ASX March winners: The best 50 stocks as smaller plays outperform large caps

Pic: Getty Images

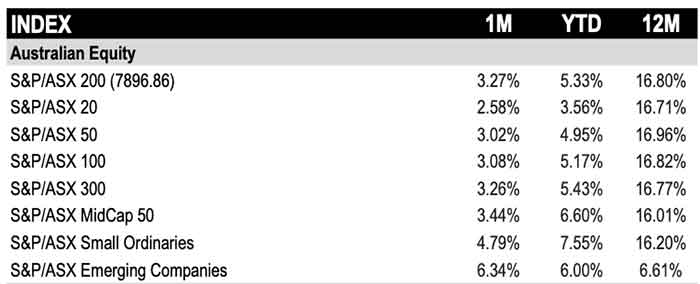

- S&P/ASX 200 rose 3.27% in March with Emerging Companies, MidCap and Small Ordinaries outperforming Large caps

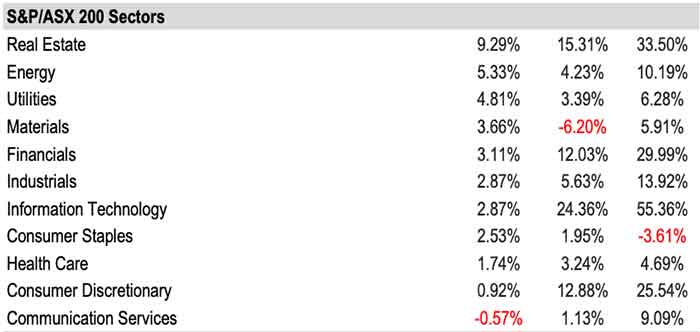

- The real estate sector was the big winner up 9.29% in March as the communications sector fell 0.57%

- Nyrada continue to soar after preclinical study shows promise of drug candidate NYR-BI03 in preventing secondary brain injury

Australia’s S&P/ASX 200 rose +3.27% in March to close at a new record high of 7896.86 points with small and emerging companies doing particularly well, according to S&P Dow Jones Indices (S&P DJI).

The S&P Emerging Companies index rose 6.34% in March, while the Small Ordinaries was up 4.79% and MidCap 50 rose 3.44%.

Looking at key economic data points released in March and US pop star Taylor Swift’s The Eras Tour in February, attracting ~600,000 enthusiastic ‘Swifties’ in Sydney and Melbourne, contributed to higher consumer spending on clothing, merchandise, accessories, and dining out in a phenomenon, known as Swiftonomics.

Australian Bureau of Statistics (ABS) figures show retail turnover increased by 0.3% in February, reaching $35.87bn.

Latest figures from the ABS show Australia’s monthly consumer price index (CPI) remained steady an annual pace of 3.4% in February, which was unchanged from January and December.

Trimmed mean inflation – the preferred measurement of the Reserve Bank of Australia (RBA) because it strips out more extreme price movements – was slightly up to an annual 3.9% in February from 3.8% in January but down from 4% in December.

The RBA kept rates on hold at 4.35% in March, but made it clear nothing would be ruled in or out over the months ahead as the central bank works to get inflation back to its 2-3% target.

The Bank of Japan (BOJ) hiked rates for the first time since 2007 in February, raising its key interest rate from -0.1% to a range of 0% to 0.1%. The decision followed an increase in wages following a rise in consumer prices.

In 2016, the BOJ cut the rate below zero in an effort to stimulate the country’s stagnant economy. Following the increase by Japan’s central bank hike, there are no longer any countries maintaining negative interest rates.

In the US – the world’s largest economy – the Federal Reserve held rates at a 23-year high in March and maintained expectations for three cuts before the end of 2024. Current US rates are at between 5.25% and 5.5%.

Real estate top performer in March, Communication services slumps

Communication services was the only sector with a loss in March. The Australian Real Estate sector rallied over 9% in March to become the second-best sector YTD after Information Technology.

After being the worst performer in February dropping ~6% energy rebounded in March, while Materials which lost ~5% in February also was back in the black.

