Pissweak Aussie inflation pumps ASX after slowest CPI read since start of last year. SAD!

News

News

Well. Inflation just slowed to its lowest pace of growth in ages – like, early 2022 – which should add some fireworks to the already party-like atmosphere surrounding Dr P. Lowe’s final meet as Reserve Bank of Australia (RBA) governor next Tuesday.

The annual inflation rate slowed to 4.9 per cent in July, according to the latest monthly consumer price index (CPI) thingy from the Boffins at the Australian Bureau of Statistics (ABS).

That’s down from 5.4% in June. And it’s the weakest run for inflation since February last year.

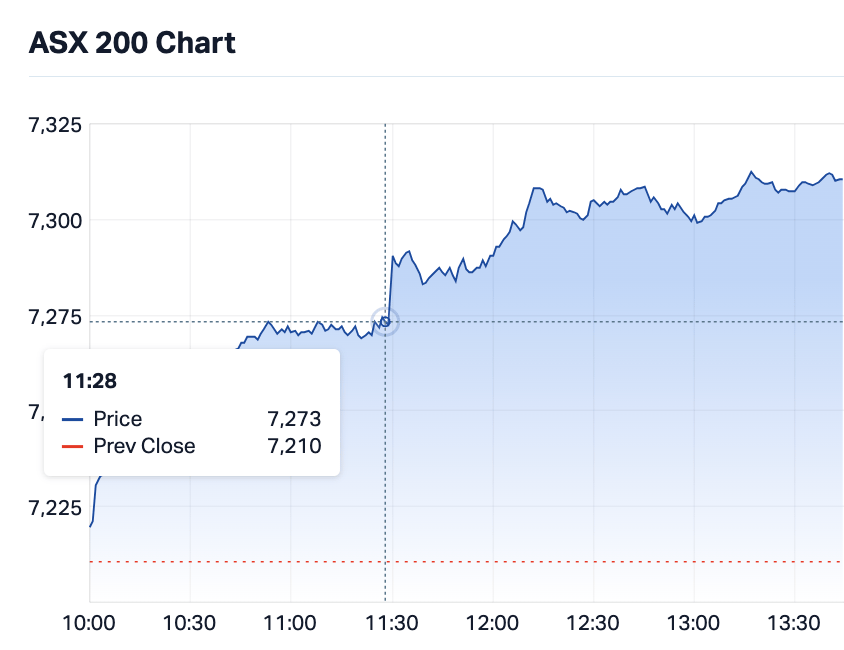

This is what the benchmark did at 11.30am when the data dropped:

