Kick Back: The biggest stories you may have missed on Stockhead this week

He really didn't take it. Picture: Getty Images

It’s been a solid week for people making money off others’ misfortune.

Let’s start with Disaster Girl, the demonspawn who launched a thousand memes:

Nearly 16 years ago, Zoë Roth’s dad asked her to smile as he snapped her in front of a house fire that was actually intentionally lit by North Carolina firefighters.

A year later, the pic won a photo contest… and a place very high up in meme canon.

And this week, Zoë finally got to collect. About half a million bucks, after selling the pic as – you guessed it – an NFT.

Given that someone now officially owns this as an NFT, we’re not sure how much longer we’re allowed to use the picture. If we ever were…

In equally glorious you-don’t-own-me news, Clive Palmer has to pay Dee Snider $1.5 million for using Twisted Sister’s most recognisable anthem in his last election campaign.

HALLELUJAH!! Just found out that the copyright infringement of "We're Not Gonna Take It" by "politician" Clive Palmer in Australia has been decided MAJORLY in favor of myself as writer and @UMG as publishers! WE'RE NOT GONNA TAKE COPYRIGHT INFRINGEMENT ANY MORE!!

— Dee Snider🇺🇸🎤 (@deesnider) April 30, 2021

Those who remember the 80s (and Clive may have blacked it out because he was trying to get Joh Bjelke-Petersen into the PM’s seat at the time) might also remember that Dee (aka Daniel Snider) was also quite the electric performer in front of officials, having brutally taken down Al Gore’s missus in a glorious 30 minutes of free speech at a Senate hearing into whether music could be evil.

So yeah, Daniel’s not scared of a fight, Clive. Maybe DYOR next time.

And while no one would doubt Jeff Bezos worked hard to build his widely mocked online bookstore into a business that by market cap would be one of the 10 largest countries in the world, raking in $US108 BILLION A QUARTER is, well, the very definition of a bit rich.

Guess everyone has to start somewhere. We choose….

Hydrogen: Here are all the ASX stocks in it and who will soon be joining the club

Actual newsroom conversation:

“Tomorrow’s lead has fallen over, anyone got anything?”

Silence.

More silence.

Then… “Guess I could just run through a list of hydrogen stocks?”

Cue this week’s most popular resources post, with daylight second.

This is not a story about how we don’t take our job seriously. It’s about how quickly the hydrogen game has grown from a single pure play to the most watched, lucrative – some might say frothy – ASX sector in a few short months.

It’s quite simply the biggest Stacks On we’ve seen at Stockhead. Here are the latest entrants.

As iron ore prices eclipse their 2011 high, how much higher can they go?

Iron ore simply refuses to lay down, despite repeated claims that China will eventually take a rest.

That’s pretty much guaranteed. But price movements in 2021 have shown it would take a brave analyst to put a date on that slowdown.

“It is worth noting that spot iron ore prices on Wednesday were at the highest level on record in Australian dollar terms,” analysts at Commonwealth Bank of Australia said.

Rebar prices are at 12-year highs. And according to Todd Warren, an iron ore and commodities markets expert and head of research at Sydney-based Tribeca Investment Partners, steel mills “are not going to stop producing steel while those margins are incredibly robust”.

Hence the appetite for iron ore. There’s could be a pattern here…

Here’s Warren’s case for $200 and beyond, and why the hand-wringers are wrong about “air pollution” and “iron ore juniors” actually being able to do anything about it.

Guy on Rocks: China paves way for $8.5 billion gold purchase

Also having a grand old time on China’s macchinations is gold.

Guy le Page brought to our attention a recent move by China to clear the way for an import of around 150 tonnes of gold sourced from Australia, South Africa and Switzerland.

That’s a cool $10 billion worth.

Looking elsewhere, le Page notes copper end-use consumption is at record levels relative to supply, and palladium’s bull run is still running.

His Hot Stock to Watch is this bargain barrel iron ore hopeful.

ASX car stocks are underrated, but here’s why they might be about to accelerate

Nick Sundich found a sector that’s kept a clean sheet in the past 12 months. Cars.

It might not come as a surprise to anyone who’s tried to buy a Ranger, or even a clapped-out Hilux. If you can nail one down, you can be guaranteed it comes with one extra feature – a price tag that has you all a bit:

Yes, that’s how much it costs, mate. Now either buy it or bugger off because there are 20 more in line.

