Lunch Wrap: ASX stays above water as Wall Street busts records; goldies rally

ASX edges up Wall Street hits record. Picture via Getty Images

- ASX edges up after Wall Street hits record

- Gold climbs, oil slides

- Insignia jumps, Vik Bansal steps down as Boral CEO

The ASX kept its head above the surface by Tuesday lunchtime in the east coast, rising a modest 0.15%.

Overnight, the S&P 500 and Nasdaq both rewrote the record books, fuelled by big tech tailwinds and Wall Street’s growing obsession with rate cuts.

Trump was again in the thick of it, heckling Fed Reserve boss Jerome Powell from his digital pulpit and warning him to cut rates or face the wrath.

With traders now betting on at least two rate cuts in 2025, gold is back in favour. The precious metal nudged up to around US$3,312 an ounce this morning.

The US dollar, bruised and limping, is down 12% from its January highs, which also made bullion a whole lot shinier for buyers.

Oil, on the other hand, has taken a tumble. WTI is now hovering around US$65 a barrel as traders weigh up how much more OPEC+ is planning to pump out.

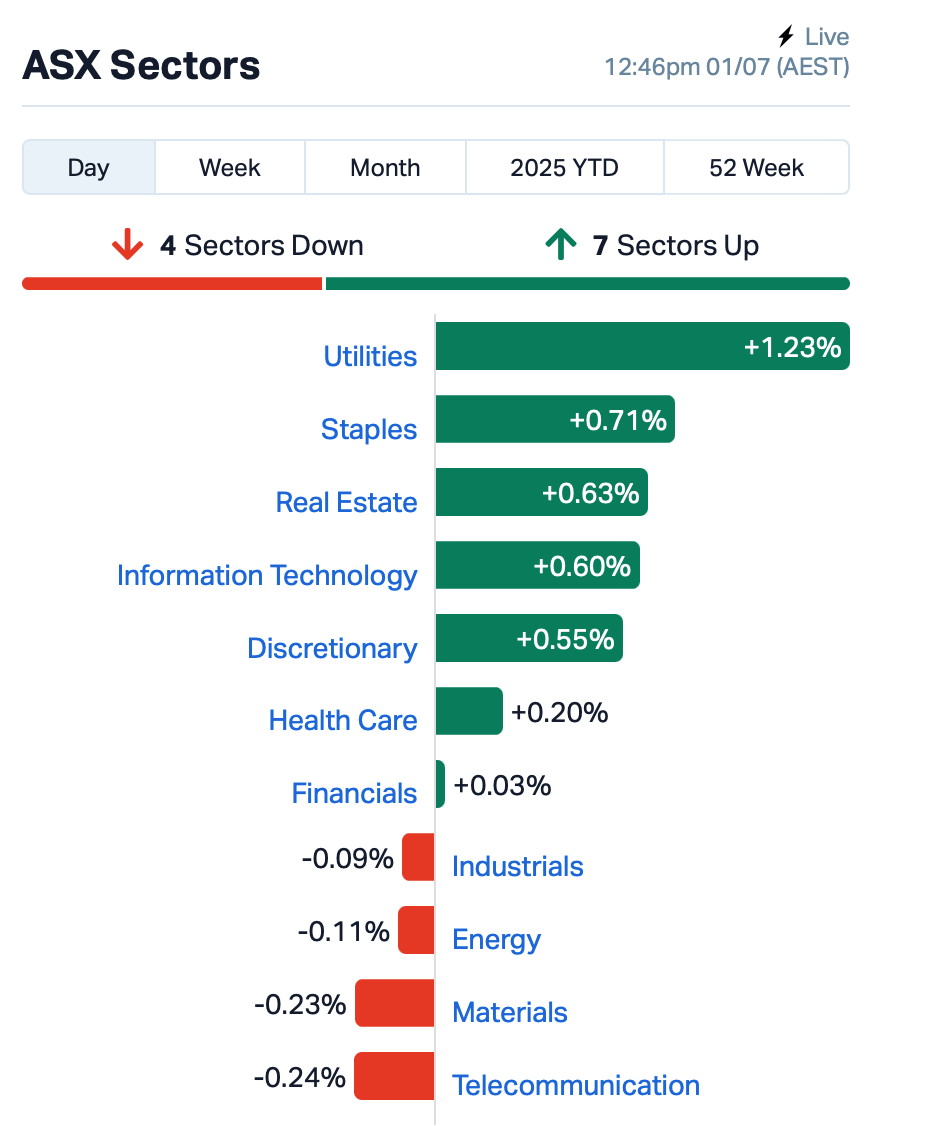

Back home on the ASX, defensive sectors – utilities, staples and real estate – led the gains this morning.

