You might be interested in

Experts

Q3 earnings showed ASX resilience, but these three companies were remarkable: Tru Datt!

Experts

CRITERION: Thinking of risking a finger on a falling knife? Sometimes they come back...

Experts

News

Mandatory isolation is over and Morgan Stanley is calling it. An incremental move back into growth stocks, if not the office, is on the cards.

With mighty little fanfare, Australia entered a new and thrilling phase of the COVID-19 pandemic last week. The Pretty Much Ignore It phase promises to be a return to Business As Usual with mandatory isolation for positive cases coming to an end across the country.

But for many working grunts worldwide business will never go back to the usual, and therein the brains at Morgan Stanley see an opportunity of aligning stars.

With workplaces around the world transformed by the pandemic experience, and varying numbers of workers heading back into the office, the investment bank says there’s enough evidence of both stock underperformance and a redoubling of investment into remote working tech, that the time is nigh for a cunning move back into growth stocks.

The broad church of work-from-home (WFH) stocks have been in tortured retreat for most of the past year.

No-one wants to fight this Fed, we booked the long flight to quality and the destination is strong balance sheets and income generation – the twin capitals of defensive positioning. And so, along with most of the Nasdaq, some of those biggest pandemic winners from the WFH sector have quickly become the biggest post-pandemic losers – some losing as much as 80% of their market capital along the journey.

It’s time to turn the car around, says Meta Marshall, Morgan Stanley Research analyst, and take another look at hybrid workplace software specialists in particular. The best places to start are in collaboration tech – specifically the cybersecurity experts, video-conferencers and virtual-desktop software developers.

As a result, some of the oversold WFH stocks may be worth a second look, as the worst is likely in the rearview mirror.

Last week analysts bit the bullet on possibly the most oversold and on-the-nose of all sectors on all bourses – European tech stocks. Morgan Stanley double-upgraded the hard hit Euro tech sector to Overweight from Underweight, saying the game’s afoot, once the Fed pulls the cord on rising interest rates.

Brokers at Citi Group even got the jump on them, lifting global tech stocks to Overweight two weeks ago in the initial inkling that the majors are already repositioning.

“We may be a bit early, but software should be relatively defensive in any further selloff, and valuations look reasonable now after EU tech has posted its biggest underperformance since 2005,” MS strategists wrote in a note to clients.

(All prices USD.)

Twilio Inc (NYSE:TWLO) closing price $74.01 USD (-188.28 or -71.78%) year to date

Twilio provides a cloud communication platform which incorporates APIs (Application Programming Interfaces) as intermediaries to streamline two-way communication.

Suggests strong growth trajectory, sales up 41% in the second quarter.

Third-quarter update, slated for early November, will show whether that confidence has waned in the intervening months

Customers now include Airbnb (NASDAQ: ABNB), eBay (NASDAQ: EBAY), and e-hailing platform Lyft (NASDAQ: LYFT)

Launched Twilio Engage last month – a marketing automation platform

Year to date, tech is really only No. 3 when it comes to the title of worst performing sector in Europe. Don’t forget though, competition in that space is fierce, so the one-third collapse in EU-Tech is right up there. Morgan Stanley has the sector trading at 18.9x forward earnings, still near pandemic lows and below the average over the past decade of 21.1x forward earnings.

According to the investment bank’s survey and data arm, AlphaWise, singed investors have learned by now that the pandemic-led boom growth of work-from-home software stocks was much too meteoric a rise not to have fallen back to Earth – in some cases – in a fireball of disgrace.

Market sentiment for these platforms ‘dimmed significantly’, the bank notes, even as employers around the world are now rebooting and taking up different positions on the whole concept of what ‘heading back to the office’ looks like.

