Uranium supply is falling well behind demand. These ASX stocks are rushing to fill the hole

Pic: John W Banagan / Stone via Getty Images

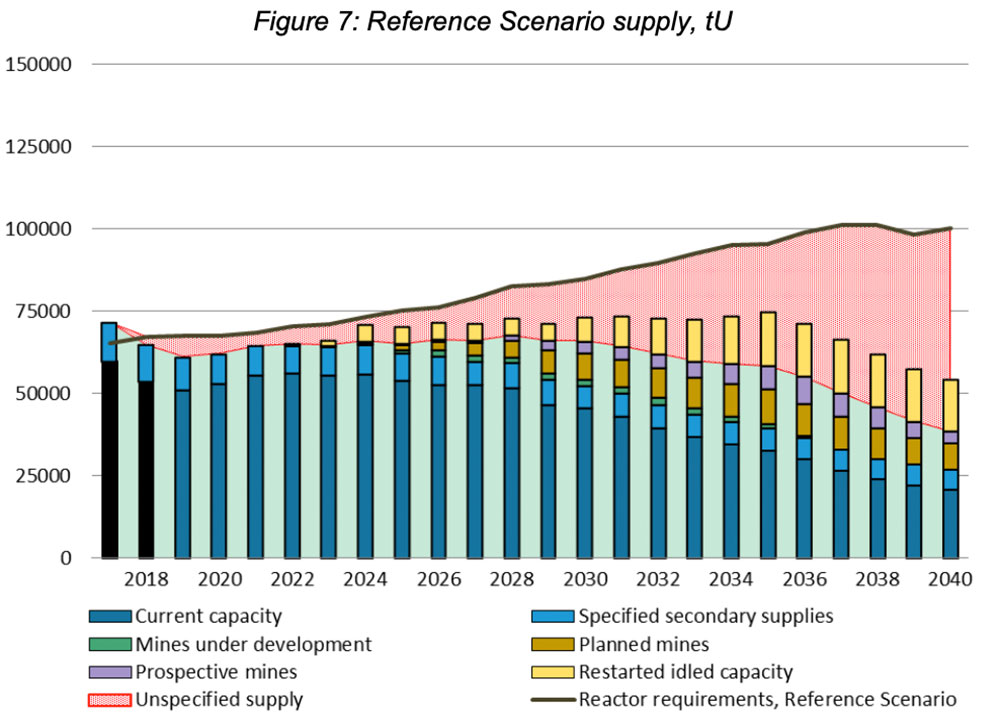

By 2030, there will not be enough uranium production to meet demand, even if every single idled mine and planned project goes into production.

That’s the base case (most expected) scenario.

Let that sink in for a minute.

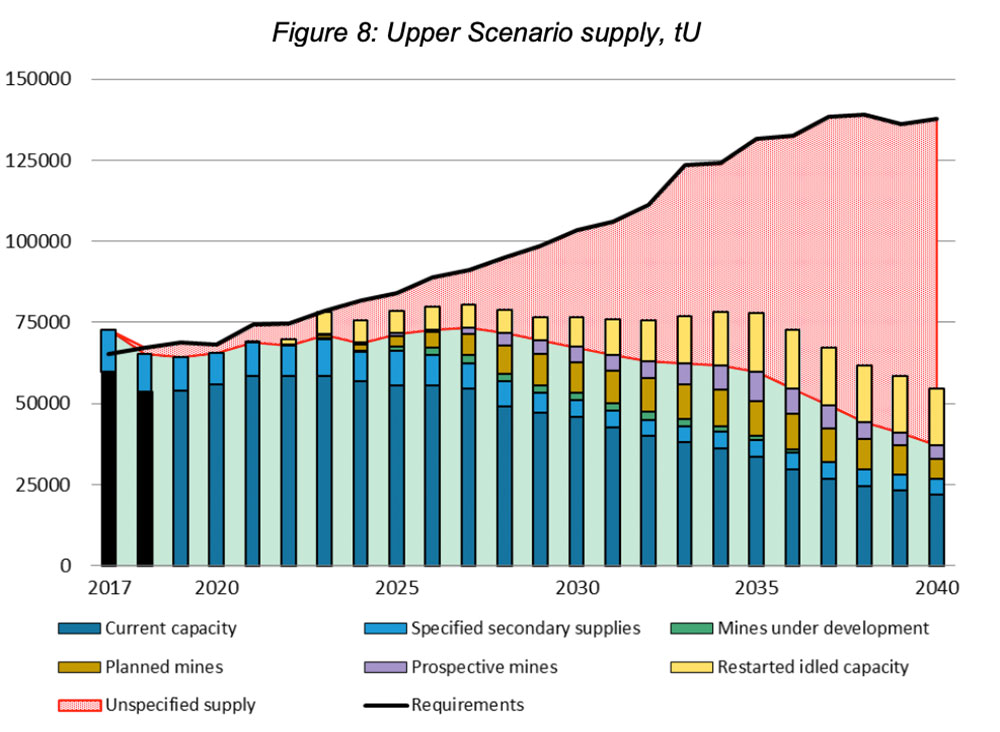

Now look at the upper case scenario, in which uranium requirements are expected to be about 103,500 tonnes in 2030, and 137,600 tonnes in 2040:

Hectic.