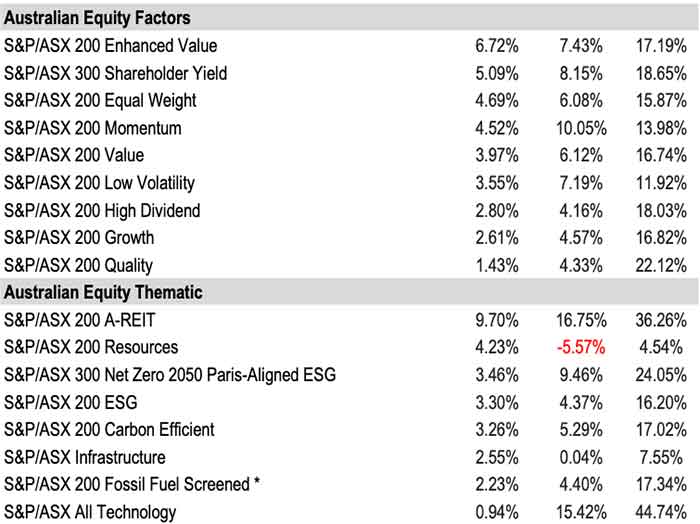

Enhanced value best performing factor in March

The S&P/ASX 200 Enhanced Value was the best performing factor in March with a 7% gain. Quality lagged with a 1% return.

S&P DJI says equity volatility was among the rare indices in the red, with the S&P/ASX 200 VIX sinking below 10 against the bullish market backdrop.

Fixed income in positive territory

After a mixed performance in February, fixed income was in positive territory in March.

Here are the 50 best performing ASX stocks for March:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | MARCH RETURN % | MARKET CAP |