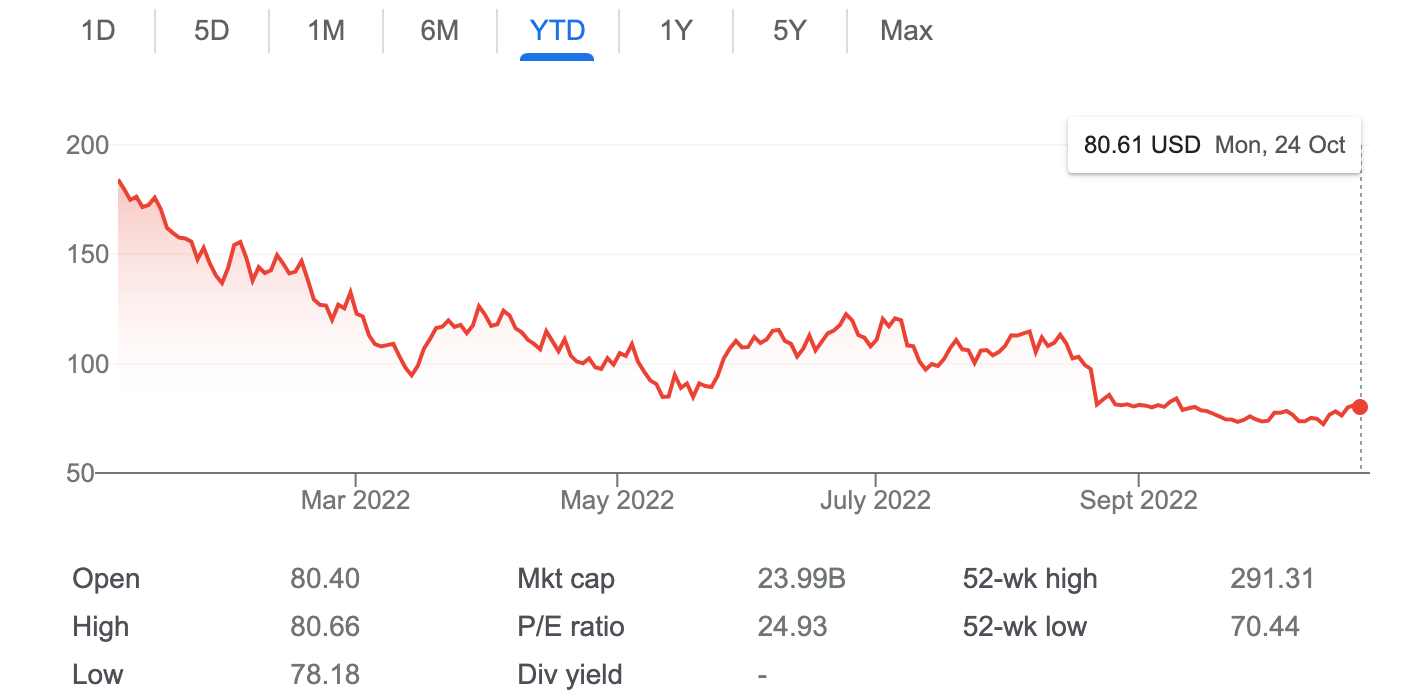

Zoom Video Communications Inc (NASDAQ:ZM) closing price $80.61 USD (-$103.65 or -56.25%) year to date

Zoom Video Communications – the poster child for COVID-carnage. The ZM stock price has now given away some 85% of its value.

Hard to believe, but buying shares in ZM is a cheaper deal than at the pandemic, kick off.

And this is a business which was picking up enterprise clients and dropping some decent numbers over Q4.

A bullish Zoom founder and CEO Eric Yuan says it doesn’t matter that some workers might be showing Zoom fatigue, because video-conferencing is here to stay

Wall Street analysts have a price target circa $154. That’s 75% of upside blue sky.

Elon Musk might want all hands on deck, but the Tesla boss is at odds with the wider world, with heaps of workers across a variety of markets and industries still opting to log in remotely.

In fact, the further out we get from lockdowns, the more it looks like the hybrid model is becoming the norm.

This means companies of all shapes and sizes are only just reevaluating their long-term models. Tough but apparently necessary investment choices are being made.

According to the AlphaWise survey of 65 chief information officers (CIOs) across the states and in Europe there’s a renewed wave of more precise investing in the WFH thematic software services – from video conferencing, telephony tech and cybersecurity architecture.