You don’t need to be a clairvoyant to see what’s coming.

We need new uranium supply, FAST. But when are uranium contract prices going to rise enough to justify new mines?

That’s the million dollar question.

Two new research notes from BMO Capital Markets and Morgan Stanley now say today’s spot price – about ~$US30/lb – is just the start of a rally in prices over the next few years to the ~$US50 level by 2024.

Stock prices are already surging in anticipation.

The smartest money jumped into uranium equities in November last year, Vimy Resources’ Mike Young says.

“On December 3, a bill came out of a US Senate committee recommending bipartisan support for the US nuclear industry [the world’s largest],” he told Stockhead.

“Because of that there was sudden flurry of activity into uranium equities, and it just hasn’t stopped.”

Near term developers Paladin ($218m), Vimy ($18.5m), Boss ($60m), Bannerman ($12m), Deep Yellow ($40m) and Lotus ($12.5m) have tapped this bullish sentiment with some significant cap raises.

“Our raise was about 80 per cent of what our market cap was four, five months ago,” Young says.

So, who stands to benefit from the pending bull market? Here are 16 ASX stocks with skin in the game.

| CODE | COMPANY | PRICE | 1 MONTH RETURN % | 6 MONTH REURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|

| PDN | Paladin Energy | 0.38 | -6 | 199 | 253 | $985.3M |

| VMY | Vimy Resources | 0.125 | -11 | 247 | 172 | $93.4M |

| LAM | Laramide Resources | 0.56 | -10 | 60 | 124 | $666K |

| TOE | Toro Energy | 0.024 | -17 | 41 | 200 | $62.0M |

| AGE | Alligator Energy | 0.015 | -6 | 200 | 400 | $34.3M |

| BOE | Boss Energy | 0.14 | -17 | 125 | 137 | $319.0M |

| MEY | Marenica Energy | 0.135 | -13 | 48 | 114 | $29.1M |

| DYL | Deep Yellow | 0.64 | -15 | 98 | 135 | $201.6M |

| CXU | Cauldron Energy | 0.038 | -5 | 19 | 73 | $17.6M |

| BMN | Bannerman Resources | 0.135 | -4 | 286 | 221 | $158.4M |

| TIN | TNT Mines | 0.18 | 9 | -18 | 275 | $15.0M |

| BKY | Berkeley Energia | 0.565 | -17 | 26 | 190 | $147.6M |

| GTR | GTI Resources | 0.022 | -15 | -4 | 267 | $13.5M |

| LOT | Lotus Resources | 0.13 | -16 | 44 | 103 | $123.51M |

| PEN | Peninsula Energy | 0.13 | 4 | 106 | 3 | $111.7M |

| THR | Thor Mining | 0.014 | -6 | -28 | 200 | $10.45M |

| 92E | 92 Energy | 0.27 | -24 | -24 | -24 | $10.44M |

| VAL | Valor Resources | 0.013 | 44 | 160 | 1200 | $44.21M |

The Miners/ Project Developers

Many of these companies can ostensibly get into production quickly once prices improve to a certain level. Most of these guys are part of the ‘planned mines’ cohort mentioned above.

Paladin is a former producer at the Langer Heinrich mine in Namibia which has been on care and maintenance, but – following a big $218m cap raise — is ready to relaunch.

Peak production was 5.6 million pounds in 2014 (2,540t) before operations were suspended due to low prices.

The company’s timetable envisages a restart of production with a fairly modest capital outlay of around $80m once contracts with utilities have been signed.

Advanced uranium explorer Vimy wants its shovel-ready Mulga Rock project up and running to take advantage of the predicted uranium price surge.

It recently raised $18.5m to advance early works at Mulga Rock in WA and to continue exploration at the Alligator River project in the Northern Territory.

“Global uranium equities have surged over 300% since late October 2020, with Vimy’s share price having tripled,” Mike Brown says.

“The growing positive sentiment for nuclear clean energy has been the catalyst for this growth.