There are several reasons for this sneaking up on us. Low interest rates, purchasing power, household savings… But perhaps the biggie is COVID.

Overseas supply is at nine-year lows, and we pretty much ditched public transport for 12 months.

And then there are those holidays we couldn’t take. All that cash burning a hole in our pockets.

Anyway, if you really, really hate the smug grin on the car salesman’s mug, why not buy the company? Because here’s something you don’t see often – a car salesman in an IPO.

The Secret Broker: When the chips are down, watch out for seagulls

While we’re on cars and palladium, here’s a story about, uh, smart homes.

It wasn’t a good week for ASX tech stock Buddy Technologies, which not only had to retract some key sales revenue figures, it then had to inform the market – and its investors – that it couldn’t make its signature app-controlled smart lights any more.

The problem? The company that makes the chips for the lights only turned around and sold all the chips to someone else, didn’t they? Gah!

In case you missed it, there’s a worldwide shortage of chips, so this could be the end of BUD.

It’s even hurting Elon Musk. We know because The Secret Broker’s been reading Tesla’s announcements and now he’s rabbiting on about McDonald’s fries and wobbly tuckshop ladies’ arms.

Why this expert panel’s Bitcoin price forecast is going to break cryptoheads’ hearts

It’s not a proper week without an outrageous Bitcoin prediction. This one comes to you courtesy of Sarah Bergstrand, the chief operating officer of BitBull Capital.

Bergstrand told Finder a 2025 valuation of $US1 million isn’t out of the question.

“The only question that needs asking in terms of longer-term valuation is whether you think Bitcoin will be around in 2025,” says Kruger.

“If the answer to this question is ‘yes’, the economics support a much higher valuation. It’s as simple as that.”

That’s going to take some admirable hodling. Especially given Finder’s survey of 35 crypto experts have some heartbreaking news for Christmas funding.

In other crypto news:

We have a table of the coins that have mooned the most in 2021. Look:

| Coin code | NAME | 7 day change | Month to date | YTD | Year | Volatility |

|---|---|---|---|---|---|---|

| OMI | Ecomi | 6.3% | -38.5% | 20278.5% | 25245.0% | 28.34% |

| BAKE | BakerySwap | 76.9% | 135.7% | 18513.9% | 38.79% | |

| 1ST | FirstBlood | 51.1% | 1064.5% | 6627.3% | 13779.9% | 122.92% |

| DENT | Dent | 19.6% | -21.9% | 5676.0% | 8770.3% | 45.87% |

| CAKE | PancakeSwap | 30.2% | 93.2% | 5598.2% | 36.48% | |

| DOGE | Dogecoin | -17.5% | 404.2% | 5585.8% | 11340.6% | 133.18% |

| DAWN | Dawn Protocol | 60.1% | 957.9% | 5108.5% | 128.48% | |

| WRX | WarizX | 0.9% | 273.2% | 4522.3% | 2041.9% | 77.64% |

| MATIC | Polygon | 123.9% | 112.8% | 4230.3% | 4731.2% | 26.89% |

| ARRR | PirateChain | 90.7% | 2668.6% | 4215.6% | 28249.1% | 213.94% |

| TEL | Telcoin | 0.8% | -9.9% | 4147.6% | 2222.3% | 15.37% |

| WOO | Wootrade | 27.4% | 95.4% | 3835.9% | 43.42% | |

| NKN | NKN | 0.3% | 249.8% | 3731.9% | 4083.5% | 93.05% |

| ONE | Harmony | 14.2% | -27.1% | 3063.5% | 5160.2% | 29.42% |

| FTM | Fantom | 30.80% | 21.60% | 2924.60% | 22.18% | |

| MED | MediBloc | -3.99% | 22.30% | 2836.10% | 4502.60% | 51.09% |

| VGX | Voyager Token | 35.70% | 0.88% | 2784.40% | 15687% | 21.70% |

| SOL | Solana | 32.10% | 128.30% | 2773.20% | 6428% | 40.79% |

| HOT | Holo | 1.58% | -3.99% | 2678.90% | 4717.10% | 40.53% |

| VTHO | VeThor | -7.75% | 14.80% | 2643.10% | 6038.30% | 23.15% |

| LUNA | Terra | 23.10% | -5.85% | 2536.60% | 8537.10% | 17.00% |

| BTT | Bittorent | -8.80% | 40.10% | 2420.20% | 2821% | 37.95% |

| BTMX | BTMX | -21.40% | -45.30% | 2403.10% | 2143.40% | 26.27% |

– MATIC hodlers rejoice as token nears $US1

– Ethereum hits fresh ATH as fanboys dream of ‘The Flippening’