And now the CIOs have been around the block with this stuff, AlphaWise suggests the businesses are more than likely to invest in more than just one provider – it’s always good to have a back-up plan it seems – especially for commercial communication services which are absolutely central to corporate practice in the new remote working world.

“While the sector may no longer have the allure of accelerating growth, we do think there is too much negativity on the degree to which the opportunity has been captured,” Marshall said.

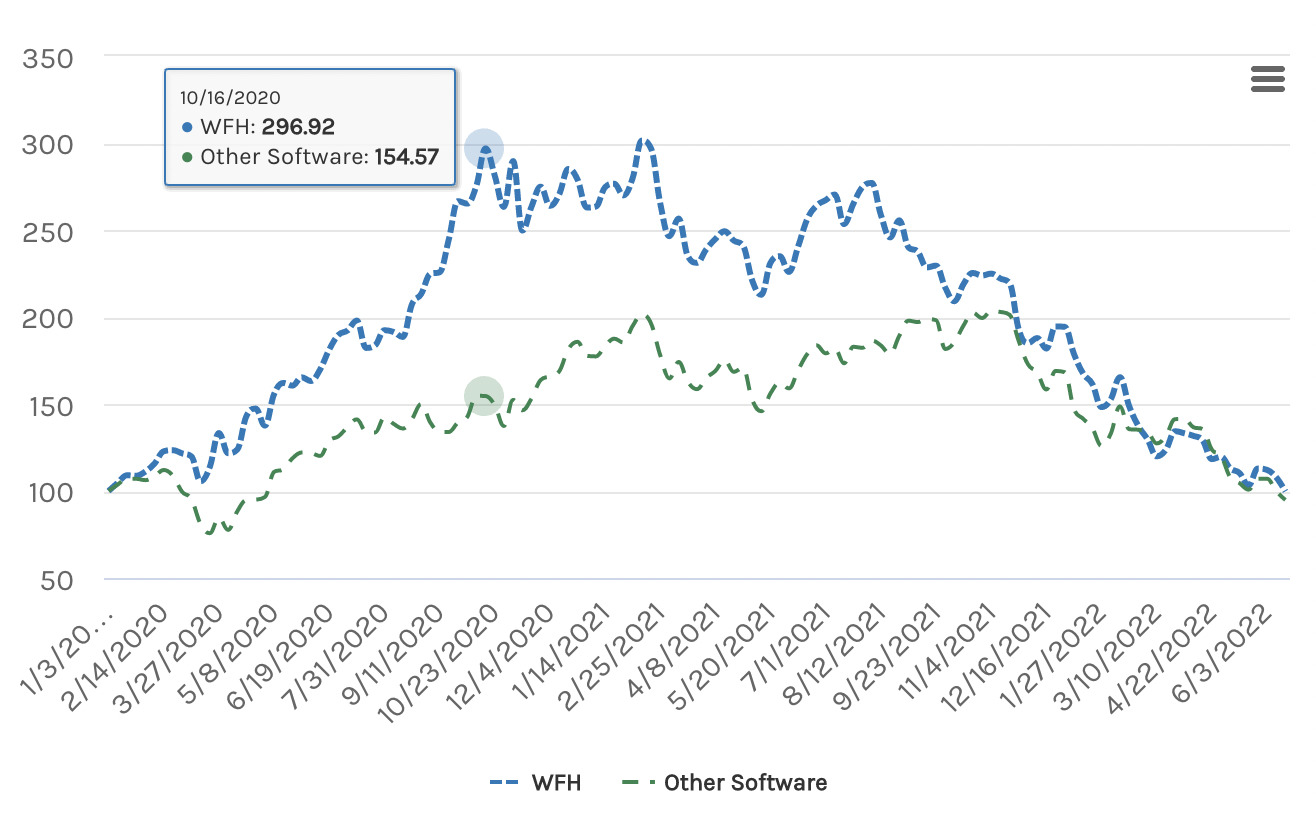

The onset of the COVID-19 pandemic and resulting lockdowns forced millions of people to remote work overnight.