In the large caps space, Insignia Financial (ASX:IFL) delivered the morning’s biggest bang, surging as high as 9% after CC Capital said it’s getting serious about making a binding bid.

Meanwhile, Kerry Stokes’ SGH (ASX:SGH), the owner of once-listed Boral, dropped nearly 2% after news broke that Vik Bansal will step down as Boral CEO and shift into a non-executive role at Seven Group Holdings (ASX:SVW).

Investors weren’t thrilled about the timing, given SGH only took full control of Boral last July.

David Di Pilla’s HMC Capital (ASX:HMC) took a hit too, sliding more than 14% after its energy transition lead Angela Karl quit, and it delayed closing the deal for Neoen’s Victorian wind and battery assets by a month.

And, insurance heavyweight Insurance Australia (ASX:IAG) lifted its profit guidance, now expecting full-year insurance profits between $1.6 and $1.8 billion, up from its previous $1.4 to $1.6 billion range. Shares were still down 0.2%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 1 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AOA | Ausmon Resorces | 0.002 | 100% | 1,004,755 | $1,311,213 |

| CT1 | Constellation Tech | 0.002 | 100% | 2,113,189 | $1,474,734 |

| EWC | Energy World Corpor. | 0.042 | 100% | 11,521,775 | $64,657,346 |

| IS3 | I Synergy Group Ltd | 0.002 | 100% | 1,502,492 | $1,502,190 |

| NXS | Next Science Limited | 0.120 | 79% | 4,293,990 | $19,574,736 |

| JAV | Javelin Minerals Ltd | 0.003 | 50% | 1,000,000 | $12,252,298 |

| TEG | Triangle Energy Ltd | 0.003 | 50% | 774,532 | $4,178,468 |

| OLL | Openlearning | 0.017 | 42% | 1,368,844 | $5,792,096 |

| M2R | Miramar | 0.004 | 33% | 1,150,000 | $2,990,470 |

| OMG | OMG Group Limited | 0.008 | 33% | 4,677,189 | $4,369,769 |

| RNX | Renegade Exploration | 0.004 | 33% | 1,364,000 | $3,865,090 |

| VFX | Visionflex Group Ltd | 0.002 | 33% | 3,500,000 | $5,051,791 |

| WBE | Whitebark Energy | 0.004 | 33% | 2,960,000 | $2,062,001 |

| GLA | Gladiator Resources | 0.009 | 29% | 426,348 | $5,308,078 |

| HMD | Heramed Limited | 0.009 | 29% | 1,232,196 | $6,129,219 |

| EV1 | Evolutionenergy | 0.014 | 27% | 340,079 | $3,989,155 |

| ENL | Enlitic Inc. | 0.029 | 26% | 424,211 | $18,989,173 |

| RMI | Resource Mining Corp | 0.015 | 25% | 2,573,218 | $8,813,440 |

| ADR | Adherium Ltd | 0.005 | 25% | 40,000 | $3,593,916 |

| ALR | Altairminerals | 0.003 | 25% | 1,958,200 | $8,593,488 |

| MEM | Memphasys Ltd | 0.005 | 25% | 100,000 | $7,934,392 |

| MPR | Mpower Group Limited | 0.010 | 25% | 29,999 | $2,749,626 |

| PIL | Peppermint Inv Ltd | 0.003 | 25% | 128,333 | $4,602,180 |

| SRL | Sunrise | 0.995 | 24% | 946,852 | $92,758,060 |

Energy World Corporation (ASX:EWC) is planning a major shake-up. It’s struck a deal with EWI and Slipform to wipe out over US$440 million in debt by converting it into shares, subject to shareholder approval. The new shares would be priced at 88 cents and would lift EWI and Slipform’s stake from 41% to around 53%. If the deal goes through, the company says it will be debt-free. At the same time, long-time boss Brian Allen is stepping down after 24 years. Alan Jowell will step in as interim Chair, and Edward McCartin takes over as CEO from today.

Wound-care biotech Next Science (ASX:NXS) is planning to sell off almost all of its assets to Italy’s Demetra for US$50 million, pending shareholder approval. After clearing debts and costs, it expects to return around US$30 million to shareholders. The deal includes its IP, contracts, inventory and approvals, but not its DME (durable medical equipment) business. Next Science says the sale gives its infection-fighting tech a better shot at global scale under Demetra’s roof. If approved, it will wrap up the transaction and then weigh up its future as a listed company.

