Kick Back: The 10 biggest stories you might have missed on Stockhead this week

News

News

Let’s not muck about. There are only 21 sleeps to Christmas and a lot to do.

Here’s the tl;dr version: Seven IPOs and Twiggy made $2.6 billion on Thursday. Well it was mostly just Twiggy. You’ll have to imagine that gif of the manly beardy dude from the 70s nodding in approval here. Don’t make me go find it.

For the rest of you, here’s the best of the week that was on Stockhead. And as far as those things go, it was an exceptional one.

Pot stocks got a lot harder to ignore in 2020. And even more so this week, because the UN has decided cannabis isn’t as bad, hmmkay, as heroin and cocaine.

On Wednesday, it formally rescheduled cannabis, culling it from Schedule IV of the 1961 Single Convention on Narcotic Drugs.

A big deal? Hoo boy yes. We spoke to a bunch of very happy pot stock execs yesterday, who gave us five excellent ways the news could boost their companies in Australia. And that’s on top of a generally very solid year. All the green you need is right here:

| Code | Company | Price | % | %Yr | MktCap |

|---|---|---|---|---|---|

| CPH | Creso Pharma Ltd | 0.089 | 41 | -39 | $43.4M |

| EXL | Elixinol Global | 0.245 | 32 | -72 | $44.6M |

| MMJ | MMJ Group Hlds Ltd | 0.155 | 29 | -6 | $27.6M |

| AC8 | Auscann Grp Hlgs Ltd | 0.155 | 15 | -23 | $42.8M |

| CAN | Cann Group Ltd | 0.565 | 14 | 26 | $133.6M |

| MXC | Mgc Pharmaceuticals | 0.025 | 14 | -24 | $37.6M |

| MRG | Murray River Grp | 0.011 | 10 | -51 | $22.1M |

| APH | AP Hemp Ltd | 0.385 | 10 | 126 | $19.6M |

| ECS | ECS Botanics Holding | 0.034 | 10 | -31 | $11.1M |

| AGH | Althea Group | 0.55 | 9 | 45 | $121.2M |

| THC | THC Global Grp Ltd | 0.25 | 9 | -32 | $41.0M |

| CAU | Cronos Australia | 0.135 | 8 | -45 | $6.1M |

| SCU | Stemcell United Ltd | 0.017 | 6 | 21 | $10.7M |

| EOF | Ecofibre Limited | 1.95 | 5 | -39 | $272.1M |

| EVE | EVE Investments Ltd | 0.0105 | 5 | 110 | $38.4M |

| BDA | Bod Australia | 0.63 | 5 | 107 | $54.8M |

| CP1 | Cannpal Animal | 0.14 | 4 | 0 | $12.6M |

| BOT | Botanix Pharma Ltd | 0.14 | 4 | 27 | $131.3M |

| SUD | Suda Pharmaceuticals | 0.038 | 0 | -36 | $11.7M |

| ROO | Roots Sustainable | 0.023 | 0 | -34 | $8.2M |

| RNO | Rhinomed Ltd | 0.175 | 0 | -17 | $44.4M |

| IHL | Incannex Healthcare | 0.14 | 0 | 112 | $141.9M |

| IDT | IDT Australia Ltd | 0.185 | 0 | 37 | $44.1M |

| ESE | Esense-Lab Ltd | 0.018 | 0 | 38 | $9.2M |

| DTZ | Dotz Nano Ltd | 0.24 | 0 | 411 | $90.3M |

| ZLD | Zelira Therapeutics | 0.088 | -2 | 31 | $106.7M |

| LSH | Lifespot Health Ltd | 0.083 | -1 | 108 | $11.3M |

| PAL | Palla Pharma Ltd | 0.82 | -1 | -4 | $104.5M |

| LGP | Little Green Pharma | 0.545 | -2 | 0 | $43.8M |

| MDC | Medlab Clinical Ltd | 0.24 | -2 | -34 | $68.5M |

| RGI | Roto-Gro Intl Ltd | 0.066 | -3 | -59 | $13.7M |

| WOA | Wide Open Agricultur | 1.05 | -7 | 740 | $101.3M |

| EN1 | Engage:Bdr Limited | 0.006 | -14 | -74 | $15.1M |

| YPB | YPB Group Ltd | 0.002 | -20 | -71 | $10.6M |

But here’s why the people who’ve been waiting so long for this ruling know it’s a big deal.

Fortescue rose about 12% on Thursday. That’s an extra Aston in the stocking for the CEO of a $10 million minnow; nice enough if you can get it.

But when you get a 12% bump in a day and your company’s worth $55 billion, well, you could buy Aston Martin, the company. Several times over, in fact.

And when it’s your company – as FMG is Twiggy Forrest’s, you could buy Aston Martin – the company – twice, with just one day’s profit.

Twiggy booked a cool $2.6 billion, personally, on Thursday. And it’s all because iron ore is going absolutely bonkers.

It’s up well over 50pc this year, and going by Thursday’s price action, a lot of people out there have really only just tuned in.

But is it too late? If you’re really looking for a cold spoon, Mike Cooper is here to tell you why a price drop might finally be coming.

Maybe.

Yes, Twiggy’s officially a legend. But he’s not alone in the most Australian of industries.