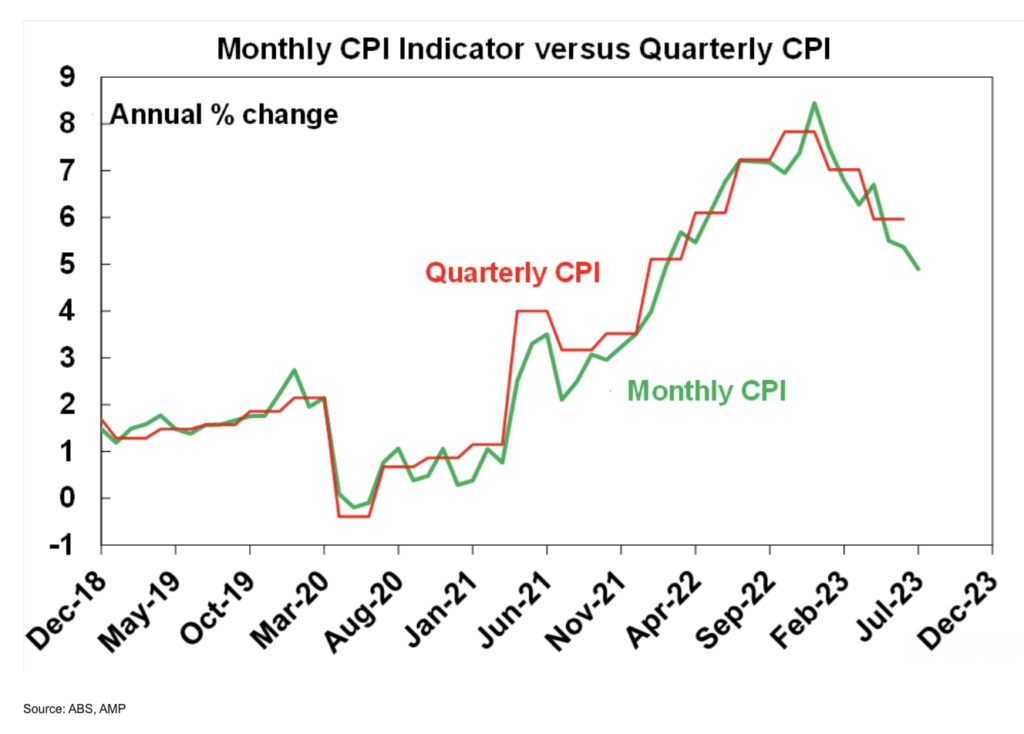

That’s probably because Australian inflation was at 8.4% (on the monthly indicator) at its peak back in December and at 7.8% on the quarterly index.

And it’s worth remembering that at 4.9%, inflation in July was still a painfully high number, in the historical sense and when considering that the RBA’s long term inflation target is 2-3%.

But, says AMP Capital’s senior economist Diana Mousina, it is a fast turnaround from the peak, similar to the experience of global peers and more downside is likely from here.

“While there is still some way to go before inflation is within the 2-3% RBA inflation target, fears of entrenched high inflation and permanent sticky prices have not eventuated.”

Pleased also to be the one to report that the read was decently below market expectations – which had inflation pegged at an annual rise of 5.2%.

With a few days before the final P. Lowe-led interest rate decision one must assume that this’ll be top of a growing pile of indicators which suggest the air is coming out of the price balloon and that 12 rate hikes since May seems to have had at least some impact.

Have stonkingly high interest rates really dampened price pressures? I don’t know, but the argument for staying on hold just got a little irresistible.

Or at least the case for rising is now looking pretty thin.

Before the ABS read, local markets were pricing in a rate hike at somewhere near zilch, given a slew of suggestive indicators led by the unexpected lift in the jobless rate for July, amid other signs the local economy was starting to ease and price pressures might slow down.

The benchmark ASX 200 up 1.1% at lunch and closing on 1.5% a few hours later.

The ABS head of prices stats Michelle Marquardt noted that the most significant contributors to the annual increase in July were housing (+7.3 per cent) and food and non-alcoholic beverages (+5.6 per cent), while price falls for automotive fuel (-7.6 per cent) and fruit and vegetables (-5.4 per cent) drove down the annual increase.

“CPI inflation is often impacted by items with volatile price changes like automotive fuel, fruit and vegetables, and holiday travel,” Ms Marquardt noted.

“This month’s annual increase of 4.9 per cent is down from 5.4 per cent in June. Annual price rises continue to ease from the peak of 8.4 per cent in December 2022.”

Mousina warns partygoers that the underlying inflation measures haven’t fallen as quickly as the headline data – remembering that the CPI strips out the volatile items like petrol et al.

Underlying inflation was up by 5.8% in July, down from 6.1% in June and the annual trimmed mean inflation rose by 5.6% in July, slightly down from 6.0% in June.

“The coverage of the monthly CPI data is not as comprehensive broad as the quarterly figures because not all components are updated every month (in July 62% of the basket was updated and categories that were not updated include restaurant/take-out meals, property and water rates, childcare and transport fares) and large monthly changes in prices can have a big impact on the headline series, especially for volatile items like petrol, clothing, recreation and holiday travel that are subject to seasonal factors,” Diana said in a very big but information-rich sentence.

The RBA meeting minutes from earlier this month suggest the bank was feeling a bit more confident inflation was dwindling, following a few reassuring indicators.

But, we’ll see.