|---|---|---|---|---|

| NYR | Nyrada Inc | 0.097 | 411% | $16,146,783.00 |

| OSX | Osteopore Limited | 0.3 | 319% | $3,098,606.70 |

| ZNO | Zoono Group Ltd | 0.12 | 243% | $26,709,674.25 |

| M4M | Macro Metals Limited | 0.007 | 180% | $25,856,534.05 |

| ASP | Aspermont Limited | 0.019 | 171% | $44,201,424.65 |

| MAG | Magmatic Resrce Ltd | 0.098 | 165% | $36,637,339.10 |

| GLV | Global Oil & Gas | 0.041 | 156% | $22,293,347.04 |

| MMM | Marley Spoon Se | 0.08 | 150% | $9,771,125.45 |

| WWG | Wiseway Group | 0.11 | 134% | $18,402,325.92 |

| MPK | Many Peaks Minerals | 0.205 | 118% | $8,193,570.59 |

| TSK | Task Group Holdings | 0.795 | 104% | $281,490,508.21 |

| CVR | Cavalier Resources | 0.19 | 100% | $4,933,481.98 |

| HXG | Hexagon Energy | 0.026 | 100% | $13,335,813.43 |

| TTT | Titomic Limited | 0.065 | 97% | $58,415,469.25 |

| MSB | Mesoblast Limited | 0.58 | 97% | $564,652,316.75 |

| SRL | Sunrise | 0.67 | 86% | $55,941,048.76 |

| SCN | Scorpion Minerals | 0.033 | 83% | $14,330,966.72 |

| ARL | Ardea Resources Ltd | 0.73 | 83% | $142,837,263.38 |

| RAC | Race Oncology Ltd | 1.41 | 82% | $228,217,777.92 |

| AD1 | AD1 Holdings Limited | 0.009 | 80% | $8,087,835.39 |

| STM | Sunstone Metals Ltd | 0.016 | 78% | $45,508,470.10 |

| SRX | Sierra Rutile | 0.12 | 76% | $48,787,191.41 |

| APS | Allup Silica Ltd | 0.062 | 72% | $1,115,835.93 |

| RNT | Rent.Com.Au Limited | 0.043 | 72% | $27,074,931.17 |

| GTE | Great Western Exp. | 0.068 | 70% | $23,316,711.34 |

| NYM | Narryer Metals | 0.051 | 70% | $3,149,637.29 |

| ASV | Assetvisonco | 0.02 | 67% | $14,516,731.30 |

| AVE | Avecho Biotech Ltd | 0.005 | 67% | $12,677,188.05 |

| MCL | Mighty Craft Ltd | 0.025 | 67% | $6,937,511.14 |

| NVQ | Noviqtech Limited | 0.005 | 67% | $7,436,536.48 |

| AWJ | Auric Mining | 0.18 | 64% | $22,900,428.43 |

| BGT | Bio-Gene Technology | 0.072 | 64% | $14,095,309.90 |

| RR1 | Reach Resources Ltd | 0.003 | 64% | $9,836,169.46 |

| AXE | Archer Materials | 0.585 | 63% | $146,537,032.48 |

| PNR | Pantoro Limited | 0.0645 | 61% | $317,445,861.35 |

| G50 | Gold50 Limited | 0.135 | 61% | $14,754,150.00 |

| MMC | Mitre Mining | 0.45 | 61% | $34,328,491.89 |

| HMI | Hiremii | 0.048 | 60% | $6,469,403.52 |

| TCG | Turaco Gold Limited | 0.175 | 59% | $99,975,111.47 |

| ANR | Anatara Ls Ltd | 0.035 | 59% | $6,883,642.81 |

| ALM | Alma Metals Ltd | 0.011 | 57% | $11,140,007.87 |

| IMC | Immuron Limited | 0.11 | 57% | $25,079,818.06 |

| COE | Cooper Energy Ltd | 0.2275 | 57% | $580,808,410.38 |

| WIA | WIA Gold Limited | 0.08 | 57% | $73,654,796.88 |

| AIS | Aeris Resources Ltd | 0.155 | 55% | $145,128,831.00 |

| XAM | Xanadu Mines Ltd | 0.062 | 55% | $99,528,348.52 |

| AUQ | Alara Resources Ltd | 0.06 | 54% | $43,085,252.46 |

| GCX | GCX Metals Limited | 0.055 | 53% | $15,594,419.90 |

| ICU | Investor Centre Ltd | 0.032 | 52% | $9,399,139.27 |

| AEI | Aeris Environmental | 0.07 | 52% | $17,198,618.57 |

Drug discovery and development company Nyrada (ASX:NYR) continued its monumental rise in March, up more than 400% after seeing its share price jump more than 300% in February.

NYR has seen its price soar after releasing positive results from its preclinical study evaluating the efficacy of its brain injury program drug candidate NYR-BI03 in preventing secondary brain injury.

The drug candidate has potential for treating patients in two important markets – stroke and traumatic brain injury.

In March NYR announced it had raised $1.755m in new equity capital from new and existing professional and sophisticated investors for a placement of 23.4m CDIs.

Osteopore (ASX:OSX) rose 319% in March but there remains uncertainty as to why the natural tissue regeneration specialist has gained so much. OSX had several announcements out during the month.

On March 27 OSX announced it had secured market approval for its orthopaedic products in Singapore and Vietnam, which saw it’s share price rise ~400% in one day.

The massive rise was on the tail of a recent huge fall in share price for OSX, after the company sought $3,000,000 through a placement priced at a massive 94.42% discount to last closing price.

That came about through a number of factors, including an ill-timed 15:1 consolidation.

On March 28, OSX went into voluntary suspension “due to unexpected delays in completing the 31 December 2023 Annual Report due to compiling information requested by the company’s auditors.”

OSX requested to be in suspension until the end of April or until the report is lodged with the ASX. The company was suspended from trade on April 2 for “not lodging the relevant periodic report by the due date”.

There are still a few question marks floating around this one, but in the absence of anything concrete, the OSX story for now simply is what it is.

Zoono Group (ASX:ZNO) was on the March winners board after entering into an exclusive agency agreement with OSY Group to promote the sale of Zoono products for the food supply chain sector.

ZNO says OSY is a leading-edge provider of technologies in the hygiene technology sector and was recently awarded an Innovate UK Award granting funding to support its food shelf-life extension work.

Iron ore junior and lithium explorer Macro Metals (ASX:M4M) was trading higher in March after announcing boardroom appointments that include two highly successful, high-profile small caps mining investors – Tolga Kumova and Evan Cranston.

The company has announced the appointment of a “highly regarded board with the dedicated focus of developing Macro’s Pilbara iron ore portfolio”.

Here are the 50 worst performing ASX stocks for March:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | MARCH RETURN % | MARKET CAP |