It’s filled with stories of giant deposits and bonanza hits that fuel the rush to set up nearology plays and add another globally significant region to a long list of globally significant regions in Australia.

It’s been going on for a while, so it’s hard to stand out from the pack as an exceptional explorer. But Mark Bennett, Norman Seckold and Terry Streeter certainly do.

These are the legends of Australian mining, and Reuben Adams is on a mission to find out where they are now, and if they score yet another company-making find.

Note: He found them all.

Also found:

View this post on Instagram

That’s what it looks like to hit 90,700 g/t Au. Or, if you prefer, 90.7kg or 3200 ounces. Or $US5.8m per tonne of dirt.

But you have to go to Canada to hit it, because that’s where Osisko scored what its CEO reckons is “certainly one the highest gold grades in terms of metal factor (grade x width) ever reported“.

The only recent find we can think of that comes close is the giant Australian hoard worth about $16 million pulled from 500m below surface in Kambalda, 60km south of Kalgoorlie.

Who’s got a new ASX listing for Christmas? Lots of people did.

There were no less than seven IPOs on the ASX this week, and pretty much all of them have started their new lives in the public domain successfully. Four of them launched today. Here we go:

We’ve got the skinny on how Booktopia (here), Cashrewards (here) and Prospech (here) hope to build their businesses.

And next week we have an interesting one – Control Bionics, which helps people with disabilities communicate, and yes, was developed with the help of one Stephen Hawking.

Which brings us to our most popular story this week- Bhavdip Sanghavi.

You might – or might not – know him better as @bhavdip143. If you do, you’d probably spent your midweek missing him on Twitter, where he’s built a decent following of fans hanging on his stock tips.

Sanghavi started investing in Australian markets four years ago, and his success has won him sophisticated investor status. That means he’s built a cash pile of at least $2.5m.

It’s all come from ASX shares, and he specialises in analysing IPOs. But he got banned from Twitter this week, because he broke Rule No 1 and read the comments. And couldn’t help but feed the trolls, in a manner too fruity for Twitter’s guardians.

Here’s what he told Mike Cooper about where he’ll be setting up shop from now on, and a few of his popular market calls.

Not having such a great year are rentals. With lockdowns jumping from state to state and travel on again, off again, it’s been difficult to keep some safe skin in the propadee game.

But if you can’t be bothered with tenants asking you to change a lightbulb every week and guests nicking your towels, REITs can take some hassle and risk out of rental. They are listed trusts which focus on various property assets – agricultural, retail, industrial – that are leased out.

You might not be able to afford a shopping centre, but an REIT allows you to jump in and out of bits of them. They’ve also lost about 9 per cent on average in the past 12 months, but here’s a good rundown of who’s stayed on top, and who’s setting up for a good time once we’ve all had our COVID jab.

And if you thought picking stocks was hard, you might consider EFTs, which work something like this:

Yes, it’s guide season. Here’s all you need to know about how EFTs and REITs work.

Another giant of Australian industry is in the money this week. The milk money.

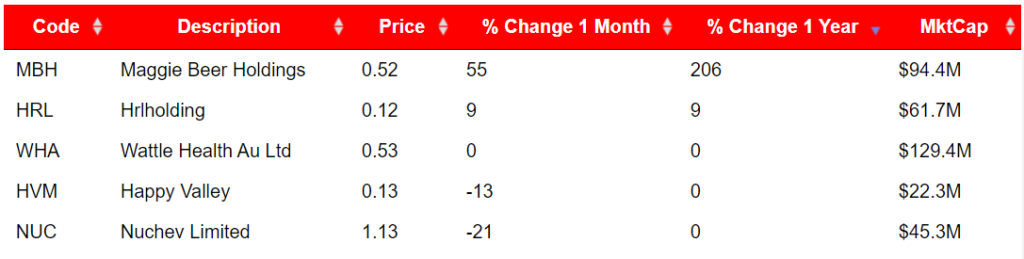

Maggie Beer’s got a very handy holding with the very Australian name of Maggie Beer Holdings. It’s not been a great year for dairy stocks, but let’s have a quick look at the top five:

No wonder she’s always smiling.

But wait, wait – is that Maggie’s secret to success? Or is it just because she found a bloke to marry with the best last name for a business in Australia?

The Secret Broker thinks he’s onto something with this whole “being nice” lark.

It’s been a while since we had some news from Mesoblast, but that has never stopped the fans talking about it.

Now they actually have something to talk about. The most watched biotech small cap of them all finally got the fast track designation for its lead drug candidate to treat COVID-19 it’s been waiting for.

Mesoblast’s remestemcel-L stem cell therapy performed spectacularly in a small trial on a dozen COVID-19 patients at a New York City hospital in March and April of this year. Nine of the patients on ventilators were discharged from the hospital on average in just 10 days.

The FDA can be a bit inconsistent when it comes to reviewing these types of things, so it’s been frustrating for MSB to see its therapy sat on the backburner.

Now, it’s officially on the fast-track. And yes, there was a pop:

It’s the first week of the month, which is sort of, kind of like Stockhead’s reporting season.

Maintaining our status as the Scoreboard of the ASX, everyone’s been going mad on their Excels and tables to bring you the winners and losers of the past 30 days. Without further ado, here are the top, and bottom:

And the overall ASX winners and losers. Happy hunting.

Have a great weekend and thanks for being a Stockhead.