AI-powered edtech outfit OpenLearning (ASX:OLL) has sealed a new three-year SaaS deal worth around $495k with CE-Logic, a major education publisher in the Philippines. The agreement will see OpenLearning’s platform used by at least 3,000 students in year one, and 20,000 in years two and three, with potential upside if usage climbs. It marks the company’s third big win in the Philippines this year, bringing total minimum contract value to about $1.26 million.

And, snack maker OMG Group (ASX:OMG) just clocked its best month ever, booking $602k in June sales and turning a $242k operating cash-flow surplus. That pushed FY25 revenue to $4.13m, up 63 % and comfortably ahead of its $4m target.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for July 1 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.001 | -33% | 235,592 | $8,429,639 |

| AN1 | Anagenics Limited | 0.004 | -20% | 30,000 | $2,481,602 |

| RCM | Rapid Critical | 0.002 | -20% | 1,000,000 | $3,539,445 |

| ROG | Red Sky Energy. | 0.004 | -20% | 47,368 | $27,111,136 |

| SIS | Simble Solutions | 0.004 | -20% | 250,000 | $5,411,652 |

| SRJ | SRJ Technologies | 0.004 | -20% | 3,318,120 | $3,027,890 |

| TMX | Terrain Minerals | 0.002 | -20% | 9,000,136 | $6,329,536 |

| PRM | Prominence Energy | 0.003 | -17% | 268,495 | $1,459,411 |

| TMK | TMK Energy Limited | 0.003 | -17% | 7,195,624 | $30,667,149 |

| C29 | C29Metalslimited | 0.017 | -15% | 808,381 | $3,483,765 |

| HMC | HMC Capital Limited | 4.370 | -14% | 2,396,960 | $2,104,340,228 |

| AON | Apollo Minerals Ltd | 0.006 | -14% | 1,362,333 | $6,499,198 |

| AR9 | Archtis Limited | 0.198 | -14% | 1,186,314 | $66,232,445 |

| TAM | Tanami Gold NL | 0.055 | -13% | 440,754 | $74,031,114 |

| IFG | Infocusgroup Hldltd | 0.014 | -13% | 1,424,953 | $4,415,389 |

| KAM | K2 Asset Mgmt Hldgs | 0.065 | -12% | 6,250 | $17,840,305 |

| PCK | Painchek Ltd | 0.040 | -11% | 3,376 | $82,892,520 |

| AAJ | Aruma Resources Ltd | 0.008 | -11% | 30,000 | $2,951,465 |

| ADG | Adelong Gold Limited | 0.004 | -11% | 233,765 | $9,309,045 |

| AM5 | Antares Metals | 0.008 | -11% | 1,160,500 | $4,633,676 |

| CLG | Close Loop | 0.032 | -11% | 3,110,554 | $19,146,595 |

| DRX | Diatreme Resources | 0.017 | -11% | 107,997 | $95,157,355 |

| SPQ | Superior Resources | 0.005 | -10% | 1,300,000 | $11,854,914 |

| ADX | ADX Energy Ltd | 0.028 | -10% | 104,901 | $17,946,172 |

IN CASE YOU MISSED IT

Brazilian Critical Minerals’ (ASX:BCM) Ema in-situ recovery field trial has successfully produced a magnet rare earth oxide-rich leach solution.

Results from the first 66 holes of ongoing Phase 1 drilling have confirmed a new gold-copper discovery for Antipa Minerals (ASX:AZY) at the Minyari project.

DY6 Metals’ (ASX:DY6) sampling has identified a 100km2 area at the Bounde licence in Cameroon with abundant rutile, including large nuggets, and heavy minerals.

Optiscan’s (ASX:OIL) latest study is now underway, using its InVue and InForm devices to help surgeons assess breast cancer margins in real time.

Aldoro Resources (ASX:ARN) expands first phase drilling at Kameelburg after assays extend mineralisation and hint at more riches at depth.

LAST ORDERS

Medallion Metals (ASX:MM8) is buying up 258 hectares of freehold property as part of its environmental offset strategy for the Ravensthorpe gold project. The company will work to re-establish native vegetation across the full extent of its offset blocks under the EPBC Act.

Buxton Resources (ASX:BUX) has completed a heritage survey for its Madman project in collaboration with six traditional owners. BUX expects to see the results in the next four to six weeks.

Star Minerals (ASX:SMS) has welcomed Clint Moxham as a new non-executive director on the board. Moxham brings extensive experience in mining operations, particularly project development and execution, aligning with SMS’s ambitions to develop the Tumblegum South gold project.

At Stockhead, we tell it like it is. While Medallion Metals, Buxton Resources and Star Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.