– and PirateChain became the hot new meme currency

Uranium supply is falling well behind demand. These ASX stocks are rushing to fill the hole

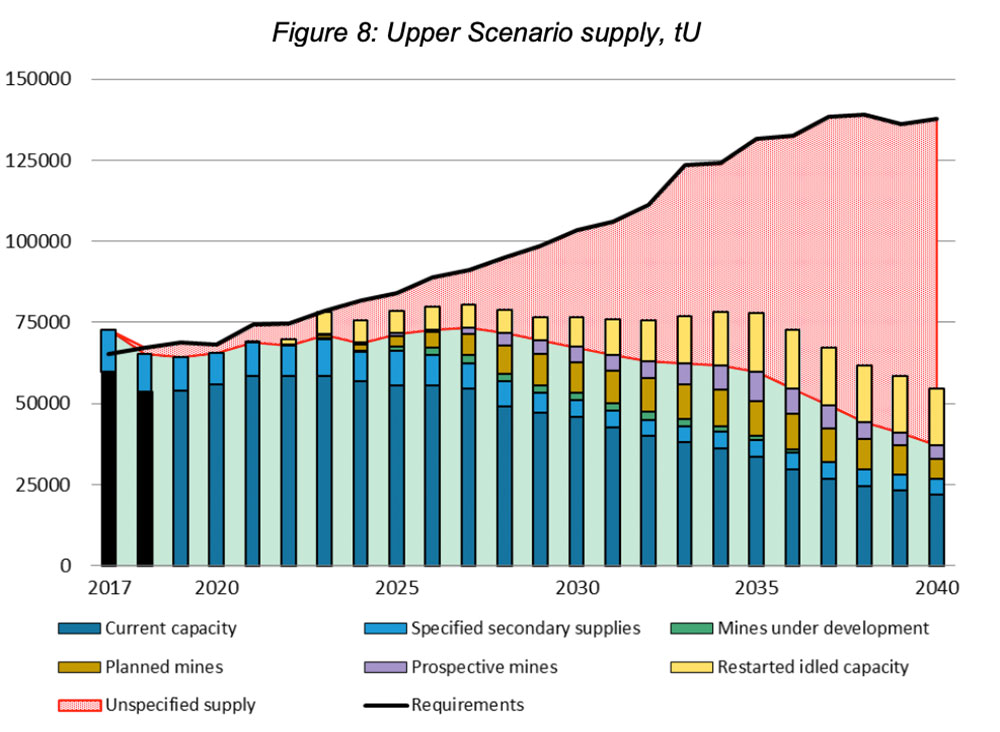

Here’s your Chart of the Week:

That’s our world’s uranium supply through to 2040, utterly failing to meet expected demand.

And that’s only if every single idled mine and planned project goes into production.

Two new research notes from BMO Capital Markets and Morgan Stanley now say today’s spot price – about ~$US30/lb – is just the start of a rally in prices over the next few years to the ~$US50 level by 2024. That’s almost enough to justify new mines, but not quite enough.

You know what comes next – here’s your ultimate guide to ASX small caps that are already surging in anticipation of demand.

‘RIP ICE’: Hybrids and battery electric vehicles owned 32.2% of the European market in Q1

Oh yeah, palladium. We’ve reported before about how 80 per cent goes into ‘autocatalysts’ in car exhausts to reduce polluting emissions.

So it still has some way to run. But maybe not forever, because soon cars won’t have exhausts.

Here’s news just in from the European Automobile Manufacturers Association (ACEA) – first quarter new battery electric vehicle (BEVs) registrations increase by 59.1% on the same period last year.

Diesel and gasoline-powered cars saw a rapid loss of market share in the EU in the first quarter, down by 16.9% on the year to 1.1 million sales.

There’s only one way this could go – RIP ICE.

Weed Week: 4/20 can’t help ASX cannabis companies

And finally, it wasn’t a great week for weed. April 20 (4/20, if you don’t understand you won’t care) came and went but no one got particularly high.

Of the 36 pot companies in the space, 27 have lost ground over the last fortnight. Just seven have advanced. These seven.

We still managed to find eight hot pot stocks that have tripled in the past 12 months.

If Google left Australia, what would happen to the stock market?

This.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.