|---|---|---|---|---|

| CMD | Cassius Mining Ltd | 0.009 | -74% | $4,878,040.46 |

| E79 | E79 Gold Mines | 0.028 | -58% | $2,684,024.74 |

| NAG | Nagambie Resources | 0.013 | -55% | $10,356,263.80 |

| CPM | Cooper Metals | 0.12 | -53% | $8,227,343.25 |

| SHO | Sportshero Ltd | 0.008 | -53% | $4,942,662.70 |

| WHK | Whitehawk Limited | 0.017 | -51% | $7,951,673.02 |

| BGE | Bridge SaaS | 0.03 | -50% | $3,581,911.68 |

| CNJ | Conico Ltd | 0.0015 | -50% | $2,707,642.42 |

| HHR | Hartshead Resources | 0.006 | -50% | $18,256,433.83 |

| RFT | Rectifier Technolog | 0.018 | -50% | $30,403,646.83 |

| RMX | Red Mount Mining | 0.001 | -50% | $5,347,152.07 |

| WYX | Western Yilgarn NL | 0.045 | -47% | $2,860,855.18 |

| OPN | Oppen Negotiation | 0.006 | -45% | $5,645,898.18 |

| DBO | Diablo Resources | 0.017 | -43% | $1,752,214.29 |

| SSH | Ssh Group | 0.085 | -43% | $5,601,487.51 |

| CHK | Cohiba Minerals | 0.002 | -43% | $8,970,610.46 |

| KTA | Krakatoa Resources | 0.008 | -43% | $3,776,857.76 |

| MOM | Moab Minerals Ltd | 0.004 | -43% | $3,559,817.37 |

| LKE | Lake Resources | 0.0665 | -42% | $104,811,589.18 |

| BEX | Bikeexchange Ltd | 0.35 | -41% | $6,524,131.82 |

| LNR | Lanthanein Resources | 0.003 | -40% | $5,864,726.71 |

| NRZ | Neurizer Ltd | 0.003 | -40% | $4,504,232.49 |

| TMK | TMK Energy Limited | 0.003 | -40% | $18,367,737.90 |

| CLV | Clover Corporation | 0.49 | -40% | $82,664,673.80 |

| BM8 | Battery Age Minerals | 0.1 | -39% | $9,634,833.39 |

| AS2 | Askari Metals | 0.051 | -39% | $4,377,324.22 |

| ETR | Entyr Limited | 0.007 | -39% | $13,881,727.25 |

| SNX | Sierra Nevada Gold | 0.06 | -39% | $3,623,747.46 |

| BEZ | Besra Gold | 0.092 | -39% | $43,900,595.13 |

| RWD | Reward Minerals Ltd | 0.031 | -38% | $6,835,594.14 |

| ENV | Enova Mining Limited | 0.025 | -38% | $17,799,496.18 |

| EXL | Elixinol Wellness | 0.005 | -38% | $6,961,587.74 |

| GTI | Gratifii | 0.005 | -38% | $6,846,113.32 |

| TZL | TZ Limited | 0.02 | -38% | $5,135,162.28 |

| IXU | Ixup Limited | 0.015 | -37% | $16,313,033.88 |

| C7A | Clara Resources | 0.012 | -37% | $2,268,468.46 |

| RCR | Rincon | 0.024 | -37% | $5,528,784.10 |

| MTM | MTM Critical Metals | 0.064 | -36% | $7,954,966.78 |

| BTH | Bigtincan Hldgs Ltd | 0.1475 | -36% | $92,437,963.50 |

| EVR | Ev Resources Ltd | 0.009 | -36% | $11,891,443.37 |

| RFA | Rare Foods Australia | 0.031 | -35% | $6,358,779.09 |

| GNM | Great Northern | 0.013 | -35% | $2,010,178.00 |

| CTQ | Careteq Limited | 0.015 | -35% | $3,533,209.38 |

| OZM | Ozaurum Resources | 0.046 | -34% | $7,461,250.00 |

| OSL | Oncosil Medical | 0.005 | -34% | $9,872,705.66 |

| AOA | Ausmon Resorces | 0.002 | -33% | $2,117,998.69 |

| ARN | Aldoro Resources | 0.07 | -33% | $9,423,662.01 |

| CCO | The Calmer Co International | 0.004 | -33% | $4,730,786.70 |

| FAU | First Au Ltd | 0.002 | -33% | $3,323,986.55 |

African-focused Cassius Mining (ASX:CMD) continued to see its share price slide in March. CMD announced in March it had entered into a share sale agreement with AustChina Holdings Limited to sell 100% of its subsidiary Cassius Mining, which holds four licence permits in Tanzania, for up to $1,150,000 and a 1% net smelter royalty.

CMD is currently locked in a dispute with Government of the Republic of Ghana. CMD has filed a claim for US$275 million, citing Ghana’s alleged breaches of contract and statute as the basis.

In March CMD also reported a net loss for the half-year ended December 21, 2023 after providing for income tax of $1,002,767, up from $214,599 on pcp.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.