the decline in goods price inflation had been less than observed in other countries. In addition, services price inflation had not yet shown signs of moderating and the evidence from abroad suggested that it may prove to be persistent.

“In contrast the arguments for an ‘on hold’ decision focussed on an economy that is already slowing and the risks the already significant increases in interest rates to date would lead to the economy slowing more sharply than expected.”

That said, a very slim majority of economists polled by Reuters are expecting a 25bps hike, while an August increase seems more sensible to the eyes of investors, who are nearly certain according to their implied rate path.

According to the CBA’s senior economist, Belinda Allen, the decision this arvo “is a line‑ball call.”

Economists on the Bloomberg survey almost evenly split between on hold and 25bp move higher.

“There are clearly strong arguments for either decision, but we favour those supporting the RBA holding rates steady in July,” Allen said.

“In our mind, the RBA has been afforded a month to pause on the back of the slower rate of prices growth evident in the monthly CPI in the context of cooling economic activity. We anticipate one final interest rate hike in August for a terminal rate of 4.35%.”

Throw into the mix this week’s monthly Melbourne Institute inflation gauge which was up by 0.1% in June, after a 0.9% rise in the prior month and, according to AMP Capital’s senior economist Diana Mousina, shows that annual growth in inflation has stepped down to 5.7% in June, from 5.9% last month which should mean some slight further moderation in the ABS’s monthly CPI index is also likely (see the chart below).

Diana says Monday’s MI data doesn’t change her expectation of another 0.25% rate hike at the board meet later today.

She expects to see the cash rate go from 4.1% to 4.35%.

“The elevated core readings of inflation in the May monthly CPI release, the strong May labour force data, signs of a broader increase in wages growth after the Fair Work Commission’s minimum wage decision and the uptick in retail spending for May, particularly in categories like eating out that the RBA wanted to see slow, will keep the central bank concerned that economic activity remains too hot in Australia.

“But, there are also good reasons to keep interest rates unchanged in July as inflation is clearly slowing in Australia and the long lags with monetary policy (and Australian households’ sensitivity to rate hikes) means that there is a risk of tightening too far at a time that activity is already slowing and risking a serious downturn or a recession. So, it is a close call which is why the market and economists are split as to whether there will be a 0.25% hike or a pause at tomorrow’s meeting.”

If there is no rate increase next week then it’s still likely that the RBA will hike in the following month, after it receives more data prints, she adds.

AUD: Asymmetrical risks

McGuire says that should the bank decide “to take the sidelines, the Aussie is unlikely to fall much, especially if they clearly telegraph an August hike.”

“For the currency to fall sharply, the Bank may need to take the sidelines and adopt a softer language about its future plans than it did in June. Nonetheless, taking into account the data, this seems a very unlikely scenario.

“Now, in case the RBA does not hesitate to go against market bets for a third consecutive time and decides to press the hike button, the Aussie is likely to rally. Given the current market pricing and the fact that the Aussie has fallen around 4.5% against its US counterpart in the last two weeks, a rally due to a hike could be larger than a potential slide due to a hawkish pause.”

Not damned if they do or don’t.

The Fixed Income POV

Emma Lawson, fixed interest strategist macroeconomics in the Janus Henderson Australian Fixed Interest team, says 3- and 10-year government bond yields ended June 68bps and 42bps higher at 4.05% and 4.02%.

The Janus Henderson Australian Fixed Interest team raised their peak RBA cash rate, to incorporate a further 50bps of hiking, to 4.60%, as the RBA warned of a bias toward reining in inflation faster than they had previously been comfortable with. They anticipate that these hikes “are likely to come in July and August, but there may be a pause at any of the next three meetings”.

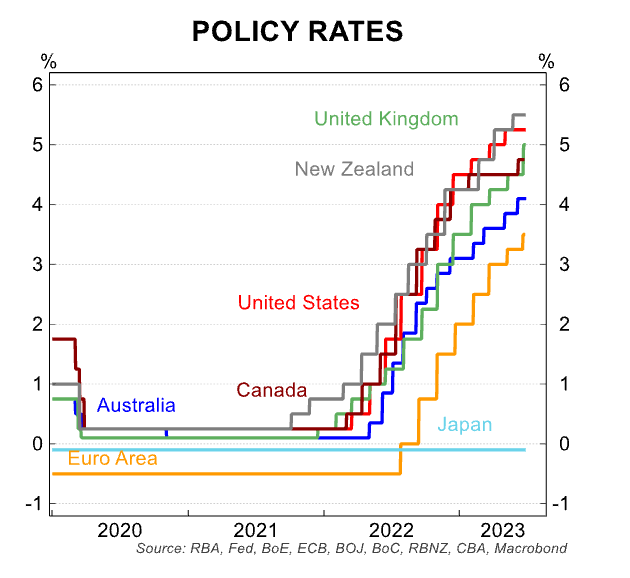

This comes about with higher peer policy rates, as the US Federal Reserve, the European Central Bank and others, also turned more hawkish on the back of stubborn core inflation.

”We see a relatively smaller risk to the upside for the RBA from our baseline scenario. We have a modest tilt to the higher case of a peak in the cash rate of 5.10% if services inflation persists. This is most likely to occur if productivity in the economy remains moribund,” Lawson said in a note.

She now believes the bank is monitoring the three-way balance between the slowing household sector, the strong labour market, and high wages growth.

“We know that the labour market lags the economy, reflecting the monetary policy conditions seen almost a year before, but the turn is difficult to pinpoint. We remain in the midst of the peaking of the economy but believe that policy will continue to grip and slow economic growth, with a shallow recession starting late this year not off the table.

“Indeed, the higher policy profile leads us to believe there is more downside to the rates path through 2024, as the RBA will need to set policy for an economy nearing stall speed.

“We currently see market pricing of at least one rate increase with the chance of another as reasonable. We currently see the Australian yield curve as slightly under-valued.

“We remain on the lookout for tactical opportunities to add further duration on spikes in yields triggered by central bank signalling and data flows.”

Lawson says that as the cumulative impact of tighter financial conditions continues to grip – and the cycle ages – the Janus Henderson focus is in the credit space with a defensive bias.

“With a keen focus on risk-adjusted returns.”

“Our strong bias is towards high-quality, liquid credit and issuers that can survive and thrive through a range of macro-economic scenarios.”

”We are avoiding illiquidity, complexity and leveraged sectors, where we anticipate balance sheets will have to contend with a painful period of adjustment in a higher cost of capital environment.

“Lastly, by adopting a patient and disciplined approach to extending risk and reserving ample investment capacity we will be well placed to take advantage of any further market dislocations.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.