“Vimy is in a unique position to capitalise on the supply shortage by progressing the Mulga Rock Project into development, where our first stage AISC is less than the uranium spot price.”

“Australia’s next uranium producer” Boss is neck deep in an Enhanced Feasibility Study (EFS) on its 2.25mlb Honeymoon project in South Australia, which is on track for completion in the June Quarter.

In March, it raised $60m to buy 1.25 million pounds of uranium on the spot market at an average price of US$30.15 per pound.

This inventory provides greater flexibility for financing and off-take negotiations, and de-risks the Honeymoon restart “as it will ensure Boss can meet offtake obligations, providing initial customers with confidence of supply”, the company says.

Deep Yellow has three uranium projects in Namibia – Reptile, Nova and Yellow Dune.

A PFS was completed in early 2021 on its 3mlb per annum Tumas project – within the Reptile tenements — and a DFS commenced February 2021.

Bannerman’s Etango-8 project — also in Namibia — has been ‘reimagined’ as smaller scale mine initially, but with the ability to ramp up production as demand improves.

In February, it raised $12m to complete the Pre-Feasibility Study (PFS) at the Etango-8 Project, undertake and complete a Definitive Feasibility Study (DFS), and continue product marketing.

Project developer Berkeley Energia (ASX:BKY) is battling through the approvals process to build its contentious Salamanca uranium mine in Spain.

Lotus’ Kayelekera project in Malawi – purchased from fellow Africa-focused Paladin Energy (ASX:PDN) in March 2020 – will cost just $US50m to get up and running, the company says.

Kayelekera is a proven uranium operation having successfully produced 11Mlbs over five years, ceasing operations in 2014 due to sustained low uranium prices.

This US-based company can get back into production within six months – and for just $US6m — once a final investment decision is made, it says.

The flagship 3mlb per annum ‘Lance’ project, located in Wyoming, is the only US-based uranium project authorised to use the industry leading, low-cost, low pH ISR process.

The Explorers

This is the uranium’s new class.

Valor jumped sharply on April 20 after releasing a Form 603 which showed mining luminary Tolga Kumova had become a substantial shareholder.

Headed by former Northern Minerals boss George Bauk, this explorer holds two uranium projects – Hook Lake and Cluff Lake — in a prolific Canadian mining district.

Early stage exploration programs are due to kick off soon.

Marenica is currently the largest uranium exploration tenement holder in Namibia, a world-class uranium province with an established mining industry.

It made headlines last year after uncovering a +30km-long uranium-rich channel at the Hirabeb project.

That’s wider than the English Channel.

Laramide has a portfolio of uranium projects, including the advanced Churchrock in-situ recovery (“ISR”) project in the US, Westmoreland in Australia and two development-stage assets, La Sal and La Jara Mesa, in the US.

Laramide also owns the large greenfield Murphy project in the Northern Territory.

Toro Energy has started development studies at the ‘Lake Maitland’ uranium and vanadium project in WA.

This scoping study will be the first proper look at whether the project is economic or not to build.

Lake Maitland is one of three uranium projects in WA that have environmental approval for mining from both the state and federal governments, the company says.

Alligator began early exploration at its newly acquired Samphire uranium project in South Australia in February this year.

A drilling program is due to kick off in July, primarily focused on upgrading the existing resource.

This explorer is preparing a first phase drilling program at the historic East Canyon in the US, where high grade assays of up to 1.27% uranium and 8.30% vanadium were returned from sampling.

Drilling is expected to kick off after the permits and remaining environmental approvals are received, TNT said late March.

Early stage uranium and vanadium exploration is due to kick off within ‘Section 36’, one of the recently acquired leases within GTI’s land position in Utah.

This fieldwork will focus on over 1,300m of historical underground workings, where previous XRF samples yielded values up to 19.64% U3O8 and 6.08% vanadium.

That’s very high grade.

The dual listed explorer holds a 100% interest in exciting uranium and vanadium exploration assets in Colorado and Utah, where drilling is scheduled to begin shortly.

The three exploration targets identified for drilling are within a historic high-grade uranium-vanadium mining district in south-west Colorado known as the Uravan mineral belt.

The mineral belt has produced +85 million pounds of uranium oxide and 660 million pounds of vanadium over the past 100 years.

Uranium explorer 92 Energy (ASX:92E) listed on the ASX in April.

Its main game is three projects, Clover, Gemini and Tower, in the Canadian province of Saskatchewan, which is home to several high profile uranium projects.

Tower is a stone’s throw (or ~10km) from Cameco’s world class Cigar Lake uranium operation.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.