MoneyTalks: 3 cybersecurity stocks to watch in the wake of the Optus hack

Experts

Experts

Money Talks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

As fallout from the Optus hack continues, today we hear from Shaw and Partners senior private wealth adviser Felicity Thomas.

A new report by US-based firm Cybersecurity Ventures has found that cybercrime costs more than the economies of most countries and would rank after the United States and China as the world’s third largest economy, with damages already totalling more than US$6 trillion.

The global cybersecurity market size was valued at $184.93 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12% from 2022 to 2030 – which is why, from an investment perspective, Shaw and Partner’s Felicity Thomas believes the sector should not go ignored.

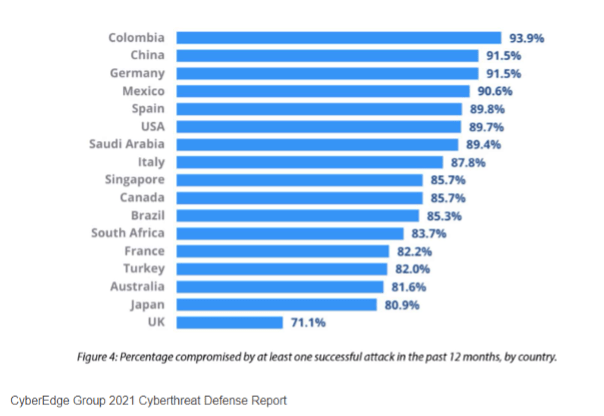

As the world continues to digitise, so does crime, with state-based cyber campaigns and ransomware attacks becoming increasingly prevalent – forcing governments to increase their focus and funding to limit potentially enormous economic impacts.

Here in Australia, the issue is even more relevant as an investment thematic following the recent Optus hack but with working from home now the norm, Thomas says the issue is becoming even more critical as increased security is needed to protect sensitive data and information stored in the cloud.

“There is expected to be around 75 billion connected devices by 2025, further highlighting cybercrimes’ potential dominance,” she says.

Thomas has three picks – the first two are in the corporate and government space, where cyber security plays out in the form of national security threats and attacks on company data and client information.

The third pick can be used as a tool to combat cybersecurity risks for children and families.

After investing two years and ~$125m acquiring several smaller firms in the highly fragmented domestic cybersecurity market, Thomas says TNT is now one of the leading players in Australia with a particularly strong presence in the government space.

Tesserent provides full service, enterprise-grade cybersecurity and networking solutions targeted at mid-market, enterprise, and government customers across Australia via its 350+ security engineers.

Recent highlights include year on year earnings growth of 115%, margins remaining strong hitting 25% year on year growth, and in FY22, the Federal Division generated top line growth (+85%) and maintained EBITDA margins at 22.4% (flat YoY).

Management have indicated previous acquisitions are performing well relative to initial expectations, Thomas says.

“We believe TNT offers investors exposure to the growing cybersecurity thematic at an attractive price – 35% and 50% discount to peers on FY23 PE and FY23 EV/EBITDA, respectively.

“I’m buying this stock because TNT’s strategic shift over the past three years has transformed the company, with the financial upside coming through, albeit not priced by the market,” she says.

“The company is operating EBITDA profitable, operating cash flow positive, and appropriately levered to execute on further accretive acquisitions should they arise.”

According to Thomas, NASDAQ-listed CrowdStrike is one of the best positioned companies in cyber security.

CrowdStrike is a cybersecurity company that leverages AI to proactively search for threats and shut them down before attackers can launch destructive attacks and prides itself on being the first cloud-native endpoint security platform on the market.

“Consider an example of a smartphone belonging to an employee at one of CrowdStrike’s customers as an ‘endpoint’,” she says.

“If it is attacked by a virus, CrowdStrikes’s Falcon platform not only stops the virus at that endpoint, but it also then uses AI to train the entire network protecting all of CrowdStrike’s customers.

“This makes the virus ineffective when it attacks another employee who works for a different customer.”

From a financial perspective, Thomas says CrowdStrike has reported phenomenal growth since its IPO in June 2019 at US$50 and continues to have very good long term growth prospects.

“I’m buying this stock because the cybersecurity market is fragmented and if CRWD can demonstrate it can be a platform play than the opportunity is likely to be significant,” she says.

“Interestingly, while highlighting the potential, CRWD is targeting a true global horizontal opportunity, is already achieving a +30% FCF margin.”

Family Zone is a world first platform that offers a singular approach to enable schools, parents and cyber safety experts to collaborate to keep children safe anywhere, at any time, on any device and any network.

The company intends to create a system where most of the parental control functions in a cloud-based application.

“Family Zone’s annual recurring revenue hit $80 million on August 22 from $77 million on June 22, meaning this is likely to grow at around 40 per cent organically,” Thomas explains.

“FZO offers unique exposure to one of the fastest growing annual recurring revenue profiles on the ASX and with multiple channels to market, strong POC conversion and robust net promoter scores, we believe FZO is likely to deliver on material US as well as international growth.”

Thomas expects FZO to pursue profitable growth in FY23, and gain the potential for strategic interest over time, particularly from US-based private equity who remain active in the space.

“Shaw and Partners’ 12 month price target for the company is at $0.66c,” she says.

“The company is now trading on 2.9x enterprise value and annual recurring revenue, which is a ~50% discount to emerging cloud companies.

“Upside to its annual recurring revenue will occur occur from further product and market entries – FZO is likely to launch products into market in the US and UK including classroom, monitoring and parental control products.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.