CIOs just as quickly had to ensure essential functions could continue without disruption in virtual settings, pushing up valuations for technologies and systems that were viewed as central to the shift. In fact, the value of companies providing collaboration software and other work-from-home technologies rose 263% in 2020.

But as of mid-June, the valuation of companies in the sector had fallen 49% on average since the beginning of 2022, with most investors thinking that the moment for collaboration software has passed and that companies will focus on one dominant player to manage video conferencing, messaging, telephony and remote desktops.

Three quarters of the CIOs surveyed by AlphaWise used a single service for video conferencing and 69% rely solely on that suite’s messaging services.

Morgan Stanley thinks there’s ample room for competition.

72% of CIOs also pay for another video-conferencing software (one that gained ubiquity during the pandemic), and more than half said they plan to maintain at least two different video platforms given differing needs and preferences.

“Given the return on investment of video, particularly versus in-person travel, we think this dynamic continues,” says Marshall.

“Particularly in a more challenged macro environment, it’s a priority to honour customers’ preferences for interaction platforms.”

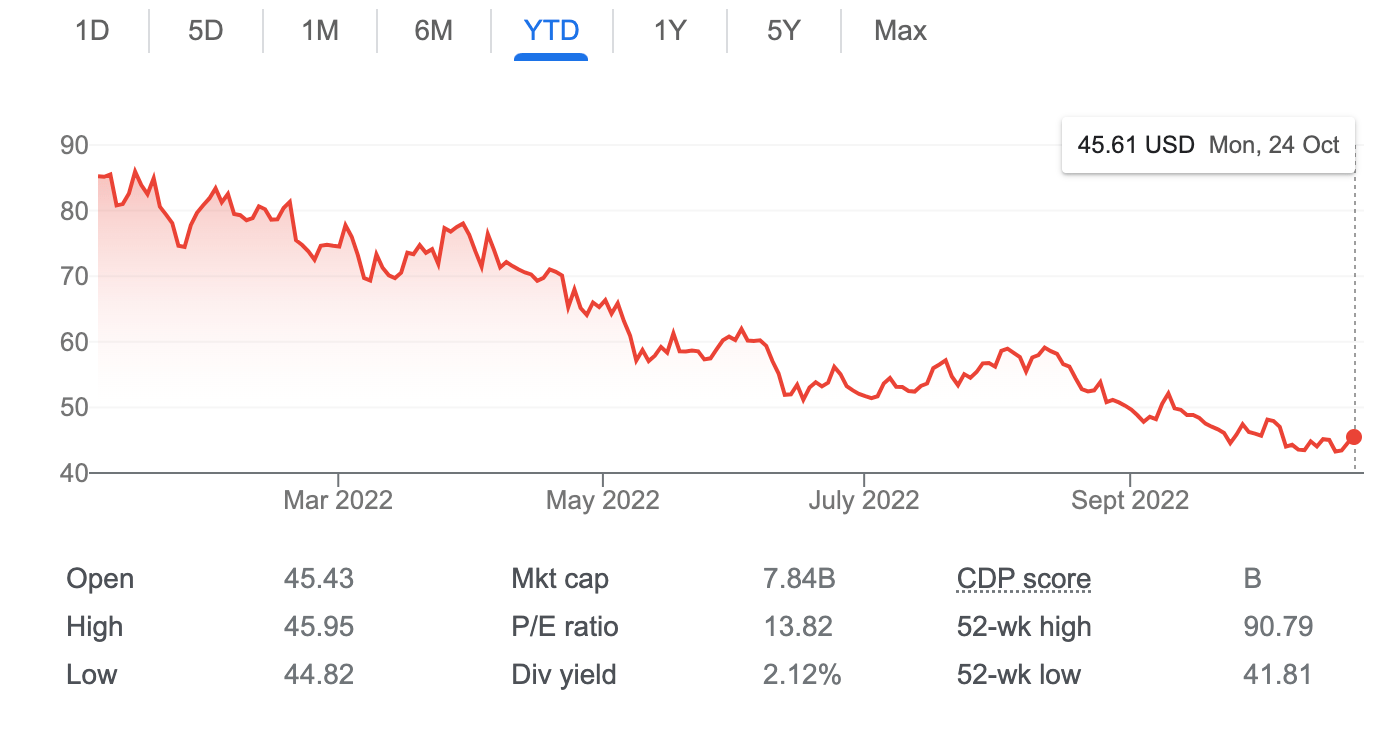

Logitech International SA (NASDAQ:LOGI) closing price $45.61 USD (-$39.62 or -46.49%) year to date

Logitech is a peripheral designer and manufacturer

Experienced a surge in demand surge during pandemic-induced lockdowns

Made famous by computer mice, keyboards et al

Logi share price collapsing since June 2021.

Since then, the stock has lost around 57% of its value

The COVID “pull-forward” in demand has hit LOGI stock as hard as any WFH play.

Many workforces have possibly over-ordered peripherals

Hardware normalisation could see share price return

LOGI retains same upside from these levels, according to Wall Street analysts

Very cheap in this regard, at just 15x trailing earnings.

Wall Street is bullish, an avge LOGI price target of $89.22, implying ~53% upside potential.

Companies are not only going in for several video-conferencing and messaging platforms; they’re also set to spend across related areas to enhance impact and drive down costs long-term.

Morgan Stanley Research sees this as an indication that the market could be undervaluing the investment opportunity created by the potential of collaboration technologies with the longevity of hybrid and work-from-home models.

Here’s where MS says companies are also investing in:

Investments in remote desktop technologies and telephony systems are normalising from pandemic expansion; MS says both areas are poised for incremental growth.

More than 50% of CIOs told MS they’d upgraded their telephony in the past two years, with 55% going for something either fully or partially in the cloud.

“We think this points to a long runway of cloud adoption still ahead and that demand hasn’t pulled forward as much as is believed today,” says Marshall.

Meanwhile, within the employee workforce covered by the AlphaWise survey, those provided with virtual desktop capabilities rose 25% since the onset of the pandemic to 67% and is set to rise to 78% in the next one to two years.

Box Inc (NASDAQ:BOX) $28.16 USD (+1.76 or +6.67%) year to date

Now this is a developer of cloud-based content management, collaboration, and file sharing tools for businesses

Box does touts a content management platform that’s fared best of the WFH stocks on this list.

In fact, Box stock was sitting at an all-time high just over a month ago before shares slipped into a 14% correction.

Founded in 2005 by Aaron Levie and Dylan Smith

Standing CEO Levie is focused on upselling customers and improving margins.

The workflow collaboration tool market is strong while the lucrative enterprise market beckons.

Box forward guidance of revenue between $233 million to $235 million range for Q1 2023.

With shares trading circa 6.1x sales, the $4bn market cap has legs

Wall Street is bullish, with the average Box price target of $32.50, implying 15% upside from today’s levels.

Security has been weighing on the minds of CIOs everywhere during the pandemic. And that’ll only take up greater territory in the proportion of sleepless CIO nights with a workforce logging in from all over the world and even telco giants far from secure.

MS says firms are still ramping up significant investment in firewalls. And they probably should.

Ask Optus. Ask Medibank, Ask US-based Cybersecurity Ventures which says something complex and confusing – cybercrime costs more than the economies of most countries and would rank after the United States and China as the world’s third largest economy. I think it means that total damages have already cost a total of more than US$6 trillion. Though, it’s a bit like asking Apple to put a total value on the cost of not having an iPhone.

MS says some 80% of CIOs said they had upgraded in the last three months. Still, the refresh cycle for firewalls is only about three years, and Morgan Stanley expects continued security investment driven by a more distributed workforce.

“A normalisation in growth does not mean investment cycles have ended,” says Marshall. “Barring a major economic downturn, we still expect most WFH-related spending categories to grow over the next few years.”

S&P/ASX All Technology Index (ASX: XTX) is down 33%. (The ASX 200 is down 13% by comparison)

Tesserent (ASX: TNT) and Prophecy International Holdings Limited (ASX: PRO), workflow platform provider Whispir (ASX: WSP), and CV Check (ASX: CV1), which helps companies bring employees on board are all local options worth a peek.